Harris Williams Advises Upstream Rehabilitation in Connection with its Sale to Revelstoke Single Asset Fund I

December 10 2019 - 12:14PM

Business Wire

Harris Williams, a global investment bank specializing in

M&A advisory services, announces that it advised Upstream

Rehabilitation (Upstream), a portfolio company of Revelstoke

Capital Partners (Revelstoke), on its sale to Revelstoke Single

Asset Fund I, a newly formed special purpose vehicle affiliated

with Revelstoke. Upstream is a leading national provider of

outpatient and specialized physical therapy services, operating

more than 746 clinics across 27 states. The advisory engagement was

led by Andy Dixon, Cheairs Porter, Ben Bloomfield and Michael

Mahoney of the Harris Williams Healthcare & Life Sciences

(HCLS) Group.

“It was a pleasure working alongside Upstream management and the

Revelstoke team throughout this transaction,” said Andy Dixon, a

managing director at Harris Williams. “Upstream is well-positioned

at the forefront of attractive tailwinds in the physical therapy

sector, and our team is excited to see the company’s next chapter

in partnership with Revelstoke.”

Having previously advised Upstream on its initial sale to

Revelstoke in 2015 and subsequently advising the sellers during

Upstream’s merger with Drayer Physical Therapy Institute, this

transaction adds to Harris Williams’ successful track record of

working with leading companies in the physical therapy space.

Upstream, one of the largest and fastest growing physical

therapy providers in the U.S., operates through a network of strong

regional brands including the following: BenchMark Physical

Therapy, Drayer Physical Therapy Institute, Peak Physical Therapy,

SERC Physical Therapy, Integrity Rehab Group and more. The company

provides a comprehensive suite of outpatient and specialized

physical therapy services and sees over 4 million patient visits

annually. Upstream is headquartered in Birmingham, Alabama.

Revelstoke is a private equity firm formed by experienced

investors who focus on building industry-leading companies in the

healthcare and related business services sectors. Revelstoke

partners with entrepreneurs and management teams to execute on a

disciplined organic and acquisition growth strategy to build

exceptional companies. Since the firm’s inception in 2013,

Revelstoke has raised over $2.3 billion of equity and has completed

65 acquisitions, which includes 17 platform companies and 48 add-on

acquisitions.

Harris Williams, an investment bank specializing in M&A

advisory services, advocates for sellers and buyers of companies

worldwide through critical milestones and provides thoughtful

advice during the lives of their businesses. By collaborating as

one firm across Industry Groups and geographies, the firm helps its

clients achieve outcomes that support their objectives and

strategically create value. Harris Williams is committed to

execution excellence and to building enduring, valued relationships

that are based on mutual trust. Harris Williams is a subsidiary of

the PNC Financial Services Group, Inc. (NYSE: PNC).

The Harris Williams HCLS Group has experience across a broad

range of sectors, including medical devices, products and

distribution; multi-site and retail healthcare providers; alternate

site care; healthcare IT; managed care and cost containment

services; outsourced clinical services; and outsourced pharma

services. For more information on the HCLS Group and other recent

transactions, visit the HCLS Group’s section of the Harris Williams

website.

Harris Williams LLC is a registered broker-dealer and member of

FINRA and SIPC. Harris Williams & Co. Ltd is a private limited

company incorporated under English law with its registered office

at 5th Floor, 6 St. Andrew Street, London EC4A 3AE, UK, registered

with the Registrar of Companies for England and Wales (registration

number 07078852). Harris Williams & Co. Ltd is authorized and

regulated by the Financial Conduct Authority. Harris Williams &

Co. Corporate Finance Advisors GmbH is registered in the commercial

register of the local court of Frankfurt am Main, Germany, under

HRB 107540. The registered address is Bockenheimer Landstrasse

33-35, 60325 Frankfurt am Main, Germany (email address:

hwgermany@harriswilliams.com). Geschäftsführer/Directors: Jeffery

H. Perkins, Paul Poggi. (VAT No. DE321666994). Harris Williams is a

trade name under which Harris Williams LLC, Harris Williams &

Co. Ltd and Harris Williams & Co. Corporate Finance Advisors

GmbH conduct business.

For media inquiries, please contact Katie Langemeier, associate

brand manager, at +1 (804) 648-0072.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191210005859/en/

Katie Langemeier, associate brand manager, +1 (804) 648-0072

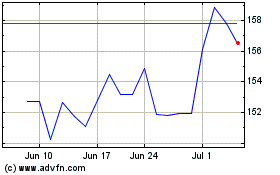

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

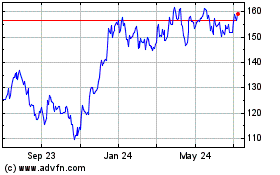

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Apr 2023 to Apr 2024