Registration No. 333-

As filed with the Securities and Exchange Commission on October 19, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________________

|

The Procter & Gamble Company

(Exact Name of Registrant as Specified in Its Charter)

|

|

Ohio

(State or Other Jurisdiction of Incorporation or Organization)

|

|

31-0411980

(I.R.S. Employer Identification No.)

|

|

One Procter & Gamble Plaza, Cincinnati, Ohio 45202

(513) 983-1100

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

|

The Procter & Gamble U.K. Share Investment Scheme

Deborah P. Majoras, Chief Legal Officer and Secretary

The Procter & Gamble Company

One Procter & Gamble Plaza, Cincinnati, Ohio 45202

(513) 983-1100

(Name, address, including zip code, and telephone number,

Including area code, of agent for service)

________________________

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☒

|

|

|

Accelerated filer

|

☐

|

|

|

Non-accelerated filer

|

☐

|

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

☐

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities To Be Registered

|

Amount To Be Registered

|

Proposed Maximum Offering Price Per Unit1

|

Proposed Maximum Offering Price

|

Amount of Registration Fee2

|

|

Common Stock (without par value)

|

100,000

|

$143.64

|

$14,364,000

|

$1,567.11

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) of the Securities Act on the basis of the average of the high and low prices of the Common Stock on

the New York Stock Exchange on October 15, 2020, within five business days prior to filing.

|

|

(2)

|

Pursuant to Rule 457(p) under the Securities Act, the registrant is applying the filing fee of $719.94 associated with certain unsold securities under its Registration Statement on Form S-3ASR

(File No. 333- 221038), originally filed by the registrant on October 20, 2017, to partially offset the entire registration fee of $1,567.11 that would otherwise be due in connection with this Registration Statement. As a result, $847.17 is

being remitted herewith.

|

PROSPECTUS

The Procter & Gamble Company

100,000 Shares

of

Common Stock

(without par value)

To Participants in The

Procter & Gamble U.K.

Share Investment Scheme

All purchases of securities made pursuant to The Procter & Gamble U.K. Share Investment Scheme (the “Plan”) may be made on any securities exchange on which common stock of The

Procter & Gamble Company is traded, in the over-the-counter market, by negotiated transactions or by purchasing the beneficial interests in shares held by Plan participants wishing to sell their shares. The Company has no control over the prices

at which the agent purchases shares of The Procter & Gamble Company common stock pursuant to the Plan. For detailed information regarding the terms and conditions of purchases made under the Plan, you should carefully read this prospectus and

any supplement before you invest. You should also read the “Incorporation of Certain Information by Reference” section of this prospectus for information on us and our financial statements. The Procter & Gamble Company’s common stock is listed

on the New York Stock Exchange under the ticker symbol “PG”.

INVESTING IN OUR SECURITIES INVOLVES RISKS. YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER THE CAPTION “RISK FACTORS” BEGINNING ON PAGE 2 OF THIS

PROSPECTUS, IN THE DOCUMENTS INCORPORATED BY REFERENCE INTO THIS PROSPECTUS AND IN ANY APPLICABLE PROSPECTUS SUPPLEMENT BEFORE YOU MAKE AN INVESTMENT IN OUR SECURITIES.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR

ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is October 19, 2020

No person has been authorized to give any information or to make any representations other than those contained or incorporated by reference in this prospectus and if given or made, such

information or representations must not be relied upon as having been authorized. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in this prospectus, or an

offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date listed on the bottom of the front cover of this prospectus. You

should not assume that the information contained in the documents incorporated by reference in this prospectus is accurate as of any date other than the respective dates of those documents. Our business, financial condition, results of operations and

prospects may have changed since those dates.

THE PROCTER & GAMBLE U.K. SHARE INVESTMENT SCHEME

The Procter & Gamble U.K. Share Investment Scheme (“Plan”) is a direct stock purchase plan designed to encourage long-term investment in The

Procter & Gamble Company (“the Company” or “P&G”) common stock (“Common Stock”) by providing eligible employees and retirees with a convenient and economical method to purchase Company shares and to reinvest cash dividends toward the purchase

of additional shares. If you are a member of another U.K. investment plan (e.g., the 1-4-1 Plan or the Matched Savings Share Purchase Plan (“MSSPP”)) and are already contributing the maximum amount allowed, or if you simply have a lump sum that you

want to invest in the Company, this is the Plan to use. It is a means for you to invest in the potential long term growth and success of the Company.

The Plan is voluntary and is designed to allow employees and retirees to invest in the Company at lower administration costs than through normal

open market channels.

Unlike the 1-4-1 Plan, the Plan offers no tax advantage. The Company pays the broker’s fees for buying the shares, but not for selling them and is

not liable for any tax or other charges levied on a member arising from the operation of the Plan.

All permanent UK employees of the Company and its subsidiaries are eligible to participate in the Plan. This includes those on unpaid leave of

absence, temporary assignment overseas and employees of P&G or any of its subsidiaries on assignment in the UK. P&G UK retirees are also eligible.

It is recommended that this prospectus be retained for future reference.

The Procter & Gamble Company is focused on providing branded consumer packaged goods of superior quality and value to improve the lives of

the world’s consumers. The Company was incorporated in Ohio in 1905, having first been established as a New Jersey corporation in 1890, and was built from a business founded in Cincinnati in 1837 by William Procter and James Gamble. Today, our products

are sold in more than 180 countries and territories. Our principal executive offices are located at One Procter & Gamble Plaza, Cincinnati, Ohio 45202, and our telephone number is (513) 983-1100.

Following is a listing you may use to contact the Plan administrator:

|

Written Inquiries:

|

The Procter & Gamble Share Investment Plan Administrator

|

|

|

Link Asset Services, Share Plans, The Registry

|

|

|

34 Beckenham Road

|

|

|

Beckenham

|

|

|

Kent

|

|

|

BR3 4TU

|

|

|

|

|

Telephone Inquiries:

|

020 8639 2456

|

|

|

|

|

Email Inquiries:

|

www.shareholderenquiries@linkgroup.co.uk

|

Our business is subject to significant risks. You should carefully consider the risks and uncertainties described in this Prospectus, any accompanying prospectus

supplement and the documents incorporated by reference herein and therein, including the risks and uncertainties described in our consolidated financial statements and the notes to those financial statements and the risks and uncertainties described in

our Annual Report on Form 10-K for the year ended June 30, 2020, as amended, and in any subsequent Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K under Item 1A, “Risk Factors” as well as in any subsequent periodic or current reports

filed with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that include “Risk Factors,” or that discuss risks to us, which are incorporated by reference in this Prospectus

or any applicable prospectus supplement. Before making an investment decision, you should carefully consider these risks, as well as any other information that we include or incorporate by reference in this Prospectus or any applicable prospectus

supplement. If any of the risks and uncertainties described in this Prospectus, any applicable prospectus supplement or the documents incorporated by reference herein or therein actually occur, our business, financial condition and results of

operations could be adversely affected in a material way. This could cause the trading price of our Common Stock to decline, perhaps significantly, and you may lose part or all of your investment.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Certain statements included or incorporated by reference in this prospectus, other than purely historical information, including estimates, projections, statements

relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section

27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and

uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information,

future events or otherwise, except to the extent required by law.

Risks and uncertainties to which our forward-looking statements are subject include, without limitation: (1) the ability to successfully manage global financial

risks, including foreign currency fluctuations, currency exchange or pricing controls and localized volatility; (2) the ability to successfully manage local, regional or global economic volatility, including reduced market growth rates, and to generate

sufficient income and cash flow to allow the Company to affect the expected share repurchases and dividend payments; (3) the ability to manage disruptions in credit markets or changes to our credit rating; (4) the ability to maintain key manufacturing

and supply arrangements (including execution of supply chain optimizations and sole supplier and sole manufacturing plant arrangements) and to manage disruption of business due to factors outside of our control, such as natural disasters, acts of war

or terrorism, or disease outbreaks; (5) the ability to successfully manage cost fluctuations and pressures, including prices of commodities and raw materials, and costs of labor, transportation, energy, pension and healthcare; (6) the ability to stay

on the leading edge of innovation, obtain necessary intellectual property protections and successfully respond to changing consumer habits and technological advances attained by, and patents granted to, competitors; (7) the ability to compete with our

local and global competitors in new and existing sales channels, including by successfully responding to competitive factors such as prices, promotional incentives and trade terms for products; (8) the ability to manage and maintain key customer

relationships; (9) the ability to protect our reputation and brand equity by successfully managing real or perceived issues, including concerns about safety, quality, ingredients, efficacy or similar matters that may arise; (10) the ability to

successfully manage the financial, legal, reputational and operational risk associated with third-party relationships, such as our suppliers, contract manufacturers, distributors, contractors and external business partners; (11) the ability to rely on

and maintain key company and third party information and operational technology systems, networks and services, and maintain the security and functionality of such systems, networks and services and the data contained therein; (12) the ability to

successfully manage uncertainties related to changing political conditions (including the United Kingdom’s exit from the European Union) and potential implications such as exchange rate fluctuations and market contraction; (13) the ability to

successfully manage regulatory and legal requirements and matters (including, without limitation, those laws and regulations involving product liability, product and packaging composition, intellectual property, labor and employment, antitrust, data

protection, tax, environmental, and accounting and financial reporting) and to resolve pending matters within current estimates;

(14) the ability to manage changes in applicable tax laws and regulations including maintaining our intended tax treatment of divestiture transactions; (15) the

ability to successfully manage our ongoing acquisition, divestiture and joint venture activities, in each case to achieve the Company’s overall business strategy and financial objectives, without impacting the delivery of base business objectives; (16)

the ability to successfully achieve productivity improvements and cost savings and manage ongoing organizational changes, while successfully identifying, developing and retaining key employees, including in key growth markets where the availability of

skilled or experienced employees may be limited; and (17) the ability to successfully manage the demand, supply, and operational challenges associated with a disease outbreak, including epidemics, pandemics, or similar widespread public health concerns

(including the novel coronavirus, COVID-19, outbreak). For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to our most recent Form 10-K, Form 10-Q and

Form 8-K reports incorporated by reference herein.

Purchases of Common Stock under the Plan will be made in the open market or from Plan participants wishing to sell their shares, and the Company will not receive any

proceeds under the Plan.

DETERMINATION OF OFFERING PRICE

The Plan Trustees will purchase shares on the open market or for an open market price the beneficial interest held in shares by Plan participants wishing to sell

their shares (See section below entitled “Selling Shares”). All shares are purchased in a single transaction on or before the fifth working day in each calendar month. Purchases are not possible at any other time. The cost of shares of the Company’s

Common Stock acquired under the Plan is the average price of all shares purchased for each purchase period.

TERMS AND CONDITIONS OF THE PROCTER & GAMBLE U.K. SHARE INVESTMENT SCHEME

The following is a description of The Procter & Gamble U.K. Share Investment Scheme:

All permanent U.K. employees of the Company and its subsidiaries are eligible to participate in the Plan. This includes those on unpaid leave of absence, temporary assignment

overseas, retirees and employees of P&G or any of its subsidiaries on assignment in the U.K.

The Trustees are employees of the Company who have appropriate experience and have been appointed by the Company. The Company Share Plan Administrator is an appropriately experienced

employee. Capita Asset Services, Share Plans is appointed to carry out administration and investment duties on behalf of the Trustees under the Plan.

|

•

|

How Contributions Are Made

|

Unless you are investing in the Plan via an associated P&G plan such as the 1-4-1 Top Up Plan, contributions must be made by standing order to the Trustees of the Plan. The

minimum contribution is £10.00, but there is no maximum limit.

Members of the Plan may change the amount of their ongoing contributions at any time by giving notice to the Trustees via the “My Benefits” section within the P&G “Life and Career”

site. Notice must be given by the 20th of the month preceding share purchase.

CONTRIBUTIONS CANNOT BE MADE ON BEHALF OF ANOTHER PERSON.

|

•

|

When Shares Are Purchased

|

This is a separate Plan from the 1-4-1 Plan, but shares for the Plan are normally purchased at the same time and for the same price as shares are bought for the main plan each month.

Purchases are not possible at any time other than the usual monthly date. Normally, only contributions which reach the Trustees on or before the 20th of the month will be used to buy shares the following month. However, contributions paid via payroll

deductions (e.g. under the 1-4-1 Top Up Plan) later than the 20th will still be used the following month.

Contributions are held by the Trustees prior to purchase. Trustees will allocate to each member the largest whole number of shares which can be covered by contributions. If Trustees

receive contributions which exceed the amount needed to buy a whole number of shares, the remaining money will be credited to the individual and held for share purchase at a later date, unless its return is requested by the individual.

You need to take account of the latest price of P&G Company shares when deciding how much to contribute. If, for example, you decide to invest £10 a month, it may be a number of

months before the Trustees receive sufficient funds from you to purchase a single share on your behalf. No interest will be paid on any contributions held in the Plan before or after share purchase.

The Trustees of the Plan will handle all contact with investors. They will produce annual statements showing the number of shares held on your behalf, any transactions which have

taken place during the year and the balance of any un-invested money held on your behalf. Trustees will account to members for any money arising from the sale or transfer of shares or rights.

During the time that shares are held on your behalf, Trustees will pay out dividends on allocated shares as soon as is practicable. They will issue tax vouchers on dividends paid on

shares held.

You can instruct the Trustees to reinvest dividends from this Plan (and the Matched Savings Share Purchase Plan (MSSPP), if you are a member) as a means of buying more shares.

Reinvestment of dividends is not subject to a minimum contribution. However, unless you are making regular contributions to the Plan anyway, you need to consider the likely level of dividends you will receive on your shares and the likely length of

time your accumulated dividends might have to remain un-invested in view of the likely share price level, before deciding on dividend reinvestment.

Shares purchased will be held by the Trustees of the Plan, in their name, until written instructions are received for sale. You can sell your shares in this Plan at any time. The

Trustees, rather than sell your shares on the open market, will normally buy your shares from you at the next time they buy or would buy shares on the open market for other members. They will pay the same price for shares bought from members as they

paid, or would have paid, for shares bought on the open market at the same time. For sale at this normal monthly sale/purchase time, you will pay a small flat rate charge.

If the Trustees receive explicit written instructions from a member to sell shares immediately rather than wait for the next normal monthly sale/purchase date, you will pay the greater

of the flat rate charge or the brokers’ fees for an open market sale of shares. Members will be notified if an open market sale is not possible.

If preferred, you can instruct the Trustees at any time to transfer your shares out of the Plan to you rather than to sell them for you.

If you are a member of the MSSPP when you retire, you may transfer the shares you hold in that plan to this Plan when they become available for transfer or sale under the rules of the

plan. The shares will then be held for you by the Trustees until they receive written instructions to sell or transfer them. This means you will be able to continue holding the shares rather than selling them and will therefore have a continuing

interest in, and connection with, the Company.

Unless a retiree, a member who ceases to be employed by the Company or its subsidiaries, for whatever reason, must instruct the Trustees as to the sale or transfer of shares held in

their name, WITHIN ONE MONTH OF THE DATE OF TERMINATION. If no such instruction is received, the Trustees sell the shares and send the proceeds to the member’s last known address.

If you die, the Trustees will transfer or sell all the shares and any residual contributions they were holding for you to your estate on production of a valid grant of probate

or letters of administration.

|

Q.1

|

Why is this Plan available?

|

|

|

|

|

A.

|

It is a natural extension of the 1-4-1 Plan (and its predecessor, the Matched Savings Share Purchase Plan). If employees want to buy more P&G shares, this Plan helps them do this. Additionally, similar plans

exist in some places elsewhere in P&G.

|

|

|

|

|

Q.2

|

Where will I find the price of a P&G Company share?

|

|

|

|

|

A.

|

It is quoted daily in the Financial Times. It appears on the P&G Intranet Home Page. In any event, once you are in the Plan, you will receive an annual statement which includes this information as at the date

the statement is issued.

|

|

|

|

|

Q.3

|

What do I have to do if I leave the Company?

|

|

|

|

|

A.

|

Except for termination on death or retirement, then you must instruct the Trustees to sell or transfer any shares held within one month of termination. If you do not do this, the Trustees will make

reasonable attempts to contact you and failing this they will sell the shares.

On death, the shares will be held until instructions are received from the Executor or administrator of the Estate.

On retirement, you can remain in the Plan.

|

|

|

|

|

Q.4

|

If I die after retirement, can my spouse continue in the Plan?

|

|

|

|

|

A.

|

No.

|

|

|

|

|

Q.5

|

Does the Plan apply to non-harmonised employees?

|

|

|

|

|

A.

|

No.

|

|

|

|

|

Q.6

|

Why is there a minimum contribution?

|

|

|

|

|

A.

|

The administrative cost of the Plan, which is borne by the Company, increases as the number of transactions goes up. Having a minimum contribution means that the

Company's support for the purchase of shares is kept at a reasonable level if it requires a number of contributions to purchase one share.

|

|

|

|

|

Q.7

|

Is there a minimum/maximum number of shares that can be sold at any one time?

|

|

|

|

|

A.

|

No - but if you want the shares sold immediately, it may not be possible for the Trustees to sell a small number of shares on the open market. Small numbers of shares can be bought in by the Trustees

from members on the one day each month when they are buying shares in the open market for other members.

|

|

|

|

|

Q.8

|

Can I instruct the Trustees to buy a specific number of shares?

|

|

|

|

|

A.

|

No. They will buy as many whole shares as can be financed by your contributions.

|

|

|

|

|

Q.9

|

If I have questions about the Plan, or about my shares, whom do I contact?

|

|

|

|

|

A.

|

Your manager should be able to answer questions about how the Plan works. Specific questions about your own shares or account should be referred directly to the Plan administrator:

The Procter & Gamble Share Investment Plan Administrator

LINK Asset Services, Share Plans, The Registry

34 Beckenham Road

Beckenham, Kent

BR3 4TU Tel: 020 8639 2456

Or access your share information on-line via the Capita share portal at www.signalshares.com

|

|

|

|

|

Q.10

|

Can I get further information about the Plan?

|

|

|

|

|

A.

|

Yes. A copy of the formal trust deed and rules is available from your HR contact/Plant Personnel Department.

|

|

|

|

|

Q.11

|

Do I have to continue making payments to the Plan once I have joined?

|

|

|

|

|

A.

|

No - you can stop at any time.

|

|

|

|

|

Q.12

|

Will I have to pay tax when I sell the shares?

|

|

|

|

|

A.

|

If you sell any of your shares, you may become liable to pay Capital Gains Tax. Generally, this is calculated on the difference between the sale price of the shares (less selling costs) and their acquisition

cost. For the 2020/21 tax year, capital gains up to £12,300 (in total for all gains on all investments for any person) are not taxed.

Above this figure, tax is payable at the prevailing Capital Gains tax rate. The timing of any sale of Plan shares in relation to other share acquisitions or sales you make may affect the calculation of your capital gains. You are therefore

advised to obtain independent financial advice before selling your shares. The sale of any of your shares may have to be reported on your annual income tax return.

|

|

|

|

|

Q.13

|

How long do the shares need to be kept?

|

|

|

|

|

A.

|

Shares in the Plan can be sold at any time.

|

|

|

|

|

Q.14

|

Are there any tax advantages of using this Plan?

|

|

|

|

|

A.

|

No. Unlike the 1-4-1 Plan, no Company contributions are paid direct to the Trustees on your behalf, the Plan does not have to be approved by the Inland Revenue, and no tax advantage arises.

|

|

|

|

|

Q.15

|

What is the role of the Plan administrator?

|

|

|

|

|

A.

|

The Plan administrator does everything except interpret the rules of the Plan. If you have any questions about your investment, or the purchase and sale of shares,

then you should contact the Plan administrator. This information is also available on-line via the Capita share portal at www.signalshares.com.

However, if you want to know about the rules or the structure of the Plan, talk to your Manager.

|

|

|

|

|

Q.16

|

Do I need to tell the Plan administrator of any change of address?

|

|

|

|

|

A.

|

Yes, you need to tell LINK directly. Changing P&G records will not change the data held by LINK.

|

THE DIVIDEND POLICY OF THE COMPANY IS NOT AFFECTED BY THIS PLAN AND WILL CONTINUE TO DEPEND ON EARNINGS, FINANCIAL REQUIREMENTS AND OTHER FACTORS.

THE COMPANY CANNOT ASSURE YOU OF A PROFIT OR PROTECT YOU AGAINST A LOSS ON SHARES OF COMMON STOCK PURCHASED UNDER THE PLAN.

DESCRIPTION OF PROCTER & GAMBLE CAPITAL STOCK

The Company's Amended Articles of Incorporation authorize the issuance of 10,000,000,000 shares of Common Stock, 600,000,000 shares of Class A Preferred Stock and 200,000,000 shares of

Class B Preferred Stock, all of which are without par value ("Common Stock," "Class A Preferred Stock," and "Class B Preferred Stock," respectively). There are no shares of Class B Preferred Stock currently outstanding.

The holders of Common Stock and Class A Preferred Stock are entitled to one vote per share on each matter submitted to a vote of shareholders. The holders of Class B Preferred Stock,

if any, are not entitled to vote other than as provided by law. The Company's Board of Directors (the "Board") is not classified and each member is elected annually. The Company’s Amended Articles of Incorporation provide for directors in uncontested

director elections to be elected by a simple majority vote. Additionally, to the extent that Ohio law would otherwise impose a supermajority vote requirement on actions to be taken at meetings of the Company’s shareholders, the Company’s Amended

Articles of Incorporation require only a vote of a majority of the Company’s outstanding capital stock that is entitled to vote on such matters.

The holders of Class A Preferred Stock and, if issued, Class B Preferred Stock have the right to receive dividends prior to the payment of dividends on the Common Stock. The Board has

the power to determine certain terms relative to any Class A Preferred Stock and Class B Preferred Stock to be issued, such as the power to establish different series and to set dividend rates, the dates of payment of dividends, the cumulative dividend

rights and dates, redemption rights and prices, sinking fund requirements, restrictions on the issuance of such shares or any series thereof, liquidation price and conversion rights. Also, the Board may fix such other express terms as may be permitted

or required by law. In the event of any liquidation or dissolution, the holders of the Common Stock are entitled to receive as a class, pro rata, the residue of the assets after payment of the liquidation price to the holders of Class A Preferred Stock

and, if issued, Class B Preferred Stock.

The Board has determined the terms of shares of Class A Preferred Stock issued as Series A ESOP Convertible Class A Preferred Stock, which can only be held by a trustee or trustees of

an employee stock ownership plan or other benefit plan of the Company. Upon transfer of Series A ESOP Convertible Class A Preferred Stock to any other person, such transferred shares shall be automatically converted into shares of Common Stock. Each

share of Series A ESOP Convertible Class A Preferred Stock has a cumulative dividend of $.5036075 per year and a liquidation price of $6.82 per share (as adjusted for the stock splits on October 20, 1989, May 15, 1992, August 22, 1997 and May 21, 2004,

and the Smucker transaction effective June 1, 2002), is redeemable by the Company or the holder without regard to any arrearage in the payment of dividends, is convertible at the option of the holder into one share of Common Stock and has certain

anti-dilution protections associated with the conversion rights. Appropriate adjustments to dividends and liquidation price will be made to give effect to any future stock splits, stock dividends or similar changes to the Series A ESOP Convertible

Class A Preferred Stock.

The Board has also determined the terms of shares of Class A Preferred Stock issued as Series B ESOP Convertible Class A Preferred Stock. Each share of Series B ESOP Convertible Class

A Preferred Stock has a cumulative dividend of $1.022 per year and a liquidation price of $12.96 per share (as adjusted for the stock splits on August 22, 1997 and May 21, 2004, and the Smucker transaction effective June 1, 2002), is redeemable by the

Company or the holder under certain circumstances, is convertible at the option of the holder into one share of Common Stock and has certain anti-dilution protections associated with the conversion rights. Appropriate adjustments to dividends and

liquidation price will be made to give effect to any future stock splits, stock dividends or similar changes to the Series B ESOP Convertible Class A Preferred Stock.

All of the issued shares of Common Stock of the Company are fully paid and non-assessable. Common Stock does not have any conversion rights and is not subject to any redemption

provisions. No holder of shares of any class of the Company’s capital stock has or shall have any right, pre-emptive or other, to subscribe for or to purchase from the Company any of the shares of any class of the Company hereafter issued or sold. No

shares of any class of the Company’s capital stock are subject to any sinking fund provisions or to calls, assessments by, or liabilities of the Company.

INTERESTS OF NAMED COUNSEL

The legality of the shares of Common Stock offered hereby has been passed upon for the Company by Ms. Jennifer Henkel, Director and Assistant General Counsel, The

Procter & Gamble Company. Ms. Henkel is an owner of shares of Common Stock of the Company.

The financial statements incorporated in this Prospectus by reference from the Company's Annual Report on Form 10-K, as amended, for the year ended June 30, 2020, and the effectiveness of the Procter

& Gamble Company's internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports, which are incorporated herein by reference. Such financial

statements have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The Securities and Exchange Commission (the “SEC”) allows us to “incorporate by reference” into this document the information which P&G filed

with the SEC. This means that we can disclose important information by referring you to those documents. Any information referred to in this way is considered part of this prospectus from the date we file that document. The information incorporated by

reference is an important part of this prospectus and information that P&G files later with the SEC will automatically update and supersede this information. The following documents filed by the Company (File No. 1-434) with the SEC pursuant to the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated herein by reference:

|

•

|

The Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2020, as amended; and

|

|

•

|

The Company’s Current Report on Form 8-K filed on August 12, 2020, September 16, 2020, October 13, 2020 (SEC Accession No. 0001193125-20-268528), and October 15, 2020.

|

All reports and other documents filed by the Company pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this registration

statement and prospectus and prior to the filing of a post-effective amendment, but excluding any information furnished to, rather than filed with, the SEC, which indicates that all securities offered hereby have been sold or which deregisters all

securities then remaining unsold shall be incorporated by reference herein and shall be deemed to be a part of this prospectus from the dates of filing of such reports and documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this

registration statement and prospectus to the extent that a statement contained in any subsequent prospectus or prospectus supplement hereunder or in any document subsequently filed with the Commission which also is or is deemed to be incorporated by

reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement or prospectus. All documents incorporated

by reference into the Form S-3 of which this prospectus is a part are also incorporated by reference, unless the information therein is superseded by a later filing.

WHERE YOU CAN FIND MORE INFORMATION

The Company will provide without charge to each person to whom a copy of this prospectus is delivered, upon the oral or written request of such

person, a copy of any or all of the documents which are incorporated by reference in this prospectus, other than exhibits to such documents (unless such exhibits are specifically incorporated by reference into such documents). Requests should be

directed to the Shareholder Services Department, The Procter & Gamble Company, P.O. Box 5572, Cincinnati, Ohio 45201-5572, telephone: (800) 742-6253 (U.S. and Canada); or (513) 983-3034 (outside the U.S. and Canada).

The Company files annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document

the Company has filed or will file with the SEC from the SEC’s public website at www.sec.gov.

You may also get a copy of these reports from our website at www.pg.com. Please note, however, that we have not incorporated any other

information by reference from our website, other than the documents listed above.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with

different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume the information in this prospectus or any supplemental prospectus is accurate as of any date other than the date

on the front of those documents.

PART II

Information Not Required in Prospectus

Item 14. Other

Expenses of Issuance and Distribution

The following is a statement of the expenses (all of which are estimated) to be incurred by the Registrant in connection with the distribution of the securities registered under this registration

statement:

|

|

Amount

to be paid

|

|

SEC registration fee

|

$1,568

|

|

Accounting fees and expenses

|

$10,000

|

|

Total

|

$11,568

|

Item 15. Indemnification of Directors and Officers

Set forth below is a description of certain provisions of the Ohio Revised Code (“ORC”) and the Company’s Regulations, as such provisions relate to the

indemnification of the directors and officers of the registrant. This description is intended only as a summary and is qualified in its entirety by reference to the ORC and the Company’s Regulations.

Section 1701 of the ORC provides that a corporation must indemnify its directors, officers, employees, and agents against expenses reasonably incurred in

connection with a successful defense (on the merits or otherwise) of any action, suit, or proceeding.

A corporation may indemnify its directors, officers, employees, and agents against expenses, including attorneys’ fees, judgments, fines and amounts paid in

settlement, in connection with actions, suits, or proceedings (except for derivative actions by or in the right of the corporation), whether civil, criminal, administrative, or investigative. The corporation may indemnify such persons if the

individual has acted in good faith and in a manner that the individual believed to be in the best interests of the corporation and, with respect to a criminal action, had no reasonable cause to believe their conduct was unlawful. The determination as

to whether this standard of conduct has been met must be made by the court, a majority of the disinterested directors, by independent legal counsel, or by the shareholders.

A similar standard applies in the case of derivative actions, except that indemnification may only extend to expenses, including attorney’s fees, incurred in

connection the defense or settlement of such action. If the person seeking indemnification has been found liable to the corporation in such an action, the court must approve the indemnification.

As permitted by the ORC, Article V of the Company’s Regulations require the Company to indemnify, to the fullest extent permitted by law, any person who was or is

a party or is threatened to be made a party to any threatened, pending, or completed claim, action, suit, or proceeding, whether civil, criminal, administrative, or investigative, by reason of the fact that he or she (a) is or was a Director, officer

or employee of the Company or its subsidiaries, (b) is or was serving at the request of the Company or its subsidiaries as a director, trustee, officer, partner, managing member or position of similar capacity, or employee of a Company subsidiary or

another corporation, limited liability company, partnership, joint venture, trust, employee benefit plan, or other enterprise (whether domestic or foreign, nonprofit or for profit), or (c) is or was providing to third party organizations volunteer

services that were duly authorized in accordance with the Company’s process for approval of such activities, against all liabilities and expenses actually and reasonable incurred by or imposed on him or her in connection with, or arising out of, any

such claim, action, suit or proceeding. This indemnity will be provided unless the person (a) failed to act in good faith, in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the Company and its subsidiaries,

(b) acted or failed to act, in either case, with deliberate intent to cause injury to the Company and its subsidiaries or with reckless disregard for the best interests of the Company or its subsidiaries, or (c) knowingly engaged in criminal activity.

The Company’s Directors, officers and certain other key employees of the Company are insured by directors and officers liability insurance policies. The Company

pays the premiums for this insurance.

|

|

|

|

Item 16.

|

Exhibits

|

|

|

|

|

|

|

(3-1)*

|

|

(3-2)*

|

|

|

(5)

|

|

|

(23)(a)

|

|

|

(23)(b)

|

|

|

(24)

|

|

*Incorporated by reference to previously filed documents

Item 17. Undertakings

The Registrant hereby undertakes:

(a) (1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration

statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the

registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration

statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and

included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule

430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that

prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such

effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the

purpose of determining liability of a Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned

Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the

undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on

behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) The portion of any other free writing prospectus relating to the offering

containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) Any other communication that is an offer in the offering made by the

undersigned Registrant to the purchaser.

(b) That, for

purposes of determining any liability under the Securities Act of 1933, each filing of The Procter & Gamble Company’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each

filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as

indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant have been advised that in

the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the

payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in

connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, The Procter & Gamble Company certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Cincinnati, State of Ohio, on the 19th day of October, 2020.

THE PROCTER & GAMBLE COMPANY

By: /s/ Jon R. Moeller ____________________

Name: Jon R. Moeller

Title: Vice Chairman, Chief Operating Officer

and Chief Financial Officer

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on October 19, 2020.

|

Signature

|

|

Title

|

|

|

|

|

|

*

|

|

Chairman of the Board, President and Chief Executive Officer (Principal Executive Officer)

|

|

David S. Taylor

|

|

|

|

|

|

|

|

*

|

|

Vice Chairman, Chief Operating Officer and Chief Financial Officer (Principal Financial Officer)

|

|

Jon R. Moeller

|

|

|

|

|

|

|

|

*

|

|

Controller and Treasurer and Group Executive Vice President - Company Transition Leader (Principal Accounting Officer)

|

|

Valarie L. Sheppard

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Francis S. Blake

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Angela F. Braly

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Amy L. Chang

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Joseph Jimenez

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Debra L. Lee

|

|

|

|

|

|

|

*

|

|

Director

|

|

Terry J. Lundgren

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Christine M. McCarthy

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

W. James McNerney, Jr.

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

Nelson Peltz

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Margaret C. Whitman

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Patricia A. Woertz

|

|

|

*By: __/s/ Deborah P. Majoras_______________________________________

Deborah P. Majoras as Attorney-in-Fact

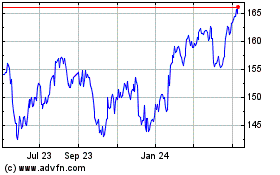

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

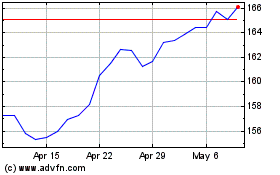

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024