Current Report Filing (8-k)

September 28 2020 - 4:17PM

Edgar (US Regulatory)

false0000086521CACA 0000086521 2020-09-28 2020-09-28 0000086521 cik0000086521:SempraEnergyMember 2020-09-28 2020-09-28 0000086521 cik0000086521:SempraEnergyCommonStockWithoutParValueMember 2020-09-28 2020-09-28 0000086521 cik0000086521:SempraEnergy6MandatoryConvertiblePreferredStockSeriesA100LiquidationPreferenceMember 2020-09-28 2020-09-28 0000086521 cik0000086521:SempraEnergy675MandatoryConvertiblePreferredStockSeriesB100LiquidationPreferenceMember 2020-09-28 2020-09-28 0000086521 cik0000086521:SempraEnergy575JuniorSubordinatedNotesDue202925ParValueMember 2020-09-28 2020-09-28

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 28, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

Exact Name of Registrants as

Specified in their Charters, Address

|

|

|

|

|

|

|

|

|

|

San Diego, California 92101

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SAN DIEGO GAS & ELECTRIC COMPANY

San Diego, California 92123

|

|

|

|

|

|

|

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sempra Energy Common Stock, without par value

|

|

|

|

|

|

|

|

|

Sempra Energy 6% Mandatory Convertible Preferred Stock, Series A, $100 liquidation preference

|

|

|

|

|

|

|

|

|

Sempra Energy 6.75% Mandatory Convertible Preferred Stock, Series B, $100 liquidation preference

|

|

|

|

|

|

|

|

|

Sempra Energy 5.75% Junior Subordinated Notes Due 2029, $25 par value

|

|

|

|

|

|

|

|

|

San Diego Gas & Electric Company:

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule

12b-2

of the Securities Exchange Act of 1934 (17 CFR

240.12b-2).

|

|

|

|

|

|

|

|

|

|

|

☐

|

San Diego Gas & Electric Company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

|

|

|

|

|

☐

|

San Diego Gas & Electric Company

|

|

☐

|

On September 28, 2020, San Diego Gas & Electric Company (the “Company”), an indirect subsidiary of Sempra Energy, closed its previously announced public offering and sale of $800,000,000 aggregate principal amount of its 1.700% First Mortgage Bonds, Series VVV, due 2030 (the “Bonds”) with proceeds to the Company (after deducting the underwriting discount but before the Company’s other expenses estimated at approximately $1,500,000) of 99.176% of the aggregate principal amount of the Bonds. The sale of the Bonds was registered under the Company’s Registration Statement on Form

S-3

(File

No. 333-239178).

The Bonds were issued pursuant to the Seventieth Supplemental Indenture, dated as of September 28, 2020, which is filed herewith as Exhibit 4.1. The Bonds will mature on October 1, 2030. The Bonds will bear interest at the rate of 1.700% per annum. Interest on the Bonds will accrue from September 28, 2020 and is payable semiannually in arrears on April 1 and October 1 of each year, beginning on April 1, 2021. The Bonds will be redeemable prior to maturity at the redemption prices and under the circumstances described in the form of Bond, which form is included in Exhibit 4.1 hereto.

The foregoing description of some of the terms of the Bonds is not complete and is qualified in its entirety by the form of Bond and the Seventieth Supplemental Indenture, which are filed as exhibits herewith and are incorporated herein by reference. Further information regarding the sale of the Bonds is contained in the Underwriting Agreement, dated September 22, 2020, which is filed as Exhibit 1.1 to the Company’s Current Report on Form

8-K

filed with the U.S. Securities and Exchange Commission on September 24, 2020.

|

|

Financial Statements and Exhibits.

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: September 28, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

Peter R. Wall

|

|

|

|

|

|

|

|

Senior Vice President, Controller and Chief Accounting Officer

|

|

|

|

|

|

|

|

|

|

Date: September 28, 2020

|

|

|

|

SAN DIEGO GAS & ELECTRIC COMPANY

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

Valerie A. Bille

|

|

|

|

|

|

|

|

Vice President, Chief Accounting Officer, Controller and Treasurer

|

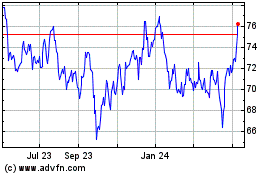

Sempra (NYSE:SRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sempra (NYSE:SRE)

Historical Stock Chart

From Apr 2023 to Apr 2024