Southwestern Energy Prices Offering of 55,000,000 Shares of Common Stock

August 13 2020 - 10:05PM

Business Wire

Southwestern Energy Company (“Southwestern Energy”) (NYSE: SWN)

priced its previously announced underwritten public offering of

55,000,000 shares of its common stock (the “offering”) at a price

to the public of $2.50 per share, before underwriting discounts and

commissions. The total gross proceeds of the offering (before

underwriter's discounts and commissions and estimated offering

expenses) are expected to be approximately $137.5 million. In

addition, Southwestern Energy granted the respective underwriters a

30-day option to purchase up to 8,250,000 additional shares of its

common stock.

Southwestern Energy intends to use the net proceeds from the

offering to partially redeem Montage Resource Corporation’s

(“Montage”) issued and outstanding senior notes that it will assume

upon the closing of its recently announced merger with Montage (the

“Merger”). If the Merger is not consummated, Southwestern Energy

intends to use the net proceeds from this offering for general

corporate purposes, including the repayment of debt. Until

Southwestern Energy applies the net proceeds from this offering for

the purposes described above, it may invest such proceeds in

short-term, liquid investments or to reduce the balance under its

credit agreement. The net proceeds from any exercise by the

underwriters of their option to purchase additional shares of

common stock from us will be used to redeem additional Montage

notes after the consummation of the Merger or for general corporate

purposes, including the repayment of debt. The closing of the

offering, which is expected to occur on August 18, 2020, is subject

to customary closing conditions.

Citigroup, Goldman Sachs & Co. LLC and J.P. Morgan are

acting as representatives of the underwriters and joint

book-running managers for the offering. BofA Securities, BMO

Capital Markets, RBC Capital Markets and Wells Fargo Securities are

also serving as joint book-running managers for the offering.

The offering is being made under an effective automatic shelf

registration statement on Form S-3 (Registration No. 333-238633)

filed by Southwestern Energy with the Securities and Exchange

Commission (“SEC”) and only by means of a prospectus supplement and

accompanying base prospectus. A preliminary prospectus supplement

has been filed with the SEC to which this communication relates.

Prospective investors should read the preliminary prospectus

supplement and the accompanying base prospectus included in the

registration statement and other documents Southwestern Energy has

filed with the SEC for more complete information about Southwestern

Energy and the offering. These documents are available at no charge

by visiting EDGAR on the SEC website at http://www.sec.gov.

Alternatively, a copy of the base prospectus and the preliminary

prospectus supplement may be obtained, when available, from:

Citigroup c/o Broadridge Financial Solutions 1155 Long Island

Avenue Edgewood, NY 11717 Telephone: 800-831-9146

Goldman Sachs & Co. LLC Attention: Prospectus Department 200

West Street New York, NY 10282 Telephone: 866-471-2526 Facsimile:

212-902-9316 Email: Prospectus-ny@ny.email.gs.com

J.P. Morgan Securities LLC c/o Broadridge Financial Solutions

Attention: Prospectus Department 1155 Long Island Avenue Edgewood,

NY 11717 Telephone: 866-803-9204

This news release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities, in any state or jurisdiction in

which such offer, solicitation or sale of these securities would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Southwestern Energy

Southwestern Energy Company is an independent energy company

engaged in natural gas, natural gas liquids and oil exploration,

development, production and marketing.

Forward Looking Statement

This news release contains forward-looking statements.

Forward-looking statements relate to future events, including, but

not limited to, anticipated results of operations, business

strategies, other aspects of Southwestern Energy’s operations or

operating results, the proposed offering, the use of proceeds of

the offering and the consummation of the Merger. In many cases you

can identify forward-looking statements by terminology such as

words “believe,” “expect,” “anticipate,” “plan,” “intend,”

“foresee,” “predict,” “budget,” “should,” “would,” “could,”

“attempt,” “appears,” “forecast,” “outlook,” “estimate,”

“continue,” “project,” “projection,” “goal,” “model,” “target,”

“potential,” “may,” “will,” “objective,” “guidance,” “outlook,”

“effort,” “are likely” and other similar expressions. Where, in any

forward-looking statement, the company expresses an expectation or

belief as to future results, such expectation or belief is

expressed in good faith and believed to have a reasonable basis.

However, there can be no assurance that such expectation or belief

will result or be achieved. The actual results of operations can

and will be affected by a variety of risks and other matters

including, but not limited to, changes in commodity prices; changes

in expected levels of natural gas and oil reserves or production;

operating hazards, drilling risks, unsuccessful exploratory

activities; limited access to capital or significantly higher cost

of capital related to illiquidity or uncertainty in the domestic or

international financial markets; international monetary conditions;

unexpected cost increases; potential liability for remedial actions

under existing or future environmental regulations; potential

liability resulting from pending or future litigation; and general

domestic and international economic and political conditions; as

well as changes in tax, environmental and other laws applicable to

the company’s business. Other factors that could cause actual

results to differ materially from those described in the

forward-looking statements include other economic, business,

competitive and/or regulatory factors affecting the company’s

business generally as set forth in the company’s filings with the

SEC. Unless legally required, Southwestern Energy Company

undertakes no obligation to update publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200813005849/en/

Investor Contacts Brittany Raiford Director, Investor

Relations (832) 796-7906 brittany_raiford@swn.com

Bernadette Butler Investor Relations Advisor (832) 796-6079

bernadette_butler@swn.com

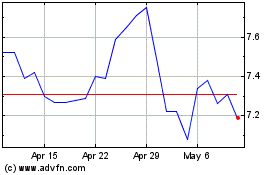

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

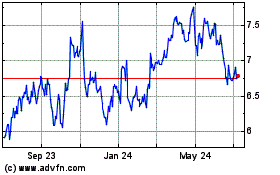

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Apr 2023 to Apr 2024