Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

October 08 2021 - 6:11AM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1934 Act Registration No. 1-14700

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

|

|

|

|

|

|

FORM 6-K

|

|

|

|

|

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

For the month of October 2021

(Commission File Number: 001-14700)

|

|

|

|

Taiwan Semiconductor Manufacturing Company Ltd.

(Translation of Registrant’s Name Into English)

|

|

|

|

No. 8, Li-Hsin Rd. 6,

Hsinchu Science Park,

Taiwan, R.O.C.

(Address of Principal Executive Offices)

|

|

|

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in papers as permitted by Regulation S-T Rule 101(b)(1):☐

Indicate by check mark if the registrant is submitting the Form 6-K in papers as permitted by Regulation S-T Rule 101(b)(7):☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Company Ltd.

|

|

Date:

|

October 8, 2021

|

By

|

/s/ Wendell Huang

|

|

|

|

|

|

Wendell Huang

|

|

|

|

|

|

Vice President & Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TSMC September 2021 Revenue Report

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hsinchu, Taiwan, R.O.C. – Oct. 8, 2021 - TSMC (TWSE: 2330, NYSE: TSM) today announced its net revenue for September 2021: On a consolidated basis, revenue for September 2021 was approximately NT$152.69 billion, an increase of 11.1 percent from August 2021 and an increase of 19.7 percent from September 2020. Revenue for January through September 2021 totaled NT$1,149.23 billion, an increase of 17.5 percent compared to the same period in 2020.

TSMC September Revenue Report (Consolidated):

|

|

|

|

|

(Unit:NT$ million)

|

|

|

|

Period

|

September

2021

|

August

2021

|

M-o-M Increase

(Decrease)

%

|

September

2020

|

Y-o-Y

Increase

(Decrease)

%

|

January to September

2021

|

January to September

2020

|

Y-o-Y

Increase

(Decrease)

%

|

|

|

|

Net

Revenue

|

152,685

|

137,427

|

11.1

|

127,585

|

19.7

|

1,149,226

|

977,722

|

17.5

|

|

|

|

|

|

|

|

|

|

|

TSMC Spokesperson:

|

|

Media Contacts:

|

|

|

|

|

|

Wendell Huang

Vice President and CFO

Tel: 886-3-505-5901

|

|

Nina Kao

Head of Public Relations

Tel: 886-3-563-6688 ext.7125036

Mobile: 886-988-239-163

E-Mail: nina_kao@tsmc.com

|

|

Hui-Chung Su

Public Relations

Tel: 886-3-563-6688 ext. 7125033

Mobile: 886-988-930-039

E-Mail: hcsuq@tsmc.com

|

|

Michael Kramer

Public Relations

Tel: 886-3-563-6688 ext. 7125031

Mobile: 886-988-931-352

E-Mail: pdkramer@tsmc.com

|

|

|

|

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Company Limited

|

|

|

|

|

|

|

|

|

|

|

|

|

This is to report the changes or status of 1) revenue, 2) funds lent to other parties, 3) endorsements and guarantees, and 4) financial derivative transactions for the period of September 2021.

|

|

|

|

|

|

1.

|

Revenue (in NT$ thousands)

|

|

|

|

Period

|

Items

|

2021

|

2020

|

|

|

|

Sept.

|

Net Revenue

|

152,685,418

|

127,584,492

|

|

|

|

Jan. ~ Sept.

|

Net Revenue

|

1,149,225,731

|

977,721,754

|

|

|

|

|

|

|

|

|

2.

|

Funds lent to other parties (in NT$ thousands)

|

|

|

|

Lending Company

|

Limit of lending

|

Amount Drawn

|

|

|

|

Bal. as of period end

|

|

|

|

TSMC China*

|

68,696,365

|

24,144,960

|

|

|

|

TSMC Global**

|

757,895,518

|

24,241,680

|

|

|

|

* The borrower is TSMC Nanjing, a wholly-owned subsidiary of TSMC.

|

|

|

|

** The borrower is TSMC.

|

|

|

|

|

|

|

|

|

3.

|

Endorsements and guarantees (in NT$ thousands):

|

|

|

|

Guarantor

|

Limit of guarantee

|

Amount

|

|

|

|

Bal. as of period end

|

|

|

|

TSMC*

|

497,946,450

|

2,318,655

|

|

|

|

TSMC**

|

181,116,000

|

|

|

|

TSMC***

|

903,351

|

|

|

|

TSMC Japan Ltd.****

|

341,659

|

329,868

|

|

|

|

* The guarantee was provided to TSMC North America, a wholly-owned subsidiary of TSMC.

** The guarantee was provided to TSMC Global, a wholly-owned subsidiary of TSMC.

*** The guarantee was provided to TSMC Arizona, a wholly-owned subsidiary of TSMC.

**** The guarantee was provided to TSMC Design Technology Japan, a wholly-owned subsidiary of TSMC.

|

|

|

|

|

|

|

|

4. Financial derivative transactions (in NT$ thousands)

|

|

|

(1) Derivatives not under hedge accounting.

|

|

|

|

‧TSMC

|

|

|

|

|

|

|

Forward

|

|

|

|

Margin Payment

|

-

|

|

|

|

Premium Income (Expense)

|

-

|

|

|

|

Outstanding Contracts

|

Notional Amount

|

126,403,873

|

|

|

|

Mark to Market Profit/Loss

|

(1,384,161)

|

|

|

|

Unrealized Profit/Loss

|

(3,415,689)

|

|

|

|

Expired Contracts

|

Notional Amount

|

628,305,025

|

|

|

|

Realized Profit/Loss

|

(2,705,195)

|

|

|

|

Equity price linked product (Y/N)

|

N

|

|

|

|

|

|

|

|

|

|

‧TSMC China

|

|

|

|

|

|

|

Forward

|

|

|

|

Margin Payment

|

-

|

|

|

|

Premium Income (Expense)

|

-

|

|

|

|

Outstanding Contracts

|

Notional Amount

|

31,291,443

|

|

|

|

Mark to Market Profit/Loss

|

13,358

|

|

|

|

Unrealized Profit/Loss

|

(74,440)

|

|

|

|

Expired Contracts

|

Notional Amount

|

230,993,734

|

|

|

|

Realized Profit/Loss

|

813,451

|

|

|

|

Equity price linked product (Y/N)

|

N

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

‧TSMC Nanjing

|

|

|

|

|

|

|

Forward

|

|

|

|

Margin Payment

|

-

|

|

|

|

Premium Income (Expense)

|

-

|

|

|

|

Outstanding Contracts

|

Notional Amount

|

16,394,808

|

|

|

|

Mark to Market Profit/Loss

|

3,386

|

|

|

|

Unrealized Profit/Loss

|

(34,446)

|

|

|

|

Expired Contracts

|

Notional Amount

|

138,165,038

|

|

|

|

Realized Profit/Loss

|

439,052

|

|

|

|

Equity price linked product (Y/N)

|

N

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Derivatives under hedge accounting.

|

|

|

|

‧TSMC

|

|

|

|

|

|

|

Forward

|

|

|

|

Margin Payment

|

-

|

|

|

|

Premium Income (Expense)

|

-

|

|

|

|

Outstanding Contracts

|

Notional Amount

|

-

|

|

|

|

Mark to Market Profit/Loss

|

-

|

|

|

|

Unrealized Profit/Loss

|

(1,144)

|

|

|

|

Expired Contracts

|

Notional Amount

|

-

|

|

|

|

Realized Profit/Loss

|

(40,272)

|

|

|

|

Equity price linked product (Y/N)

|

N

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

‧TSMC Global

|

|

|

|

|

|

|

Future

|

|

|

|

Margin Payment

|

(22,431)

|

|

|

|

Premium Income (Expense)

|

-

|

|

|

|

Outstanding Contracts

|

Notional Amount

|

2,374,013

|

|

|

|

Mark to Market Profit/Loss

|

37,769

|

|

|

|

Unrealized Profit/Loss

|

38,959

|

|

|

|

Expired Contracts

|

Notional Amount

|

14,675,969

|

|

|

|

Realized Profit/Loss

|

101,616

|

|

|

|

Equity price linked product (Y/N)

|

N

|

|

|

|

|

|

|

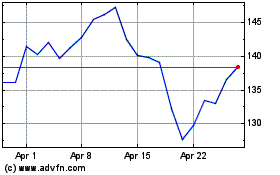

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024