Meten EdtechX (NASDAQ: EDTX) (NASDAQ: EDTXW) Shows

Compelling Value Compared to Red-Hot Chinese Online Education

Industry Average

March 12, 2020 -- InvestorsHub NewsWire -- via Spotlight Growth --

Global stock markets continue to see extremely volatile trading in

recent weeks, as the coronavirus outbreak officially reaches

pandemic levels. The overall flight to safety has led to a surge in

U.S. Treasury bond prices, as yields were crushed to record lows.

Major corporations are continuing to warn about the likely hit to

their top and bottom earnings as a result of the outbreak and its

disruption to supply chains.

However, it has not been all bad news in the equity markets.

Surprisingly, there are even some industries that have been

benefitting from the outbreak. Outside of toilet paper and hand

sanitizer suppliers, Chinese online education companies have

largely not only outperformed the broader market, but they are

seeing positive returns thus far in 2020.

Source: Meten EdtechX

Before the outbreak, the Chinese online education industry was

already drawing a strong outlook consensus from the investment

community. However, with the outbreak closing down traditional

classroom learning, millions of students have had to turn to online

education opportunities. This has led to what Bloomberg described as

one of the “biggest sustained, mass experiment in online education

since the internet was founded in the 1980s.”

While Chinese digital education stocks have seen strong upward

moves over the past month, one company that could be next to make

waves is Meten EdtechX (NASDAQ:

EDTX) (NASDAQ:

EDTXW).

EDTX: Meten Merger Estimated to Close March 30,

2020

EdtechX is a London-based education technology company, which

also happened to be the first edtech SPAC (special purpose

acquisition company) to be listed on the Nasdaq. The company's

common shares are listed under the symbol "EDTX," while its

warrants trade under the symbol "EDTXW."

As of March 11, 2020, EDTX has returned 0.42% year-to-date,

while EdtechX’s warrants, EDTXW, have soared 24.63% since the start

of 2020.

Source: EDTX Investor Deck

In December 2019, EDTX announced a $535 million merger agreement

with Meten Education, an omnichannel Chinese education company

based out of Shenzhen. The merger is estimated to close on March

30, 2020.

Meten is a market leader in English language training and

education services across China. Being based out of Shenzhen,

China’s “Silicon Valley,” Meten is in a prime location to continue

capturing growth. The company’s Likeshuo digital

education platform has seen strong enrollment growth as a result of

the coronavirus outbreak, according to a recent press release from

the company.

Between February 1-17, 2020, Meten disclosed that its gross

billings for its online courses surged 287% year-over-year,

including the number of new paying users which grew by 119%

year-over-year. Meten noted that the massive growth was “driven by a

combination of continuous enhancements to the company’s digital

offering and the impact of the coronavirus epidemic on the Chinese

education industry.”

In 2018, Meten reported revenues of $200 million (RMB 1,424m)

and $20.1 million (RMB 144m) in EBITDA. This is a strong increase

from Meten’s 2016 results of $113.9 million (RMB 802m) in revenue

and $2.4 million (RMB 17.1m) in EBITDA. Overall, this represents a

two-year revenue CAGR of 33% and EBITDA CAGR of 190%.

Meten EdtechX: Recent Filings Show Strong Operational

Progress

EdtechX has delivered several key operational developments

recently via SEC filings. One of the most important updates was

from a Forward Purchase Agreement with Azimut Enterprises, which

produced an aggregate investment of $20 million.

According to the agreement, Azimut agreed to

purchase up to 2,000,000 units of EDTX at $10.00 per unit, through

a private placement offering. At the end of February 2020, EdtechX

informed Azimut that they “would be required to purchase 2,000,000

units of EdtechX, for an aggregated investment of $20 million, upon

the closing of the business combination,” according to the SEC

filing.

Source: EDTX Investor Deck

EdtechX CEO, Benjamin Vedrenne-Cloquet, and Chairman, Charles

McIntyre, were recently interviewed in a news article published

by Alpha Week. In the article

published February 24, 2020, Alpha Week focuses on EdtechX’s merger

with Meten Education.

On March 9th, EdtechX was also mentioned in an

article from Financial News entitled

“What Kind of Business Does Well in China During a Quarantine?”

This is great for the company, as mainstream media is beginning to

pick up on EDTX’s story and potential.

New Investor Presentation Shows Company Trading At

Discount to Several Industry Averages

Meten EdtechX management also released an updated version of its

investor presentation, which now provides in-depth information on

Meten, the overall industry, and valuations. According to the

deck’s pro forma valuation and

outlook estimates, Meten EdtechX is trading at a discount to the

industry average for the Chinese education industry.

Source: EDTX Investor Deck

According to the company, Meten EdtechX’s enterprise

value-to-sales (EV/Sales) ratio is trading at an estimated 3 times

in 2019, 2.5 times in 2020, and 2.1 times in 2021. These estimates

are trading at discounts ranging from 60-68% compared to the

industry averages: average EV/Sales 2019E of 9.3x (68% discount),

2020E of 7.2x (65% discount), and 2021E of 5.2x (60% discount).

When isolating EV/Sales estimates for Meten’s online business,

the discounts to the industry average only continue to grow. The

average EV/Sales ratio for the industry estimated for 2019 comes in

at 16.5x (82% discount), 2020E is at 9.7x (74% discount), and 2021E

is 6x (66% discount). Meten’s EV/Sales discounts to industry

average between 2019-2021 range from 66% to 82%.

Source: EDTX Investor Deck

Valuation discounts to industry averages extend beyond just

EV/Sales. In 2020, Meten EdtechX sees its EV/Adjusted EBITDA coming

in at 19.6, with 2021 estimates set at 14.6. This compares to the

industry average EV/Adjusted EBITDA estimates of 54.4 in 2020 (64%

discount) and 33 in 2021 (56% discount).

Looking at Price/Adjusted Earnings, Meten EdtechX estimates 2020

multiple of 29 and 2021 estimates of 20.2. The average industry

estimates for 2020 and 2021 are less compelling: 2020 estimates of

158.8 (82% discount) and 2021 estimates of 49.4 (59% discount).

Peers and Coronavirus Performance

During the coronavirus outbreak, the average peer in China’s

online education industry has seen gains of almost 48%. This

includes companies like GSX

Techedu, Inc. (NYSE:

GSX), Youdao, Inc. (NYSE:

DAO), LAIX, Inc. (NYSE: LAIX), IDP (ASX: IEL), and Koolearn

(SEHK: 1797).

Source: EDTX Investor Deck

Omnichannel peers like TAL Education Group (NYSE:

TAL) and New Oriental Education & Technology Group (NYSE:

EDU), have seen average gains of 11.50% since the beginning of the

outbreak.

- GSX +92.68% YTD

- DAO +57.03%

- LAIX -3.50%

- IEL +2.02%

- Koolearn +65.68%

- EDTX +0.42%

- EDTXW +24.63%

Comparing EDTX’s common stock returns compared to online and

omnichannel peers highlights the potential opportunity, as the

underlying fundamentals of the industry show strength. The

company’s warrants have seen nice returns in recent weeks, which

makes them a potential compelling option as well for more

sophisticated investors that understand warrants.

Outlook & Estimates

Between 2016 and 2018, Meten saw its revenue grow at a compound

annual growth rate (CAGR) of 33.3% to 1.42 billion RMB (USD $199.3

million) in 2018. In the investor presentation, management provides

estimates and guidance for full-year 2019, 2020, and 2021

results.

Source: Meten EdtechX EDTX Investor Deck

Currently, EdtechX is forecasting full-year

2019 revenues to come in at $202 million USD, before growing to

$245 million USD in 2020 and $299 million USD in 2021. Between 2018

and 2021, this represents revenue CAGR of 14.50%. However, when

breaking down growth by online and offline, digital revenue growth

is projected to grow 37.80% between 2018 and 2021.

Bottom-line estimates for 2019-2021 are also flashing strong

growth. EdtechX estimates 2019 adjusted EBITA of $19 million USD

and adjusted net income of $9 million USD. For 2020, adjusted

EBITDA is estimated to come in at $31.14 million USD and adj. net

income at $22.4 million USD. In 2021, adj. EBITDA estimates grow to

$42.1 million USD and adj. net income of $32.2 million USD. Between

2018 and 2021, this represents adj. EBITDA CAGR of 27.8% and adj.

net income CAGR of 44.7%.

Source: Meten EdtechX EDTX Investor Deck

During a time when Chinese online education companies are seeing

big recognition, EdtechX looks like an appealing option for those

that may have missed the initial rally or are looking for value in

the space. The upcoming merger completion with Meten Education will

only further solidify the growth story, which is projecting strong

earnings growth over the next several years. Despite the strong

growth estimates and an overall fundamentally-sound industry

environment, EdtechX trades at steep discounts compared to its

peers’ average in the industry. For value and growth investors

alike, this is an interesting story beginning to unfold.

Disclaimer:

Spotlight Growth is compensated, either directly or via a third

party, to provide investor relations services for its

clients. Spotlight Growth creates exposure for companies

through a customized marketing strategy, including design of

promotional material, the drafting and editing of press releases

and media placement.

All information on featured companies is provided by the

companies profiled, or is available from public sources. Spotlight

Growth and its employees are not a Registered Investment Advisor,

Broker Dealer or a member of any association for other research

providers in any jurisdiction whatsoever and we are not qualified

to give financial advice. The information contained herein is based

on external sources that Spotlight Growth believes to be reliable,

but its accuracy is not guaranteed. Spotlight Growth may create

reports and content that has been compensated by a company or

third-parties, or for purposes of self-marketing. Spotlight Growth

was compensated three thousand dollars for the creation and

dissemination of this content by the company.

This material does not represent a solicitation to buy or sell

any securities. Certain statements contained herein constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements may

include, without limitation, statements with respect to the

Company's plans and objectives, projections, expectations and

intentions. These forward-looking statements are based on current

expectations, estimates and projections about the Company's

industry, management's beliefs and certain assumptions made by

management.

The above communication, the attachments and external Internet

links provided are intended for informational purposes only and are

not to be interpreted by the recipient as a solicitation to

participate in securities offerings. Investments referenced

may not be suitable for all investors and may not be permissible in

certain jurisdictions.

Spotlight Growth and its affiliates, officers, directors, and

employees may have bought or sold or may buy or sell shares in the

companies discussed herein, which may be acquired prior, during or

after the publication of these marketing materials. Spotlight

Growth, its affiliates, officers, directors, and employees may sell

the stock of said companies at any time and may profit in the event

those shares rise in value. For more information on our

disclosures, please visit: http://spotlightgrowth.com/index.php/disclosures/

SOURCE: Spotlight Growth

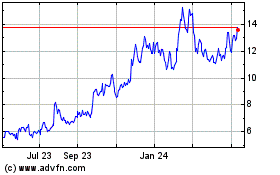

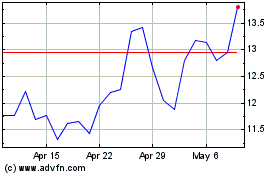

Tal Education (NYSE:TAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tal Education (NYSE:TAL)

Historical Stock Chart

From Apr 2023 to Apr 2024