Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 06 2020 - 4:34PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-228157

July 6, 2020

REALTY INCOME CORPORATION

PRICING TERM SHEET

3.250% Notes due 2031

This free writing prospectus relates only to the securities described below and should be read together with Realty Income Corporation’s preliminary prospectus supplement dated July 6, 2020 (the “Preliminary Prospectus Supplement”), the accompanying prospectus dated November 5, 2018 (the “Prospectus”) and the documents incorporated and deemed to be incorporated by reference therein. As described in the Preliminary Prospectus Supplement under “Description of Notes—General,” the 3.250% Notes due 2031 (the “notes”) offered by the Preliminary Prospectus Supplement and the Prospectus constitute a further issuance of, and a single series with, Realty Income Corporation’s outstanding 3.250% Notes due 2031, of which $600,000,000 aggregate principal amount was issued on May 8, 2020 and is outstanding as of the date of this free writing prospectus (the “existing notes”).

|

Issuer:

|

|

Realty Income Corporation (the “Company”)

|

|

|

|

|

|

Trade Date:

|

|

July 6, 2020

|

|

|

|

|

|

Anticipated Ratings(1):

|

|

A3 by Moody’s Investors Service, Inc. (stable outlook)

|

|

|

|

A- by Standard & Poor’s Ratings Group (stable outlook)

|

|

|

|

BBB+ by Fitch Ratings (stable outlook)

|

|

|

|

|

|

Expected Settlement Date:

|

|

July 16, 2020 (T+8)

|

|

|

|

|

|

Delayed Settlement:

|

|

The Company expects that the delivery of the notes will be made against payment therefor on or about the settlement date specified above, which will be the 8th business day following the date of this pricing term sheet. Under rules of the Securities and Exchange Commission, trades in the secondary market generally are required to settle in two business days, unless the parties to that trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes before the second business day prior to the settlement date specified above will be required, by virtue of the fact that the normal settlement date for that trade would occur prior to the closing date for the issuance of the notes, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement, and should consult their own advisors with respect to these matters.

|

|

|

|

|

|

Net Proceeds:

|

|

Approximately $376.6 million after deducting the underwriting discount but before deducting other estimated expenses payable by the Company and excluding approximately $31,597.22 (assuming the settlement date for this offering occurs on July 16, 2020) payable to the Company in

|

(1) Note: A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time.

|

|

|

respect of interest accrued on the notes offered hereby for the period from and including July 15, 2020 to but excluding the settlement date for this offering.

|

|

|

|

|

|

Use of Proceeds:

|

|

The Company intends to use the net proceeds it receives from this offering to increase its liquidity by repaying borrowings outstanding under its $3.0 billion revolving credit facility and, to the extent not used for that purpose, to fund potential investment opportunities and for other general corporate purposes. As of July 1, 2020, the Company had approximately $628.6 million of outstanding borrowings under its revolving credit facility (including approximately £329.5 million of GBP-denominated borrowings). As of July 1, 2020, the Company had a total of approximately $74.0 million in cash and cash equivalents, and a $300 million term deposit maturing on July 24, 2020. For information concerning potential conflicts of interest that may arise from the Company’s use of proceeds to repay borrowings under its $3.0 billion revolving credit facility, see “Underwriting (Conflicts of Interest)—Other Relationships” and “Underwriting (Conflicts of Interest)—Conflicts of Interest” in the Preliminary Prospectus Supplement.

|

|

|

|

|

|

Security:

|

|

3.250% Notes due 2031 (the “notes”)

|

|

|

|

|

|

Principal Amount:

|

|

$350,000,000

|

|

|

|

|

|

Maturity Date:

|

|

January 15, 2031

|

|

|

|

|

|

Interest Rate:

|

|

3.250% per annum, accruing from July 15, 2020

|

|

|

|

|

|

Interest Payment Dates:

|

|

January 15 and July 15, commencing January 15, 2021. The settlement date of this offering will be after July 15, 2020 and, as a result, investors will not be entitled to receive any payment of interest on July 15, 2020 on the notes they purchase in this offering.

|

|

|

|

|

|

Price to Public:

|

|

108.241%, plus accrued interest from and including July 15, 2020 to but excluding the settlement date, which accrued interest totals approximately $31,597.22 (assuming the settlement date is July 16, 2020). Such accrued interest must be paid by the purchasers of the notes offered hereby.

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+165 basis points

|

|

|

|

|

|

Benchmark Treasury:

|

|

0.625% due May 15, 2030

|

|

|

|

|

|

Benchmark Treasury Price/Yield:

|

|

99-12 / 0.691%

|

|

|

|

|

|

Reoffer Yield:

|

|

2.341%

|

|

|

|

|

|

Optional Redemption:

|

|

Prior to October 15, 2030 (the “Par Call Date”), the notes will be redeemable at any time in whole or from time to time in part at the option of the Company at a redemption price equal to the greater of: (a) 100% of the principal amount of the notes to be redeemed, and (b) the sum of the present values of the remaining scheduled payments of principal of and interest on the notes to be redeemed (exclusive of interest accrued to the applicable redemption date), assuming that the notes matured and that accrued and unpaid interest on the notes was payable on the Par Call

|

2

|

|

|

Date, discounted to such redemption date on a semiannual basis, assuming a 360-day year consisting of twelve 30-day months, at the Treasury Rate (as such term is defined under the caption “Description of Notes—Optional Redemption” in the Preliminary Prospectus Supplement) plus 40 basis points, plus, in the case of both clauses (a) and (b) above, accrued and unpaid interest on the principal amount of the notes being redeemed to such redemption date.

|

|

|

|

|

|

|

|

On and after the Par Call Date, the notes will be redeemable at any time in whole or from time to time in part at the option of the Company at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest on the principal amount of the notes being redeemed to the applicable redemption date.

|

|

|

|

|

|

|

|

See the information under the caption “Description of Notes—Optional Redemption” in the Preliminary Prospectus Supplement for further terms and provisions applicable to optional redemption of the notes.

|

|

|

|

|

|

CUSIP/ISIN:

|

|

756109 AX2 / US756109AX24

|

|

|

|

|

|

Underwriters

|

|

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

Goldman Sachs & Co. LLC

Barclays Capital Inc.

Credit Suisse Securities (USA) LLC

BofA Securities, Inc.

J.P. Morgan Securities LLC

RBC Capital Markets, LLC

Regions Securities LLC

TD Securities (USA) LLC

Wells Fargo Securities, LLC

BNY Mellon Capital Markets, LLC

Citigroup Global Markets Inc.

Mizuho Securities USA LLC

Morgan Stanley & Co. LLC

U.S. Bancorp Investments, Inc.

|

|

|

|

|

|

Co-Lead Managers:

|

|

BMO Capital Markets Corp.

PNC Capital Markets LLC

Scotia Capital (USA) Inc.

Stifel, Nicolaus & Company, Incorporated

SunTrust Robinson Humphrey, Inc.

UBS Securities LLC

|

|

|

|

|

|

Senior Co-Managers:

|

|

Comerica Securities, Inc.

Moelis & Company LLC

Samuel A. Ramirez & Company, Inc.

|

|

|

|

|

|

Co-Managers:

|

|

Academy Securities, Inc.

Siebert Williams Shank & Co., LLC

|

3

Associated Investment Services, Inc. (AIS), a Financial Industry Regulatory Authority, Inc. member and a subsidiary of Associated Banc-Corp, is being paid a referral fee by Samuel A. Ramirez & Company, Inc. A subsidiary of Associated Banc-Corp is a lender under the Company’s $3.0 billion revolving credit facility.

Comerica Securities, Inc., a Financial Industry Regulatory Authority, Inc. member, is paying a referral fee to an affiliated entity, Comerica Bank, which is a lender under the Company’s $3.0 billion revolving credit facility.

Stifel, Nicolaus & Company, Incorporated may pay an unaffiliated entity, which is also a lender under the Company’s $3.0 billion revolving credit facility, or its affiliate a fee in connection with this offering.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and the related prospectus supplement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and related prospectus supplement if you request it by contacting Goldman Sachs & Co. LLC by telephone (toll free) at 1-866-471-2526, Barclays Capital Inc. by telephone (toll free) at 1-888-603-5847 or Credit Suisse Securities (USA) LLC by telephone (toll free) at 1-800-221-1037.

4

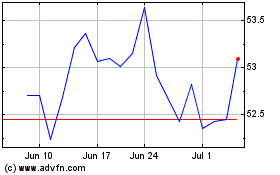

Realty Income (NYSE:O)

Historical Stock Chart

From Mar 2024 to Apr 2024

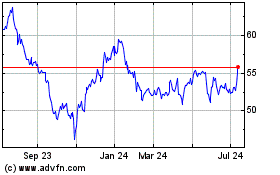

Realty Income (NYSE:O)

Historical Stock Chart

From Apr 2023 to Apr 2024