Current Report Filing (8-k)

December 11 2019 - 4:21PM

Edgar (US Regulatory)

0001423221

false

0001423221

2019-12-04

2019-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): December 5, 2019

QUANEX BUILDING PRODUCTS CORPORATION

(Exact Name of Registrant as Specified

in its Charter)

|

Delaware

|

|

001-33913

|

|

26-1561397

|

|

(State or Other Jurisdiction

of

Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

1800 West Loop South, Suite 1500

Houston, Texas

|

|

77027

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number,

including area code: (713) 961-4600

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.01 per share

|

|

NX

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01.

|

Entry into a Material Definitive Agreement

|

The disclosure set

forth below under Item 5.02 relating to certain compensatory arrangements between Quanex Building Products Corporation (the “Company”)

and George L. Wilson, and between the Company and William C. Griffiths, is incorporated into this Item 1.01.

Item 5.02 Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

Chief Executive

Officer Transition; Addition of Board Member

On December 11, 2019,

the Company issued a Press Release announcing that the Company’s Chief Executive Officer and President, William C. Griffiths,

will be stepping down from those roles effective January 1, 2020. From that date, Mr. Griffiths will remain with the Company as

its Executive Chairman of the Board, and George L. Wilson will become the Company’s President and Chief Executive Officer.

On December 5, 2019,

in connection with the executive transition noted above, the Board appointed Mr. Wilson as a director of the Company for a term

to end at the Company’s Annual Meeting of Stockholders to be held in 2020, with such appointment also to be effective January

1, 2020.

Mr. Wilson, 51, has

served as the Company’s Vice President – Chief Operating Officer since 2017. Prior to that time, he served as President

of the Company’s Insulating Glass Systems division from 2011 until 2017, and in the 18 years prior to joining Quanex, he

held various operational and financial positions of increasing responsibility at Lauren International and Federal-Mogul. Mr. Wilson

holds a Master of Business Administration degree from Indiana University and a Bachelor of Science degree from The University of

Akron.

Compensatory Arrangements

In their new roles,

Messrs. Griffiths and Wilson will be compensated as set forth below:

· Mr.

Wilson will receive an annual base salary of $575,000, with future Annual Incentive Award target values equal to 100% of base salary,

and future Long Term Incentive award target values equal to $1,250,000. Mr. Wilson will receive other benefits to the same extent

as he enjoyed prior to his promotion, or as may be provided to other Company employees and officers in accordance with Company

policies then in effect, and subject to the terms and conditions of such benefit plans.

· Mr.

Griffiths will receive an annual base salary of $500,000, with future Annual Incentive Award target values equal to 100% of base

salary. Mr. Griffiths is not expected to receive Long Term Incentive awards in his new role. Mr. Griffiths will receive other benefits

to the same extent as he enjoyed prior to entering his new role, or as may be provided to other Company employees and officers

in accordance with Company policies then in effect, and subject to the terms and conditions of such benefit plans.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On December 11, 2019,

the Company issued a press release announcing the appointment of Mr. Wilson as a Director and as President and Chief Executive

Officer of the Company, as well as Mr. Griffiths’ transition to the role of Executive Chairman of the Board. The foregoing

is qualified by reference to such Press Release, which is filed as Exhibit 99.1 to this Current Report on Form 8-K and is

incorporated herein by reference.

This information shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

*Filed herewith.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

QUANEX

BUILDING PRODUCTS CORPORATION

|

|

|

|

|

Date:

December 11, 2019

|

By:

|

/s/

Paul B. Cornett

|

|

|

|

Paul

B. Cornett

|

|

|

|

Senior

Vice President – General Counsel & Secretary

|

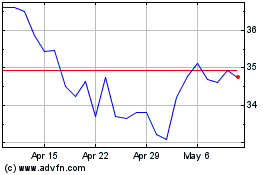

Quanex (NYSE:NX)

Historical Stock Chart

From Mar 2024 to Apr 2024

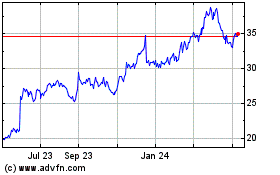

Quanex (NYSE:NX)

Historical Stock Chart

From Apr 2023 to Apr 2024