Report of Foreign Issuer (6-k)

July 20 2020 - 6:03AM

Edgar (US Regulatory)

Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July 2020

Commission File Number: 001-13464

Telecom Argentina S.A.

(Translation of registrant’s name into English)

Alicia Moreau de Justo, No. 50, 1107

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Table of Contents

|

FREE TRANSLATION

Buenos Aires, July 17, 2020

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Re.: Outstanding 6.500% Senior Notes due 2021

Dear Sirs,

We refer to the Subscription Notice published by us, Telecom Argentina S.A., on July 7, 2020, in respect of the initiation of the public offering of our Class 5 Negotiable Obligations (8.500% Senior Amortizing Notes) due 2025 (the “New Notes”), available for subscription in cash or in kind with our outstanding Class A Negotiable Obligations (6.500% Notes) due June 15, 2021 (the “Old Notes”), and the related solicitation of consents to vote in favor of certain amendments in respect of the Old Notes.

On July 17, 2020, we entered into a non-binding memorandum of understanding with Deutsche Bank AG, London Branch (“Deutsche Bank”) and CPPIB Credit Investments, Inc. (“CPPIB Credit”), providing, among other things, that they will indicate their interest to subscribe for New Notes in cash in a total aggregate principal amount ranging from US$ 85 to US$ 131 million, depending on certain thresholds of acceptance of the in kind subscription for New Notes by holders of the Old Notes, subject to certain conditions, including that the aggregate principal amount of New Notes to be issued under the offer (including any New Notes exchanged for Old Notes) equals or exceeds US$297 million.

Telecom Argentina S.A. intends to use a portion of the net cash proceeds raised from the sale of the New Notes to the above-mentioned institutions and to any other investor to repay principal outstanding and accrued interest under a term loan agreement, dated as of November 8, 2018, among Telecom Argentina S.A., as borrower, Deutsche Bank Trust Company Americas, as administrative agent, Deutsche Bank and CPPIB Credit, as lenders, Deutsche Bank, as sole book-runner and lead arranger, and any other uses permitted by Article 36 of the Argentine Negotiable Obligations Law.

This announcement is not an offer of securities for sale in the United States, and none of the New Notes has been or will be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or any state securities law. They may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons except pursuant to an exemption from, or in a transaction not subject to the registration requirements of the Securities Act. This letter does not constitute an offer of the New Notes for sale, or the solicitation of an offer to buy any securities, in any state or other jurisdiction in which any offer, solicitation or sale would be unlawful. Any person considering making an investment decision relating to any securities must inform itself independently based solely on an offering memorandum to be provided to eligible investors in the future in connection with any such securities before taking any such investment decision.

Best regards,

|

|

Telecom Argentina S.A.

|

|

|

|

|

|

/s/ Fernando Balmaceda

|

|

|

Responsible for Markets Relations

|

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Telecom Argentina S.A.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

July 20, 2020

|

|

By:

|

/s/ Fernando J. Balmaceda

|

|

|

|

|

|

Name:

|

Fernando J. Balmaceda

|

|

|

|

|

|

Title:

|

Responsible for Market Relations

|

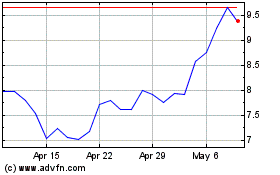

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

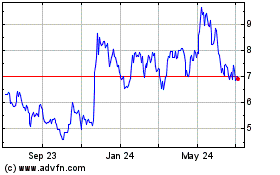

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Apr 2023 to Apr 2024