Spotify Loss Deepens Despite Subscriber, Podcast Growth

July 29 2020 - 6:29AM

Dow Jones News

By Anne Steele

Spotify Technology SA deepened its loss in the three months

ended June 30, as its recent stock run-up came with

higher-than-expected payroll taxes that offset strong user

growth.

The Stockholm-based music-streaming company said customers'

overall time spent listening to the service recovered to

pre-pandemic levels, as habits began to normalize after an initial

upset brought on by Covid-19.

The global health crisis began to drag on the business in the

first quarter of the year, with declines in daily active users and

overall listening. However, by the end of June all regions had come

back except for Latin America, where cases have sharply risen.

At the end of the second quarter Spotify had 299 million monthly

active users and 138 million paying subscribers, its most lucrative

type of customer, with both coming in at the top of its guidance.

Growth in North America was stronger than the company expected,

more than making up for softness in Latin America and other

emerging markets that saw upticks in subscriber cancellations and

payment failures.

During the quarter, average revenue per user for the

subscription business slipped 9% to EUR4.41 ($5.17). The decline

stemmed mostly from new subscribers coming in via discounted plans

through family and student accounts as well as lower pricing power

in new international markets.

Spotify's revenue from subscriptions climbed 17% to EUR1.76

billion. Ad-supported revenue -- which had been on a double-digit

rise before the pandemic -- slid 21% to EUR131 million. The company

said ad sales slowed amid the pandemic but started to improve in

June, and podcast advertising performed better than anticipated.

Advertising is a relatively small part of Spotify's business --

accounting for 10% or less of overall revenue -- but has been a

growth area over the past year, as the company has expanded its

podcast business.

The company said 21% of its monthly active users now listen to

podcasts, up from 19% in the previous quarter, while overall

consumption of podcasts more than doubled.

In all for the period, Spotify posted a loss of EUR356 million,

or EUR1.91 a share, versus EUR76 million, or 42 European cents a

share, in the year-earlier quarter. A recent spate of deals has run

the company's stock up more than 70% since the end of May, when

comedian Joe Rogan's podcast was announced to be coming exclusively

to Spotify. The deeper loss was owing to the taxes the company

accrues on its employees in Sweden -- more than one-third of its

workforce -- as determined by the stock price at the end of each

quarter.

During the quarter, the company also announced exclusive

podcasting deals with Warner Bros.'s DC superhero brand and Kim

Kardashian. Last week Spotify struck a new licensing agreement with

Vivendi SA's Universal Music Group that signs the largest music

company onto its "two-sided marketplace" for selling marketing and

data back to labels.

Free cash flow -- a measure of the cash a company generates from

operations and a gauge that many investors view as a proxy for

performance -- was EUR27 million, down from EUR50 million a year

earlier.

Revenue rose 13% to EUR1.89 billion, in line with guidance.

For the current quarter, the company forecast monthly active

users to grow to between 312 million and 317 million, and for

premium subscribers to rise to between 140 million and 144 million.

Revenue is expected to come in between EUR1.85 billion and EUR2.05

billion.

News Corp's Dow Jones & Co., publisher of The Wall Street

Journal, has a content partnership with Spotify's Gimlet Media

unit.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 29, 2020 06:14 ET (10:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

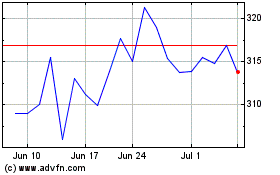

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

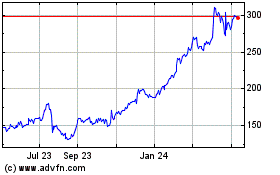

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Apr 2023 to Apr 2024