TIDMTDE

RNS Number : 8722R

Telefonica SA

05 March 2019

TELEFÓNICA, S.A., in compliance with the Securities Market

legislation, hereby communicates the following

INSIDE INFORMATION

Telefónica Europe B.V. (the "Issuer") invites today the holders

of its outstanding

(i) EUR 850,000,000 Undated 5 Year Non-Call Deeply Subordinated

Guaranteed Fixed Rate Reset Securities (the "EUR 2019 Notes"),

(ii) EUR 750,000,000 Undated 6 Year Non-Call Deeply Subordinated

Guaranteed Fixed Rate Reset Securities (the "EUR 2020 Notes"),

(each a "Series" and together the "Notes") irrevocably

guaranteed by Telefónica, S.A. (the "Guarantor"), to tender such

Notes for purchase by the Issuer for cash (each such invitation an

"Offer" and together the "Offers").

The Offers are being made on the terms and subject to the

conditions contained in the tender offer memorandum dated 5 March

2019 (the "Tender Offer Memorandum") and are subject to the

restrictions set out in the Tender Offer Memorandum. Capitalised

terms used and not otherwise defined in this announcement have the

meaning given in the Tender Offer Memorandum.

Summary of the Offers

Aggregate

Principal

Description of First Reset Amount Maximum Acceptance

Notes ISIN Date Outstanding Purchase Price Priority Amount

---------------- -------------- ---------------- ---------------- --------------- --------- --------------------

EUR 850,000,000

Undated 5 Year

Non-Call

Deeply

Subordinated

Guaranteed

Fixed Rate

Reset

Securities

EUR 103,038

Current per EUR

Coupon: 4.20% XS1148359356 4/12/2019 EUR 704,800,000 100,000 1 Any and all

EUR 750,000,000 XS1050460739 31/3/2020 EUR 591,800,000 EUR 104,923 2 An amount

Undated 6 Year per EUR determined by the

Non-Call 100,000 Issuer in its sole

Deeply discretion. The

Subordinated total aggregate

Guaranteed principal amount

Fixed Rate of EUR 2020 Notes

Reset accepted for

Securities purchase will not

exceed the

Current difference between

Coupon: 5.00% (i) the aggregate

principal amount of

New Notes (as

defined herein) and

(ii) the aggregate

principal amount

outstanding of the

EUR 2019 Notes

prior to the Offers

The Offers commence on 5 March 2019 and will expire at 17:00 CET

on 12 March 2019 (the "Expiration Deadline"), unless extended,

re-opened, withdrawn or terminated at the sole discretion of the

Issuer.

Purpose of the Offers

The purpose of the Offers is, amongst other things, to

proactively manage the Issuer's layer of hybrid capital. The Offers

also provide Noteholders with the opportunity to switch into the

New Notes (as defined below) ahead of upcoming first call

dates.

New Financing Condition

The Issuer intends to issue new EUR denominated Undated 6 Year

Non-Call Deeply Subordinated Guaranteed Fixed Rate Reset Securities

guaranteed by the Guarantor (the "New Notes"). Whether the Issuer

will accept for purchase any Notes validly tendered in the Offers

is subject, without limitation, to the settlement of the issue of

the New Notes (the "New Financing Condition").

Purchase Price

Subject to the applicable Minimum Denomination in respect of the

relevant Series of Notes, the price payable per EUR 100,000 in

principal amount of the Notes (the "Purchase Price") will be (a) in

respect of the EUR 2019 Notes, EUR 103,038 per EUR 100,000, and (b)

in respect of the EUR 2020 Notes, EUR 104,923 per EUR 100,000. In

respect of any Notes accepted for purchase, the Issuer will also

pay an amount equal to any accrued and unpaid interest on the

relevant Notes from, and including, the relevant interest payment

date for the Notes immediately preceding the Settlement Date up to,

but excluding, the Settlement Date, which is expected to be no

later than 15 March 2019.

Notes repurchased by the Issuer pursuant to the Offer may be

cancelled. Notes which have not been validly tendered and accepted

for purchase pursuant to the Offers will remain outstanding after

the Settlement Date.

Maximum Acceptance Amount

The Issuer proposes to accept Notes for purchase up to a maximum

aggregate principal amount equal to the aggregate principal amount

of the New Notes (the "Maximum Acceptance Amount") on the terms and

conditions contained in the Tender Offer Memorandum.

If the Issuer decides to accept any Notes for purchase pursuant

to the Offers, the Issuer intends to accept any and all of the EUR

2019 Notes for purchase in priority to the EUR 2020 Notes. The

Issuer intends that the aggregate principal amount of EUR 2020

Notes which it will accept for purchase (if any) will be an amount

which will not exceed: (i) the Maximum Acceptance Amount, less (ii)

the aggregate principal amount outstanding of EUR 2019 Notes prior

to the Offers. The Issuer will determine the Series Acceptance

Amount in respect of the EUR 2020 Notes in its sole discretion.

Indicative Timetable

Number of Business Days from and

Date including Launch Action

-------------------------------------- -------------------------------------- --------------------------------------

5 March 2019 1 Commencement of the Offers

On or before the Expiration Deadline Pricing of the New Notes

17:00 CET on 12 March 2019 6 Expiration Deadline

Deadline for receipt by the Tender

Agent of all Tender Instructions in

order for Noteholders

to be able to participate in the

Offers.

At or around 10:00 a.m. CET on 13 7 Announcement of Result of Offers

March 2019 Announcement of the Issuer's decision

whether to accept valid tenders of

Notes for purchase

pursuant to any or all of the Offers

subject only to the satisfaction of

the New Financing

Condition and, if so accepted,

details of (i) the final aggregate

principal amount of the

Notes of each Series tendered

pursuant to the Offers and (ii) the

Series Acceptance Amount

and the pro-ration factor, if

applicable, in respect of the EUR

2020 Notes distributed.

Expected to be on 15 March 2019 9 Settlement

Subject to satisfaction of the New

Financing Condition, expected

Settlement Date for the Offers.

Payment of Purchase Consideration and

Accrued Interest Payment in respect

of the Offers.

Madrid, 5 March 2019

None of the Offers, the Tender Offer Memorandum or this

announcement constitute an offer of securities or the solicitation

of an offer of securities to the public in Spain under the Spanish

Securities Market Law approved by Legislative Royal Decree 4/2015,

of 23 October (Real Decreto Legislativo 4/2015, de 23 de octubre,

por el que se aprueba el texto refundido de la Ley del Mercado de

Valores), Royal Decree 1310/2005, of 4 November 2005 and Royal

Decree 1066/2007, of 27 July 2007. Accordingly, neither the Tender

Offer Memorandum nor this announcement has been and will not be

submitted for approval nor approved by the Spanish Securities

Market Regulator (Comisión Nacional del Mercado de Valores).

Not for distribution in or into or to any person located or

resident in the United States, its territories and possessions

(including Puerto Rico, the U.S. Virgin Islands, Guam, American

Samoa, Wake Island and the Northern Mariana Islands, any state of

the United States and the District of Columbia) (the "United

States") or to any U.S. person or into any other jurisdiction where

it is unlawful to distribute this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TENKELBBKXFBBBQ

(END) Dow Jones Newswires

March 05, 2019 04:25 ET (09:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

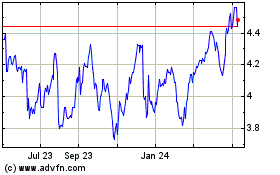

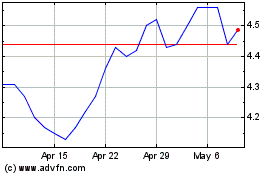

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024