First Trust Advisors L.P. Announces Share Repurchase Programs for Certain Closed-end Funds

September 15 2020 - 4:31PM

Business Wire

First Trust Advisors L.P. (“FTA”) is pleased to announce that

the Board of Trustees of each of First Trust Energy Income and

Growth Fund (NYSE: FEN), First Trust New Opportunities MLP &

Energy Fund (NYSE: FPL), First Trust MLP and Energy Income Fund

(NYSE: FEI) and First Trust Energy Infrastructure Fund (NYSE: FIF)

has authorized a Share Repurchase Program for each Fund. Pursuant

to each Fund’s Share Repurchase Program, each Fund may, from time

to time and at the direction of management personnel, repurchase up

to the amount of shares in each Fund’s Share Repurchase Program

described below in secondary market transactions in accordance with

applicable law. Each Fund’s Share Repurchase Program will continue

until the earlier of (i) the repurchase 5% of each Fund’s

outstanding shares or (ii) March 15, 2021.

Fund

Number of Shares Available for

Repurchase through March 15, 2021

First Trust Energy Income and Growth

Fund

1,001,042

First Trust New Opportunities MLP &

Energy Fund

1,285,769

First Trust MLP and Energy Income Fund

2,350,362

First Trust Energy Infrastructure Fund

877,512

Each Fund’s repurchase activity will be disclosed in its

shareholder report for the relevant fiscal period. There is no

assurance that any Fund will purchase shares at any specific levels

or in any specific amounts.

The risks of investing in each Fund are spelled out in its

respective shareholder reports, and other regulatory filings. Each

Fund’s daily closing price and net asset value per share as well as

other information can be found at www.ftportfolios.com or by

calling (800) 988-5891.

First Trust Advisors L.P. (“FTA”) is a federally registered

investment advisor and serves as each Fund’s investment advisor.

FTA and its affiliate First Trust Portfolios L.P. (“FTP”), a FINRA

registered broker-dealer, are privately-held companies that provide

a variety of investment services. FTA has collective assets under

management or supervision of approximately $152 billion as of

August 31, 2020 through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds and separate managed

accounts. FTA is the supervisor of the First Trust unit investment

trusts, while FTP is the sponsor. FTP is also a distributor of

mutual fund shares and exchange-traded fund creation units. FTA and

FTP are based in Wheaton, Illinois.

Energy Income Partners, LLC (“EIP”) serves as each Fund’s

investment sub-advisor and provides advisory services to a number

of investment companies and partnerships for the purpose of

investing in MLPs and other energy infrastructure securities. EIP

is one of the early investment advisors specializing in this area.

As of July 31, 2020, EIP managed or supervised approximately $4.0

billion in client assets.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, FTA is not undertaking to give

advice in any fiduciary capacity within the meaning of ERISA and

the Internal Revenue Code. FTA has no knowledge of and has not been

provided any information regarding any investor. Financial advisors

must determine whether particular investments are appropriate for

their clients. FTA believes the financial advisor is a fiduciary,

is capable of evaluating investment risks independently and is

responsible for exercising independent judgment with respect to its

retirement plan clients.

This press release does not constitute an offer to sell or a

solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or

qualification under the laws of such state or jurisdiction.

Source: First Trust Advisors L.P.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200915006293/en/

Press Inquiries Jane Doyle 630-765-8775

Analyst Inquiries Jeff Margolin 630-765-7643

Broker Inquiries Jeff Margolin 630-765-7643

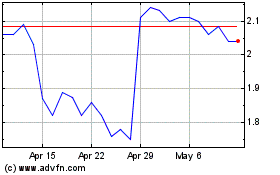

Phoenix New Media (NYSE:FENG)

Historical Stock Chart

From Mar 2024 to Apr 2024

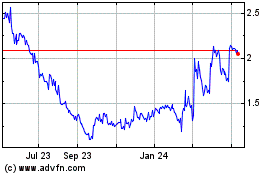

Phoenix New Media (NYSE:FENG)

Historical Stock Chart

From Apr 2023 to Apr 2024