Sea Limited (NYSE: SE) (“Sea” or the “Company”) today announced

its financial results for the quarter ended September 30, 2019.

Third Quarter 2019 Highlights

- Group

- Total adjusted revenue was US$763.3 million, up 214.3%

year-on-year from US$242.8 million for the third quarter of

2018.

- Total adjusted EBITDA was US$(30.8) million compared to

US$(183.8) million for the third quarter of 2018.

- Digital Entertainment

- Adjusted revenue was US$451.0 million, up 212.0% year-on-year

from US$144.6 million for the third quarter of 2018.

- Adjusted EBITDA was US$266.0 million, up 395.0% year-on-year

from US$53.7 million for the third quarter of 2018.

- Adjusted EBITDA margin increased to 59.0% for the third quarter

of 2019 from 37.2% for the third quarter of 2018.

- Quarterly active users (“QAUs”) reached 321.1 million, an

increase of 82.3% year-on-year from 176.1 million for the third

quarter of 2018.

- Quarterly paying users continued to grow, accounting for 9.1%

of QAUs for the third quarter of 2019, increasing from 4.1% for the

same period in 2018.

- Average revenue per user was US$1.4 compared to US$0.8 for the

third quarter of 2018.

- Our self-developed global hit game, Free Fire, recently

celebrated its second anniversary and continues to grow across

different regions. Free Fire was the highest grossing mobile game

in Latin America1 and in Southeast Asia in the third quarter of

2019, and was ranked among the top five most downloaded mobile

games globally for the third straight quarter across the Google

Play and iOS App Stores combined, according to App Annie. In

October 2019, Free Fire was also the highest grossing mobile game

in India on the Google Play Store, according to App Annie. As of

the end of October 2019, Free Fire had recorded a total cumulative

adjusted revenue of over US$1 billion since launch.

- We launched Call of Duty®: Mobile, a mobile version of the

classic action game of Activision, in Indonesia, Taiwan, Thailand,

the Philippines, Malaysia, and Singapore on October 1. It was the

most downloaded mobile game on both the Google Play and iOS App

Stores in each of these markets for the month of October, according

to App Annie.

- We continue to focus on esports and community building

activities. Since September, we have been running national

qualifiers and regional leagues for our largest global esports

tournament for Free Fire, the Free Fire World Series 2019, which

has achieved over 100 million cumulative online views to date. For

the final match of the Brazil qualifiers alone, we recorded over 1

million concurrent viewers online.

- E-commerce

- Adjusted revenue was US$257.2 million, up 261.1% year-on-year

from US$71.2 million for the third quarter of 2018.

- Adjusted revenue included US$208.1 million of marketplace

revenue2, up 313.6% year-on-year from US$50.3 million for the third

quarter of 2018, and US$49.2 million of product revenue3, up 134.9%

year-on-year from US$20.9 million for the third quarter of

2018.

- Gross orders for the quarter totaled 321.4 million, an increase

of 102.8% year-on-year from 158.5 million for the third quarter of

2018.

- Gross merchandise value (“GMV”) was US$4.6 billion, an increase

of 69.9% year-on-year from US$2.7 billion for the third quarter of

2018.

- Adjusted revenue as a percentage of total GMV increased to 5.6%

in the third quarter of 2019, up from 2.6% for the same period a

year ago. Adjusted marketplace revenue as a percentage of total GMV

was 4.5% in the third quarter of 2019.

- Sales and marketing expenses were US$199.2 million, an increase

of 30.2% year-on-year from US$152.9 million for the third quarter

of 2018.

- Adjusted EBITDA was US$(253.7) million compared to US$(214.9)

million for the third quarter of 2018. Adjusted EBITDA loss per

order decreased by 41.9%, from US$1.36 to US$0.79 in the third

quarter of 2019, compared to the same period in 2018.

- In Indonesia, our largest market, Shopee further extended its

leadership as the largest e-commerce platform by orders. We

registered over 138 million orders for the market in the third

quarter, or a daily average of over 1.5 million orders, an increase

of 117.8% year-on-year. Shopee also ranked first by average monthly

active users and downloads in the Shopping category across the

Google Play and iOS App Stores combined in the third quarter of

2019, according to App Annie.

- In Taiwan, we recorded a positive quarterly adjusted EBITDA,

even after allocation of the headquarters’ common expenses in the

third quarter of 2019.

- Shopee ranked number one in the Shopping category by average

monthly active users and by downloads in both Southeast Asia and

Taiwan, and ranked number five worldwide by downloads in the same

category, across the Google Play and iOS App Stores combined in the

third quarter, according to App Annie.

- In Southeast Asia as a whole, and in each of our five largest

markets, Shopee ranked number one by total time spent in app on

Android in the third quarter, according to App Annie.

1 Latin America rankings data for App Annie is based on

Argentina, Brazil, Chile, Colombia, Mexico, and Uruguay.

2 Marketplace revenue mainly consists of transaction-based fees

and advertising income and revenue generated from other value-added

services.

3 Product revenue mainly consists of revenue generated from

direct sales.

Guidance

We are raising the guidance for both digital entertainment and

e-commerce for the full year of 2019.

We now expect adjusted revenue for digital entertainment to be

between US$1.7 billion and US$1.8 billion, representing 157.2% to

172.3% growth from 2018. This compares to the previously disclosed

guidance of between US$1.6 billion and US$1.7 billion, representing

142.0% to 157.2% growth.

We also expect adjusted revenue for e-commerce to be between

US$880 million and US$920 million, representing 202.7% to 216.5%

growth from 2018. This compares to the previously disclosed

guidance of between US$780 million and US$820 million, representing

168.3% to 182.1% growth.

Unaudited Summary of Financial Results

(Amounts are expressed in thousands of US dollars “$”)

For the Three Months

ended September 30,

2018

2019

$

$

YOY%

Revenue

Service revenue

Digital Entertainment

112,520

329,058

192.4%

E-commerce and other services

71,319

229,740

222.1%

Sales of goods

21,082

51,339

143.5%

204,921

610,137

197.7%

Cost of revenue

Cost of service

Digital Entertainment

(63,960)

(117,194)

83.2%

E-commerce and other services

(113,223)

(240,037)

112.0%

Cost of goods sold

(22,128)

(49,738)

124.8%

(199,311)

(406,969)

104.2%

Gross profit

5,610

203,168

3,521.5%

Other operating income

3,072

3,985

29.7%

Sales and marketing expenses

(180,304)

(251,751)

39.6%

General and administrative expenses

(57,285)

(99,265)

73.3%

Research and development expenses

(17,293)

(43,599)

152.1%

Total operating expenses

(251,810)

(390,630)

55.1%

Operating loss

(246,200)

(187,462)

(23.9)%

Non-operating income, net

30,903

9,786

(68.3)%

Income tax expense

(2,020)

(27,370)

1,255.0%

Share of results of equity investees

(702)

(1,051)

49.7%

Net loss

(218,019)

(206,097)

(5.5)%

Net loss excluding share-based

compensation and changes in fair value of the 2017 convertible

notes (1)

(237,568)

(175,162)

(26.3)%

Adjusted revenue of Digital Entertainment

(1)

144,558

451,004

212.0%

Adjusted revenue of E-commerce (1)

71,233

257,213

261.1%

Adjusted revenue of Digital Financial

Services (1)

3,113

2,019

(35.1)%

Revenue of Other Services

23,934

53,021

121.5%

Total adjusted revenue (1)

242,838

763,257

214.3%

Adjusted EBITDA for Digital Entertainment

(1)

53,724

265,958

395.0%

Adjusted EBITDA for E-commerce (1)

(214,861)

(253,712)

18.1%

Adjusted EBITDA for Digital Financial

Services (1)

(7,001)

(33,628)

380.3%

Adjusted EBITDA for Other Services (1)

(13,850)

(6,494)

(53.1)%

Unallocated expenses (2)

(1,764)

(2,921)

65.6%

Total adjusted EBITDA (1)

(183,752)

(30,797)

(83.2)%

(1) For a discussion of the use of non-GAAP financial measures,

see “Non-GAAP Financial Measures.”

(2) Unallocated expenses are mainly related to share-based

compensation and general and corporate administrative costs such as

professional fees and other miscellaneous items that are not

allocated to segments. These expenses are excluded from segment

results as they are not reviewed by the Chief Operation Decision

Maker (“CODM”) as part of segment performance.

Three Months Ended September 30, 2019 Compared to Three

Months Ended September 30, 2018

Revenue

The table below sets forth revenue and adjusted revenue

generated from our reported segments. Amounts are expressed in

thousands of US dollars (“$”).

For the Three Months ended

September 30,

2018

2019

$

% of

revenue

$

% of

revenue

YOY%

Revenue

Service revenue

Digital Entertainment

112,520

54.9

329,058

53.9

192.4%

E-commerce and other services

71,319

34.8

229,740

37.7

222.1%

Sales of goods

21,082

10.3

51,339

8.4

143.5%

Total revenue

204,921

100.0

610,137

100.0

197.7%

2018

2019

$

% of total adjusted revenue

$

% of total adjusted revenue

YOY%

Adjusted revenue

Service revenue

Digital Entertainment

144,558

59.5

451,004

59.1

212.0%

E-commerce and other services

77,040

31.7

260,914

34.2

238.7%

Sales of goods

21,240

8.8

51,339

6.7

141.7%

Total adjusted revenue

242,838

100.0

763,257

100.0

214.3%

Our total revenue increased by 197.7% to US$610.1 million in the

third quarter of 2019 from US$204.9 million in the third quarter of

2018. Our total adjusted revenue increased by 214.3% to US$763.3

million in the third quarter of 2019 from US$242.8 million in the

third quarter of 2018. These increases were mainly driven by the

growth in each of the segments detailed as follows:

- Digital Entertainment: Revenue increased by 192.4% to US$329.1

million in the third quarter of 2019 from US$112.5 million in the

third quarter of 2018. Adjusted revenue increased by 212.0% to

US$451.0 million in the third quarter of 2019 from US$144.6 million

in the third quarter of 2018. This increase was primarily due to

the increase of our active user base as well as the deepened paying

user penetration as we continue to bring new and engaging content

to our users and enhance the game and monetization features based

on a deep understanding of local preferences and conditions as well

as our strong efforts in esports and community-building.

- E-commerce and other services: Revenue increased by 222.1% to

US$229.7 million in the third quarter of 2019 from US$71.3 million

in the third quarter of 2018. Adjusted revenue increased by 238.7%

to US$260.9 million in the third quarter of 2019 from US$77.0

million in the third quarter of 2018. This increase was primarily

driven by the growth of our e-commerce marketplace, and positive

development in each of our marketplace revenue streams

–transaction-based fees, value-added services, and

advertising.

- Sales of goods: Revenue and adjusted revenue increased by

143.5% and 141.7% respectively to US$51.3million in the third

quarter of 2019, primarily due to the increase in our product

offerings.

Cost of Revenue

Our total cost of revenue increased by 104.2% to US$407.0

million in the third quarter of 2019 from US$199.3 million in the

third quarter of 2018.

- Digital Entertainment: Cost of revenue increased by 83.2% to

US$117.2 million in the third quarter of 2019 from US$64.0 million

in the third quarter of 2018. The increase was largely in line with

revenue growth in our digital entertainment business. Improvement

in gross profit margins was largely due to higher revenue

contribution from our self-developed game.

- E-commerce and other services: Cost of revenue for our

e-commerce and other services combined increased by 112.0% to

US$240.0 million in the third quarter of 2019 from US$113.2 million

in the third quarter of 2018. The increase was primarily due to

costs incurred in line with growth of our e-commerce marketplace,

including, among other costs, higher bank transaction fees driven

by GMV growth, higher costs associated with value-added services

and other ancillary services we provided to our e-commerce platform

users, as well as higher staff compensation and benefit costs.

- Cost of goods sold: Cost of goods sold increased by 124.8% to

US$49.7 million in the third quarter of 2019 from US$22.1 million

in the third quarter of 2018. The increase was largely in line with

the increase in our product offerings.

Sales and Marketing Expenses

Our total sales and marketing expenses increased by 39.6% to

US$251.8 million in the third quarter of 2019 from US$180.3 million

in the third quarter of 2018. The table below sets forth the

breakdown of the sales and marketing expenses of our two major

reporting segments. Amounts are expressed in thousands of US

dollars (“$”).

For the Three Months

ended September 30,

2018

2019

YOY%

Sales and Marketing Expenses

$

$

Digital Entertainment

19,046

24,750

29.9%

E-commerce

152,934

199,167

30.2%

- Digital Entertainment: Sales and marketing expenses increased

by 29.9% to US$24.8million in the third quarter of 2019 from

US$19.0 million in the third quarter of 2018. The increase was

primarily due to launch of new games and marketing, esports and

other user engagement activities for the existing games.

- E-commerce: Sales and marketing expenses increased by 30.2% to

US$199.2 million in the third quarter of 2019 from US$152.9 million

in the third quarter of 2018. The increase in marketing efforts was

aligned with our strategy to fully capture the market growth

opportunity and was primarily attributable to the ramping up of

brand marketing as well as higher staff compensation and benefit

costs.

General and Administrative Expenses

Our general and administrative expenses increased by 73.3% to

US$99.3 million in the third quarter of 2019 from US$57.3 million

in the third quarter of 2018. This increase was primarily due to

the expansion of our staff force and the increase in office

facilities and related expenses.

Research and Development Expenses

Our research and development expenses increased by 152.1% to

US$43.6 million in the third quarter of 2019 from US$17.3 million

in the third quarter of 2018, primarily due to the increase in

research and development staff force.

Non-operating Income or Losses, Net

Non-operating income or losses consist of interest income,

interest expense, investment gain (loss), fair value change for the

2017 convertible notes and foreign exchange gain (loss). We

recorded a net non-operating income of US$9.8 million in the third

quarter of 2019, compared to a net non-operating income of US$30.9

million in the third quarter of 2018.

Income Tax Expense

We had a net income tax expense of US$27.4 million in the third

quarter of 2019 and net income tax expense of US$2.0 million in the

third quarter of 2018. The income tax expense in the third quarter

of 2019 was primarily due to withholding tax and corporate income

tax expenses incurred by our digital entertainment segment,

partially offset by deferred tax assets recognized during the

period.

Net Loss

As a result of the foregoing, we had net losses of US$206.1

million and US$218.0 million in the third quarter of 2019 and 2018,

respectively.

Net Loss Excluding Share-based Compensation and Changes in

Fair Value of the 2017 Convertible Notes

Net loss excluding share-based compensation and changes in fair

value of the 2017 convertible notes, was US$175.2 million and

US$237.6 million in the third quarter of 2019 and 2018,

respectively.

Webcast and Conference Call Information

The Company’s management will host a conference call today to

review Sea’s business and financial performance.

Details of the conference call and webcast are as follows:

Date and time:

7:30 AM U.S. Eastern Time on November 12,

2019

8:30 PM Singapore / Hong Kong Time on

November 12, 2019

Webcast link:

https://services.choruscall.com/links/se191112.html

Dial in numbers:

US Toll Free:

1-888-317-6003

Hong Kong: 800-963-976

International:

1-412-317-6061

Singapore: 800-120-5863

United Kingdom: 08-082-389-063

Passcode for Participants: 7282425

A replay of the conference call will be available at the

Company’s investor relations website

(https://www.seagroup.com/investor/financials). An archived webcast

will be available at the same link above.

About Sea Limited

Sea’s mission is to better the lives of the consumers and small

businesses of our region with technology. Our region includes the

key markets of Indonesia, Taiwan, Vietnam, Thailand, the

Philippines, Malaysia and Singapore. Sea operates three businesses

across digital entertainment, e-commerce, and digital financial

services, known as Garena, Shopee, and AirPay, respectively.

Forward-Looking Statements

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “confident,” “guidance,” and similar

statements. Among other things, statements that are not historical

facts, including statements about Sea’s beliefs and expectations,

the business, financial and market outlook, and projections from

its management in this announcement, as well as Sea’s strategic and

operational plans, contain forward-looking statements. Sea may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (the “SEC”),

in its annual report to shareholders, in press releases, and other

written materials, and in oral statements made by its officers,

directors, or employees to third parties. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: Sea’s goals and strategies; its future

business development, financial condition, financial results, and

results of operations; the growth in, and market size of, the

digital entertainment, e-commerce and digital financial services

industries in the region, including segments within those

industries; changes in its revenue, costs or expenditures; its

ability to continue to source, develop and offer new and attractive

online games and to offer other engaging digital entertainment

content; the growth of its digital entertainment, e-commerce and

digital financial services businesses and platforms; the growth in

its user base, level of user engagement, and monetization; its

ability to continue to develop new technologies and/or upgrade its

existing technologies; growth and trends of its markets and

competition in its industries; government policies and regulations

relating to its industries; and general economic and business

conditions in the region. Further information regarding these and

other risks is included in Sea’s filings with the SEC. All

information provided in this press release and in the attachments

is as of the date of this press release, and Sea undertakes no

obligation to update any forward-looking statement, except as

required under applicable law.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with U.S. GAAP, we use the

following non-GAAP financial measures to help evaluate our

operating performance:

- “Adjusted revenue” of our digital entertainment segment

represents revenue of the digital entertainment segment plus change

in digital entertainment deferred revenue. This financial measure

is used as an approximation of cash spent by our users in the

applicable period that is attributable to our digital entertainment

segment. Although other companies may present such measures related

to gross billings differently or not at all, we believe that the

adjusted revenue of our digital entertainment segment provides

useful information to investors about the segment’s core operating

results, enhancing their understanding of our past performance and

future prospects.

- “Adjusted revenue” of our e-commerce segment represents revenue

of the e-commerce segment (currently consisting of marketplace

revenue and product revenue) plus certain revenues that were

net-off against their corresponding sales incentives. This

financial measure enables our investors to follow trends in our

e-commerce monetization capability over time and is a useful

performance measure.

- “Adjusted revenue” of our digital financial services segment

represents revenue of the digital financial services segment plus

certain revenues that were net-off against their corresponding

sales incentives.

- “Total adjusted revenue” represents the sum of the adjusted

revenue of our digital entertainment segment, the adjusted revenue

of our e-commerce segment, the adjusted revenue of our digital

financial services segment, and the revenue of our other services.

This financial measure enables our investors to follow trends in

our overall group monetization capability over time and is a useful

performance measure.

- “Net loss excluding share-based compensation and changes in

fair value of the 2017 convertible notes” represents net loss

before share-based compensation and changes in fair value of

convertible notes. This financial measure helps to identify

underlying trends in our business that could otherwise be distorted

by the effect of certain expenses that are included in net loss.

The use of this measure has its limitations in that it does not

include all items that impact the net loss or income for the

period, and share-based compensation and changes in fair value of

convertible notes are significant expenses.

- “Adjusted EBITDA” for our digital entertainment segment

represents operating income (loss) before share-based compensation

plus (a) depreciation and amortization expenses, and (b) the net

effect of changes in deferred revenue and its related cost for our

digital entertainment segment. Although other companies may

calculate adjusted EBITDA differently or not present it at all, we

believe that the segment adjusted EBITDA helps to identify

underlying trends in our operating results, enhancing their

understanding of the past performance and future prospects.

- “Adjusted EBITDA” for our e-commerce segment, digital financial

services segment and other services segment represents operating

income (loss) before share-based compensation plus depreciation and

amortization expenses. Although other companies may calculate

adjusted EBITDA differently or not present it at all, we believe

that the segment adjusted EBITDA helps to identify underlying

trends in our operating results, enhancing their understanding of

the past performance and future prospects.

- “Total adjusted EBITDA” represents the sum of adjusted EBITDA

of all our segments combined, plus unallocated expenses. Although

other companies may calculate adjusted EBITDA differently or not

present it at all, we believe that the total adjusted EBITDA helps

to identify underlying trends in our operating results, enhancing

their understanding of the past performance and future

prospects.

These non-GAAP financial measures have limitations as analytical

tools. None of the above financial measures should be considered in

isolation or construed as an alternative to revenue, net

loss/income, or any other measure of performance or as an indicator

of our operating performance. These non-GAAP financial measures

presented here may not be comparable to similarly titled measures

presented by other companies. Other companies may calculate

similarly titled measures differently, limiting their usefulness as

comparative measures to Sea’s data. We compensate for these

limitations by reconciling the non-GAAP financial measures to their

nearest U.S. GAAP financial measures, all of which should be

considered when evaluating our performance. We encourage you to

review our financial information in its entirety and not rely on

any single financial measure.

The tables below present selected unaudited financial

information of our reporting segments, the non-GAAP financial

measures that are most directly comparable to GAAP financial

measures, and the related reconciliations between the financial

measures. Amounts are expressed in thousands of US dollars

(“$”).

For the Three Months ended

September 30, 2019

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(3)

Unallocated

expenses(4)

Consolidated

$

$

$

$

$

$

Revenue

329,058

226,396(1)

1,662

53,021

-

610,137

Changes in deferred revenue

121,946

-

-

-

-

121,946

Sales incentives net-off

-

30,817

357

-

-

31,174

Adjusted revenue

451,004

257,213(2)

2,019

53,021

-

763,257

Operating income (loss)

169,369

(277,219)

(34,553)

(9,429)

(35,630)

(187,462)

Net effect of changes in deferred revenue

and its related cost

91,654

-

-

-

-

91,654

Depreciation and Amortization

4,935

23,507

925

2,935

-

32,302

Share-based compensation

-

-

-

-

32,709

32,709

Adjusted EBITDA

265,958

(253,712)

(33,628)

(6,494)

(2,921)

(30,797)

For the Three Months ended

September 30, 2018

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(3)

Unallocated expenses(4)

Consolidated

$

$

$

$

$

$

Revenue

112,520

65,919(1)

2,548

23,934

-

204,921

Changes in deferred revenue

32,038

-

-

-

-

32,038

Sales incentives net-off

-

5,314

565

-

-

5,879

Adjusted revenue

144,558

71,233(2)

3,113

23,934

-

242,838

Operating income (loss)

19,403

(223,787)

(7,387)

(16,186)

(18,243)

(246,200)

Net effect of changes in deferred revenue

and its related cost

26,192

-

-

-

-

26,192

Depreciation and Amortization

8,129

8,926

386

2,336

-

19,777

Share-based compensation

-

-

-

-

16,479

16,479

Adjusted EBITDA

53,724

(214,861)

(7,001)

(13,850)

(1,764)

(183,752)

(1) For the third quarter of 2019, revenue of $226,396 included

marketplace revenue of $177,235 and product revenue of $49,161 net

of sales incentives. For the third quarter of 2018, revenue of

$65,919 included marketplace revenue of $45,147 and product revenue

of $20,772 net of sales incentives.

(2) For the third quarter of 2019, adjusted revenue of $257,213

included marketplace revenue of $208,052 and product revenue of

$49,161. For the third quarter of 2018, adjusted revenue of $71,233

included marketplace revenue of $50,303 and product revenue of

$20,930.

(3) A combination of multiple business activities that does not

meet the quantitative thresholds to qualify as reportable segments

are grouped together as “Other Services.”

(4) Unallocated expenses are mainly related to share-based

compensation and general and corporate administrative costs such as

professional fees and other miscellaneous items that are not

allocated to segments. The expenses are excluded from segment

results as they are not reviewed by the CODM as part of segment

performance.

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS

Amounts expressed in thousands of US

dollars (“$”) except for number of shares & per share

data

For the Nine Months

ended September 30,

2018

2019

$

$

Revenue

Service revenue

Digital Entertainment

331,207

731,935

E-commerce and other services

157,693

526,144

Sales of goods

54,844

140,075

Total revenue

543,744

1,398,154

Cost of revenue

Cost of service

Digital Entertainment

(189,513)

(296,788)

E-commerce and other services

(275,052)

(612,833)

Cost of goods sold

(56,462)

(148,465)

Total cost of revenue

(521,027)

(1,058,086)

Gross profit

22,717

340,068

Operating income (expenses):

Other operating income

5,508

9,875

Sales and marketing expenses

(497,528)

(627,803)

General and administrative expenses

(153,621)

(276,160)

Research and development expenses

(40,887)

(107,167)

Total operating expenses

(686,528)

(1,001,255)

Operating loss

(663,811)

(661,187)

Interest income

8,567

24,539

Interest expense

(21,413)

(31,041)

Investment gain, net

9,374

4,817

Changes in fair value of the 2017

convertible notes

(19,928)

(466,102)(1)

Foreign exchange gain

5,304

5,583

Loss before income tax and share of

results of equity investees

(681,907)

(1,123,391)

Income tax expense

(1,095)

(49,853)

Share of results of equity investees

(1,974)

(2,558)

Net loss

(684,976)

(1,175,802)

Net loss (profit) attributable to

non-controlling interests

358

(3,208)

Net loss attributable to Sea Limited’s

ordinary shareholders

(684,618)

(1,179,010)

Net loss excluding share-based

compensation and changes in fair value of the 2017 convertible

notes (2)

(622,985)

(627,566)

Loss per share:

Basic and diluted

(2.03)

(2.75)

Shares used in loss per share

computation:

Basic and diluted

337,804,410

428,606,948

(1) Fair value loss of $466.1 million on the 2017 convertible

notes was recorded as our share prices significantly exceeded the

conversion prices of the 2017 convertible notes.

(2) For a discussion of the use of non-GAAP financial measures,

see “Non-GAAP Financial Measures.”

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of

December 31,

As of

September 30,

2018

2019

$

$

ASSETS

Current assets

Cash and cash equivalents

1,002,841

2,297,187

Restricted cash

254,100

360,065

Accounts receivable, net

97,782

138,198

Prepaid expenses and other assets

312,387

489,272

Inventories, net

37,689

21,372

Short-term investments

690

9,416

Amounts due from related parties

5,224

2,277

Total current assets

1,710,713

3,317,787

Non-current assets

Property and equipment, net

192,357

294,783

Operating lease right-of-use assets,

net

-

168,366

Intangible assets, net

12,887

14,914

Long-term investments

111,022

99,086

Prepaid expenses and other assets

69,065

66,330

Restricted cash

2,371

16,583

Deferred tax assets

63,302

73,100

Goodwill

30,952

30,952

Total non-current assets

481,956

764,114

Total assets

2,192,669

4,081,901

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of

December 31,

As of

September 30,

2018

2019

$

$

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities

Accounts payable

37,163

48,124

Accrued expenses and other payables

636,880

826,887

Advances from customers

29,355

50,203

Amount due to related parties

46,025

45,959

Short-term borrowings

856

1,307

Operating lease liabilities

-

49,729

Deferred revenue

426,675

990,677

Convertible notes

-

22,706

Income tax payable

9,539

16,138

Total current liabilities

1,186,493

2,051,730

Non-current liabilities

Accrued expenses and other payables

7,894

22,633

Long-term borrowings

1,026

633

Operating lease liabilities

-

134,293

Deferred revenue

171,262

164,976

Convertible notes

1,061,796

445,936

Deferred tax liabilities

679

791

Unrecognized tax benefits

2,974

1,409

Total non-current liabilities

1,245,631

770,671

Total liabilities

2,432,124

2,822,401

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of

December 31,

As of

September 30,

2018

2019

$

$

Shareholders’ equity

Class A Ordinary shares

94

154

Class B Ordinary shares

76

76

Additional paid-in capital

1,809,232

4,505,967

Accumulated other comprehensive income

15,199

(6,979)

Statutory reserves

46

46

Accumulated deficit

(2,067,786)

(3,246,796)

Total Sea Limited shareholders’

(deficit) equity

(243,139)

1,252,468

Non-controlling interests

3,684

7,032

Total shareholders’ (deficit)

equity

(239,455)

1,259,500

Total liabilities and shareholders’

(deficit) equity

2,192,669

4,081,901

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

Amounts expressed in thousands of US

dollars (“$”)

For the Nine Months

ended

September 30,

2018

2019

$

$

Net cash (used in) generated from

operating activities

(357,029)

97,663

Net cash used in investing activities

(158,938)

(219,538)

Net cash generated from financing

activities

545,106

1,534,550

Effect of foreign exchange rate changes on

cash, cash equivalents and restricted cash

(14,739)

1,848

Net increase in cash, cash equivalents and

restricted cash

14,400

1,414,523

Cash, cash equivalents and restricted cash

at beginning of the period

1,444,978

1,259,312

Cash, cash equivalents and restricted cash

at end of the period

1,459,378

2,673,835

1 UNAUDITED SEGMENT INFORMATION

The Company has three reportable segments, namely digital

entertainment, e-commerce and digital financial services. The Chief

Operation Decision Maker (“CODM”) reviews the performance of each

segment based on revenue and certain key operating metrics of the

operations and uses these results for the purposes of allocating

resources to and evaluating the financial performance of each

segment. Amounts are expressed in thousands of US dollars

(“$”).

For the Three Months ended

September 30, 2019

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Revenue

329,058

226,396

1,662

53,021

-

610,137

Operating income (loss)

169,369

(277,219)

(34,553)

(9,429)

(35,630)

(187,462)

Non-operating income, net

9,786

Income tax expense

(27,370)

Share of results of equity investees

(1,051)

Net loss

(206,097)

For the Three Months ended

September 30, 2018

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Revenue

112,520

65,919

2,548

23,934

-

204,921

Operating income (loss)

19,403

(223,787)

(7,387)

(16,186)

(18,243)

(246,200)

Non-operating income, net

30,903

Income tax expense

(2,020)

Share of results of equity investees

(702)

Net loss

(218,019)

(1) A combination of multiple business activities that does not

meet the quantitative thresholds to qualify as reportable segments

are grouped together as “Other Services.”

(2) Unallocated expenses are mainly related to share-based

compensation and general and corporate administrative costs such as

professional fees and other miscellaneous items that are not

allocated to segments. The expenses are excluded from segment

results as they are not reviewed by the CODM as part of segment

performance

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191112005556/en/

Martin Reidy Investors / analysts: ir@seagroup.com Media:

media@seagroup.com

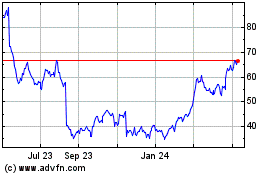

Sea (NYSE:SE)

Historical Stock Chart

From Mar 2024 to Apr 2024

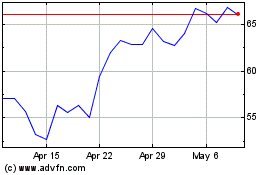

Sea (NYSE:SE)

Historical Stock Chart

From Apr 2023 to Apr 2024