Coronavirus Boosts Target's Sales but Squeezes Profits

March 25 2020 - 7:05AM

Dow Jones News

By Sarah Nassauer

Target Corp. said sales of food and household goods are surging

because of the coronavirus pandemic, but the retailer may report

lower-than-expected profits as demand falls for high-margin goods

such as apparel and it becomes more expensive to staff and clean

stores.

Comparable sales, those from stores and digital channels

operating for at least 12 months, are up more than 20% thus far in

March compared with the same period last year. Sales of household

essentials, food and beverages have risen more than 50% during that

time, while sales of apparel and accessories have declined more

than 20%.

Target, Walmart Inc., Amazon.com Inc. and other retailers

selling groceries and cleaning products have struggled to restock

stores and handle the surge as people race to stock up as the virus

spreads. Walmart and Amazon have announced plans to hire 250,000

temporary workers.

As schools around the country close and many people work from

home, sales of home-office supplies and children's entertainment

items have risen, but "higher-margin discretionary categories

declined dramatically, " Target Chief Executive Brian Cornell said

on a call with reporters. If that trend continues, gross profit

margin will be lower than expected for the current quarter, he

said.

Target is also spending more than expected on worker pay and

benefits because of the spike in product volume moving through its

supply chain and the need for more-rigorous cleaning routines, the

company said. The company expects those changes to cost more than

$300 million during the current quarter.

Target withdrew financial guidance for the quarter and full year

and will suspend share repurchases, the company said.

Previously, Target said adjusted earnings per share for the

current quarter would hit $1.55 to $1.75 per share, and $6.70 to

$7.00 per share for the full year.

Shopper behavior and economic pressures are fluid and

unpredictable, said Mr. Cornell. Target is surveying shoppers to

gauge how the new-coronavirus pandemic may affect behavior longer

term, he said.

"Usually a recession is something that builds gradually over a

period of time. This has happened virtually overnight," said Mr.

Cornell. "It's safe to say sitting here today that America is

largely closed for business."

Dozens of retailers from Macy's Inc. to Dick's Sporting Goods

Inc. have closed thousands of stores as the number of U.S.

infections increased and health officials advised people to limit

travel. The number of coronavirus cases in the U.S. exceeds more

than 50,000, according to Johns Hopkins University.

Executives at Nike Inc., which closed its U.S. stores March 16,

said online sales in the U.S. have surged for the sportswear brand

in recent days.

Retailers staying open to sell food, cleaning supplies and other

essential goods have made a number of changes, offering more paid

leave to encourage sick workers to stay home, boosting hourly pay,

instituting senior-citizens-only hours and doing more-frequent

cleaning.

Target said Wednesday that it will beef up those efforts,

cleaning self-checkout areas after each shopper and placing signs

on the floor and other areas to remind shoppers to stay apart from

each other. Starting Thursday, Target will also temporarily stop

accepting returns and won't sell reusable bags or let store workers

load shoppers' reusable bags, Mr. Cornell said.

Walmart said Tuesday that it will add sneeze guards to checkout

areas in the coming weeks to protect cashiers, spray down carts

with sanitizing chemicals and place floor decals near entrances and

registers, "making it easier for customers to judge the proper

social distance from each other."

Target will also pull back on its previous plans to remodel

around 300 stores this year, instead completing the 130 already

under way and putting off the rest until next year. The retailer

plans to open 15 to 20 new small-format stores this year instead of

the 36 previously planned, moving those projects to next year.

"We are prioritizing the work that's in front of us to support

our team, store operations and supply chain," said Mr. Cornell.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

March 25, 2020 06:50 ET (10:50 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

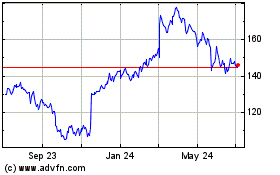

Target (NYSE:TGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

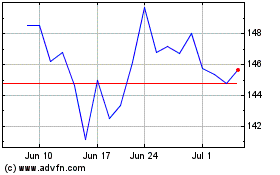

Target (NYSE:TGT)

Historical Stock Chart

From Apr 2023 to Apr 2024