By Bob Davis, Kate O'Keeffe in Washington and Asa Fitch in San Francisco

Taiwan Semiconductor Manufacturing Co., the world's largest

contract manufacturer of silicon chips, said Friday it would spend

$12 billion to build a chip factory in Arizona, as U.S. concerns

grow about dependence on Asia for the critical technology.

TSMC said the project, disclosed earlier Thursday by The Wall

Street Journal, has the support of the federal government and the

state of Arizona. It comes as the Trump administration has sought

to jump-start development of new chip factories in the U.S. due to

rising fears about the U.S.'s heavy reliance on Taiwan, China and

South Korea to produce microelectronics and other key

technologies.

TSMC made the decision to go ahead with the project at a board

meeting on Tuesday in Taiwan, according to people familiar with the

matter, adding that both the State and Commerce Departments are

involved in the plans. Construction will begin next year with

production targeted for 2024, the company said in a statement.

TSMC's new plant would make chips branded as having 5-nanometer

transistors, the tiniest, fastest and most power-efficient ones

manufactured today. TSMC just started rolling out 5-nanometer chips

at a factory in Taiwan in recent months.

TSMC said the plant would make 20,000 wafers a month, making it

a relatively small facility for a company that made more than 12

million wafers last year alone. TSMC's Fab 18 in Taiwan, which

currently produces its 5-nanometer chips, was targeted for 100,000

wafers a month when it broke ground in 2018.

The company didn't say what financial incentives it may have

secured to build in the U.S., or where in Arizona the plant would

be built.

TSMC said the factory would employ more than 1,600 people, the

company said. The company cited the U.S.'s investment climate,

skilled workforce and investment policies as reasons to extend

manufacturing in the country beyond a smaller factory in Washington

state. Most of TSMC's factories are in Taiwan.

Politically, the announcement could be a win for President Trump

who has been campaigning to get companies to build in the U.S. He

has also been looking to make sure that Republicans retain their

majority in the U.S. Senate. Arizona Sen. Martha McSally is among

the Republicans facing a tough challenge in this November's

election.

"We shouldn't have supply chains. We should have them all in the

U.S.," the president said on Fox Business on Thursday, when

discussing production during the pandemic.

In a statement, Commerce Secretary Wilbur Ross praised TSMC's

plan and called the plant a sign that Mr. Trump's manufacturing

agenda was succeeding. It resulted from years of talks between

TSMC, Arizona's government and the administration, he said.

TSMC has had to spend big to maintain its lead in chip-making,

which requires some of the world's most complicated manufacturing

tools. In January the company outlined capital expenditures of

between $15 billion and $16 billion for this year.

The chip plant investment could also help TSMC in lobbying

efforts to get the Trump administration to drop its plans to

require an export license for many chips shipped to Chinese telecom

giant Huawei Technologies Co. that are produced by U.S.-designed

chip-making tools. The proposed new rule would give the Commerce

Department the ability to block the sale of semiconductors

manufactured by TSMC for Huawei, which the U.S. deems a major

national security threat. Huawei denies the allegations.

TSMC has been arguing that the rule, which national security

officials say is essential, would significantly reduce its revenue

and make it harder financially for it to build a manufacturing

facility in the U.S. Although senior cabinet officials decided in

late March to move ahead with the regulation, it has been stalled

with Commerce officials providing no clear deadline for its

publication.

The warming relations between TSMC and the administration could

stoke concerns from TSMC's U.S. competitors that they could face

even tougher U.S. restrictions than a foreign firm. They are

wrestling now with new export rules that make it harder for U.S.

companies to ship microchips and other advanced products to Chinese

customers without seeking an export license from the Commerce

Department provided they weren't destined for military use. Those

rules don't apply to foreign firms like TSMC.

The Trump administration has long sought to attract foreign

investment as a pillar of its America-first policy. Some of those

projects, however, haven't worked out well. Hon Hai Precision

Industry Co., the Taiwanese contract-manufacturing giant better

known as Foxconn, announced a $10 billion plant to make LCD panels

in Mount Pleasant, Wis. in 2017, but the operation has fallen far

short of initial ambitions.

TSMC's plant would likely not be at the leading edge of

chip-making technology by the time it begins production, if it

manufactures 5-nanometer chips as planned. TSMC has already started

making 5-nanometer chips, and has plans to move to 3-nanometer

transistors and smaller in the next few years.

TSMC's project would also not likely address a desire by the

Pentagon to have a U.S. firm make more chips for defense

purposes.

Last month, Intel Corp. chief executive Bob Swan sent a letter

to Defense Department officials expressing his company's readiness

to build a commercial foundry in partnership with the Pentagon, The

Wall Street Journal reported Sunday. A foundry is an industry term

typically referring to a chip factory that can make products on

contract for other companies.

A Defense Department official sent Intel's letter to Senate

Armed Services Committee staffers the next day, according to an

email viewed by the Journal, calling the proposal an "interesting

and intriguing option."

Intel has several manufacturing operations in Chandler, Ariz.,

from which a TSMC factory might threaten to poach. U.S. chip-makers

may also be wary of any incentives given to a foreign company that

they can't also access.

Intel declined to comment.

TSMC had been talking to U.S. officials as well as to Apple

Inc., one of its largest customers, about building a chip factory

in the U.S. for some time, but the conversations gained momentum

recently as concerns mounted about the fragility of the Asian

supply chain, according to people familiar with the matter.

The U.S. already has dozens of semiconductor factories, but only

Intel's are capable of making today's most advanced chips, those

branded as having transistors 10 nanometers or smaller. Intel,

however, mostly makes silicon for its own products.

Among foundries that make chips on contract for other companies,

only TSMC and Samsung Electronics Co. in South Korea make chips at

10 nanometers or lower. In the U.S., GlobalFoundries is a major

contract manufacturer that works closely with the Pentagon, but it

decided to halt development of the most advanced chips in 2018.

Laurie Kelly, a GlobalFoundries spokeswoman, said the company

stood ready to join with the industry and U.S. government "to

ensure America has the manufacturing capability it needs to supply

semiconductors to its most secure and sensitive technologies."

Added Saam Azar, a senior vice president of GlobalFoundries,

"You'd think to solve the public policy concern [of maintaining

U.S. leadership] you'd want to make sure U.S. domestic players are

getting the first bite, if not the only bite of the apple."

Many U.S. chip companies, including Qualcomm Inc., Nvidia Corp.,

Broadcom Inc., Xilinx Inc. and Advanced Micro Devices Inc., rely on

TSMC to manufacture many of their most advanced products. Intel

also makes chips with TSMC, according to TSMC's 2019 annual

report.

U.S. chip makers have backed off on building cutting-edge chip

factories domestically in recent years largely because of their

cost, and a rapid development cycle that means the benefits of

being ahead don't last long.

Meanwhile, other governments, including China, Taiwan, Singapore

and Israel, have poured generous financial support into developing

their own domestic manufacturing, paying for factory buildings and

subsidizing expensive equipment.

Write to Bob Davis at bob.davis@wsj.com, Kate O'Keeffe at

kathryn.okeeffe@wsj.com and Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

May 14, 2020 23:37 ET (03:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

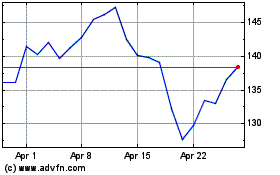

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024