Huawei Warns U.S. of Retaliation by Beijing; Profit Growth Slows -- Update

March 31 2020 - 9:08AM

Dow Jones News

By Dan Strumpf

HONG KONG -- The chairman of Huawei Technologies Co. warned the

U.S. to expect countermeasures from the Chinese government if it

further restricts the technology giant's access to suppliers, as

the company's profit last year grew at the slowest pace in three

years.

Eric Xu, Huawei's chairman, said he believes Beijing would

respond with restrictions of its own on American companies

operating in China if the U.S. follows through with reported plans

to cut off Huawei's access to a major Taiwanese chip supplier.

"I think the Chinese government will not just stand by," Mr. Xu

said during a press conference held via videoconferencing from the

Chinese company's headquarters in Shenzhen on Tuesday. "I believe

the Chinese government may also take some countermeasures," he

said, citing a report in Chinese state media warning of the

prospect of retaliation by Beijing.

The Trump administration is moving forward with new restrictions

aimed at cutting off Huawei's access to Taiwan Semiconductor

Manufacturing Co.,the world's largest contract-chip manufacturer,

according to people familiar with the situation.

Huawei continues to face a deepening U.S. campaign to hamstring

its business and block allies from buying its 5G technology, in

which it is a world leader. In addition to slapping it with a

blacklisting, the U.S. has filed two indictments alleging the

Chinese company stole technology and violated U.S. sanctions on

Iran. Huawei has denied all of the charges.

Huawei faces broader issues this year, including the outbreak of

the novel coronavirus in China in late December that has since

spread across the world, disrupting supply and logistics chains,

battering economies and reducing consumer demand.

Mr. Xu said he expects 5G network rollouts to be delayed in

Europe, where several countries are among the hardest-hit by the

pandemic. He said 5G rollouts were on track in China after the

country's progress in controlling the disease.

Restrictions imposed last May on Huawei buying some blacklisted

U.S. suppliers contributed to the steep slowdown in growth in

profit in 2019, Mr. Xu said. That was despite reporting a 19% jump

in revenue to almost 860 billion yuan ($121 billion.) Net income

rose 6% to 62.7 billion yuan, or about $8.8 billion. That was the

smallest rise since 2016. In 2018, profit jumped 25%, and rose 28%

the year before, amid brisk demand globally for its smartphones and

telecom gear.

Mr. Xu said Huawei could source chips from alternative suppliers

in China and South Korea if the Trump administration moved forward

with new supply-chain restrictions, but he warned that escalating

restrictions from both sides would spell "the destruction of the

global technology ecosystem."

The revenue jump came with Huawei's growing reliance on its home

market. Mr. Xu said it reflected the toll that the U.S. efforts to

restrict its business was having on Huawei's overseas sales of

smartphones and telecom equipment.

Revenue in China rose 36%, accounting for 59% of total revenue.

In 2018, China accounted for 52% of revenue. In Europe, the Middle

East and Africa, its biggest overseas region, revenue grew less

than 1%, after growing 24% in 2018.

Huawei's chief executive and founder, Ren Zhengfei, told The

Wall Street Journal in an interview last week that more than 90% of

its China-based workforce was back to work following the

coronavirus outbreak, as movement restrictions began to relax

across the country.

Huawei greatly expanded its research and development budget last

year, at 131.7 billion yuan, which stood at about $18.7 billion,

making it one of the top spenders on R&D world-wide. Mr. Ren

told The Journal last week that he expected R&D spending to top

$20 billion this year, more than double its net income for

2019.

Huawei, the world's largest maker of telecom equipment and the

No. 2 smartphone vendor, releases a snapshot of its financial

performance each year in an audited annual report. Though not

listed, the company has bonds that trade publicly.

U.S. officials argue that Huawei gear could be used by Beijing

for espionage or to disrupt telecom networks, allegations that the

company denies. Huawei's employees share in profits through an

annual stock-purchase plan.

Write to Dan Strumpf at daniel.strumpf@wsj.com

(END) Dow Jones Newswires

March 31, 2020 08:53 ET (12:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

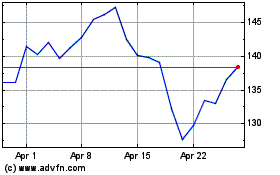

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024