American Airlines, Southwest Swing to Loss Amid Rise in Covid-19 Cases -- 2nd Update

July 23 2020 - 9:22AM

Dow Jones News

By Doug Cameron and Alison Sider

The nation's largest domestic airline said demand continues to

falter because of rising Covid-19 cases but pledged to avoid any

compulsory job cuts even after federal aid runs out in October.

Southwest Airlines Co. provided a more downbeat outlook than

some rivals wrestling with the impact of the pandemic during the

summer travel season, with cancellations continuing to rise and

demand weakening into the fall. American Airlines Group Inc., which

had bet on the recovery in business, said it was slowing some of

its planned expansion.

"We will adjust our flight schedule aggressively and frequently

in response to this volatile demand environment," said Southwest

Chief Executive Gary Kelly as it reported a quarterly loss.

U.S. carriers are battling to restore passenger confidence about

travel, with ever-tougher policies on wearing masks and contrasting

approaches to filling aircraft that are making perceptions of

safety a competitive factor.

Airlines are all trimming the amount of flying going into the

fall, but Southwest said that its cancellations continue to rise

and that is set to burn more cash without further action. Recent

commentary from United Airlines Holdings Inc. and others pointed to

demand plateauing in June and July as Covid-19 cases started to

soar in many states, with cash burn falling.

American, the world's largest airline, told crew members earlier

this week that it is paring capacity in August as it confronts the

challenge that rising case numbers pose to its plans to keep flying

more than some competitors this summer.

American is joining rivals including United, Delta Air Lines

Inc. and Spirit Airlines Inc. in scaling back its summer plans as

the nascent travel recovery has begun to stall. American did not

say how many flights it plans to cut but told pilots in a memo this

week to prepare for schedule adjustments.

Southwest still plans to keep August capacity at 70% to 80% of

2019 levels, but with projected cash burn of $23 million a day in

the current quarter -- level with the three months to June 30 --

said it will adjust as necessary.

It plans to keep the middle seats on aircraft free through

October, mirroring the policy of Delta Air LInes Inc. Southwest and

American also said late Wednesday that all passengers over 2 years

must wear masks on board, removing exemptions for medical

conditions. United will require its passengers to wear masks in the

airport.

Southwest also said it will test using thermal cameras to scan

for passengers with high temperatures at Dallas Love Field airport,

something that Mr. Kelly has called on the Transportation Security

Administration to take on.

American and Southwest reported a combined loss of $3 billion in

the June quarter, normally the most lucrative season for airlines

ahead of the drop in traffic after Labor Day when they depend more

on business passengers, a market that has all but disappeared.

Both airlines are cutting costs in response to demand that

industry executives don't expect to recover meaningfully until a

treatment for Covid-19 becomes widely available.

Southwest said 4,400 staff had taken a voluntary separation

package while an additional 12,500 will take extended time off, and

it pledged to avoid any compulsory furloughs or job cuts this year.

American earlier this month said that it would be overstaffed by

20,000 employees this fall but that it still hopes to mitigate or

avoid forced cuts through early retirement and leave programs.

Other carriers have issued furlough notices, potentially affecting

more than 50,000 employees.

Southwest reported a loss of $915 million in the June quarter

compared with a profit of $741 million last year. The per-share

loss of $2.73 a share excluding special items compared with the

$2.73 consensus among analysts polled by FactSet.

American reported a loss of $2.1 billion in the second quarter,

compared with a profit of $4.3 billion a year earlier. Excluding

one-time items such as government aid to cover payroll, the airline

reported a loss of $3.4 billion, or $7.82 per share compared with

the $4.86 consensus among analysts.

Southwest shares turned negative in pre-open trade, with other

carriers narrowly ahead.

--Dave Sebastian contributed to this article.

Write to Doug Cameron at doug.cameron@wsj.com and Alison Sider

at alison.sider@wsj.com

(END) Dow Jones Newswires

July 23, 2020 09:07 ET (13:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

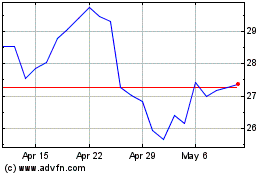

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Mar 2024 to Apr 2024

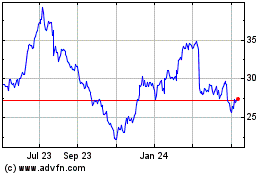

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Apr 2023 to Apr 2024