Procter & Gamble Posts Strong Sales Growth, Writes Down Gillette Business

July 30 2019 - 8:39AM

Dow Jones News

By Aisha Al-Muslim

Procter & Gamble Co. reported a loss in the latest quarter

after the consumer-products giant booked an $8 billion charge to

write down the value of its Gillette shave-care business, despite

strong sales growth.

The Cincinnati-based company said Tuesday it posted a net loss

of $5.24 billion, or $2.12 a share, compared with a profit of $1.89

billion, or 72 cents a share, a year earlier. Core earnings per

share were $1.10, above the $1.05 a share analysts polled by

FactSet expected.

The one-time, noncash charge was to adjust the carrying value of

Gillette Shave Care's goodwill and trade-name intangible assets,

the company said.

The company attributed the write-down in part to the market for

blades and razors in developed markets due to lower shaving

frequency and increased competition.

The stock rose 4% to $120.63 in premarket trading. Shares are up

about 45% in the past year.

The maker of Tide detergent and Gillette razors said organic

sales -- a closely watched metric that strips out currency moves,

acquisitions and divestitures -- rose 7% in the quarter.

Organic sales were boosted by 3% due to higher shipment volumes

compared with a year ago, as well as higher pricing.

P&G said net sales rose 4% to $17.09 billion in the quarter

ended June 30, above the consensus forecast of $16.86 billion from

analysts polled by FactSet. Unfavorable foreign exchange hurt sales

by 4%, the company said.

For fiscal 2020, the company guided net sales growth of 3% to 4%

and organic sales growth of 3% to 4%. Core earnings per share are

expected to increase 4% to 9%, compared with $4.52 in fiscal

2019.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

July 30, 2019 08:24 ET (12:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

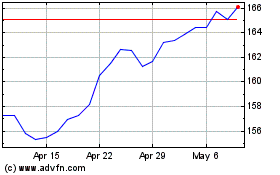

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

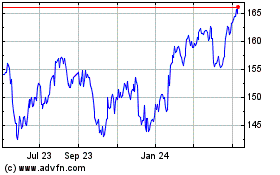

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024