Report of Foreign Issuer (6-k)

October 28 2019 - 3:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF OCTOBER 2019

Commission File Number: 333-04906

SK Telecom Co., Ltd.

(Translation of registrant’s name into English)

65 Euljiro, Jung-gu

Seoul 04539, Korea

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ☐

Decision on Acquisition of Shares of Kakao

On October 28, 2019, in order to pursue a strategic alliance with Kakao Corp. (“Kakao”), the board of directors of SK Telecom

Co., Ltd. (the “Company”) approved the Company’s entry into a share purchase agreement with Kakao (the “Agreement”), pursuant to which the Company will acquire newly-issued common shares of Kakao (the “Shares”) (in

the aggregate amount of approximately Won 300 billion) through third-party allotment, and Kakao will acquire treasury shares of the Company.

|

|

|

|

|

|

|

|

|

|

|

1. Details of Kakao

|

|

Company Name

|

|

Kakao Corp.

|

|

|

Country of Incorporation

|

|

Republic of Korea

|

|

Representatives

|

|

Minsu Yeo, Suyong Joh

|

|

|

Share Capital (Won)

|

|

41,998,334,500

|

|

Relationship to Company

|

|

—

|

|

|

Total Number of Shares Issued and Outstanding

|

|

83,896,669

|

|

Principal Business

|

|

Mobile services

|

|

|

|

|

|

2. Details of Acquisition

|

|

Number of the Shares to be Acquired

|

|

2,177,401

|

|

|

Aggregate Acquisition Value (Won)

|

|

300,000,132,379

|

|

|

Company’s Total Shareholders’ Equity (Won)

|

|

22,349,250,355,012

|

|

|

Ratio of Aggregate Acquisition Value to the Company’s Total Shareholders’ Equity as of December 31, 2018

|

|

1.34%

|

|

|

|

|

|

3. Number of Shares to be Held by the Company and Shareholding Ratio after Acquisition

|

|

Number of Shares to be Held

|

|

2,177,401

|

|

|

Shareholding Ratio

|

|

2.53%

|

|

|

|

|

4. Acquisition Method

|

|

Cash

|

|

|

|

|

5. Purpose of Acquisition

|

|

To strengthen collaboration in the future information and communications technology business through a strategic alliance with Kakao.

|

|

|

|

|

6. Scheduled Acquisition Date

|

|

November 5, 2019

|

|

|

|

|

7. Date of Resolution by the Board of Directors

|

|

October 28, 2019

|

|

|

|

|

• Attendance of Outside Directors

|

|

Present: 5; Absent: 0

|

|

|

|

|

8. Put Options or Other Agreements

|

|

Pursuant to the Agreement, the Shares will be deposited with the Korea Securities Depositary for a lock-up period of one year after the closing date of the acquisition.

|

|

|

|

|

9. Other Important Matters Relating to Investment Decision

|

|

• The share capital and total number of shares issued and outstanding

of Kakao in Item 1 above are as of October 28, 2019.

• The Company’s total shareholders’ equity in Item 2 above is on a consolidated basis as

of December 31, 2018.

• The above matters and timetable may change subject to discussions with, or approvals by, relevant

authorities. Within the scope of authorities granted by the Company’s board of directors, decisions regarding any changes to the timing, conditions and other particulars are delegated to the Company’s representative director.

|

2

Summary Consolidated Financial Information of Kakao (Unit: in millions of Won)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the year ended December 31,

|

|

Total Assets

|

|

|

Total

Liabilities

|

|

|

Total

Shareholder’s

Equity

|

|

|

Share

Capital

|

|

|

Revenue

|

|

|

Profit

|

|

|

2018

|

|

|

7,959,542

|

|

|

|

2,332,385

|

|

|

|

5,627,158

|

|

|

|

41,744

|

|

|

|

2,416,992

|

|

|

|

15,889

|

|

|

2017

|

|

|

6,349,428

|

|

|

|

1,886,506

|

|

|

|

4,462,923

|

|

|

|

34,004

|

|

|

|

1,972,326

|

|

|

|

125,093

|

|

|

2016

|

|

|

5,484,117

|

|

|

|

1,816,066

|

|

|

|

3,668,051

|

|

|

|

33,858

|

|

|

|

1,464,233

|

|

|

|

65,455

|

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SK TELECOM CO., LTD.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Jung Hwan Choi

|

|

|

|

|

|

(Signature)

|

|

|

|

|

|

Name:

|

|

Jung Hwan Choi

|

|

|

|

|

|

Title:

|

|

Senior Vice President

|

|

|

|

|

|

|

Date: October 28, 2019

|

|

|

|

|

|

|

4

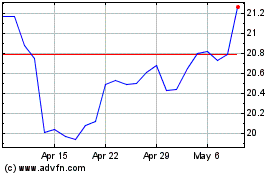

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Mar 2024 to Apr 2024

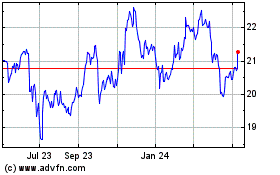

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Apr 2023 to Apr 2024