Southwest Airlines Sees 3Q Capacity Down 30%-35%, to Reduce November Schedule

September 16 2020 - 7:42AM

Dow Jones News

By Dave Sebastian

Southwest Airlines Co. said it expects third-quarter capacity to

fall 30% to 35% and plans to cut its November flight schedule, as

passenger demand and booking trends remain leisure-oriented and

inconsistent by region amid the Covid-19 pandemic.

The airline said it expects November capacity falling in the

range of 35% to 40%.

Southwest said leisure bookings modestly improved for the

remainder of September and October. It will continue limiting the

number of seats sold on each flight, with middle seats remaining

open for passengers who aren't traveling together through Nov. 30,

the company said.

The company's operating revenue fell 70% in August, compared

with a 70% to 75% decline it had expected. It forecast operating

revenue would fall by between 65% and 70% in September, narrower by

five percentage points on the range's upper end from the previous

guidance, and fall 65% to 75% for October.

Southwest posted a load factor, or the proportion of seats sold,

of 42% for August, in line with the company's guidance range. It

expects a September load factor of 45% to 50%, compared with its

prior outlook of 40% to 50%, and October load factor of 45% to

55%

August available-seat miles, a measure of capacity also known as

ASM, were down 27%. It expects ASM to fall 40% in September and by

40% to 45% in October, narrower by five percentage points on the

range's upper end from the prior outlook.

The company said its cash burn was about $19 million a day, on

average, in August. It expects average daily core cash burn of

about $17 million in the third quarter, compared with its prior

estimate of about $20 million.

Southwest said it anticipates third-quarter economic fuel costs

of $1.20 to $1.25 a gallon, compared with its prior estimate of

$1.20 to $1.30 a gallon. It continues to expect third-quarter

operating expenses, excluding fuel and oil expenses and other

items, to fall 10% to 20%.

The company said it has raised about $18.7 billion so far this

year, including $13.2 billion in debt issuances and

sale-and-leaseback transactions, $2.2 billion through a common

stock offering and $3.3 billion of Payroll Support Program

proceeds.

Southwest said it doesn't currently plan to use its loyalty

program to back additional financing, a move other airlines have

explored. It continues to have unencumbered assets worth about $12

billion, including about $10 billion in aircraft and about $2

billion in non-aircraft assets such as spare engines, ground

equipment and real estate.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

September 16, 2020 07:27 ET (11:27 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

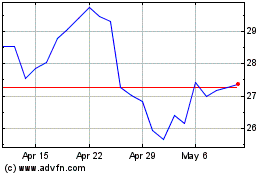

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Mar 2024 to Apr 2024

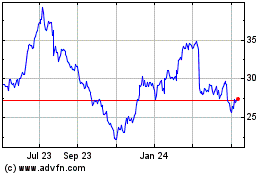

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Apr 2023 to Apr 2024