By Sharon Terlep | Photographs and video by Bryan Anselm for The Wall Street Journal

SUMMIT, N.J.- -- Procter & Gamble Co. started a dry-cleaning

chain a decade ago to market detergent and learn more about how

consumers like their laundry. That experiment has evolved into the

sector's second-largest U.S. player as mom-and-pop rivals

struggle.

Tide Dry Cleaners was an unusual move for the world's biggest

maker of household staples. It remained a low-priority project,

limited to a couple dozen locations scattered about the U.S.

The venture took on heightened importance a few years ago when

P&G, stung by the consumer shift away from big brands and

competition from leaner startups and online rivals, started seeking

new ways to reach customers. The cleaning business, while still

small within P&G, is gaining revenue as it adds locations and

offerings, from campus delivery to wash-and-fold service.

"The industry was declining; it was ready for someone to come in

and change the way things are done," said Lou Pacifico, owner of

two Tide locations in Summit, N.J. He owned a valet-parking

business when he learned about Tide Cleaners in 2015 and decided to

become a franchisee. "Still, we were trying something new, and we

didn't know how it was going to go."

Mr. Pacifico said he aims eventually to open five to 10

locations.

Overall, P&G operates or franchises 146 dry-cleaning

locations. The chain accounts for roughly 2.5% of the U.S.

dry-cleaning industry's $9.1 billion in annual sales, and its

locations generate more revenue than the average dry cleaner,

according to market-research firm IBISWorld.

"At first it was a one-off, an experiment," said Sundar Ramen,

P&G's president of fabric care in North America, who took over

the venture in 2015. "Part of what we're trying to do now at

P&G is get into things we haven't done before."

The business isn't making money yet, P&G says, but it is

betting attractive stores, modern equipment, a focus on strong

service and the use of Tide detergent on laundry orders will draw

in customers. Expanding operations, as P&G first did in Chicago

to include wash-and-fold laundry, on-campus delivery and lockers

for pickup or drop-off, will make for a profitable business model,

the company said.

Mr. Ramen said P&G plans to continue opening dozens of

outlets a year and has a waiting list of potential franchisees. He

declined to specify how many locations P&G ultimately aims to

open.

Huntington Co. in Berkley, Mich., is the biggest U.S. dry-clean

franchiser with more than 700 locations. Owner Wayne Wudyka sees

flaws in his rival's business model. He says building new

facilities as the industry declines, as P&G has done, rather

than consolidating existing cleaners, will be too pricey for

franchisees to make money.

"We've watched Tide over the years, and they haven't had a

long-term strategy yet," he said. "When I look at the economics of

what they are doing, it's counterintuitive."

Mr. Ramen said P&G franchises only to owners who directly

operate the business, and focuses on helping successful owners

expand rather than attracting new ones. Expanding the dry-cleaning

business into wash-and-fold, laundromats and pickup and drop-off

lockers improves profitability, he said.

Tide Cleaners owners have to outfit the store with high-end

machines and automated equipment. Clothes are tagged with a tiny,

permanent bar code that enables the cleaner to automatically sort

items and track their washing history over time.

P&G requires franchisees to pay a $20,000 fee and invest

between $660,000 and $1.6 million for their initial store, which

must include machinery to dry-clean on site.

With dry cleaning, P&G picked an industry in decline.

Overall, there are nearly 33,000 dry-cleaning locations in the

U.S., down from close to 40,000 in 2010. Americans increasingly

prefer casual clothes and, even with more formal items, apparel

makers are using more fabrics that don't require dry cleaning.

Meanwhile, operators face regulatory mandates to swap out

machines that use chemicals common to the dry-cleaning process in

favor of safer solvents.

Perchloroethylene, known as perc or PCE, has long been the most

commonly used dry-cleaning solvent. In 2012, the U.S. Environmental

Protection Agency classified the substance as a "likely human

carcinogen," and state and federal regulators have pushed to phase

out the substance, requiring dry cleaners to make costly updates to

equipment.

Tide Dry Cleaners, like many in the industry, uses a

silicone-based alternative chemical dubbed Green Earth that is used

in many cosmetics.

Alan Spielvogel, director of technical services for the National

Dry Cleaners Association trade group, has watched the Tide chain

grow. Its offerings, he said, are packaged differently but are

basically similar to services offered by a typical dry cleaner.

"They are relying on brand recognition," he said, "but they're

really not processing the garment any differently than anyone else

is."

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

September 03, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

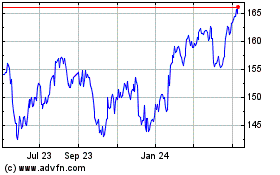

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

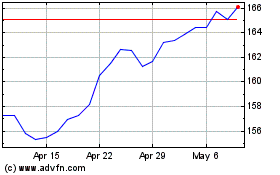

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024