What a Small Chip Fab Really Buys

May 15 2020 - 2:46PM

Dow Jones News

By Dan Gallagher

Anyone in the business of making chips knows that little things

can make a big difference.

Taiwan Semiconductor Manufacturing, better known as TSMC,

currently makes chips with circuitry measuring 5 nanometers thick.

That is about twice the diameter of a strand of human DNA, and is

the most advanced chipmaking process in production today. It will

be put to use in the new fabrication plant the company is now

planning to build in Arizona, with the explicit blessing of the

U.S. government.

But despite the impressive-sounding specs, the project TSMC

announced Friday morning will actually be rather limited in scale

and impact. The company says it will spend a total of $12 billion

on the project over an eight-year period starting next year; TSMC's

capital expenditures this year alone are expected to top $15

billion. And by the time the plant is fully up and running in 2024,

5 nanometers won't even count as top of the line anymore. TSMC

disclosed on its earnings call last month that its 3-nanometer

process is expected to be in volume production by the second half

of 2022.

Nor will the project do much for the U.S. government's widely

touted efforts to bring more of the high-tech supply chain onshore.

TSMC says the Arizona facility will produce about 20,000 silicon

wafers a month. That is just one-fifth the size of its largest fabs

currently running in Taiwan and wouldn't even be close to meeting

the needs of the company's largest U.S. customers. Mark Li of

Bernstein estimates that Apple alone requires 60,000 to 100,000

wafers a month. He also says that TSMC's history with other fabs

built outside of its home base in Taiwan suggest the Arizona

facility will be a "margin drag" unless government incentives or

higher prices can make up the difference.

What the new facility does buy TSMC is a better seat at the

table. Chipmaking has become a high-profile weapon in the trade war

between the U.S. and China. That point was driven home Friday

morning when the Commerce Department released new rules that add

further restrictions to chip products sold to Huawei and its

subsidiaries. The rule would appear to sharply limit TSMC's ability

to supply chips to Huawei, since they are mostly made with

equipment from U.S. companies such as Applied Materials, KLA and

Lam Research. Those three stocks averaged a drop of 5% Friday

morning.

TSMC's U.S.-listed shares fell Friday as well, though it is

highly likely the company's Arizona project will help shield it

from some of the fallout. Citi's Atif Malik wrote to clients that

the timing of the two announcements was likely "strategic and part

of a compromise" that would allow TSMC to keep producing some chips

for Huawei while also being subject to the new regulations. Pierre

Ferragu of New Street Research believes the new export controls are

a way to give the Trump administration more negotiating leverage to

limit Huawei's "commercial ambitions" as opposed to killing the

Chinese tech giant outright.

Chipmakers might just be pawns in a geopolitical game, but

TSMC's latest move could keep it from being a sacrificed one. A

little fab can go a long way.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

May 15, 2020 14:31 ET (18:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

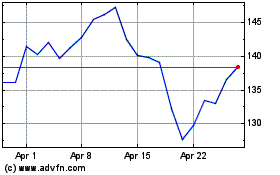

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024