A Pandemic and Huawei Woes? No Problem, Says Taiwan's Chip Champion -- Heard on the Street

July 16 2020 - 8:08AM

Dow Jones News

By Jacky Wong

Investors were dazzled today by the splashy $6.5 billion listing

of China's top chip contender, Semiconductor Manufacturing

International, in Shanghai, but catching the technology leaders

will be challenging. Meanwhile, the world's largest contract chip

manufacturer, Taiwan Semiconductor Manufacturing, keeps quietly

delivering the goods.

TSMC reported on Thursday a 3% quarter-over-quarter gain in net

profit for the three months ending in June, handily beating

analysts' expectations of a decline, as polled by S&P Global

Market Intelligence. The company is confident it can weather the

Covid-19 pandemic and the loss of a major customer--Chinese telecom

champion Huawei--thanks to its technology edge.

Strong demand for chips used in data centers, boosted by the

surge in working from home, offset weakness in smartphones. Sales

at TSMC's high-performance computing segment, which includes server

chips, grew 12% from a quarter earlier, while all other segments

recorded declines. Some Chinese electronic manufacturers might have

stockpiled chips from TSMC, in case any future sanctions from

worsening U.S.-China tensions disrupt supplies.

What is more impressive is that the company expects things to

stay strong. TSMC expects revenue to increase this year more than

20% from 2019, up from its earlier forecast of mid-to-high-teens

growth. It also raised its 2020 guidance on capital expenditure by

$1 billion, to between $16 billion and $17 billion.

Continued strong demand from data centers as more people use

services such as videoconferencing will likely help TSMC. The

company, which counts Apple as its customer, also expects demand

from 5G, even though fewer people will buy a new phone this year.

Market-research firm IDC expects global smartphone shipments to

drop 11.9% in 2020.

TSMC also expects to sustain high growth even though the company

hasn't taken new orders from Huawei since the Trump administration

barred companies using U.S. technology from supplying the Chinese

company without first securing a license. American semiconductor

equipment is essential to chip makers. Even TSMC has to rely on it

and wouldn't be able to circumvent such restrictions. Huawei is

estimated to have accounted for 15% to 20% of TSMC's revenue last

year.

There are grounds for such optimism. Even though U.S. sanctions

will greatly hurt Huawei, its rivals could quickly fill the vacuum

in semiconductor demand. Due to its leading position, those rivals

would have to order from TSMC, too.

Write to Jacky Wong at JACKY.WONG@wsj.com

(END) Dow Jones Newswires

July 16, 2020 07:53 ET (11:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

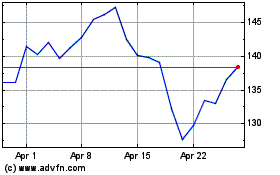

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024