J.C. Penney, Viacom, General Electric: Stocks That Defined the Week

August 16 2019 - 5:11PM

Dow Jones News

By Francesca Fontana

Major U.S. stock indexes fell for the week on renewed concerns

that the economy could be headed toward a recession, fueled by an

inversion of the yield curve and other market signals flashing

red.

In individual stocks, J.C. Penney Co. said it would start

selling secondhand clothes, Viacom Inc. and CBS Corp. agreed to get

back together, and Bernie Madoff whistleblower Harry Markopolos now

has his sights set on General Electric Co.

J.C. Penney Co.

The hand-me-down is going mainstream. J.C. Penney and Macy's

both said during earnings announcements this week that they will

start selling secondhand clothes in partnership with thredUP Inc.

as department stores continue to lose shoppers to newer forms of

retailing. To be sure, the booming market for used goods isn't

immune to the pressures facing retailers that sell new products.

The RealReal Inc., an online marketplace for preowned luxury goods,

said Tuesday that discounting by department stores weighed on sales

in the most recent quarter. J.C. Penney shares gained 2.2% Thursday

after its earnings announcement.

Apple Inc.

Apple received an early Christmas present from President Trump

when the White House on Tuesday announced a delay in some planned

tariffs on Chinese-produced goods. "We're doing this for Christmas

season, just in case some of the tariffs would have an impact on

U.S. customers," Mr. Trump said. The tariffs, including 10% levies

on mobile phones and laptop computers, were originally set to take

effect on Sept. 1 and would have seriously hampered Apple's annual

iPhone launch that typically takes place in late September. Apple's

share price had fallen 6% since Mr. Trump first announced the

tariffs on Aug. 1 -- double the drop of the S&P 500 in that

time. Apple shares gained 4.2% Tuesday.

BlackRock Inc.

The world's biggest money manager now owns some of America's

best-known brands. BlackRock said it purchased a stake in the

company that controls Sports Illustrated, Nine West and

Aéropostale. The deal was the first for a new BlackRock

private-equity fund known as Long Term Private Capital, part of an

effort to bulk up alternative businesses that lock up money for

longer and charge higher fees. BlackRock's stake in Authentic

Brands Group LLC is worth roughly $875 million, according to The

Wall Street Journal. The deal was announced Sunday and shares fell

2.3% Monday

Rite Aid Corp.

Rite Aid found someone willing to nurse the pharmacy chain back

to health. The company appointed Heyward Donigan as chief executive

Monday, saying her experience leading health-care companies would

help Rite Aid confront competition that dampened sales and caused

job cuts. Shares of the third-largest U.S. pharmacy chain have

plunged more than 50% this year. "I recognized the opportunity to

really revitalize Rite Aid," Ms. Donigan told The Wall Street

Journal. Ms. Donigan was chief executive of Sapphire Digital, a

website for analyzing health-care plans that was previously known

as Vitals. She is now one of 33 women leading the largest 500 U.S.

publicly traded companies by revenue, according to

corporate-research firm Equilar. Rite Aid shares fell 2.4%

Monday.

Viacom Inc.

Viacom and CBS Corp. are getting back together. Thirteen years

after the two companies split they agreed Tuesday to merge in an

all-stock deal that would reunite the media empire of mogul Sumner

Redstone. The combined company is valued at roughly $30 billion,

combining Viacom properties such as MTV, Nickelodeon, Comedy

Central and the Paramount film and TV studio with CBS's broadcast

network and Showtime premium network. However, it would still be

much smaller than competitors. Analysts say CBS and Viacom could

become a buyout target, and further acquisitions by the merged

company could make it a more attractive one. Viacom shares gained

2.4% Tuesday while CBS shares added 1.4%.

General Electric Co.

Fraud at General Electric? That's what Harry Markopolos, the

accounting expert who raised red flags about Bernie Madoff's Ponzi

scheme, is claiming. In a research report posted online Thursday,

Mr. Markopolos alleged the struggling conglomerate has masked the

depths of its problems, resulting in inaccurate and fraudulent

financial filings with regulators. The report, reviewed by The Wall

Street Journal, is a mixture of detailed financial analysis and

sweeping claims. A GE spokeswoman told the Journal that GE stands

behind its financials. "While we can't comment on the detailed

content of a report that we haven't seen, the allegations we have

heard are entirely false and misleading," she said in an email.

General Electric shares plummeted 11.3% Thursday.

Verizon Communications Inc.

Verizon is saying goodbye to Tumblr. The telecom giant has

agreed to sell the blogging website to the owner of popular

online-publishing tool WordPress.com, the companies said Monday.

Tumblr once fetched a purchase price of more than $1 billion, but

Automattic Inc. will buy Tumblr for an undisclosed sum that The

Wall Street Journal reported isn't material to Verizon. A decision

last year by Verizon to ban adult content on Tumblr alienated some

users. Automattic's CEO says the company plans to maintain that

policy and sees the site as complementary to WordPress.com. "It's

just fun," he said of Tumblr. "We're not going to change any of

that." Verizon shares rose 1.2% Tuesday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

August 16, 2019 16:56 ET (20:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

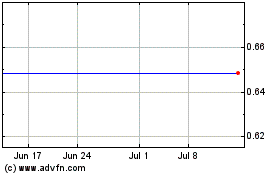

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2023 to Apr 2024