NEW YORK (Dow Jones)--J.P. Morgan Chase & Co. (JPM) and

Wells Fargo & Co. (WFC) said Thursday they have reserved for

their respective $5.3 billion shares of the settlement that big

banks reached with the Justice Department, the Department of

Housing and Urban Development and 49 state attorneys general.

The long-awaited $26 billion settlement involving the nations'

largest companies collecting mortgage payments and executing

foreclosures is a relief to investors because it removes some

uncertainty about the financial impact of the foreclosure

trouble.

But analysts warned that other litigation still looms, and that

banks will still have to struggle with investors in mortgage-backed

securities who demand that the banks buy back soured loans.

Financially, at least, shareholders likely won't have to bear

new costs for Thursday's settlement.

"Given the extended length of time over which negotiations took

place, we expect that the five largest servicers have largely

provisioned for the cost of this settlement," RBC Capital Markets

analysts wrote in a research report. "Thus, we expect little, if

any, impact to our bank income statements."

J.P. Morgan's share of the settlement is $5.3 billion, the same

as for Wells Fargo. Bank of America Corp. (BAC) is bearing the

biggest share, $11.8 billion; Citigroup Inc. (C) has to pay $2.2

billion, and Ally Financial Inc. must pay $310 million.

Citi, in a statement, said that it will take $209 million in

retroactive fourth-quarter charges, but added that its existing

reserves "will be sufficient to cover customer relief payments and

all but a small portion of the cash payment called for under this

settlement."

A spokeswoman for J.P. Morgan said in a statement that the bank

has set aside the estimated cost of Thursday's $26 billion

settlement in previous quarters.

"We will incur some additional operating costs to implement the

new servicing standards," but those "will not be material," she

said.

Bank of America didn't immediately comment on the settlement or

its reserves for the financial impact.

Citi, in a statement, said existing reserves "will be sufficient

to cover customer relief payments and all but a small portion of

the cash payment called for under this settlement." However, the

bank said it will adjust fourth-quarter earnings to reflect a

charge of $84 million.

Ally said it doesn't expect the financial impact of the

agreement to be material, a spokeswoman said. The lender took a

charge of $270 million in the fourth quarter for expected

foreclosure-related penalties.

Wells Fargo, in a press release, said it "had fully accrued" for

the following elements of the settlement that affect the company: a

$900 million refinance program, a $3.4 billion relief program for

consumers who experience financial hardship and $1 billion paid to

the federal government.

"The Refinance Program will not result in any current-period

charge as the impact of this program will be recognized over a

period of years in the form of lower interest income as qualified

borrowers benefit from reduced interest rates on loans refinanced

under the program," Wells Fargo said.

However, the settlement will reduce interest from mortgage

lending for years because borrowers benefit from reduced interest

rates on loans refinanced under the program, Wells Fargo and Citi

said.

Wells Fargo Chief Financial Officer Timothy Sloan told investors

during a Credit Suisse Financial Services conference in Miami that

the settlement is good for customers and shareholders. "We are very

pleased with the settlement, we are pleased to put this behind us,"

he said.

Shareholders responded somewhat indifferently. Bank of America's

stock rose 1.85%; shares of J.P. Morgan, Citi, and Wells Fargo

fell, but all less than 1%. While shares of tobacco companies fell

after the big 1998 settlement, bank stocks likely won't take a hit

following the settlement because banks have reserved for the

financial impact, Keefe, Bruyette & Woods said in a research

report.

"While the settlement likely reduces future liability related to

foreclosure matters, the agreement does not reduce future liability

related to securitization activities, federal or state criminal

claims, or claims brought by individual homeowners," wrote Wells

Fargo Securities analyst Matthew Burnell, who follows Bank of

America and J.P. Morgan Chase.

J.P. Morgan said in a regulatory filing that the settlement

releases the bank "from further claims related to servicing

activities, including foreclosures and loss mitigation activities,"

but that this doesn't include securitization matters or New York

Attorney General Eric T. Schneiderman's suit against Bank of

America, J.P. Morgan Chase and Wells Fargo over a private national

mortgage electronic registry system, MERS.

Mike Heid, president of Wells Fargo Home Mortgage, said in an

interview that the issues surrounding housing and the economic

recovery "are very broad, very complex," and "there is no one

action, no one solution that takes care of all of that."

He declined to discuss the New York state suit about MERS, but

said, "The spirit of cooperation that was achieved through that

settlement approach I would believe could and should carry forward

in a lot of other ways."

Further, there was no word Thursday about regional banks signing

on to the settlement. Last month, PNC Financial Services Group Inc.

(PNC), SunTrust Banks Inc. (STI), and U.S. Bancorp (USB) said they

put aside reserves for the settlement. "We anticipate investors may

hear more news on these companies later on in the process," RBC

analysts said.

-By Matthias Rieker, Dow Jones Newswires; 212-416-2471;

matthias.rieker@dowjones.com

--Nick Timiraos and Andrew R. Johnson contributed to this

article.

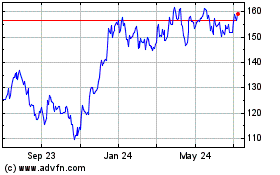

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Aug 2024 to Sep 2024

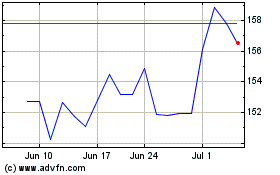

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Sep 2023 to Sep 2024