TC PipeLines, LP (NYSE: TCP) (the Partnership) today reported net

income attributable to controlling interests of $88 million and

distributable cash flow of $88 million for the three months ended

March 31, 2020.

“We are living in a world of unprecedented events with the

COVID-19 pandemic front and center coupled with significant recent

challenges in the energy space,” said Nathan Brown, president of TC

PipeLines, GP, Inc. “The events of the last two months have

underscored the importance of resilience and stability and we

believe the credit strength of our customer group, fundamental

market strength of our assets’ locations, and the substantial

utility demand-pull nature of our long-term, take-or-pay contracted

capacity set the Partnership apart and will help us to maintain the

momentum we have built across our geographic footprint. Our

businesses provide critical energy delivery 24/7 to ensure the most

important functions of our country can run uninterrupted, even in

the most challenging times. We implemented business continuity

plans across our operations and continue to deliver our services

with employee health and safety as paramount values. That is never

more important as we, through TC Energy Corporation, operate our

assets with a coordinated approach to maintain our critical

operations, maintenance and growth projects.

“Our assets performed well in the first quarter of 2020 and

generated solid operational results,” continued Brown. “We

experienced uninterrupted demand for our services, although this

year’s moderate winter impeded our ability to sell short-term

services compared to the same period last year.

“In these unprecedented times, TC PipeLines is focused on

maintaining the current distribution level and self-funding

operating and growth activities. Accordingly, we see substantial

value for our investors moving forward in the near term with an

enviable suite of opportunities for growth in the long term,”

concluded Brown.

First quarter highlights

(unaudited)

- Generated net income attributable to controlling interests of

$88 million;

- Paid cash distributions of $55 million, including $8 million

paid to Class B units;

- Declared cash distribution of $0.65 per common unit for the

first quarter of 2020;

- Generated Adjusted EBITDA of $138 million and distributable

cash flow of $88 million;

- No outstanding balance on our Senior Credit Facility;

- Received FERC approval to begin construction of Phase III of

PNGTS’ Portland XPress project in early March;

- Continued permitting, engineering and construction activities

on our PNGTS, GTN XPress and Tuscarora XPress projects; and

- Continued to progress North Baja XPress and Iroquois’ ExC

project.

The Partnership’s financial highlights for the

first quarter of 2020 compared to the same period in 2019 were:

| |

Three months ended |

| (unaudited) |

March 31, |

|

(millions of dollars, except per common unit amounts) |

2020 |

|

|

2019 |

|

| Net income |

94 |

|

|

100 |

|

| Net income attributable to

controlling interests |

88 |

|

|

93 |

|

| Net income per common unit –

basic and diluted (a) |

$1.21 |

|

|

$1.28 |

|

| |

|

|

|

| Earnings before interest,

taxes, depreciation and amortization (EBITDA) (b) |

134 |

|

|

142 |

|

| Adjusted EBITDA(b) |

138 |

|

|

152 |

|

| |

|

|

|

| Cash distributions paid |

(47 |

) |

|

(47 |

) |

| Class B distributions paid

(c) |

(8 |

) |

|

(13 |

) |

| Distributable cash flow

(b) |

88 |

|

|

116 |

|

| |

|

|

|

| Cash distribution declared per

common unit |

$0.65 |

|

|

$0.65 |

|

| |

|

|

|

| Weighted average

common units outstanding – basic and diluted

(millions) |

71.3 |

|

|

71.3 |

|

| |

|

|

|

| Common units

outstanding, end of period (millions) |

71.3 |

|

|

71.3 |

|

|

(a) |

Net income per

common unit is computed by dividing net income attributable to

controlling interests, after deduction of net income attributable

to TC PipeLines GP, Inc. (the General Partner), by the weighted

average number of common units outstanding. Refer to the “Financial

Summary-Consolidated Statements of Operations” section of this

release. |

| (b) |

EBITDA, Adjusted EBITDA and Distributable Cashflow are non-GAAP

financial measures. Refer to the description of these non-GAAP

financial measures in the section of this release entitled

“Non-GAAP Measures” and the Supplemental Schedule for further

detail, including a reconciliation to the comparable GAAP

measures. |

| (c) |

Reflects distributions allocable to Class B units in the years

ended December 31, 2019 and 2018 and paid in the three months ended

March 31, 2020 and 2019, respectively. |

Recent business

developments:

Current outlook including the uncertainty surrounding COVID-19

pandemic and global crude oil market:

On March 11, 2020, the World Health Organization declared the

novel coronavirus, or COVID-19, a global

pandemic. Additionally, amid the COVID-19 crisis, the global

oil market experienced a precipitous decline in the price for crude

oil due to an oversupply of oil in the first quarter of

2020.

As primary operator of our pipelines, TC Energy Corporation’s

(TC Energy) business continuity plans were put in place across the

organization and TC Energy continues to effectively operate our

assets, conduct commercial activities and execute on projects with

a focus on health, safety and reliability. At the current time, our

business is broadly considered an essential or critical business in

the United States given the important role our infrastructure plays

in delivering energy to North American markets. We anticipate that

changes to work practices and other restrictions put in place by

government and health authorities in response to the COVID-19

pandemic will have an impact on certain projects. We generally

believe this will not be material to our operations, but the

long-term impact of the COVID-19 pandemic and associated effects is

uncertain at this time.

Our pipeline assets are largely backed by long-term, take-or-pay

contracts resulting in revenues that are materially insulated from

short-term volatility associated with volume throughput and

commodity prices. More importantly, a significant portion of our

long-term contract revenue is with investment-grade customers and

we have not experienced any collection issues on our receivables to

date. Aside from the impact of maintenance activities and normal

seasonal factors, to date we have not seen any pronounced changes

in the utilization of our assets. While it is too early to

ascertain any long-term impact that the COVID-19 pandemic or the

oil price decline may have on our capital growth program, we note

that we could experience a delay in construction and other related

activities.

Capital market conditions in 2020 have been significantly

impacted by the COVID-19 pandemic and the oil price decline

resulting in periods of heightened volatility and reduced

liquidity. Despite this, our liquidity remains strong underpinned

by stable cashflow from operations, cash on hand and full access to

our $500 million senior revolving credit facility. Additionally, we

expect to refinance GTN's $100 million Senior Notes due in June

2020 and Tuscarora's $23 million Unsecured Term Loan due in August

2020 together with additional funding to be used to finance a

portion of GTN XPress and Tuscarora XPress. We continue to

conservatively manage our financial position, self-fund our ongoing

capital expenditures and maintain our debt at prudent levels, and

we believe we are well positioned to fund our obligations through a

prolonged period of disruption, should it occur. Based on current

expectations, we believe our business will continue to deliver

consistent financial performance going forward and support our

current quarterly distribution level of $0.65 per common unit.

Organic growth projects:

PNGTS’ Portland XPress Project (PXP) - Phases I and II of this

project are in service, and on March 5, 2020, FERC granted PNGTS’

request to begin construction of Phase III of the project.

Construction activities are expected to ramp up during the second

quarter and PXP is currently on track to be fully in service on

November 1, 2020. Once fully in service, all three phases of PXP in

aggregate are expected to generate approximately $50 million of

annual revenue for PNGTS.

ANR's Alberta XPress project - On February 12, 2020, TC Energy

approved the Alberta XPress project, an expansion project on its

ANR Pipeline system with an estimated in-service date of 2022. This

project utilizes existing capacity on our Great Lakes and TC

Energy’s Canadian Mainline systems to connect growing natural gas

supply from the WCSB to U.S. Gulf Coast LNG export markets. As a

result, an ANR contract on the Great Lakes system totaling

approximately 168,000 Dth/day of capacity will be converted to a

new 20-year commitment at maximum rates for a total contract value

of $182 million starting in 2022. This contract, which has a full

quantity reduction option at any time before October 1, 2022, is

dependent on ANR being able to secure the required regulatory

approvals and other requirements of the project.

Cash distributions:

On April 21, 2020, the board of directors of our

General Partner declared the Partnership’s first quarter 2020 cash

distribution in the amount of $0.65 per common unit payable on May

12, 2020 to unitholders of record as of May 1, 2020. The declared

distribution to our General Partner was $1 million for its two

percent general partner interest.

Results of operations

The Partnership’s net income attributable to controlling

interests decreased by $5 million in the three months ended

March 31, 2020 compared to the same period in 2019, mainly due

to the following:

Transmission revenues - The $12 million decrease in transmission

revenues was largely the result of the following:

- lower revenue on GTN due to (i) its scheduled 6.6 percent rate

decrease effective January 1, 2020, (ii) lower discretionary

services sold due to moderate weather conditions in early 2020

compared to colder weather experienced in early 2019, and (iii)

additional sales in 2019 related to regional supply constraints

from a force majeure event experienced by a neighboring pipeline

that were not repeated in 2020;

- lower revenue on Tuscarora due to its scheduled 10.8 percent

rate decrease effective August 1, 2019;

- lower revenue from discretionary services sold by PNGTS in 2020

compared to 2019 due to more moderate weather conditions in early

2020, partially offset by new revenues from Westbrook XPress which

went into service on November 1, 2019;

- lower volume of discretionary services sold by North Baja;

and

- lower revenue on Bison as a result of the expiration of one of

its legacy contracts at the end of January 2019.

Operating expenses - The $ 2 million decrease in operation and

maintenance expenses was primarily due to an overall net decrease

in property taxes on Bison and PNGTS and an overall decrease in

allocated employee costs.

Financial charges and other - The $3 million decrease was

primarily attributable to the $68 million reduction in our overall

debt balance when compared to our debt balance at March 31, 2019.

The reduction was the result of (a) a $50 million prepayment on our

2013 $500 million term loan facility during the second quarter of

2019; (b) a $35 million repayment of GTN's outstanding balance

under its unsecured term loan facility during the second quarter of

2019; and (c) a $1 million scheduled payment on Tuscarora's

unsecured term loan facility during the third quarter of 2019;

offset by (d) $18 million of additional borrowings under PNGTS'

revolving credit facility.

Net income attributable to non-controlling interests - The $1

million decrease in the Partnership's net income attributable to

non-controlling interests was due to the decrease in PNGTS' net

income primarily as a result of its lower revenue, partially offset

by lower property taxes.

Non-GAAP Financial Measures - Our EBITDA was lower for the three

months ended March 31, 2020 compared to the same period in 2019.

The $8 million decrease was primarily due to lower revenue from our

consolidated subsidiaries as discussed above.

Our Adjusted EBITDA was lower for the three months ended March

31, 2020 compared to the same period in 2019. The $14 million

decrease was primarily due to:

- lower revenue from consolidated subsidiaries as discussed

above; and

- lower distribution from Iroquois as it satisfied its final

surplus cash distribution of approximately $2.6 million in the

fourth quarter of 2019.

Our distributable cash flow decreased by $28 million in the

three months ended March 31, 2020 compared to the same period in

2019 due to the net effect of:

- lower Adjusted EBITDA;

- higher maintenance capital expenditures at GTN as a result of

increased spending on major equipment overhauls at several

compressor stations and certain system upgrades; and

- lower interest expense due to lower average debt balance during

the three months ended March 31, 2020 compared to the same period

in 2019.

Cash flow analysis

Operating cash flows

In the three months ended March 31, 2020, the Partnership's

net cash provided by operating activities decreased by $4 million

compared to the same period in 2019 primarily due to the net effect

of:

- lower net cash flow from operations of our consolidated

subsidiaries primarily due to the decrease in their revenue;

- the timing of receipt of Iroquois' third quarter 2019

distributions from its operating activities, which we would

ordinarily have received during the fourth quarter of 2019 but was

not received until early in the first quarter of 2020; and

- the impact from amount and timing of operating working capital

changes.

Investing cash flows

During the three months ended March 31, 2020, the cash used

in our investing activities was higher by $7 million compared to

the same period in 2019 primarily due to the net effect of:

- the timing of receipt of Iroquois' third quarter 2019

distributions amounting to approximately $2.6 million, a portion of

which was considered a return of investment, which we would

ordinarily have received during the fourth quarter of 2019 but was

not received until early in the first quarter of 2020; and

- the higher capital maintenance expenditures on GTN for its

overhaul projects together with continued capital spending on our

GTN XPress, PXP and Westbrook XPress projects.

Financing cash flows

The Partnership's net cash used for financing activities was

approximately $43 million lower in the three months ended

March 31, 2020 compared to the same period in 2019 primarily

due to the net effect of:

- additional borrowings on PNGTS’ revolving credit facility of $6

million in 2020 to fund its PXP and Westbrook XPress projects

compared to a net debt repayment of $42 million in 2019; and

- $5 million decrease in distributions paid to Class B units in

2020 as compared to 2019.

Overall current financial condition:

At March 31, 2020, the balance of our cash and cash

equivalents of $134 million was higher than our position at

December 31, 2019 by approximately $51 million and our overall

long-term debt balance increased by approximately $7 million as a

result of the financing required during the period on PNGTS' PXP

and Westbrook XPress projects.

We continue to be financially disciplined by using our available

cash to fund ongoing capital expenditures and maintaining debt at

prudent levels and we believe we are well positioned to fund our

obligations through a prolonged period of disruption, should it

occur.

We believe our (1) cash on hand, (2) operating cash flows, (3)

$500 million available borrowing capacity on our senior revolving

credit facility at May 6, 2020, and (4) if needed, and subject to

customary lender's approval upon request, an additional $500

million capacity that is available under our senior revolving

credit facility accordion feature, are sufficient to fund our

short-term liquidity requirements, including distributions to our

unitholders, ongoing capital expenditures, required debt repayments

and other financing needs such as capital contribution requests

from our equity investments.

Non-GAAP financial

measures

The following non-GAAP financial measures are

presented as a supplement to our financial statements:

- EBITDA;

- Adjusted EBITDA;

- Total distributable cash flow; and

- Distributable cash flow

EBITDA is an approximate measure of our operating cash flow

during the current earnings period and reconciles directly to the

most comparable measure of net income, which includes net income

attributable to non-controlling interests and earnings from our

equity investments. It measures our earnings before deducting

interest, depreciation and amortization and taxes.

Adjusted EBITDA is our EBITDA, less (1) earnings from our equity

investments, plus (2) distributions from our equity investments,

and plus or minus (3) certain non-recurring items (if any) that are

significant but not reflective of our underlying operations.

Beginning the three months ended March 31, 2020, we are providing

Adjusted EBITDA as an additional performance measure of the current

operating profitability of our assets.

During the three months ended March 31, 2020, the Partnership

revised its calculation of Adjusted EBITDA to include distributions

from our equity investments, net of equity earnings from our

investments as described above, which were previously excluded from

such measure. The presentation of Adjusted EBITDA for the

three months ended March 31, 2019 was recast to conform

with the current presentation. The Partnership believes the

revised presentation more closely aligns with similar non-GAAP

measures presented by our peers and with the Partnership’s

definitions of such measures.

Total distributable cash flow and distributable

cash flow provide measures of distributable cash generated during

the current earnings period and reconcile directly to the net

income amounts presented.

Total distributable cash flow includes Adjusted

EBITDA less:

- Allowance for funds used during construction (AFUDC);

- Interest expense;

- Current Income taxes;

- Distributions to non-controlling interests; and

- Maintenance capital expenditures from consolidated

subsidiaries.

Distributable cash flow is computed net of

distributions declared to the General Partner and any distributions

allocable to Class B units. Distributions declared to the General

Partner are based on its two percent interest plus, if applicable,

an amount equal to incentive distributions. Distributions allocable

to the Class B units equal 30 percent of GTN’s distributable cash

flow for the year ending December 31, 2020 less $20 million, the

residual of which is further multiplied by 43.75 percent and if

required, the percentage by which distributions payable to common

units were reduced (Class B Reduction). The Class B Reduction was

implemented during the first quarter of 2018 following the

Partnership’s common unit distribution reduction of 35 percent. The

Class B Reduction will apply to any calendar year during which

distributions payable in respect of common units for such calendar

year are less than $3.94 per common unit. Distributions allocable

to the Class B units in 2019 equaled 30 percent of GTN’s

distributable cashflow less $20 million and the Class B

Reduction.

The non-GAAP financial measures described above

are performance measures presented to assist investors in

evaluating our business performance. We believe these measures

provide additional meaningful information in evaluating our

financial performance and cash generating capacity.

The non-GAAP financial measures presented as

part of this release are provided as a supplement to GAAP financial

results and are not meant to be considered in isolation or as

substitutes for financial results prepared in accordance with GAAP.

Additionally, these measures as presented may not be comparable to

similarly titled measures of other companies.

For a reconciliation of these non-GAAP financial

measures to GAAP measures, please see the table captioned

"Reconciliation of Net income to Distributable Cash Flow” included

at the end of this release.

Conference call

Members of the investment community and other interested parties

are invited to participate in a teleconference by calling

800.806.5484 and entering pass code 3139820# on May 6, 2020 at

10:00 a.m. CDT/11:00 a.m. EDT. Nathan Brown, President of the

General Partner, along with other members of management, will

discuss the Partnership’s first quarter financial results and

provide an update on the Partnership’s business, followed by a

question and answer session. Please dial in 10 minutes prior to the

start of the call. A live webcast of the conference call will also

be available through the Partnership’s website at

www.tcpipelineslp.com/events or via the following

URL:http://www.gowebcasting.com/10573. Slides for the presentation

will be posted on the Partnership’s website under “Events and

Presentations” prior to the webcast.

A replay of the teleconference will also be available two hours

after the conclusion of the call and until 11 p.m. CDT /midnight

EDT on May 13, 2020, by calling 800.408.3053, then entering pass

code 6063505#.

About TC PipeLines, LP

TC PipeLines, LP is a Delaware master limited partnership with

interests in eight federally regulated U.S. interstate natural gas

pipelines which serve markets in the Western, Midwestern and

Northeastern United States. The Partnership is managed by its

general partner, TC PipeLines GP, Inc., a subsidiary of TC Energy

Corporation (NYSE: TRP). For more information about TC PipeLines,

LP, visit the Partnership’s website at

http://www.tcpipelineslp.com.

Forward-looking statements

Certain non-historical statements in this release relating to

future plans, projections, events or conditions are intended to be

“forward-looking statements.” These statements are based on current

expectations and, therefore, subject to a variety of risks and

uncertainties that could cause actual results to differ materially

from the projections, anticipated results or other expectations

expressed in this release, including, without limitation to the

ability of these assets to generate ongoing value to our

unitholders, impact of potential impairment charges, decreases in

demand on our pipeline systems, increases in operating and

compliance costs, the outcome of rate proceedings, the impact of

recently issued and future accounting updates and other changes in

accounting policies, potential changes in the taxation of MLP

investments by state or federal governments such as the elimination

of pass-through taxation or tax deferred distributions, our ability

to identify and complete expansion and growth opportunities,

operating hazards beyond our control, the impact of a potential

slowdown in construction activities or delay in completion of our

capital projects including increase in costs and availability of

labor, equipment and materials, the impact of downward changes in

oil and natural gas prices, including any effects on the

creditworthiness of our shippers or the availability of natural gas

in a low oil price environment, uncertainty surrounding the impact

of global health crises that reduce commercial and economic

activity, including the recent outbreak of the COVID-19 virus, and

the potential impact on our business and our ability to access debt

and equity markets that negatively impacts the Partnership’s

ability to finance its capital spending. These and other factors

that could cause future results to differ materially from those

anticipated are discussed in “Item 1A. Risk Factors” in our Annual

Report on Form 10-K for the year-ended December 31, 2019 filed with

the Securities and Exchange Commission (the SEC), as updated and

supplemented by subsequent filings with the SEC. All

forward-looking statements are made only as of the date made and

except as required by applicable law, we undertake no obligation to

update any forward-looking statements to reflect new information,

subsequent events or other changes.

–30–

Media Inquiries: Hejdi Carlsen / Jaimie

Harding 403.920.7859 or 800.608.7859

Unitholder and Analyst Inquiries: Rhonda

Amundson 877.290.2772investor_relations@tcpipelineslp.com

TC PipeLines,

LPFinancial Summary

Consolidated Statements of

Income

|

|

|

Three months ended |

|

(unaudited) |

|

March 31, |

|

(millions of dollars, except per common unit amounts) |

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

Transmission revenues |

|

101 |

|

|

113 |

|

|

Equity earnings |

|

55 |

|

|

54 |

|

|

Operation and maintenance expenses |

|

(16 |

) |

|

(16 |

) |

|

Property taxes |

|

(6 |

) |

|

(7 |

) |

|

General and administrative |

|

(1 |

) |

|

(2 |

) |

|

Depreciation and amortization |

|

(20 |

) |

|

(20 |

) |

|

Financial charges and other |

|

(19 |

) |

|

(22 |

) |

|

Net income before taxes |

|

94 |

|

|

100 |

|

|

Income taxes |

|

- |

|

|

- |

|

|

Net income |

|

94 |

|

|

100 |

|

|

|

|

|

|

|

|

Net income attributable to non-controlling interests |

|

6 |

|

|

7 |

|

|

Net income attributable to controlling

interests |

|

88 |

|

|

93 |

|

|

|

|

|

|

|

|

Net income attributable to controlling interest

allocation |

|

|

|

|

|

Common units |

|

86 |

|

|

91 |

|

|

General Partner |

|

2 |

|

|

2 |

|

|

|

|

88 |

|

|

93 |

|

|

|

|

|

|

|

|

Net income per common unit – basic and diluted

(a) |

|

$1.21 |

|

|

$1.28 |

|

|

|

|

|

|

|

|

Weighted average common units outstanding – basic

and diluted (millions) |

|

71.3 |

|

|

71.3 |

|

|

|

|

|

|

|

|

Common units outstanding, end of period

(millions) |

|

71.3 |

|

|

71.3 |

|

|

(a) |

Net income per

common unit is computed by dividing net income attributable to

controlling interests, after deduction of amounts attributable to

the General Partner and Class B units, by the weighted average

number of common units outstanding. The amount allocable to the

General Partner equals an amount based upon the General Partner’s

two percent general partner interest. The amount allocable to the

Class B units in 2020 will equal 30 percent of GTN’s distributable

cash flow during the year ending December 31, 2020 less $20

million, the residual of which is further multiplied by 43.75

percent. This amount is further reduced by the estimated Class B

Reduction for 2020 (December 31, 2019 - $20 million less Class

B Reduction) as applicable. During the three months ended March 31,

2020 and 2019, no amounts were allocated to the Class B units as

the thresholds had not been exceeded. |

TC PipeLines,

LPFinancial Summary

Consolidated Balance

Sheets

| (unaudited) |

|

|

|

|

|

(millions of dollars) |

|

March 31, 2020 |

|

December 31, 2019 |

| |

|

|

|

|

| ASSETS |

|

|

|

|

| Current Assets |

|

|

|

|

|

Cash and cash equivalents |

|

134 |

|

|

83 |

|

| Accounts receivable and

other |

|

37 |

|

|

48 |

|

| Distribution receivable

from Iroquois |

|

- |

|

|

14 |

|

| Inventories |

|

11 |

|

|

10 |

|

| Other |

|

3 |

|

|

6 |

|

| |

|

185 |

|

|

156 |

|

| Equity investments |

|

1,102 |

|

|

1,098 |

|

| Property, plant and

equipment |

|

|

|

|

| (Net of $1,201

accumulated depreciation; 2019 - $1,187) |

|

1,540 |

|

|

1,528 |

|

| Goodwill |

|

71 |

|

|

71 |

|

| Other assets |

|

- |

|

|

- |

|

| TOTAL

ASSETS |

|

2,898 |

|

|

2,853 |

|

| |

|

|

|

|

| LIABILITIES AND

PARTNERS’ EQUITY |

|

|

|

|

| Current Liabilities |

|

|

|

|

| Accounts payable and

accrued liabilities |

|

33 |

|

|

28 |

|

| Accounts payable to

affiliates |

|

6 |

|

|

8 |

|

| Accrued interest |

|

20 |

|

|

11 |

|

| Current portion of

long-term debt |

|

123 |

|

|

123 |

|

| |

|

182 |

|

|

170 |

|

| Long-term debt, net |

|

1,887 |

|

|

1,880 |

|

| Deferred state income

taxes |

|

7 |

|

|

7 |

|

| Other liabilities |

|

43 |

|

|

36 |

|

| |

|

2,119 |

|

|

2,093 |

|

| Partners’ Equity |

|

|

|

|

| Common units |

|

584 |

|

|

544 |

|

| Class B units |

|

95 |

|

|

103 |

|

| General partner |

|

15 |

|

|

14 |

|

| Accumulated other

comprehensive income (loss) (AOCI) |

|

(18 |

) |

|

(5 |

) |

| Controlling interests |

|

676 |

|

|

656 |

|

| Non-controlling interest |

|

103 |

|

|

104 |

|

| |

|

779 |

|

|

760 |

|

| TOTAL LIABILITIES AND

PARTNERS’ EQUITY |

|

2,898 |

|

|

2,853 |

|

TC PipeLines,

LPFinancial Summary

Consolidated Statement of Cash

Flows

| |

|

Three months ended |

| (unaudited) |

|

March 31, |

|

(millions of dollars) |

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

| Cash Generated from

Operations |

|

|

|

|

| Net income |

|

94 |

|

|

100 |

|

| Depreciation and

amortization |

|

20 |

|

|

20 |

|

| Equity earnings from equity

investments |

|

(55 |

) |

|

(54 |

) |

| Distributions received from

operating activities of equity investments |

|

65 |

|

|

56 |

|

| Change in operating working

capital |

|

9 |

|

|

13 |

|

| Other |

|

(2 |

) |

|

- |

|

| |

|

131 |

|

|

135 |

|

| Investing

Activities |

|

|

|

|

| Investment in Great Lakes |

|

(5 |

) |

|

(5 |

) |

| Distribution received from

Iroquois as return of investment |

|

5 |

|

|

2 |

|

| Capital expenditures |

|

(24 |

) |

|

(16 |

) |

| Other |

|

- |

|

|

2 |

|

| |

|

(24 |

) |

|

(17 |

) |

| Financing

Activities |

|

|

|

|

| Distributions paid to common

units, including the General Partner |

|

(47 |

) |

|

(47 |

) |

| Distributions paid to Class B

units |

|

(8 |

) |

|

(13 |

) |

| Distributions paid to

non-controlling interests |

|

(7 |

) |

|

(7 |

) |

| Long-term debt issued, net of

discount |

|

6 |

|

|

18 |

|

| Long-term debt repaid |

|

- |

|

|

(50 |

) |

| |

|

(56 |

) |

|

(99 |

) |

| Increase in cash and

cash equivalents |

|

51 |

|

|

19 |

|

| Cash and cash equivalents,

beginning of period |

|

83 |

|

|

33 |

|

| Cash and cash

equivalents, end of period |

|

134 |

|

|

52 |

|

TC PipeLines,

LPSupplemental Schedule

Non-GAAP Measures

Reconciliations of Net income to Distributable

Cash Flow

| |

|

Three months ended |

| (unaudited) |

|

March 31, |

|

(millions of dollars) |

|

2020 |

|

|

2019 |

|

| Net

income |

|

94 |

|

|

100 |

|

| |

|

|

|

|

| Add: |

|

|

|

|

| Interest expense (a) |

|

20 |

|

|

22 |

|

| Depreciation and

amortization |

|

20 |

|

|

20 |

|

| Income taxes |

|

- |

|

|

- |

|

| |

|

|

|

|

| EBITDA |

|

134 |

|

|

142 |

|

| |

|

|

|

|

| Less: |

|

|

|

|

| Equity Earnings: |

|

|

|

|

| Northern Border |

|

(22 |

) |

|

(21 |

) |

| Great Lakes |

|

(20 |

) |

|

(20 |

) |

| Iroquois |

|

(13 |

) |

|

(13 |

) |

| |

|

(55 |

) |

|

(54 |

) |

| Add: |

|

|

|

|

| Distributions from equity

investments (b) |

|

|

|

|

| Northern Border |

|

27 |

|

|

27 |

|

| Great Lakes |

|

21 |

|

|

23 |

|

| Iroquois (c) |

|

11 |

|

|

14 |

|

| |

|

59 |

|

|

64 |

|

| |

|

|

|

|

| ADJUSTED

EBITDA |

|

138 |

|

|

152 |

|

| Less: |

|

|

|

|

| AFUDC |

|

(1 |

) |

|

- |

|

| Interest expense (a) |

|

(20 |

) |

|

(22 |

) |

| Current Income taxes |

|

- |

|

|

- |

|

| Distributions to

non-controlling interest (d) |

|

(6 |

) |

|

(7 |

) |

| Maintenance capital

expenditures (e) |

|

(22 |

) |

|

(6 |

) |

| |

|

(49 |

) |

|

(35 |

) |

| |

|

|

|

|

| Total Distributable

Cash Flow |

|

89 |

|

|

117 |

|

| General Partner distributions

declared (f) |

|

(1 |

) |

|

(1 |

) |

| Distributions allocable to

Class B units (g) |

|

- |

|

|

- |

|

| Distributable Cash

Flow |

|

88 |

|

|

116 |

|

|

(a) |

Interest

expense as presented includes net realized loss or gain related to

the interest rate swaps. |

| (b) |

Amounts are calculated in accordance with the cash distribution

policies of each of our equity investments. Distributions from our

equity investments represent our respective share of these

entities’ quarterly distributable cash for the current reporting

period. |

| (c) |

This amount represents our proportional 49.34 percent share of

the distribution declared by our equity investee, Iroquois, for the

current reporting period. For the three months ended March 31,

2019, the amount includes our 49.34 percent share of the Iroquois

unrestricted cash distribution amounting to approximately $2.6

million (March 31, 2020- none). |

| (d) |

Distributions to non-controlling interests represent the

respective share of our consolidated entities’ distributable cash

from earnings not owned by us for the periods presented. |

| (e) |

The Partnership’s maintenance capital expenditures include cash

expenditures made to maintain, over the long term, the operating

capacity, system integrity and reliability of our pipeline assets.

This amount represents the Partnership’s and its consolidated

subsidiaries’ maintenance capital expenditures and does not include

the Partnership’s share of maintenance capital expenditures for our

equity investments. Such amounts are reflected in “Distributions

from equity investments” as those amounts are withheld by those

entities from their quarterly distributable cash. |

| (f) |

No incentive distributions were declared to the General Partner

for the three months ended March 31, 2020 and 2019. |

| (g) |

For the three months ended March 31, 2020 and 2019, no

distributions were allocated to the Class B units. |

PDF

available: http://ml.globenewswire.com/Resource/Download/9731f57e-7d95-490b-8a8f-10230b71ff13

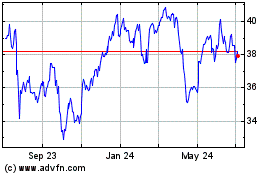

TC Energy (NYSE:TRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

TC Energy (NYSE:TRP)

Historical Stock Chart

From Apr 2023 to Apr 2024