Current Report Filing (8-k)

June 04 2019 - 5:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 4, 2019

Tanger Factory Outlet Centers, Inc.

Tanger Properties Limited Partnership

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

North Carolina

North Carolina

(State or Other Jurisdiction

of Incorporation)

|

1-11986

333-03526-01

(Commission

File Number)

|

56-1815473

56-1822494

(IRS Employer

Identification No.)

|

|

|

|

|

|

3200 Northline Avenue, Suite 360 Greensboro, NC 27408

(Address of Principal Executive Offices, including Zip Code)

|

|

3200 Northline Avenue, Suite 360 Greensboro, NC 27408

(Address of Principal Executive Offices, including Zip Code)

|

Registrant's telephone number, including area code:

(336) 292-3010

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Tanger Factory Outlet Centers, Inc.:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares,

$0.01 par value

|

SKT

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

|

|

|

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain officers; Compensatory Arrangements of Certain Officers.

|

On June 4, 2019, Thomas E. McDonough notified Tanger Factory Outlet Centers, Inc. (the “Company”) of his retirement (collectively, the “Retirement”) as President and Chief Operating Officer (“COO”) of the Company and as an employee of the Company’s operating partnership, Tanger Properties Limited Partnership (the “Partnership”), effective as of December 31, 2019 (the “Transition Date”).

In connection with Mr. McDonough’s Retirement, the Partnership has entered into a transition agreement and release of claims with Mr. McDonough (collectively, the “Transition Agreement”). The terms of Mr. McDonough’s existing Employment Agreement with the Partnership, dated as of August 23, 2010 (the “Employment Agreement”), will continue to control until the Transition Date, subject to the terms of the Transition Agreement.

Mr. McDonough will be entitled to receive, subject to Mr. McDonough’s execution of a release of claims agreement (and provided that Mr. McDonough does not resign from the Partnership or that Mr. McDonough’s employment is not terminated for cause by the Partnership prior to the Transition Date): (i) continued base salary for 12 months following the Transition Date (the “Transition Period”), which equals an aggregate amount of $401,880 and premium payments through June 30, 2021 for any COBRA health continuation coverage that he timely elects as if Mr. McDonough had remained an active executive during such period; provided, however, if Mr. McDonough does not have a full-time paid position on December 31, 2020, his base salary will continue at the same annualized rate until the earlier of June 30, 2021 or the date he accepts a full-time paid position which would equal an aggregate amount of up to $200,940 (ii) a cash bonus for fiscal 2019 of $400,000 to be payable at the same time in 2020 as for other executives; (iii) accelerated vesting of his outstanding restricted share awards; and (iv) continued vesting of performance awards pro-rata through the Transition Date, subject to the actual achievement of the applicable performance measures.

The foregoing description of the Transition Agreement does not purport to be complete and is qualified in its entirety by reference to the full Transition Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

|

|

|

|

|

|

Item 7.01.

|

Regulation FD.

|

A copy of a press release announcing Mr. McDonough’s retirement is hereby furnished as Exhibit 99.1 to this Current Report on Form 8-K.

|

|

|

|

|

|

Item 9.01.

|

Financial Statement and Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

10.1

|

|

|

99.1

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 4, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TANGER FACTORY OUTLET CENTERS, INC.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

|

James F. Williams

|

|

|

|

|

|

James F. Williams

|

|

|

|

|

|

Executive Vice President, Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

TANGER PROPERTIES LIMITED PARTNERSHIP

|

|

|

|

|

|

|

|

|

|

By: TANGER GP TRUST, its sole general partner

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

|

James F. Williams

|

|

|

|

|

|

James F. Williams

|

|

|

|

|

|

Vice President and Treasurer (Principal Financial Officer)

|

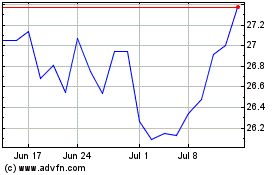

Tanger (NYSE:SKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

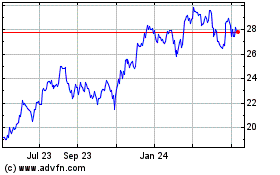

Tanger (NYSE:SKT)

Historical Stock Chart

From Apr 2023 to Apr 2024