Current Report Filing (8-k)

June 30 2021 - 4:16PM

Edgar (US Regulatory)

0000931015

false

0000931015

2021-06-30

2021-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of the Securities Exchange Act of 1934

June 30, 2021

Date of Report (Date of

earliest event reported)

POLARIS INC.

(Exact name of Registrant as specified

in its charter)

|

Minnesota

|

|

1-11411

|

|

41-1790959

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

2100 Highway 55

|

|

Medina, Minnesota 55340

|

(Address of principal executive offices)

(Zip Code)

|

(Registrant’s telephone number, including

area code) (763) 542-0500

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $.01 par value per share

|

|

PII

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Amendment No. 3 to Fourth Amended and Restated Credit Agreement

On June 30, 2021, Polaris

Inc. (the “Company”) entered into an amendment (the “Third Amendment to Credit Agreement”) to its existing credit

facility with U.S. Bank National Association, as administrative agent (the “Administrative Agent”), and the several lenders

party thereto dated as of July 2, 2018 (as amended, the “Existing Credit Agreement;” the Existing Credit Agreement as amended

by the Third Amendment to Credit Agreement, the “Credit Agreement”). The Third Amendment to Credit Agreement amends

the Existing Credit Agreement to, among other things:

|

|

(i)

|

increase the size of the revolving credit facility under the Credit Agreement from $700 million to $1

billion;

|

|

|

(ii)

|

extend the maturity date of the facility to June 30, 2026;

|

|

|

(iii)

|

revise the leverage ratio covenant to permit the Company to net from consolidated funded indebtedness

certain unrestricted and unencumbered cash of the Company and its subsidiaries on the date of calculation in an amount not to exceed $300

million;

|

|

|

(iv)

|

increase the sublimit for the issuance of letters of credit under the revolving credit facility from $50

million to $100 million; and

|

|

|

(v)

|

permit the Company and the Administrative Agent to enter into a future pricing amendment to establish

specified Key Performance Indicators (“KPI’s”) with respect to certain Environmental, Social and Governance objectives

providing for certain adjustments (increase, decrease or no adjustment) to the applicable facility fee rate and applicable margin for

loans under the Credit Agreement based on the Company’s performance against the KPI’s, with any such adjustments not to exceed

a 3 basis point increase or decrease in the applicable margin and a 1 basis point increase or decrease in the applicable facility fee

rate.

|

The applicable margins on

the loans and the facility fee rates were not modified from the Existing Credit Agreement, except that pricing will now be based on the

net leverage ratio as further described above. The Credit Agreement continues to be subject to various other covenants, including, among

other things, mergers and consolidations and asset sales and is subject to acceleration upon various events of default.

A copy of the Third Amendment

to Credit Agreement is filed as Exhibit 10.01 hereto, qualifies the above description and is incorporated by reference herein.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned duly authorized officer.

|

Date: June 30, 2021

|

|

|

|

|

|

POLARIS INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

/s/ Robert P. Mack

|

|

|

Robert P. Mack

|

|

|

Chief Financial Officer, Executive Vice President – Finance and Corporate Development

|

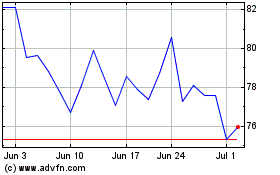

Polaris (NYSE:PII)

Historical Stock Chart

From Mar 2024 to Apr 2024

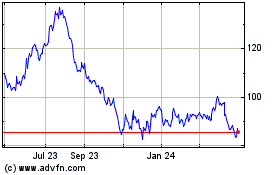

Polaris (NYSE:PII)

Historical Stock Chart

From Apr 2023 to Apr 2024