By Anne Steele

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 30, 2020).

Spotify Technology SA continued to add paying and

advertising-supported users in the most recent quarter, but it

lowered its revenue guidance for the year as ad sales were dented

amid uncertainty around the coronavirus pandemic.

The global health crisis began to affect the business in late

February, the company said, with a notable decline in daily active

users and consumption in hard-hit markets such as Italy and Spain.

Listening has started to rebound in recent weeks, with consumption

in many markets "meaningfully recovered."

The decline in consumption didn't drag on user growth: For the

quarter that ended March 31, Spotify had 286 million monthly active

users, at the high end of the company's expectations. It had 130

million paying subscribers, its most lucrative type of customer,

also at the high end of its guidance.

Shares in the Stockholm-based company closed roughly 11% higher

at $156 Wednesday in New York.

Monthly churn, or the number of users who end a subscription,

improved compared with the year earlier, the company said, despite

some impact from the effect of Covid-19 -- a modest increase in

cancellations and payment failures. Spotify said one in six

respondents to its exit survey in the U.S. cited Covid-related

reasons for canceling their accounts, with more than 80% indicating

they are extremely likely or likely to renew once the economic

situation improves.

In a letter to investors, the company noted that use of its

service in cars, on wearable devices and on the web declined, while

its audience through television and videogame consoles grew by more

than 50%. Spotify said its data indicate morning routines have

changed, and every day looks more like the weekend, with fewer

people commuting to work. Still, listening time around activities

like cooking, family time and relaxing has increased, as has

consumption of podcasts related to wellness and meditation.

"We've seen some massive shifts in user behavior," said Chief

Executive Daniel Ek in an interview. "People are listening more to

classical and chill music."

Mr. Ek has said Spotify's focus is less on its streaming

competitors and more on the billions of listeners of terrestrial

radio.

"The trend we've been seeing is everything linear moves to

on-demand," he said Wednesday. "This pandemic will accelerate that

trend."

With fewer people tuning in to radio in their cars, Spotify has

seen more pronounced user growth.

"Because we offer a personalized and on-demand experience, they

end up staying," he said.

On a call with investors, Mr. Ek said Spotify's free tier is

more valuable now than ever, noting that 60% of paid subscribers

come in through the ad-supported service. He also said the service

has seen many listeners with lapsed accounts come back in recent

weeks.

During the quarter, average revenue per user for the

subscription business declined 6% to EUR4.42 ($4.78), partly due to

an extended free-trial period from the previous quarter, but also

owing to new subscribers coming in via discounted plans through

family and student accounts, and lower pricing power in

international markets.

Spotify's revenue from subscriptions rose a better-than-expected

23% to EUR1.7 billion. Ad-supported revenue -- which had been on a

double-digit rise in recent quarters -- dropped 32% to EUR148

million, falling short of expectations. The company said before the

pandemic that revenue was pacing ahead of its forecast, but sales

decelerated in March as previously booked business was canceled or

paused, and programmatic buyers pulled back spending.

Though advertising is a relatively small part of Spotify's

business -- accounting for 10% or less of overall revenue -- it has

been a growth area over the past year as the company expands its

podcast business.

While the hit to Spotify's podcast listening was bigger than

music at the beginning of stay-at-home orders, it has also

rebounded, with news and science podcasts performing particularly

well, and some shows like "Science Vs" adding episodes.

Executives said they plan to continue to invest in podcasts --

of which it now has more than three million on its platform -- as a

long-term bet, and anticipate a depressed ad market could make

exclusive and original deals with Spotify a more attractive

opportunity for many podcasters.

Meanwhile, Spotify said it expects its "two-sided marketplace,"

where it sells tools and services to artists and their

representatives, to grow 50% this year. Late last year, the company

introduced sponsored recommendations, which lets labels pay to

promote new music to specific listeners. The company said

click-through and conversion rates are strong, and that Vivendi

SA's Republic records booked a campaign to promote the Weeknd's new

album.

In all for the period, Spotify swung to a profit of EUR1 million

from a loss of EUR142 million. Owing to accounting issues, the

company reported a per-share loss of 20 European cents, compared

with a loss of 79 European cents in the same quarter a year

earlier. Revenue jumped 22% to EUR1.85 billion, in line with

guidance.

For the current quarter, the company guided for monthly active

users to grow to between 289 million and 299 million. Paying

subscribers are projected to rise to between 133 million and 138

million, and revenue is projected between EUR1.75 billion and

EUR1.95 billion.

The company backed its monthly-active-user and subscriber

guidance for the year but trimmed both ends of its revenue guidance

to EUR7.65 billion to EUR8.05 billion from EUR8.08 billion to

EUR8.48 billion, citing changes in foreign exchange rates and the

impact of Covid-19 on advertising expectations.

News Corp's Dow Jones & Co., publisher of The Wall Street

Journal, has a content partnership with Spotify's Gimlet Media

unit.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 30, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

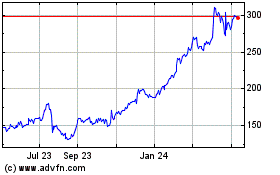

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

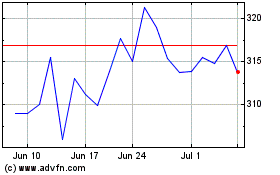

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Apr 2023 to Apr 2024