Tejon Ranch Co., or the Company, (NYSE:TRC), a diversified real

estate development and agribusiness company, today announced

financial results for the three-months ended March 31, 2019.

The Company is in the process of entitling, planning and

developing four master planned developments. Three of the

developments are mixed-use residential communities and the fourth

is a large commercial/industrial center currently in execution with

more than 5.0 million square feet already developed and an

additional 14.3 million square feet available for development. When

all entitlements are approved, the Company's current and future

master planned developments will be home to 34,783 housing units,

more than 35 million square feet of commercial/industrial space and

750 lodging units.

“We achieved a considerable milestone with the final approval by

the Los Angeles County Board of Supervisors of our Centennial at

Tejon Ranch mixed-used residential development,” said Gregory S.

Bielli, President and CEO of Tejon Ranch Co. “Now, all of our

master planned developments have received their initial legislative

approval and we look forward to advancing each of these projects

through their various stages to ultimate build-out. We are also

pleased to see continuing demand, especially out of the Los Angeles

basin, for our industrial product at the Tejon Ranch Commerce

Center. To lease more than two-thirds of a building, even as you’re

just breaking ground, is testament to the market’s favorable view

of TRCC,” Bielli added.

First Quarter Financial Results

- Net income attributable to common

stockholders for the first quarter of 2019 was $0.1 million, or net

income per share attributed to common stockholders, basic and

diluted, of $0.00, compared with $1.5 million, or net income per

share attributed to common stockholders, basic and diluted, of

$0.06, for the first quarter of 2018.

- Revenues and other income, including

equity in earnings of unconsolidated joint ventures, for the first

quarter of 2019 were $11.9 million, a decrease of $2.0 million, or

14%, from $13.9 million for the same period in 2018. Factors

affecting first-quarter results include:

- Strong California winter rainfall

reduced water sales opportunities, causing a decrease in mineral

resources revenues of $3.0 million. Comparatively, the Company sold

4,445 acre feet and 7,442 acre feet of water as of March 31,

2019 and 2018, respectively. The aforementioned decrease in mineral

resources revenues was partially offset by an increase in

commercial revenues of $0.7 million primarily driven by an increase

of $0.4 million in spark spread revenues from the Company's

Pastoria Energy Facility lease.

- The Company's share of earnings from

its joint ventures for the first three months of 2019 was $0.9

million, an increase of $0.7 million, or 350%, from $0.2 million

for the same period in 2018. Within this increase, $0.6 million was

attributed to an increase in the Company's share of earnings from

its TA/Petro joint venture driven by improved fuel margins.

Comparatively diesel margins were $0.36 and $0.17 per gallon as of

March 31, 2019 and 2018, respectively. Comparatively, gasoline

margins were $0.62 and $0.45 per gallon as of March 31, 2019

and 2018, respectively.

2019 Operational Highlights

- The Company's TRC-MRC 3 joint venture,

a partnership with Majestic Realty Co., has commenced construction

of a 579,040 square foot industrial building. The building is

already 67% leased and the tenant is expected to take occupancy in

the fourth quarter of 2019.

- The Company received final approval of

its Centennial mixed-use residential community upon completion of

the finding of facts and the adoption of other resolutions by the

Los Angeles County Board of Supervisors on April 30, 2019. This

also includes a Development Agreement between Los Angeles County

and Centennial, which provides the Company with vested rights to

build the project as approved for 30 years. With this approval,

Centennial at Tejon Ranch achieved local legislative approval for

the building of 19,333 residential units and more than 10.1 million

square feet of commercial space.

2019 Outlook:

The Company's capital structure provides a solid foundation for

continued investment in ongoing and future projects. As of

March 31, 2019, total capital, including debt, was

approximately $499.6 million. The Company has cash and securities

totaling approximately $68.2 million and $30.0 million available on

its line of credit.

The Company will continue to aggressively pursue development,

leasing, and investment within Tejon Ranch Commerce Center and in

its joint ventures. The Company will also continue to invest in its

residential projects, including the engineering necessary to

advance approved tract maps to a final map status, as well as

defining potential capital funding sources for Mountain Village at

Tejon Ranch, advancing re-entitlement efforts for Grapevine at

Tejon Ranch and preparing for permit applications and potential

litigation following Los Angeles County’s approval of Centennial at

Tejon Ranch.

California is one of the most highly regulated states in which

to engage in real estate development and, as such, natural delays,

including those resulting from litigation, can be reasonably

anticipated.

Throughout the next few years, the Company expects net income to

fluctuate from year-to-year based on commodity prices, production

within its farming segment, and the timing of sales of land and the

leasing of land within its industrial developments.

The Company believes the variability of its quarterly and annual

operating results will continue during 2019 due to the nature of

its current farming and real estate activities. Nut and grape crop

markets are particularly sensitive to the size of each year’s world

crop and the demand for those crops. Large crops in California and

abroad can rapidly depress prices. Weather conditions can impact

the number of tree and vine dormant hours, which are integral to

tree and vine growth. The Company will not know the impact of

current weather conditions on 2019 production until the early

summer of 2019. Thus far, the Company has experienced extended

heavier rainfall and colder temperatures during the almond bloom

period when compared to the 2017-2018 winter, which could

negatively impact 2019 almond production. In addition, 2019 is the

alternative bearing cycle for our pistachio trees and a lower than

average crop is anticipated, especially compared to our record high

yields in 2018. Additionally, increased tariffs from China and

India, which are major customers of almonds and pistachios, can

make American products less competitive and push customers to

switch to another producing country.

Water sales opportunities for the remainder of 2019 will be

limited based on winter rain and snow levels, as well as the

California State Water Project, or SWP, water allocations being at

a 70% level.

About Tejon Ranch Co.

Tejon Ranch Co. (NYSE: TRC) is a diversified real estate

development and agribusiness company, whose principal asset is its

270,000-acre land holding located approximately 60 miles north of

Los Angeles and 30 miles south of Bakersfield.

More information about Tejon Ranch Co. can be found on the

Company's website at www.tejonranch.com.

To watch a video overview of Tejon Ranch Co., please visit:

http://tejonranch.com/investorvideo/.

Forward Looking Statements:

The statements contained herein, which are not historical facts,

are forward-looking statements based on economic forecasts,

strategic plans and other factors, which by their nature involve

risk and uncertainties. Some of the factors that could cause actual

results to differ materially are the following: business conditions

and the general economy, future commodity prices and yields, market

forces, the ability to obtain various governmental entitlements and

permits, interest rates and other risks inherent in real estate and

agriculture businesses. For further information on factors that

could affect the Company, the reader should refer to the Company’s

filings with the Securities and Exchange Commission.

TEJON RANCH CO.CONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands, except earnings per

share)(Unaudited)

Three Months Ended March 31, 2019 2018

Revenues: Real estate - commercial/industrial $ 2,826 $ 2,154

Mineral resources 6,132 9,131 Farming 815 1,195 Ranch operations

889 989 Total revenues from Operations 10,662 13,469

Operating Income (Loss): Real estate - commercial/industrial 1,034

835 Real estate - resort/residential (648 ) (415 ) Mineral

resources 2,300 4,900 Farming (783 ) (643 ) Ranch operations (461 )

(400 ) Income from Operating Segments 1,442 4,277

Investment income 349 283 Other loss, net 26 (14 ) Corporate

expense (2,474 ) (2,732 ) (Loss) income from operations before

equity in earnings of unconsolidated joint ventures (657 ) 1,814

Equity in earnings of unconsolidated joint ventures, net 876

167 Income before income tax expense 219 1,981 Income tax

expense 95 526 Net income 124 1,455 Net income (loss)

attributable to non-controlling interest 5 (2 ) Net income

attributable to common stockholders $ 119 $ 1,457 Net

income per share attributable to common stockholders, basic $ —

$ 0.06 Net income per share attributable to common

stockholders, diluted $ — $ 0.06 Weighted average

number of shares outstanding: Common stock 25,992,374 25,912,819

Common stock equivalents 17,707 28,509 Diluted shares

outstanding 26,010,081 25,941,328

Non-GAAP Financial Measure

This news release includes references to the Company’s non-GAAP

financial measure “EBITDA.” EBITDA represents our share of

consolidated net income in accordance with GAAP, before interest,

taxes, depreciation, and amortization, plus the allocable portion

of EBITDA of unconsolidated joint ventures accounted for under the

equity method of accounting based upon economic ownership interest,

and all determined on a consistent basis in accordance with GAAP.

EBITDA is a non-GAAP financial measure, and is used by us and

others as a supplemental measure of performance. We use Adjusted

EBITDA to assess the performance of our core operations, for

financial and operational decision making, and as a supplemental or

additional means of evaluating period-to-period comparisons on a

consistent basis. Adjusted EBITDA is calculated as EBITDA,

excluding stock compensation expense. We believe Adjusted EBITDA

provides investors relevant and useful information because it

permits investors to view income from our operations on an

unleveraged basis before the effects of taxes, depreciation and

amortization, and stock compensation expense. By excluding interest

expense and income, EBITDA and Adjusted EBITDA allow investors to

measure our performance independent of our capital structure and

indebtedness and, therefore, allow for a more meaningful comparison

of our performance to that of other companies, both in the real

estate industry and in other industries. We believe that excluding

charges related to share-based compensation facilitates a

comparison of our operations across periods and among other

companies without the variances caused by different valuation

methodologies, the volatility of the expense (which depends on

market forces outside our control), and the assumptions and the

variety of award types that a company can use. EBITDA and Adjusted

EBITDA have limitations as measures of our performance. EBITDA and

Adjusted EBITDA do not reflect our historical cash expenditures or

future cash requirements for capital expenditures or contractual

commitments. While EBITDA and Adjusted EBITDA are relevant and

widely used measures of performance, they do not represent net

income or cash flows from operations as defined by GAAP, and they

should not be considered as alternatives to those indicators in

evaluating performance or liquidity. Further, our computation of

EBITDA and Adjusted EBITDA may not be comparable to similar

measures reported by other companies.

TEJON RANCH CO.Non-GAAP

Financial Measures(Unaudited)

Three Months Ended March 31, 2019 2018 Net

income $ 124 $ 1,455 Net income (loss) attributed to

non-controlling interest 5 (2 ) Net income attributable to

common stockholders 119 1,457 Interest, net: Consolidated (349 )

(283 ) Our share of interest expense from unconsolidated joint

ventures 738 501 Total interest, net 389 218 Income

taxes 95 526 Depreciation and amortization: Consolidated 1,089

1,071 Our share of depreciation and amortization from

unconsolidated joint ventures 1,109 919 Total

depreciation and amortization 2,198 1,990 EBITDA

2,801 4,191 Stock compensation expense 813 948

Adjusted EBITDA $ 3,614 $ 5,139

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190507005198/en/

Tejon Ranch Co.Robert D. Velasquez, 661-248-3000Senior Vice

President, Finance, and Chief Financial Officer

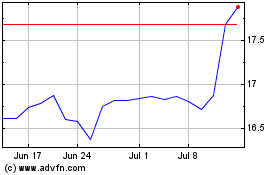

Tejon Ranch (NYSE:TRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

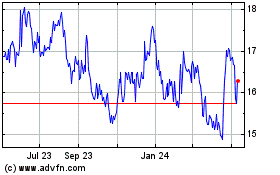

Tejon Ranch (NYSE:TRC)

Historical Stock Chart

From Apr 2023 to Apr 2024