UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 11-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

o TRANSITION REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______to _______

Commission file number: 001-12215

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

THE PROFIT SHARING PLAN OF QUEST DIAGNOSTICS INCORPORATED

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

QUEST DIAGNOSTICS INCORPORATED

500 PLAZA DRIVE

SECAUCUS, NJ 07094

The Profit Sharing Plan of Quest Diagnostics Incorporated

Index to Financial Statements and Supplemental Schedule

|

|

|

|

|

|

|

|

|

Page

|

|

Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Schedules*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA have been omitted because they are no longer applicable.

|

|

|

|

|

|

Exhibit

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

Plan Administrator and Plan Participants

The Profit Sharing Plan of Quest Diagnostics Incorporated

Opinion on the financial statements

We have audited the accompanying statements of net assets available for benefits of The Profit Sharing Plan of Quest Diagnostics Incorporated (the “Plan”) as of December 31, 2020 and 2019, the related statement of changes in net assets available for benefits for the year ended December 31, 2020, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020 and 2019, and the changes in net assets available for benefits for the year ended December 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental information

The Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year) as of December 31, 2020 (“supplemental information”) has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ GRANT THORNTON LLP

We have served as the Plan's auditor since 2008.

Boston, Massachusetts

June 28, 2021

The Profit Sharing Plan of Quest Diagnostics Incorporated

Statements of Net Assets Available for Benefits

December 31, 2020 and 2019

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

Assets

|

|

|

|

|

Cash

|

$

|

—

|

|

|

$

|

714

|

|

|

Investments, at fair value

|

4,917,683

|

|

|

4,503,452

|

|

|

Receivables

|

|

|

|

|

Employer contributions receivable

|

—

|

|

|

1,405

|

|

|

Notes receivable from participants

|

97,221

|

|

|

90,236

|

|

|

Investment related receivables

|

698

|

|

|

598

|

|

|

Total assets

|

5,015,602

|

|

|

4,596,405

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

Investment related payables

|

1,223

|

|

|

1,128

|

|

|

Other liabilities

|

1,519

|

|

|

1,209

|

|

|

Total liabilities

|

2,742

|

|

|

2,337

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

5,012,860

|

|

|

$

|

4,594,068

|

|

The accompanying notes are an integral part of these financial statements.

The Profit Sharing Plan of Quest Diagnostics Incorporated

Statement of Changes in Net Assets Available for Benefits

For the Year Ended December 31, 2020

(in thousands)

|

|

|

|

|

|

|

|

Additions:

|

|

|

Investment Income

|

|

|

Net appreciation in fair value of investments

|

$

|

544,278

|

|

|

Dividends and interest

|

165,294

|

|

|

Total investment income

|

709,572

|

|

|

|

|

|

Interest income on notes receivable from participants

|

4,523

|

|

|

|

|

|

Contributions

|

|

|

Employer

|

65,067

|

|

|

Participants

|

162,138

|

|

|

Total contributions

|

227,205

|

|

|

|

|

|

Total additions

|

941,300

|

|

|

|

|

|

Deductions:

|

|

|

Benefits paid to participants

|

522,051

|

|

|

Administrative expenses

|

457

|

|

|

Total deductions

|

522,508

|

|

|

|

|

|

Net increase

|

418,792

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

Beginning of year

|

4,594,068

|

|

|

|

|

|

End of year

|

$

|

5,012,860

|

|

The accompanying notes are an integral part of these financial statements.

The Profit Sharing Plan of Quest Diagnostics Incorporated

December 31, 2020 and 2019

Notes to Financial Statements (dollars in thousands)

1. Description of the Plan

Background - The Profit Sharing Plan of Quest Diagnostics Incorporated (the “Plan”) is a defined contribution plan established by Quest Diagnostics Incorporated ("Quest Diagnostics" or the “Company” or the “Plan Sponsor”) to provide its eligible employees with retirement benefits. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The following description of the Plan provides only general information. Participants should refer to the Summary Plan Description for a more complete description of the Plan's provisions.

Coronavirus Aid, Relief, and Economic Security Act - In March 2020, in response to the COVID-19 pandemic, the Coronavirus Aid, Relief, and Economy Security Act ("CARES Act") was signed into law. The Company amended the Plan to enable Plan participants who were qualified individuals, as defined in Section 2202(b) of the CARES Act, to receive a loan subject to the increased limits on loans set forth in the CARES Act. This ability to receive a loan subject to such increased limit applied through January 31, 2021. In line with the CARES Act, Plan participants impacted by COVID-19 were able to initiate distributions of up to $100 without the usual early 10% withdrawal penalty.

Eligibility and Participant Contributions - Effective January 1, 2020, all eligible employees can participate in the Plan as soon as administratively feasible upon becoming an employee of the Company. Participants may contribute an amount between 1% and 35% of their eligible compensation, as defined, for the contribution period. Catch-up contributions, as defined in the Internal Revenue Code (the "Code"), are permissible for eligible participants. Participants may modify their contribution percentage at any time.

Employer Matching Contributions - Prior to May 29, 2020, the Company matched 100% of a participant's contribution, up to 5% of eligible compensation, in cash after the participant completes 12 months of service, as defined, with the Company. Effective for paychecks after May 29, 2020, the Company amended the Plan to eliminate regular employer matching contributions to the Plan as part of a series of actions to protect the Company's financial flexibility due to the COVID-19 pandemic, and to allow the Company to make discretionary employer matching contributions in an amount equal to a uniform percentage of employee pre-tax contributions made by each participant at a rate that does not exceed 5% of eligible compensation. Employer matching contributions were reinstated beginning with the September 4, 2020 paycheck through discretionary employer matching contributions in an amount equal to 100% of an eligible participant's contribution, up to 5% of eligible compensation, through the remainder of 2020. Effective January 1, 2021, the Plan was amended to re-establish regular employer matching contributions in accordance with the Plan provisions that existed prior to May 29, 2020. Employer matching contributions are remitted to the Plan at the same time that the corresponding participants' contributions are remitted.

Participant Accounts - A separate individual account is established for each participant in the Plan. Each participant's account is credited with the participant's contributions and the employer matching contributions, plus actual earnings thereon. Earnings are allocated by fund based on the ratio of the participant's account invested in a particular fund to all participants' investments in that fund.

Vesting - Participants immediately vest in their voluntary contributions and employer matching contributions plus actual earnings thereon. Certain participants who were active in plans sponsored by previous employers have vesting requirements applied to their previous employer contribution accounts consistent with the vesting requirements in effect before the assets were merged into the Plan.

Investment Options - Participants may elect to have their voluntary contributions and employer matching contributions invested in any or all of the available investment options, most of which are managed by Fidelity Management & Research Company (“FMRC”). Participants may also elect to have their voluntary contributions and employer matching contributions invested in shares of the Company's common stock. Participants have the ability to modify their investment elections daily, subject to certain short-term trading restrictions imposed by FMRC and the Company's securities trading policy, which prohibits trading in the Company's common stock on a short-term basis and while in possession of material non-public information about the Company.

Participants cannot contribute greater than 25% per pay period of pre-tax contributions into Quest Diagnostics common stock. In addition, participants can transfer monies into Quest Diagnostics stock only to the extent the percentage of holdings in Quest Diagnostics stock after the transfer remains below 25% of the participant's entire account balance.

The Profit Sharing Plan of Quest Diagnostics Incorporated

December 31, 2020 and 2019

Notes to Financial Statements (dollars in thousands) - continued

Participants may elect to receive their dividends on investments in Quest Diagnostics stock as a taxable cash payment or to have those dividends automatically reinvested.

Distribution Options - Participants can elect to have their benefit distributions, equal to the value of the vested portion of their account balance, paid in the form of a lump sum distribution, a direct rollover into another eligible retirement plan or traditional individual retirement account, installment payments, or for appropriate assets, an annuity.

Withdrawals - Withdrawals may be made for qualified emergencies, as defined in the Code. Depending upon the type of withdrawal and the status of the contribution, penalties upon withdrawal may apply. Participants may also begin to make withdrawals without penalty at age 59 ½, subject to certain limitations as defined by the Plan.

Forfeitures - Employer contributions in forfeited nonvested accounts may be used to reduce future employer contributions or pay the Plan's expenses. The forfeiture activity and account balance was not material as of December 31, 2020 and 2019.

Parties-in-Interest - Certain investments of the Plan, as of December 31, 2020 and 2019, are shares of mutual funds and collective funds managed by FMRC. These transactions qualify as party-in-interest transactions. As of December 31, 2020 and 2019, investments with a fair value of $3,958,330 and $3,584,999, respectively, were managed by FMRC.

The Company also is a party-in-interest to the Plan under the definition provided in Section 3(14) of ERISA. Therefore, Quest Diagnostics stock transactions qualify as party-in-interest transactions. As of December 31, 2020 and 2019, the total fair value of the Plan's investment in Quest Diagnostics stock was $311,954 and $308,062, respectively. During 2020, total purchases and sales of Quest Diagnostics stock by the Plan were $1,204 and $32,243, respectively.

In addition, the Plan receives revenue sharing credits, as described below, which is considered a party-in-interest transaction.

Revenue Sharing Credits - A portion of the operating expenses and management fees are paid by the Plan using revenue sharing credits which are included in net appreciation in fair value of investments. Any amount in excess of the fees is allocated to participant accounts. Revenue sharing credits earned for the year ended December 31, 2020 were $4,819, $997 of which were used for permissible management and recordkeeping fees and $3,822 of which were allocated to participant accounts. As of December 31, 2020 and 2019, the revenue sharing credit balance was $3,655 and $4,481, respectively.

Notes Receivable from Participants - Except with respect to loans to qualified individuals for COVID-19 related reasons, participants are permitted to obtain loans in amounts not less than one thousand dollars and up to the lesser of (1) fifty thousand dollars, subject to certain limitations as defined by the Plan, or (2) 50% of the participant's vested portion of their account value. Except with respect to loans to qualified individuals for COVID-19 related reasons and pre-existing loans transferred or merged into the Plan, a participant may have only one outstanding loan at a time and loans are repayable over a period of up to five years, unless the proceeds are used to purchase a primary residence, in which case a period of up to ten years is permitted. Loans are secured by one-half of a participant's vested account balance and bear interest at prime plus 1%. Rates range from 3.75% to 10.25%; maturities vary by participant. Principal and interest are repaid to the Plan through payroll deductions for active employees. Participants can elect to pay the entire outstanding balance of a loan directly to Fidelity Management Trust Company ("FMTC"). Actively employed participants can also submit a partial loan repayment directly to FMTC outside the normal payroll deductions, accelerating the payoff date. Participants who are no longer active employees may continue to repay outstanding loan balances directly to FMTC.

In addition, notes receivable from participants qualify as party-in-interest transactions. As of December 31, 2020 and 2019, the carrying value of the Plan's notes receivable from participants was $97,221 and $90,236, respectively.

Plan Administration - The Plan Administrator is the Benefits Administration Committee, which is appointed by the Company's Board of Directors. The Plan's trustee and recordkeeper for the Plan investments are FMTC and Fidelity Investments Institutional Operations Company, Inc., respectively.

The Profit Sharing Plan of Quest Diagnostics Incorporated

December 31, 2020 and 2019

Notes to Financial Statements (dollars in thousands) - continued

Tax Status - The Internal Revenue Service (“IRS”) has determined and informed the Company by letter dated September 22, 2014, that the Plan and related trust are designed in accordance with applicable sections of the Code. The Plan Sponsor believes that the Plan, which has been amended since the IRS determination, continues to be designed and operated in compliance with the applicable requirements of the Code and, therefore, believes that the Plan is qualified and related trust is tax-exempt.

Accounting principles generally accepted in the United States (“US GAAP”) requires the Plan Administrator to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2020 and 2019 there are no uncertain positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing authorities; however, there are currently no audits for any tax periods in progress.

Administrative Expenses - Accounting fees and certain administrative expenses of the Plan may be paid by the Plan or the Company. Loan origination and certain distribution fees are charged against participant accounts.

Investment Management Fees - Investment management fees and operating expenses charged to the Plan for investments in the Plan are deducted from income earned on a daily basis and are not separately reflected. Consequently, investment management fees and operating expenses are reflected as a reduction of investment return for such investments.

Plan Termination - The Company intends to continue the Plan indefinitely, but reserves the right to change or discontinue the Plan at its discretion. Participants will become fully vested in their rights under the Plan if it is terminated or if employer matching contributions are completely discontinued.

2. Summary of Significant Accounting Policies

Basis of Presentation - The Plan maintains its financial records on the accrual basis of accounting.

Use of Estimates - The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities, if any, at the date of the financial statements and the reported amounts of additions to and deductions from net assets during the reporting period. Actual results could differ from those estimates.

Risks and Uncertainties - The Plan provides for participant-directed investment of their voluntary contributions and employer matching contributions in a number of investment funds. Certain underlying investment securities are exposed to various risks, such as interest rate, market and credit risk. Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the value of investment securities, changes in these risks could materially affect participants' account balances and the amounts reported in the Statements of Net Assets Available for Benefits and the Statement of Changes in Net Assets Available for Benefits.

Benefits paid to participants - Benefits payments to participants are recorded when paid.

Valuation of Investments - Investments are stated at fair value at year end. Refer to Note 3 for additional information related to the valuation of Plan investments.

Security Transactions and Income - Purchases and sales of securities are recorded on a trade-date basis. Dividend income is recorded on the ex-dividend date. Interest income from investments is recorded as earned on an accrual basis.

Net appreciation in fair value of investments represents the Plan's net realized and unrealized gains (losses) on investments held by the Plan.

Notes Receivable from Participants - Notes receivable from participants are valued at their unpaid principal balance, plus any accrued but unpaid interest. Interest income from notes receivable from participants is recorded on an accrual basis.

The Profit Sharing Plan of Quest Diagnostics Incorporated

December 31, 2020 and 2019

Notes to Financial Statements (dollars in thousands) - continued

Refundable Contributions - The Plan completes non-discrimination testing annually to ensure compliance with the Code. For the year ended December 31, 2020, excess contributions determined as a result of the Actual Deferral Percentage test of $1,519 were netted against participant contributions in the Statement of Changes in Net Assets Available for Benefits, reflected in other liabilities in the Statements of Net Assets Available for Benefits and were refunded to plan participants in 2021.

New Accounting Standard Adopted - On January 1, 2020, the Plan adopted a new accounting standard issued by the Financial Accounting Standards Board which amended the disclosure requirements for fair value measurements to remove disclosures that are no longer considered cost beneficial, clarify the specific requirements of disclosures and add disclosure requirements identified as relevant. The adoption of this standard did not have a material impact on the Plan's net assets available for benefits, changes in net assets available for benefits or footnote disclosures.

3. Fair Value Measurements

Fair value measurements are based upon the exit price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants, and are determined by either the principal market or the most advantageous market.

Inputs used in the valuation techniques to derive fair values are classified based on a three-level hierarchy to prioritize the inputs used in the valuation techniques to derive fair values. The basis for fair value measurements for each level within the hierarchy is described below with Level 1 having the highest priority and Level 3 having the lowest. During the year ended December 31, 2020, there was no transfer between levels.

|

|

|

|

|

|

|

|

Level 1:

|

Quoted prices in active markets for identical assets or liabilities.

|

|

|

|

|

Level 2:

|

Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs are observable in active markets.

|

|

|

|

|

Level 3:

|

Valuations derived from valuation techniques in which one or more significant inputs are unobservable.

|

The following table provides a summary of the assets in the Plan that are measured at fair value on a recurring basis:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basis of Fair Value Measurements

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2020

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Mutual funds

|

|

$

|

3,494,729

|

|

|

$

|

3,494,729

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Quest Diagnostics stock

|

|

311,954

|

|

|

311,954

|

|

|

—

|

|

|

—

|

|

|

Other common stock

|

|

227,729

|

|

|

227,685

|

|

|

—

|

|

|

44

|

|

|

Preferred stock

|

|

1,993

|

|

|

1,250

|

|

|

—

|

|

|

743

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal

|

|

$

|

4,036,405

|

|

|

$

|

4,035,618

|

|

|

$

|

—

|

|

|

$

|

787

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments measured at NAV as a practical expedient: (A)

|

|

881,278

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments, at fair value

|

|

$

|

4,917,683

|

|

|

|

|

|

|

|

The Profit Sharing Plan of Quest Diagnostics Incorporated

December 31, 2020 and 2019

Notes to Financial Statements (dollars in thousands) - continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basis of Fair Value Measurements

|

|

December 31, 2019

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Mutual funds

|

|

$

|

3,265,906

|

|

|

$

|

3,265,906

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Quest Diagnostics stock

|

|

308,062

|

|

|

308,062

|

|

|

—

|

|

|

—

|

|

|

Other common stock

|

|

204,775

|

|

|

204,731

|

|

|

—

|

|

|

44

|

|

|

Preferred stock

|

|

2,028

|

|

|

1,485

|

|

|

—

|

|

|

543

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal

|

|

$

|

3,780,771

|

|

|

$

|

3,780,184

|

|

|

$

|

—

|

|

|

$

|

587

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments measured at NAV as a practical expedient: (A)

|

|

722,681

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments, at fair value

|

|

$

|

4,503,452

|

|

|

|

|

|

|

|

(A) Certain investments, including the Collective Funds, that were measured at fair value using the net asset value ("NAV") per share (or its equivalent) practical expedient were not classified in the fair value hierarchy. There are no unfunded commitments or redemption restrictions related to these investments.

Following is a description of the valuation methodologies used for assets measured at fair value. There have been no significant changes in the methodologies used as of December 31, 2020 and 2019.

Mutual Funds: Valued at the NAV of shares held by the Plan at year end reported on an active market.

Quest Diagnostics Stock, Other Common Stock and Preferred Stock classified as level 1: Valued at the closing price reported on the active market on which the individual securities are traded.

Other Common Stock and Preferred Stock classified as level 3: Valued using a valuation technique based on available information, which may consider market-based valuation multiples; a discount or premium from market value of a similar, freely traded equity security of the same issuer; or some combination. These fair value measurements are classified within Level 3 of the fair value hierarchy as the fair value is based on significant inputs that are not observable.

Collective Funds: Valued at NAV per unit as determined by the trustee at year end. The NAV is used as a practical expedient to estimate fair value.

The preceding methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

5. Subsequent Event

Following the acquisition of the remaining 56% interest in Mid America Clinical Laboratories, LLC ("MACL") by the Plan Sponsor, the 401(k) plan sponsored by MACL was merged into the Plan on June 21, 2021 with participant account balances of $36,460 and notes receivable from participants of $381.

The Profit Sharing Plan of Quest Diagnostics Incorporated

EIN: #16-1387862 Plan: #333

Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year)

December 31, 2020 (dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue, Borrower, Lessor, or Similar Party

|

|

(c)

Description

|

|

(d)

Cost

|

|

(e)

Current

Value

|

|

|

|

Vanguard Total International Stock Index Fund Institutional Shares

|

|

Mutual Fund

|

|

***

|

|

$

|

31,127

|

|

|

|

|

Invesco Global Real Estate Fund - R5 class

|

|

Mutual Fund

|

|

***

|

|

8,724

|

|

|

|

|

DFA U.S. Small Cap Value Portfolio Institutional Class

|

|

Mutual Fund

|

|

***

|

|

129,768

|

|

|

|

|

Vanguard Extended Market Index Fund Institutional Shares

|

|

Mutual Fund

|

|

***

|

|

43,305

|

|

|

|

|

Vanguard Total Bond Market Index Fund - Institutional Plus Share Class

|

|

Mutual Fund

|

|

***

|

|

150,534

|

|

|

|

|

MFS Global Equity Fund Class R4

|

|

Mutual Fund

|

|

***

|

|

17,994

|

|

|

*

|

|

Fidelity Diversified International Fund Class K

|

|

Mutual Fund

|

|

***

|

|

102,217

|

|

|

*

|

|

Fidelity Freedom K 2005 Fund

|

|

Mutual Fund

|

|

***

|

|

5,543

|

|

|

*

|

|

Fidelity Freedom K 2010 Fund

|

|

Mutual Fund

|

|

***

|

|

22,885

|

|

|

*

|

|

Fidelity Freedom K 2015 Fund

|

|

Mutual Fund

|

|

***

|

|

66,578

|

|

|

*

|

|

Fidelity Freedom K 2020 Fund

|

|

Mutual Fund

|

|

***

|

|

221,359

|

|

|

*

|

|

Fidelity Freedom K 2025 Fund

|

|

Mutual Fund

|

|

***

|

|

378,720

|

|

|

*

|

|

Fidelity Freedom K 2030 Fund

|

|

Mutual Fund

|

|

***

|

|

403,244

|

|

|

*

|

|

Fidelity Freedom K 2035 Fund

|

|

Mutual Fund

|

|

***

|

|

320,988

|

|

|

*

|

|

Fidelity Freedom K 2040 Fund

|

|

Mutual Fund

|

|

***

|

|

240,704

|

|

|

*

|

|

Fidelity Freedom K 2045 Fund

|

|

Mutual Fund

|

|

***

|

|

177,738

|

|

|

*

|

|

Fidelity Freedom K 2050 Fund

|

|

Mutual Fund

|

|

***

|

|

110,634

|

|

|

*

|

|

Fidelity Freedom K 2055 Fund

|

|

Mutual Fund

|

|

***

|

|

50,523

|

|

|

*

|

|

Fidelity Freedom K 2060 Fund

|

|

Mutual Fund

|

|

***

|

|

16,551

|

|

|

*

|

|

Fidelity Freedom K 2065 Fund

|

|

Mutual Fund

|

|

***

|

|

898

|

|

|

*

|

|

Fidelity Freedom K Income Fund

|

|

Mutual Fund

|

|

***

|

|

15,809

|

|

|

*

|

|

Fidelity Puritan Fund Class K

|

|

Mutual Fund

|

|

***

|

|

398,042

|

|

|

*

|

|

Fidelity 500 Index Fund - Institutional Premium Class

|

|

Mutual Fund

|

|

***

|

|

474,466

|

|

|

*

|

|

Fidelity Investments Money Market Government Portfolio - Institutional Class

|

|

Mutual Fund

|

|

***

|

|

106,378

|

|

|

|

|

Total Interest in Mutual Funds

|

|

|

|

|

|

$

|

3,494,729

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Fidelity Managed Income Portfolio II - Class 3

|

|

Collective Fund

|

|

***

|

|

$

|

244,898

|

|

|

*

|

|

Fidelity Contrafund Comingled Pool

|

|

Collective Fund

|

|

***

|

|

338,730

|

|

|

*

|

|

Fidelity OTC Comingled Pool

|

|

Collective Fund

|

|

***

|

|

261,425

|

|

|

|

|

Prudential Core Plus Bond Fund Class 5

|

|

Collective Fund

|

|

***

|

|

34,697

|

|

|

|

|

State Street Short Term Investment Fund

|

|

Collective Fund

|

|

***

|

|

1,528

|

|

|

|

|

Total Interest in Collective Funds

|

|

|

|

|

|

$

|

881,278

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Quest Diagnostics Stock

|

|

Common Stock

|

|

***

|

|

$

|

311,954

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Profit Sharing Plan of Quest Diagnostics Incorporated

EIN: #16-1387862 Plan: #333

Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year)

December 31, 2020 (dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue, Borrower, Lessor, or Similar Party

|

|

(c)

Description

|

|

(d)

Cost

|

|

(e)

Current

Value

|

|

|

|

Abbvie Inc

|

|

Other Common Stock

|

|

***

|

|

$

|

1,348

|

|

|

|

|

Advanced Micro Devices Inc

|

|

Other Common Stock

|

|

***

|

|

1,050

|

|

|

|

|

Airbnb Inc Class A

|

|

Other Common Stock

|

|

***

|

|

93

|

|

|

|

|

Alibaba Group Holding Ltd Spon Adr

|

|

Other Common Stock

|

|

***

|

|

2,739

|

|

|

|

|

Alphabet Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

7,806

|

|

|

|

|

Alphabet Inc Cl C

|

|

Other Common Stock

|

|

***

|

|

3,299

|

|

|

|

|

Amazon.Com Inc

|

|

Other Common Stock

|

|

***

|

|

13,822

|

|

|

|

|

Ameren Corp

|

|

Other Common Stock

|

|

***

|

|

737

|

|

|

|

|

American International Group

|

|

Other Common Stock

|

|

***

|

|

1,931

|

|

|

|

|

Anthem Inc

|

|

Other Common Stock

|

|

***

|

|

859

|

|

|

|

|

Apple Inc

|

|

Other Common Stock

|

|

***

|

|

6,561

|

|

|

|

|

Applied Materials Inc

|

|

Other Common Stock

|

|

***

|

|

1,873

|

|

|

|

|

Aptiv Plc

|

|

Other Common Stock

|

|

***

|

|

1,955

|

|

|

|

|

Asml Hldg Nv (Ny Reg Shs) New York Registered Shar

|

|

Other Common Stock

|

|

***

|

|

2,133

|

|

|

|

|

Avalonbay Communities Inc Reit

|

|

Other Common Stock

|

|

***

|

|

372

|

|

|

|

|

Avantor Inc

|

|

Other Common Stock

|

|

***

|

|

1,093

|

|

|

|

|

Bank Of America Corporation

|

|

Other Common Stock

|

|

***

|

|

861

|

|

|

|

|

Becton Dickinson & Co

|

|

Other Common Stock

|

|

***

|

|

2,374

|

|

|

|

|

Boeing Co

|

|

Other Common Stock

|

|

***

|

|

729

|

|

|

|

|

Bunge Limited

|

|

Other Common Stock

|

|

***

|

|

752

|

|

|

|

|

Carmax Inc

|

|

Other Common Stock

|

|

***

|

|

574

|

|

|

|

|

Carvana Co Cl A

|

|

Other Common Stock

|

|

***

|

|

1,111

|

|

|

|

|

Caterpillar Inc

|

|

Other Common Stock

|

|

***

|

|

756

|

|

|

|

|

Centene Corp

|

|

Other Common Stock

|

|

***

|

|

831

|

|

|

|

|

Cf Industries Holdings Inc

|

|

Other Common Stock

|

|

***

|

|

964

|

|

|

|

|

Chipotle Mexican Grill Inc

|

|

Other Common Stock

|

|

***

|

|

843

|

|

|

|

|

Chubb Ltd

|

|

Other Common Stock

|

|

***

|

|

2,207

|

|

|

|

|

Cigna Corp

|

|

Other Common Stock

|

|

***

|

|

3,134

|

|

|

|

|

Cisco Systems Inc

|

|

Other Common Stock

|

|

***

|

|

1,421

|

|

|

|

|

Citrix Systems Inc

|

|

Other Common Stock

|

|

***

|

|

668

|

|

|

|

|

Coca Cola Co

|

|

Other Common Stock

|

|

***

|

|

746

|

|

|

|

|

Comcast Corp Cl A

|

|

Other Common Stock

|

|

***

|

|

1,156

|

|

|

|

|

Conagra Brands Inc

|

|

Other Common Stock

|

|

***

|

|

931

|

|

|

|

|

Conocophillips

|

|

Other Common Stock

|

|

***

|

|

745

|

|

|

|

|

Costar Group Inc

|

|

Other Common Stock

|

|

***

|

|

1,094

|

|

|

|

|

Cummins Inc

|

|

Other Common Stock

|

|

***

|

|

666

|

|

|

|

|

Cvs Health Corp

|

|

Other Common Stock

|

|

***

|

|

1,107

|

|

|

|

|

Disney (Walt) Co

|

|

Other Common Stock

|

|

***

|

|

1,161

|

|

|

|

|

Dollar General Corp

|

|

Other Common Stock

|

|

***

|

|

1,710

|

|

The Profit Sharing Plan of Quest Diagnostics Incorporated

EIN: #16-1387862 Plan: #333

Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year)

December 31, 2020 (dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue, Borrower, Lessor, or Similar Party

|

|

(c)

Description

|

|

(d)

Cost

|

|

(e)

Current

Value

|

|

|

|

Doordash Inc

|

|

Other Common Stock

|

|

***

|

|

$

|

72

|

|

|

|

|

Draftkings Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

746

|

|

|

|

|

Dupont De Nemours Inc

|

|

Other Common Stock

|

|

***

|

|

1,983

|

|

|

|

|

Edison Intl

|

|

Other Common Stock

|

|

***

|

|

983

|

|

|

|

|

Elanco Animal Health Inc

|

|

Other Common Stock

|

|

***

|

|

767

|

|

|

|

|

Entergy Corp

|

|

Other Common Stock

|

|

***

|

|

465

|

|

|

|

|

Equitable Holdings Inc

|

|

Other Common Stock

|

|

***

|

|

760

|

|

|

|

|

Exxon Mobil Corp

|

|

Other Common Stock

|

|

***

|

|

857

|

|

|

|

|

Facebook Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

8,289

|

|

|

|

|

Farfetch Ltd Cl A

|

|

Other Common Stock

|

|

***

|

|

598

|

|

|

|

|

Fidelity Natl Inform Svcs Inc

|

|

Other Common Stock

|

|

***

|

|

850

|

|

|

|

|

Fifth Third Bancorp

|

|

Other Common Stock

|

|

***

|

|

1,242

|

|

|

|

|

Fortune Brands Home & Sec Inc

|

|

Other Common Stock

|

|

***

|

|

516

|

|

|

|

|

Fox Corporation B

|

|

Other Common Stock

|

|

***

|

|

559

|

|

|

|

|

General Electric Co

|

|

Other Common Stock

|

|

***

|

|

2,798

|

|

|

|

|

Gilead Sciences Inc

|

|

Other Common Stock

|

|

***

|

|

432

|

|

|

|

|

Global Payments Inc

|

|

Other Common Stock

|

|

***

|

|

5,264

|

|

|

|

|

Goldman Sachs Group Inc

|

|

Other Common Stock

|

|

***

|

|

1,420

|

|

|

|

|

Hca Healthcare Inc

|

|

Other Common Stock

|

|

***

|

|

1,547

|

|

|

|

|

Hologic Inc

|

|

Other Common Stock

|

|

***

|

|

945

|

|

|

|

|

Humana Inc

|

|

Other Common Stock

|

|

***

|

|

1,207

|

|

|

|

|

Iac/Interactivecorp

|

|

Other Common Stock

|

|

***

|

|

797

|

|

|

|

|

Illinois Tool Works Inc

|

|

Other Common Stock

|

|

***

|

|

699

|

|

|

|

|

Incyte Corp

|

|

Other Common Stock

|

|

***

|

|

763

|

|

|

|

|

Ingersoll Rand Inc

|

|

Other Common Stock

|

|

***

|

|

1,263

|

|

|

|

|

International Paper Co

|

|

Other Common Stock

|

|

***

|

|

1,570

|

|

|

|

|

Intuit Inc

|

|

Other Common Stock

|

|

***

|

|

3,556

|

|

|

|

|

Intuitive Surgical Inc

|

|

Other Common Stock

|

|

***

|

|

2,635

|

|

|

|

|

Johnson & Johnson

|

|

Other Common Stock

|

|

***

|

|

1,545

|

|

|

|

|

Jpmorgan Chase & Co

|

|

Other Common Stock

|

|

***

|

|

1,222

|

|

|

|

|

Kimberly Clark Corp

|

|

Other Common Stock

|

|

***

|

|

597

|

|

|

|

|

Kohls Corp

|

|

Other Common Stock

|

|

***

|

|

469

|

|

|

|

|

Las Vegas Sands Corp

|

|

Other Common Stock

|

|

***

|

|

561

|

|

|

|

|

Lululemon Athletica Inc

|

|

Other Common Stock

|

|

***

|

|

1,086

|

|

|

|

|

Magna Intl Inc

|

|

Other Common Stock

|

|

***

|

|

1,035

|

|

|

|

|

Marsh & Mclennan Cos Inc

|

|

Other Common Stock

|

|

***

|

|

940

|

|

|

|

|

Marvell Technology Group Ltd

|

|

Other Common Stock

|

|

***

|

|

767

|

|

|

|

|

Match Group Inc

|

|

Other Common Stock

|

|

***

|

|

1,528

|

|

|

|

|

Medtronic Plc

|

|

Other Common Stock

|

|

***

|

|

1,847

|

|

The Profit Sharing Plan of Quest Diagnostics Incorporated

EIN: #16-1387862 Plan: #333

Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year)

December 31, 2020 (dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue, Borrower, Lessor, or Similar Party

|

|

(c)

Description

|

|

(d)

Cost

|

|

(e)

Current

Value

|

|

|

|

Merck & Co Inc New

|

|

Other Common Stock

|

|

***

|

|

$

|

516

|

|

|

|

|

Metlife Inc

|

|

Other Common Stock

|

|

***

|

|

1,592

|

|

|

|

|

Microsoft Corp

|

|

Other Common Stock

|

|

***

|

|

13,455

|

|

|

|

|

Mongodb Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

899

|

|

|

|

|

Morgan Stanley

|

|

Other Common Stock

|

|

***

|

|

2,813

|

|

|

|

|

Netflix Inc

|

|

Other Common Stock

|

|

***

|

|

2,962

|

|

|

|

|

News Corp New Cl A

|

|

Other Common Stock

|

|

***

|

|

700

|

|

|

|

|

Nextera Energy

|

|

Other Common Stock

|

|

***

|

|

2,672

|

|

|

|

|

Nielsen Holdings Plc

|

|

Other Common Stock

|

|

***

|

|

467

|

|

|

|

|

Nike Inc Cl B

|

|

Other Common Stock

|

|

***

|

|

1,064

|

|

|

|

|

Norfolk Southern Corp

|

|

Other Common Stock

|

|

***

|

|

634

|

|

|

|

|

Nxp Semiconductors Nv

|

|

Other Common Stock

|

|

***

|

|

703

|

|

|

|

|

Paypal Hldgs Inc

|

|

Other Common Stock

|

|

***

|

|

3,075

|

|

|

|

|

Perrigo Co Plc

|

|

Other Common Stock

|

|

***

|

|

500

|

|

|

|

|

Pfizer Inc

|

|

Other Common Stock

|

|

***

|

|

907

|

|

|

|

|

Philip Morris Intl Inc

|

|

Other Common Stock

|

|

***

|

|

1,317

|

|

|

|

|

Pioneer Natural Resources Co

|

|

Other Common Stock

|

|

***

|

|

523

|

|

|

|

|

Qualcomm Inc

|

|

Other Common Stock

|

|

***

|

|

2,323

|

|

|

|

|

Ringcentral Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

531

|

|

|

|

|

Rockwell Automation Inc

|

|

Other Common Stock

|

|

***

|

|

533

|

|

|

|

|

Ross Stores Inc

|

|

Other Common Stock

|

|

***

|

|

2,495

|

|

|

|

|

S&P Global Inc

|

|

Other Common Stock

|

|

***

|

|

817

|

|

|

|

|

Salesforce.Com Inc

|

|

Other Common Stock

|

|

***

|

|

2,808

|

|

|

|

|

Schlumberger Ltd

|

|

Other Common Stock

|

|

***

|

|

271

|

|

|

|

|

Schwab Charles Corp

|

|

Other Common Stock

|

|

***

|

|

2,007

|

|

|

|

|

Sea Ltd Adr

|

|

Other Common Stock

|

|

***

|

|

383

|

|

|

|

|

Sempra Energy

|

|

Other Common Stock

|

|

***

|

|

535

|

|

|

|

|

Servicenow Inc

|

|

Other Common Stock

|

|

***

|

|

1,932

|

|

|

|

|

Shopify Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

180

|

|

|

|

|

Signature Bank

|

|

Other Common Stock

|

|

***

|

|

593

|

|

|

|

|

Sl Green Realty Corp Reit

|

|

Other Common Stock

|

|

***

|

|

382

|

|

|

|

|

Slack Technologies Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

374

|

|

|

|

|

Snap Inc - A

|

|

Other Common Stock

|

|

***

|

|

3,620

|

|

|

|

|

Snowflake Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

127

|

|

|

|

|

Southern Co

|

|

Other Common Stock

|

|

***

|

|

2,419

|

|

|

|

|

Southwest Airlines Co

|

|

Other Common Stock

|

|

***

|

|

734

|

|

|

|

|

Splunk Inc

|

|

Other Common Stock

|

|

***

|

|

1,696

|

|

|

|

|

Spotify Technology Sa

|

|

Other Common Stock

|

|

***

|

|

2,265

|

|

The Profit Sharing Plan of Quest Diagnostics Incorporated

EIN: #16-1387862 Plan: #333

Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year)

December 31, 2020 (dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue, Borrower, Lessor, or Similar Party

|

|

(c)

Description

|

|

(d)

Cost

|

|

(e)

Current

Value

|

|

|

|

State Street Corp

|

|

Other Common Stock

|

|

***

|

|

$

|

752

|

|

|

|

|

Stericycle Inc

|

|

Other Common Stock

|

|

***

|

|

431

|

|

|

|

|

Stripe Inc Class B Pp

|

|

Other Common Stock

|

|

***

|

|

44

|

|

|

|

|

Stryker Corp

|

|

Other Common Stock

|

|

***

|

|

2,880

|

|

|

|

|

Synopsys Inc

|

|

Other Common Stock

|

|

***

|

|

1,044

|

|

|

|

|

Tc Energy Corp

|

|

Other Common Stock

|

|

***

|

|

715

|

|

|

|

|

Te Connectivity Ltd

|

|

Other Common Stock

|

|

***

|

|

815

|

|

|

|

|

Tencent Holdings Ltd Uns Adr

|

|

Other Common Stock

|

|

***

|

|

2,724

|

|

|

|

|

Texas Instruments Inc

|

|

Other Common Stock

|

|

***

|

|

1,361

|

|

|

|

|

The Booking Holdings Inc

|

|

Other Common Stock

|

|

***

|

|

1,537

|

|

|

|

|

Thermo Fisher Scientific Inc

|

|

Other Common Stock

|

|

***

|

|

679

|

|

|

|

|

Tjx Companies Inc New

|

|

Other Common Stock

|

|

***

|

|

1,003

|

|

|

|

|

Total Se Adr

|

|

Other Common Stock

|

|

***

|

|

1,924

|

|

|

|

|

Tyson Foods Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

1,202

|

|

|

|

|

United Parcel Service Inc Cl B

|

|

Other Common Stock

|

|

***

|

|

2,282

|

|

|

|

|

Unitedhealth Group Inc

|

|

Other Common Stock

|

|

***

|

|

2,797

|

|

|

|

|

Vertex Pharmaceuticals Inc

|

|

Other Common Stock

|

|

***

|

|

1,576

|

|

|

|

|

Visa Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

5,679

|

|

|

|

|

Walmart Inc

|

|

Other Common Stock

|

|

***

|

|

747

|

|

|

|

|

Wells Fargo & Co

|

|

Other Common Stock

|

|

***

|

|

2,267

|

|

|

|

|

Welltower Inc

|

|

Other Common Stock

|

|

***

|

|

562

|

|

|

|

|

Weyerhaeuser Co

|

|

Other Common Stock

|

|

***

|

|

1,814

|

|

|

|

|

Wix.Com Ltd

|

|

Other Common Stock

|

|

***

|

|

397

|

|

|

|

|

Xp Inc Cl A

|

|

Other Common Stock

|

|

***

|

|

363

|

|

|

|

|

Zimmer Biomet Hldgs Inc

|

|

Other Common Stock

|

|

***

|

|

918

|

|

|

|

|

Total Interest in Other Common Stock

|

|

|

|

|

|

$

|

227,729

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Becton Dickinson And Co 6.5% Pc 06/01/2023

|

|

Preferred Stock

|

|

***

|

|

$

|

228

|

|

|

|

|

Elanco Animal Health Inc 5% Pc 02/01/2023

|

|

Preferred Stock

|

|

***

|

|

31

|

|

|

|

|

Sempra Energy Ser A Pc 6% 01/15/2021 Pfd

|

|

Preferred Stock

|

|

***

|

|

497

|

|

|

|

|

Sempra Energy Pc 6.75% 7/15/2021

|

|

Preferred Stock

|

|

***

|

|

145

|

|

|

|

|

Southern Company Pc 6.75% 08/01/2022

|

|

Preferred Stock

|

|

***

|

|

349

|

|

|

|

|

Aurora Innovation Ser B Pc Pp

|

|

Preferred Stock

|

|

***

|

|

83

|

|

|

|

|

Uipath Inc 0% Ser D-1 Pfd Perp Pp

|

|

Preferred Stock

|

|

***

|

|

171

|

|

|

|

|

Uipath Inc 0% Ser D-2 Pfd Perp Pp

|

|

Preferred Stock

|

|

***

|

|

29

|

|

|

|

|

Rivian Automotive Inc Ser D Pfd Perp Pp

|

|

Preferred Stock

|

|

***

|

|

460

|

|

|

|

|

Total Interest in Preferred Stock

|

|

|

|

|

|

$

|

1,993

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Profit Sharing Plan of Quest Diagnostics Incorporated

EIN: #16-1387862 Plan: #333

Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year)

December 31, 2020 (dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue, Borrower, Lessor, or Similar Party

|

|

(c)

Description

|

|

(d)

Cost

|

|

(e)

Current

Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value

|

|

|

|

|

|

$

|

4,917,683

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Notes Receivable from Participants**

|

|

Loans

|

|

|

|

$

|

97,221

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

|

|

|

|

|

|

$

|

5,014,904

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Party-in-interest to the Plan.

|

|

|

|

|

|

|

|

**

|

|

Rates range from 3.75% to 10.25%; maturities vary by participant.

|

|

|

|

|

|

***

|

|

The cost of participant-directed investments is not required to be disclosed.

|

|

|

|

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Plan Sponsor of The Profit Sharing Plan of Quest Diagnostics Incorporated has duly caused this annual report to be signed on its behalf by the undersigned, hereunto duly authorized.

June 28, 2021

The Profit Sharing Plan of Quest Diagnostics Incorporated

|

|

|

|

|

|

|

|

By:

|

/s/ Mark J. Guinan

|

|

|

Mark J. Guinan

|

|

|

Executive Vice President, Chief Financial Officer and Member of the Quest Diagnostics Incorporated Benefits Administration Committee

|

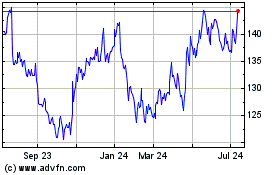

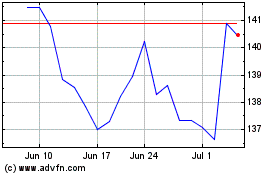

Quest Diagnostics (NYSE:DGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Quest Diagnostics (NYSE:DGX)

Historical Stock Chart

From Apr 2023 to Apr 2024