- Net Income of $1.29 Per Share

- Adjusted Net Income of $1.15 Per Share

- Home Sale Revenues Increased 3% to $2.5 Billion

- Homebuilding Gross Margin Increased 80 Basis Points to

23.9%

- Backlog of 13,214 Homes Up 12%; Backlog Value Up 13% to $5.8

Billion

- Net New Orders Decreased 4% to 6,522 Homes

- Cash of $1.7 Billion After Repaying $700 Million on its

Revolving Credit Facility

- Company Provides Update on the Impacts of COVID-19

PulteGroup, Inc. (NYSE: PHM) announced today financial results

for its second quarter ended June 30, 2020. For the quarter, the

Company reported net income of $349 million, or $1.29 per share.

Adjusted net income for the period was $311 million, or $1.15 per

share, after excluding $61 million of pre-tax benefit from an

insurance reserve adjustment and $10 million of pre-tax severance

charges resulting from previously announced staffing actions taken

in the period. The Company’s prior year net income was $241

million, or $0.86 per share.

“Following a period of demand weakness beginning in late March

and into April as COVID-19 first impacted the country, new home

sales experienced a material acceleration as the second quarter

progressed,” said Ryan Marshall, President and Chief Executive

Officer of PulteGroup. “The recovery in demand reflects a number of

factors, including: low interest rates, a restricted supply of

existing-home inventory, pent-up demand following the economic

shutdown, the appeal of single-family living in a new home and a

desire among some buyers to exit more densely populated urban

centers.”

“By effectively adjusting our business practices to the rapidly

changing market dynamics caused by COVID-19, PulteGroup realized a

34% increase in adjusted earnings per share and generated strong

cash flows in the current quarter. With industry leading gross

margins, a backlog valued at $5.8 billion and $1.7 billion of cash

on hand, the Company is well positioned to navigate current market

conditions.”

Home sale revenues for the second quarter increased 3% over the

prior year to $2.5 billion. Higher revenues for the quarter reflect

a 6% increase in closings to 5,937 homes, partially offset by a 3%

decrease in average sales price to $416,000. The lower average

sales price for the period primarily reflects an ongoing shift in

the Company’s product mix to include more first-time buyer homes

which typically carry a lower sales price.

Gross margin for the second quarter was 23.9%, which represents

an increase of 80 basis points over the second quarter of the prior

year and is up 20 basis points from the first quarter of 2020.

Reported SG&A expense for the quarter of $197 million, or 8.0%

of home sale revenues, included the $61 million pre-tax insurance

benefit and the $10 million pre-tax severance charges. Excluding

these items, the Company’s adjusted SG&A expense for the

quarter was $247 million, or 10.0% of home sale revenues. Prior

year SG&A expense for the second quarter was $259 million, or

10.8% of home sale revenues.

Net new orders for the second quarter decreased 4% from the

prior year to 6,522 homes. The dollar value of net new orders was

$2.7 billion, or an average sales price of $410,000, which is down

from $426,000 last year. The lower average selling price reflects

the Company’s ongoing efforts to expand its sales among first-time

buyers. For the quarter, the Company operated out of an average of

887 communities.

Unit backlog at the end of the quarter totaled 13,214 homes,

which is an increase of 12%, or 1,421 homes, over the prior year

backlog of 11,793 homes. The total value of homes in backlog of

$5.8 billion, an increase of 13% over last year, reflects a

favorable geographic and product mix of homes to be closed.

Second quarter pre-tax income for the Company's financial

services operations was $60 million, which represents an increase

of 141% over prior year second quarter pre-tax income of $25

million. The increase in pre-tax income for the period reflects a

strong margin environment, higher loan volumes resulting from

growth in the Company’s homebuilding operations, and a higher

mortgage capture rate. Our mortgage capture rate for the second

quarter increased to 87% from 81% last year.

For the quarter, the Company reported $108 million of income tax

expense, representing an effective tax rate of 23.7%.

In the second quarter, the Company elected to repay $700 million

that had been borrowed on its revolving credit facility in March of

2020 as a precautionary action at the start of the COVID-19

pandemic. As previously announced, the Company has suspended its

share repurchase activities given uncertainties created by

COVID-19.

COVID-19 Update

In conjunction with announcing its second quarter financial

results, the Company also provided the following update on the

impact of the COVID-19 pandemic on housing demand and its overall

operations:

“After a period during which we elected to close our sales

centers and leverage multiple technologies to sell remotely, all of

our communities are now reopened to walk-in traffic with sales

staff working on-site,” said Mr. Marshall. “Our Financial Services

teams also adapted their business practices to operate remotely and

continue to do so currently. Our construction and manufacturing

operations were deemed essential services in all but a handful of

markets, so we incurred only limited production disruptions in the

second quarter and are now operating at effectively full capacity

in all markets. In response to the ongoing risks relating to the

pandemic, all of our teams are working under enhanced safety

protocols designed to protect the health of our employees,

customers and trade partners.”

“PulteGroup was in a strong financial position at the start of

this health crisis, but given the risks of severe economic impact

we moved quickly to protect our overall liquidity and financial

flexibility. Our actions included: reducing controllable

expenditures, tightly managing investment in the business, drawing

$700 million on our revolver, and suspending share repurchase

activity. These actions, coupled with the improving operations we

experienced through the quarter, resulted in strong free cash flow

generation in the quarter. As a result, our cash balance at the end

of the second quarter was $1.7 billion, after having repaid the

$700 million we borrowed under our revolver.”

“New home demand has clearly rebounded, but we continue to take

a disciplined approach to our business given the ongoing spread of

the coronavirus. As a result, we are gradually increasing our land

acquisition and development spend to help ensure future lot

availability. We are also increasing our start cadence and related

investment in house inventory, while continuing to expand our

offering of first-time buyer product to meet the growing demand for

more affordably priced homes. We have also recalled the majority of

furloughed employees and may rehire additional staff as the

recovery continues to unfold.”

“Given the strength of second quarter sales, we are encouraged

about the back half of 2020 and plan to provide guidance for the

remainder of the year as part of our second quarter earnings

call.”

A conference call discussing PulteGroup's second quarter 2020

results is scheduled for Thursday, July 23, 2020, at 8:30 a.m.

Eastern Time. Interested investors can access the live webcast via

PulteGroup's corporate website at www.pultegroup.com.

Forward-Looking Statements

This release includes "forward-looking statements." These

statements are subject to a number of risks, uncertainties and

other factors that could cause our actual results, performance,

prospects or opportunities, as well as those of the markets we

serve or intend to serve, to differ materially from those expressed

in, or implied by, these statements. You can identify these

statements by the fact that they do not relate to matters of a

strictly factual or historical nature and generally discuss or

relate to forecasts, estimates or other expectations regarding

future events. Generally, the words “believe,” “expect,” “intend,”

“estimate,” “anticipate,” “plan,” “project,” “may,” “can,” “could,”

“might,” "should", “will” and similar expressions identify

forward-looking statements, including statements related to any

potential impairment charges and the impacts or effects thereof,

expected operating and performing results, planned transactions,

planned objectives of management, future developments or conditions

in the industries in which we participate and other trends,

developments and uncertainties that may affect our business in the

future.

Such risks, uncertainties and other factors include, among other

things: interest rate changes and the availability of mortgage

financing; competition within the industries in which we operate;

the availability and cost of land and other raw materials used by

us in our homebuilding operations; the impact of any changes to our

strategy in responding to the cyclical nature of the industry,

including any changes regarding our land positions and the levels

of our land spend; the availability and cost of insurance covering

risks associated with our businesses; shortages and the cost of

labor; weather related slowdowns; slow growth initiatives and/or

local building moratoria; governmental regulation directed at or

affecting the housing market, the homebuilding industry or

construction activities; uncertainty in the mortgage lending

industry, including revisions to underwriting standards and

repurchase requirements associated with the sale of mortgage loans;

the interpretation of or changes to tax, labor and environmental

laws which could have a greater impact on our effective tax rate or

the value of our deferred tax assets than we anticipate; economic

changes nationally or in our local markets, including inflation,

deflation, changes in consumer confidence and preferences and the

state of the market for homes in general; legal or regulatory

proceedings or claims; our ability to generate sufficient cash flow

in order to successfully implement our capital allocation

priorities; required accounting changes; terrorist acts and other

acts of war; the negative impact of the COVID-19 pandemic on our

financial position and ability to continue our Homebuilding or

Financial Services activities at normal levels or at all in

impacted areas; the duration, effect and severity of the COVID-19

pandemic; the measures that governmental authorities take to

address the COVID-19 pandemic which may precipitate or exacerbate

one or more of the above-mentioned and/or other risks and

significantly disrupt or prevent us from operating our business in

the ordinary course for an extended period of time; and other

factors of national, regional and global scale, including those of

a political, economic, business and competitive nature. See

PulteGroup's Annual Report on Form 10-K for the fiscal year ended

December 31, 2019, and other public filings with the Securities and

Exchange Commission (the "SEC") for a further discussion of these

and other risks and uncertainties applicable to our businesses.

PulteGroup undertakes no duty to update any forward-looking

statement, whether as a result of new information, future events or

changes in PulteGroup's expectations.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one

of America’s largest homebuilding companies with operations in 40

markets throughout the country. Through its brand portfolio that

includes Centex, Pulte Homes, Del Webb, DiVosta Homes, American

West and John Wieland Homes and Neighborhoods, the company is one

of the industry’s most versatile homebuilders able to meet the

needs of multiple buyer groups and respond to changing consumer

demand. PulteGroup’s purpose is building incredible places where

people can live their dreams.

For more information about PulteGroup, Inc. and PulteGroup’s

brands, go to pultegroup.com; www.pulte.com; www.centex.com;

www.delwebb.com; www.divosta.com; www.jwhomes.com; and

www.americanwesthomes.com. Follow PulteGroup, Inc. on Twitter:

@PulteGroupNews.

PulteGroup, Inc.

Consolidated Statements of

Operations

($000's omitted, except per

share data)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2020

2019

2020

2019

Revenues:

Homebuilding

Home sale revenues

$

2,472,029

$

2,403,559

$

4,693,532

$

4,353,415

Land sale and other revenues

26,950

29,469

45,877

32,445

2,498,979

2,433,028

4,739,409

4,385,860

Financial Services

94,802

55,957

149,352

99,819

Total revenues

2,593,781

2,488,985

4,888,761

4,485,679

Homebuilding Cost of Revenues:

Home sale cost of revenues

(1,880,209

)

(1,848,155

)

(3,575,074

)

(3,340,946

)

Land sale and other cost of revenues

(20,041

)

(26,214

)

(35,055

)

(28,265

)

(1,900,250

)

(1,874,369

)

(3,610,129

)

(3,369,211

)

Financial Services expenses

(34,378

)

(30,901

)

(69,327

)

(62,350

)

Selling, general, and administrative

expenses

(196,858

)

(259,440

)

(460,527

)

(512,166

)

Goodwill impairment

—

—

(20,190

)

—

Other expense, net

(5,286

)

(3,499

)

(7,810

)

(4,473

)

Income before income taxes

457,009

320,776

720,778

537,479

Income tax expense

(108,389

)

(79,735

)

(168,447

)

(129,681

)

Net income

$

348,620

$

241,041

$

552,331

$

407,798

Per share:

Basic earnings

$

1.29

$

0.86

$

2.03

$

1.46

Diluted earnings

$

1.29

$

0.86

$

2.03

$

1.45

Cash dividends declared

$

0.12

$

0.11

$

0.24

$

0.22

Number of shares used in

calculation:

Basic

268,324

276,652

269,167

277,142

Effect of dilutive securities

701

932

960

967

Diluted

269,025

277,584

270,127

278,109

PulteGroup, Inc.

Condensed Consolidated Balance

Sheets

($000's omitted)

(Unaudited)

June 30, 2020

December 31, 2019

ASSETS

Cash and equivalents

$

1,658,530

$

1,217,913

Restricted cash

39,266

33,543

Total cash, cash equivalents, and

restricted cash

1,697,796

1,251,456

House and land inventory

7,584,739

7,680,614

Land held for sale

29,409

24,009

Residential mortgage loans

available-for-sale

394,288

508,967

Investments in unconsolidated entities

47,707

59,766

Other assets

910,271

895,686

Intangible assets

173,507

124,992

Deferred tax assets, net

120,768

170,107

$

10,958,485

$

10,715,597

LIABILITIES AND SHAREHOLDERS’

EQUITY

Liabilities:

Accounts payable

$

295,249

$

435,916

Customer deposits

335,040

294,427

Accrued and other liabilities

1,302,822

1,399,368

Income tax liabilities

146,729

36,093

Financial Services debt

256,359

326,573

Notes payable

2,770,618

2,765,040

5,106,817

5,257,417

Shareholders' equity

5,851,668

5,458,180

$

10,958,485

$

10,715,597

PulteGroup, Inc.

Consolidated Statements of

Cash Flows

($000's omitted)

(Unaudited)

Six Months Ended

June 30,

2020

2019

Cash flows from operating

activities:

Net income

$

552,331

$

407,798

Adjustments to reconcile net income to net

cash from operating activities:

Deferred income tax expense

49,661

51,458

Land-related charges

12,181

6,810

Goodwill impairment

20,190

—

Depreciation and amortization

31,538

26,497

Share-based compensation expense

16,682

17,304

Other, net

(975

)

2,664

Increase (decrease) in cash due to:

Inventories

101,766

(399,520

)

Residential mortgage loans

available-for-sale

114,139

116,974

Other assets

(3,772

)

31,593

Accounts payable, accrued and other

liabilities

(85,869

)

44,129

Net cash provided by (used in) operating

activities

807,872

305,707

Cash flows from investing

activities:

Capital expenditures

(36,746

)

(29,575

)

Investments in unconsolidated entities

12,955

(4,664

)

Business acquisition

(83,256

)

(163,724

)

Other investing activities, net

1,597

4,592

Net cash provided by (used in) investing

activities

(105,450

)

(193,371

)

Cash flows from financing

activities:

Repayments of notes payable

(10,106

)

(297,303

)

Borrowings under revolving credit

facility

700,000

—

Repayments under revolving credit

facility

(700,000

)

—

Financial Services borrowings

(repayments)

(70,214

)

(114,226

)

Stock option exercises

99

5,208

Share repurchases

(95,676

)

(108,471

)

Cash paid for shares withheld for

taxes

(14,853

)

(10,350

)

Dividends paid

(65,332

)

(61,620

)

Net cash provided by (used in) financing

activities

(256,082

)

(586,762

)

Net increase (decrease) in cash, cash

equivalents, and restricted cash

446,340

(474,426

)

Cash, cash equivalents, and restricted

cash at beginning of period

1,251,456

1,133,700

Cash, cash equivalents, and restricted

cash at end of period

$

1,697,796

$

659,274

Supplemental Cash Flow

Information:

Interest paid (capitalized), net

$

3,206

$

5,560

Income taxes paid (refunded), net

$

5,865

$

12,618

PulteGroup, Inc.

Segment Data

($000's omitted)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2020

2019

2020

2019

HOMEBUILDING:

Home sale revenues

$

2,472,029

$

2,403,559

$

4,693,532

$

4,353,415

Land sale and other revenues

26,950

29,469

45,877

32,445

Total Homebuilding revenues

2,498,979

2,433,028

4,739,409

4,385,860

Home sale cost of revenues

(1,880,209

)

(1,848,155

)

(3,575,074

)

(3,340,946

)

Land sale and other cost of revenues

(20,041

)

(26,214

)

(35,055

)

(28,265

)

Selling, general, and administrative

expenses ("SG&A")

(196,858

)

(259,440

)

(460,527

)

(512,166

)

Goodwill impairment

—

—

(20,190

)

—

Other expense, net

(5,286

)

(3,521

)

(7,759

)

(4,490

)

Income before income taxes

$

396,585

$

295,698

$

640,804

$

499,993

FINANCIAL SERVICES:

Income before income taxes

$

60,424

$

25,078

$

79,974

$

37,486

CONSOLIDATED:

Income before income taxes

$

457,009

$

320,776

$

720,778

$

537,479

OPERATING METRICS:

Gross margin % (a)(b)

23.9

%

23.1

%

23.8

%

23.3

%

SG&A % (a)

(8.0

)%

(10.8

)%

(9.8

)%

(11.8

)%

Operating margin % (a)

16.0

%

12.3

%

14.0

%

11.5

%

(a) As a percentage of home

sale revenues

(b) Gross margin represents home

sale revenues minus home sale cost of revenues

PulteGroup, Inc.

Segment Data,

continued

($000's omitted)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2020

2019

2020

2019

Home sale revenues

$

2,472,029

$

2,403,559

$

4,693,532

$

4,353,415

Closings - units

Northeast

260

349

570

568

Southeast

1,104

951

2,032

1,848

Florida

1,380

1,252

2,590

2,260

Midwest

808

822

1,516

1,548

Texas

1,194

1,119

2,322

1,968

West

1,191

1,096

2,280

2,032

5,937

5,589

11,310

10,224

Average selling price

$

416

$

430

$

415

$

426

Net new orders - units

Northeast

383

455

831

816

Southeast

1,095

1,214

2,236

2,287

Florida

1,488

1,460

3,173

2,806

Midwest

896

975

1,915

1,999

Texas

1,431

1,323

2,940

2,689

West

1,229

1,365

2,922

2,658

6,522

6,792

14,017

13,255

Net new orders - dollars

$

2,677,074

$

2,890,709

$

5,945,823

$

5,626,561

Unit backlog

Northeast

850

718

Southeast

2,069

2,049

Florida

2,889

2,435

Midwest

1,939

1,853

Texas

2,468

2,213

West

2,999

2,525

13,214

11,793

Dollars in backlog

$

5,788,096

$

5,109,293

PulteGroup, Inc.

Segment Data,

continued

($000's omitted)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2020

2019

2020

2019

MORTGAGE ORIGINATIONS:

Origination volume

4,474

3,720

8,344

6,718

Origination principal

$

1,436,103

$

1,161,906

$

2,649,370

$

2,076,617

Capture rate

86.8

%

81.0

%

86.8

%

80.4

%

Supplemental Data

($000's omitted)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2020

2019

2020

2019

Interest in inventory, beginning of

period

$

213,425

$

235,313

$

210,383

$

227,495

Interest capitalized

39,686

41,650

79,599

84,031

Interest expensed

(45,169

)

(42,254

)

(82,040

)

(76,817

)

Interest in inventory, end of period

$

207,942

$

234,709

$

207,942

$

234,709

PulteGroup, Inc. Reconciliation of

Non-GAAP Financial Measures (Unaudited)

This report contains information about our operating results

reflecting certain adjustments, including: adjustments to selling,

general, and administrative expenses ("SG&A"); income tax

expense; net income; and diluted earnings per share ("EPS"). These

measures are considered non-GAAP financial measures under the SEC's

rules and should be considered in addition to, rather than as a

substitute for, the comparable GAAP financial measures as measures

of our profitability. We believe that reflecting these adjustments

provides investors relevant and useful information for evaluating

the comparability of financial information presented and comparing

our profitability to other companies in the homebuilding industry.

Although other companies in the homebuilding industry report

similar information, the methods used may differ. We urge investors

to understand the methods used by other companies in the

homebuilding industry to calculate these measures and any

adjustments thereto before comparing our measures to those of such

other companies.

The following tables set forth a reconciliation of the non-GAAP

financial measures to the GAAP financial measures that management

believes to be most directly comparable ($000's

omitted):

Three Months Ended

June 30,

Results of Operations

Classification

2020

2019

Net income, as reported

$

348,620

$

241,041

Adjustments to income before income

taxes:

Insurance adjustments

SG&A

(60,662

)

*

Severance expense

SG&A

10,328

*

Income tax effect of the above items

Income tax expense

12,347

*

Adjusted net income

$

310,633

$

241,041

EPS (diluted), as reported

$

1.29

$

0.86

Adjusted EPS (diluted)

$

1.15

$

0.86

Three Months Ended

June 30,

2020

2019

Home sale revenues

$

2,472,029

$

2,403,559

Gross margin (a)

$

591,820

23.9

%

$

555,404

23.1

%

SG&A, as reported

$

196,858

8.0

%

$

259,440

10.8

%

Adjustments:

Insurance adjustments

60,662

2.5

%

*

*

Severance expense

(10,328

)

(0.4

)%

*

*

Adjusted SG&A

$

247,192

10.0

%

$

259,440

10.8

%

Operating margin, as reported

(b)

16.0

%

12.3

%

Adjusted operating margin (c)

13.9

%

12.3

%

*Item not meaningful for the period

presented

(a) Gross margin represents home sale

revenues minus home sale cost of revenues

(b) Operating margin represents gross

margin less SG&A

(c) Adjusted operating margin represents

gross margin less SG&A

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200723005291/en/

Investors: Jim Zeumer (404) 978-6434

jim.zeumer@pultegroup.com

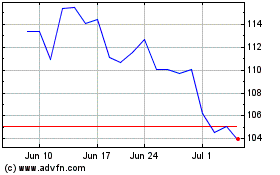

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024