Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

October 29 2020 - 5:01PM

Edgar (US Regulatory)

Free Writing Prospectus

Filed pursuant to Rule 433

To Prospectus dated October 27, 2020

Preliminary Prospectus Supplement dated October 29, 2020

Registration Statement File No. 333-249689

Stanley Black & Decker, Inc.

Offering of:

$750,000,000 2.750% Notes due 2050 (the “Notes”)

(the “Offering”)

Term Sheet

October 29, 2020

The information in this pricing term sheet relates to the Offering and should be read together with the preliminary prospectus

supplement dated October 29, 2020 (the “Preliminary Prospectus Supplement”), including the documents incorporated by reference therein and the related base prospectus dated October 27, 2020, filed pursuant to Rule 424(b) under

the Securities Act of 1933 (Registration Statement File No. 333-249689). Terms used but not defined herein, with respect to the Offering, have the meanings ascribed to them in the Preliminary Prospectus

Supplement.

|

|

|

|

|

|

|

|

Issuer:

|

|

Stanley Black & Decker, Inc. (NYSE: SWK)

|

|

|

|

|

Trade Date:

|

|

October 29, 2020

|

|

|

|

|

Settlement Date (T+2):

|

|

November 2, 2020

|

|

|

|

|

Title of Security:

|

|

2.750% Notes due 2050

|

|

|

|

|

Principal Amount:

|

|

$750,000,000

|

|

|

|

|

Maturity Date:

|

|

November 15, 2050

|

|

|

|

|

Coupon:

|

|

2.750% accruing from November 2, 2020

|

|

|

|

|

Interest Payment Dates:

|

|

May 15 and November 15, commencing May 15, 2021

|

|

|

|

|

Benchmark Treasury:

|

|

1.250% due May 15, 2050

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

|

90-30 / 1.638%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

T + 112.5 bps

|

|

|

|

|

Yield to Maturity:

|

|

2.763%

|

|

|

|

|

Price to Public:

|

|

99.735% of the Principal Amount, plus accrued interest, if any, from the Settlement Date

|

|

|

|

|

|

|

|

|

Optional Redemption Provision:

|

|

|

|

|

|

|

Make-Whole Call:

|

|

Prior to May 15, 2050 (the date that is six months prior to the maturity date), make-whole call at Treasury Rate plus 20 bps

|

|

|

|

|

Par Call:

|

|

At any time on or after May 15, 2050

|

|

|

|

|

CUSIP / ISIN:

|

|

854502AN1 / US854502AN14

|

|

|

|

|

Day Count Convention:

|

|

30/360

|

|

|

|

|

Payment Business Days:

|

|

New York

|

|

|

|

|

Expected Ratings*:

|

|

Moody’s: Baa1 (Stable)

S&P: A

(Negative Outlook)

Fitch: A- (Negative Outlook)

|

|

|

|

|

Joint Book-Running Managers:

|

|

Barclays Capital Inc.

Deutsche Bank Securities

Inc.

Goldman Sachs & Co. LLC

Morgan

Stanley & Co. LLC

|

|

|

|

|

Co-Managers:

|

|

HSBC Securities (USA) Inc.

|

|

|

|

RBC Capital Markets, LLC

|

* Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time.

The issuer has filed a registration statement, including a prospectus, with the Securities and

Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete

information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, copies may be obtained by contacting Barclays Capital Inc., c/o Broadridge Financial Solutions,

1155 Long Island Avenue, Edgewood, New York 11717, by email at barclaysprospectus@broadridge.com or by calling 1-888-603-5847;

Deutsche Bank Securities Inc., Attention: Prospectus Department, 60 Wall Street, New York, New York 10005, by email at prospectus.cpdg@db.com or by calling 1-800-503-4611; Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, New York 10282, by email at

prospectus-ny@ny.email.gs.com or by calling 1-212-902-1171; and Morgan Stanley &

Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014, by email at prospectus@morganstanley.com or by calling

1-866-718-1649.

This communication should be read in conjunction with the Preliminary Prospectus Supplement and the accompanying base prospectus. The

information in this communication supersedes the information in the Preliminary Prospectus Supplement and the accompanying base prospectus to the extent inconsistent with the information in the Preliminary Prospectus Supplement and the accompanying

base prospectus.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE

DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

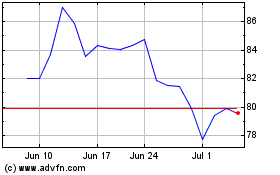

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

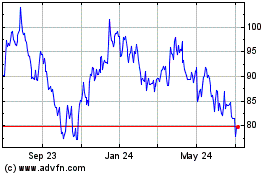

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Apr 2023 to Apr 2024