Report of Foreign Issuer (6-k)

October 11 2019 - 8:22AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October 2019

Commission File Number: 001-13464

Telecom Argentina S.A.

(Translation of registrant’s name into English)

Alicia Moreau de Justo, No. 50, 1107

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes o No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes o No x

Buenos Aires, October 10, 2019

SECURITIES AND EXCHANGE COMMISSION

Dear Sirs,

TELECOM ANNOUNCES CNV AUTHORIZATION OF THE PUBLICATION

OF THE LOCAL PROSPECTUS REGARDING THE PRELIMINARY MERGER AGREEMENT WITH PEM S.A.U., CV BERAZATEGUI S.A. AND ÚLTIMA MILLA S.A.

On October 10, 2019, Telecom Argentina S.A. (“Telecom”), received confirmation that the Argentine Securities Commission (Comisión Nacional de Valores) authorized the publication of the local Argentine prospectus regarding Telecom’s proposed absorption of the Split Away Assets of PEM S.A.U., Última Milla S.A., and CV Berazategui S. A., all of them companies organized under the laws of the Republic of Argentina and 100% owned by Telecom (the “Merger”). Under the proposed Merger, Telecom would continue as the surviving company known as “Telecom Argentina S.A.”.

A copy of the local Argentine prospectus has been filed with the CNV and is available on the CNV’s website (www.cnv.gob.ar).

|

|

Telecom Argentina S.A.

|

|

|

|

|

|

/s/ Gabriel P. Blasi

|

|

|

Responsible for Market Relations

|

FREE TRANSLATION

PRELIMINARY MERGER AGREEMENT

entered into between

TELECOM ARGENTINA S.A.

and

PEM S.A.U.,

CV BERAZATEGUI S.A.

and

ÚLTIMA MILLA S.A.

SEPTEMBER 10, 2019

PRELIMINARY MERGER AGREEMENT

In the Autonomous City of Buenos Aires, on the 10th day of September 2019, Telecom Argentina S.A., with registered domicile at Alicia Moreau de Justo 50, Buenos Aires City (hereinafter “Telecom” or the “Surviving Company”), represented herein by its Chairman, Mr. Alejandro Alberto Urricelqui, and PEM S.A.U. (hereinafter “PEM”), CV Berazategui S.A. (hereinafter “CVB”) and Última Milla S.A. (hereinafter “Última Milla”), all of them with registered domicile at General Hornos 690, Buenos Aires City and represented herein by their Chairman Carlos Alberto Moltini, (hereinafter PEM, CVB and Última Milla jointly with Telecom, the “Companies” and / or the “Parties”), enter into this Preliminary Merger Agreement (hereinafter the “Agreement”) subject to the terms and conditions below and to the requirements of sections 82 and subsequent of the General Corporate Law No. 19,550, sections 174 and subsequent of the General Resolution 7/15 of the Inspección General de Justicia, sections 77 and subsequent of law 20,628 (text compiled in 1997 and its amendments), and in accordance with the Rules of the Comisión Nacional de Valores (hereinafter “CNV”) in all respects applicable to Telecom as a corporation which is subject to the control of said Commission. By virtue of the foregoing, the Parties agree as follows:

ONE: The Parties agree to carry out a process of corporate reorganization in accordance with the abovementioned rules and regulations and the terms and conditions of this Agreement, whereby Telecom will be the Surviving Company that will take over the assets, liabilities, rights and obligations of Última Milla and CVB, as well as certain assets, liabilities, rights and obligations that are a split away from PEM´s equity (hereinafter the “Split Away Assets of PEM”). Última Milla and CVB, as a result of merging into the Surviving Company, will be dissolved in advance without liquidation, and Telecom will take over all the activities, credits, assets and all rights and obligations of both companies, both existing at the date of the merger and those that may exist or occur due to actions or activities before or after the merger. Telecom takes over all the rights and obligations that make up the Split Away Assets of PEM, continuing with the activity associated with the Split Away Assets of PEM. Consequently, PEM’s equity after the split away/merger will be comprised of those assets and liabilities in its equity that are not included in said Split Away Assets. PEM will continue its commercial activity and business with the remaining assets and liabilities that are not split from its assets, and without changing its name or corporate purpose.

TWO: Given that CVB, Última Milla and PEM are companies directly and indirectly owned by Telecom, the purpose of this Agreement is to unify the operations of Telecom, Última Milla, CVB and the Split Away Assets of PEM, thus increasing efficiency, synergy and cost reductions, and optimizing, through the business reorganization, the use of the technical, administrative and financial structures of the Companies.

THREE: This corporate reorganization is carried out on the basis of the equity situation as reported on the financial statements of the Companies as of June 30, 2019. The special merger individual financial statements of Telecom, the special merger financial statements of Última Milla, the special merger financial statements of CVB, the special split away individual financial statements and special split away/merger individual financial statements of PEM, and the special consolidated financial statements of the merger, in all cases as of June 30, 2019, have been prepared on a consistent basis and using similar valuation criteria, in accordance with the professional accounting standards in force in the Argentine Republic.

FOUR: Pursuant to the provisions of section 83 paragraph 1 section C of Law 19,550, it is recorded that all the shares of PEM, CVB and Última Milla belong directly and indirectly to Telecom, so this corporate reorganization does not require an exchange of shares.

FIVE: As a consequence of this corporate reorganization: (i) CVB and Última Milla will be dissolved without liquidation by virtue of their merger into Telecom, and (ii) PEM will be split and its share capital will be reduced in the amount of ARS 10,296,566. Consequently, after this reduction, PEM’s share capital will amount to ARS 3,261,945 and will be represented by ARS 3,261,945 nominal non-endorsable ordinary shares of nominal value ARS 1 each and entitled to 1 vote per share.

SIX: Pursuant to the provisions of section FIVE above, PEM must amend Article Four of its Bylaws, as follows: “The share capital is established in the amount of ARS 3,261,945 and is represented by ARS 3,261,945 ordinary, registered non-endorsable shares of one peso nominal value each and entitled to one vote per share. The share capital can be increased by decision of the ordinary shareholders’ meeting up to five times its amount in accordance with section 188 of Law 19,550. The minutes authorizing such increase must be notarized, published and registered with the supervisory authority”. Such amendment will be submitted to the consideration of the extraordinary Shareholders’ Meeting that deals with the current process of split/merger and merger.

SEVEN: The capital stock of the Companies that are a party to this Agreement as of June 30, 2019 is as follows: Telecom: ARS 2,165,236,424, represented by 683,856,600 class “A” ordinary book-entry shares of nominal value ARS 1 and entitled to one vote per share; 639,502,300 class “B” ordinary book-entry shares of nominal value ARS 1 and entitled to one vote per share; 210,866 class C ordinary book-entry shares of nominal value ARS 1 and entitled to one vote per share, and 841,666,658 class D ordinary book-entry shares of nominal value ARS 1 and entitled to one vote per share; Última Milla: ARS 12,000, represented by 12,000 registered non-endorsable ordinary shares of nominal value ARS 1 each and entitled to one vote per share; CVB: ARS 2,109,000, represented by 2,109,000 registered non-endorsable ordinary shares of nominal value ARS 1 each and entitled to 1 vote per share of which 632,700 are Class “A” and 1,476,300 are Class “B”, and PEM: ARS 13,558,511 represented by 13,558,511 ordinary non-endorsable nominative shares of nominal value ARS 1 each and entitled to one vote per share.

EIGHT: The merger date is set on the 1st day of October 2019; on that date Telecom will continue with the operations of CVB, Última Milla and the Split Away Assets of PEM, generating the corresponding operational, accounting and tax effects. As of that date, all assets and liabilities, including registrable assets, rights and obligations belonging to CVB and Última Milla, and to the Split Away Assets of PEM, shall be considered incorporated into Telecom’s equity, as Surviving Company.

NINE: This Agreement will be approved by the administrative bodies of the Companies that are a Party to this Agreement and must be ratified by the respective extraordinary Shareholders’ Meetings.

TEN: The managers of Última Milla and CVB will continue in office with their own powers, until the moment of signing the definitive merger agreement; on that date, the administration of said companies will be governed according to the provisions included in the last paragraph of section 84 of Law 19,550. PEM’s managers will continue in office with their own powers, since PEM will continue its commercial activity as a going concern with the equity that is not part of the split away.

ELEVEN: Any difference that may arise in the application of this Agreement, as well as in any matter associated with the split away/merger of the Split Away Assets of PEM and the merger of CVB and Última Milla, will be subject to the jurisdiction of the National Lower Courts hearing Commercial Matters of the Buenos Aires City, for which purpose the Parties declare their special domiciles to be the addresses first above written.

IN WITNESS WHEREOF, the Parties have signed four equally valid copies of this Agreement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Telecom Argentina S.A.

|

|

|

|

|

|

|

|

Date: October 11, 2019

|

By:

|

/s/ Gabriel P. Blasi

|

|

|

|

Name:

|

Gabriel P. Blasi

|

|

|

|

Title:

|

Responsible for Market Relations

|

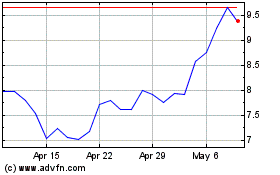

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

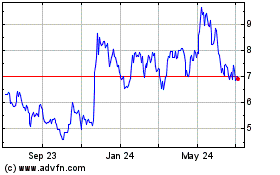

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Apr 2023 to Apr 2024