Target Gains Sales In Stores And Online -- WSJ

November 21 2019 - 3:02AM

Dow Jones News

Retailer says it is taking market share; CEO sees 'bifurcation

of winners and losers'

By Sarah Nassauer

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 21, 2019).

Target Corp. posted another quarter of rising sales, saying it

continues to draw more shoppers and capture spending both in its

stores and online.

Sales in stores and digital channels operating for at least 12

months rose 4.5% in the quarter ended Nov. 2, marking over two

years of consecutive quarterly sales growth. E-commerce sales rose

31% in the period, with most of that growth coming from same-day

delivery or pickup, the company said.

Consumers continue to feel like spending, Target Chief Executive

Brian Cornell said in an interview. "We are starting to see the

bifurcation of winners and losers" in retail, he said.

Retailers reporting quarterly sales thus far provide conflicting

views on the health of the American consumer heading into the

pivotal holiday season. Department-store chains Kohl's Corp. and

J.C. Penney Co. have reported weak sales, but Amazon.com Inc.,

Walmart Inc. and TJX Cos. have logged strong gains.

Target's third-quarter results were better than Wall Street's

forecasts and the chain raised its profit forecast for the fiscal

year. Shares jumped more than 14% on Wednesday.

Home improvement chain Lowe's Co. reported weaker-than-expected

quarterly sales on Wednesday but raised its adjusted full-year

profit forecast and said it would close some Canadian stores. Its

shares rose 3.9%.

Target, which has around 1,800 stores, is gaining market share

in the apparel, home and beauty categories, Mr. Cornell said. Those

categories have been helped by new in-house brands, store remodels

and changes to how Target staffs those areas to offer better

customer service, he said.

Consumer spending has been relatively robust this year, boosted

by the strong U.S. economy, rising wages and low unemployment. The

National Retail Federation said it expects holiday sales to rise in

the range of 3.8% to 4.2% -- to about $730 billion.

Target on Wednesday raised its adjusted earnings-per-share

targets for the year to $6.25 to $6.45, compared with the prior

range of $5.90 to $6.20.

The Minneapolis, Minn.-based company expects stronger profits as

it sells higher-margin store-brand products and expands in

categories such as beauty that also tend to be higher margin, said

Mr. Cornell.

In addition, he said, the profitability of its e-commerce sales

has improved as Target has shifted its fulfillment system away from

distribution centers to one based on compiling orders from nearby

stores.

Target's total revenue rose 4.7% in the quarter to $18.7

billion, up from $17.8 billion during the same period last year.

Net income from continuing operations rose 14.5% to $706 million

during the quarter, up from $616 million during the same period

last year.

Adding more online pickup and delivery options, while keeping

customer service levels high, is costly, said executives on a

conference call with analysts Wednesday.

Target has doubled the number of store workers dedicated to

online fulfillment and same-day services in stores and added

500,000 more labor hours in training store workers versus last

year, Mr. Cornell said on the call with analysts. Target will spend

$50 million more this holiday season on payroll, he said.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

November 21, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

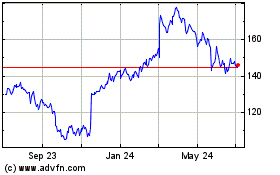

Target (NYSE:TGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

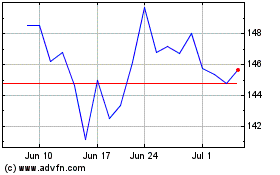

Target (NYSE:TGT)

Historical Stock Chart

From Apr 2023 to Apr 2024