Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 09 2020 - 6:07AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-232863

June 8, 2020

PRICING TERM SHEET

|

|

|

|

|

Issuer:

|

|

Phillips 66

|

|

|

|

|

Guarantor:

|

|

Phillips 66 Company

|

|

|

|

|

Ratings*:

|

|

A3 (Moody’s); BBB+ (S&P)

|

|

|

|

|

Issue of Securities:

|

|

3.850% Senior Notes due 2025 (the “Additional 2025 Notes”)

|

|

|

|

|

Principal Amount:

|

|

$150,000,000. The Additional 2025 Notes will be part of the same series of notes as the $500,000,000 aggregate principal amount of 3.850% Senior Notes due 2025 issued and sold by the Company on April 9, 2020 (the “Existing

2025 Notes”). Upon settlement, the Additional 2025 Notes will be treated as a single series with the Existing 2025 Notes, and the aggregate principal amount of the Existing 2025 Notes and Additional 2025 Notes will be $650,000,000.

|

|

|

|

|

Coupon:

|

|

3.850%

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually on April 9 and October 9, commencing on October 9, 2020

|

|

|

|

|

Maturity Date:

|

|

April 9, 2025

|

|

|

|

|

Treasury Benchmark:

|

|

0.250% due May 31, 2025

|

|

|

|

|

U.S. Treasury Yield:

|

|

0.450%

|

|

|

|

|

Spread to Treasury:

|

|

80 bps

|

|

|

|

|

Re-offer Yield:

|

|

1.250%

|

|

|

|

|

Initial Price to Public:

|

|

111.947% of principal amount, plus accrued interest of $978,541.67 from April 9, 2020 to, but excluding, June 10, 2020

|

|

|

|

|

Optional Redemption:

|

|

Prior to March 9, 2025 (the date that is one month prior to the maturity date of the Additional 2025 Notes), the Company may elect to redeem any or all of the Additional 2025 Notes, at any time in principal amounts of $2,000 or

any integral multiple of $1,000 above that amount. The Company will pay an amount equal to the principal amount of Additional 2025 Notes redeemed plus a make-whole premium. The Company will also pay accrued but unpaid interest to, but not including,

the redemption date. Beginning on March 9, 2025, the Company may redeem the Additional 2025 Notes at a redemption price equal to 100% of the principal amount of the Additional 2025 Notes, plus accrued but unpaid interest thereon to, but not

including, the redemption date.

|

|

|

|

|

Make-Whole Spread:

|

|

T + 50 bps

|

|

|

|

|

Settlement Date:

|

|

June 10, 2020

|

|

|

|

|

Settlement Cycle:

|

|

T+2

|

|

|

|

|

Day Count Convention:

|

|

30 / 360

|

|

|

|

|

CUSIP / ISIN:

|

|

718546 AV6 / US718546AV68

|

|

|

|

|

|

|

|

|

Denomination:

|

|

$2,000 and increments of $1,000 in excess thereof

|

|

|

|

|

Joint Book-Running Managers:

|

|

BNP Paribas Securities Corp.

Goldman Sachs & Co. LLC

MUFG Securities Americas Inc.

Scotia Capital (USA) Inc.

Commerz Markets LLC

RBC Capital Markets, LLC

Barclays Capital Inc.

BofA Securities,

Inc.

Citigroup Global Markets Inc.

Mizuho Securities USA LLC

TD Securities (USA) LLC

Credit Suisse Securities (USA) LLC

J.P. Morgan Securities LLC

SMBC Nikko Securities America, Inc.

Wells Fargo Securities, LLC

|

|

|

|

|

Co-Managers:

|

|

SunTrust Robinson Humphrey, Inc.

BMO Capital Markets Corp.

CIBC World Markets Corp.

Credit Agricole Securities (USA) Inc.

HSBC Securities (USA) Inc.

PNC Capital Markets LLC

Siebert Williams Shank &

Co., LLC

U.S. Bancorp Investments, Inc.

UniCredit Capital Markets LLC

|

* Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling BNP Paribas

Securities Corp. toll free at 1-800-854-5674, Goldman Sachs & Co. LLC toll free at 1-866-471-2526, MUFG Securities Americas Inc. toll free at

1-877-649-6848 or Scotia Capital (USA) Inc. toll free at 1-800-372-3930.

|

|

|

|

|

Issuer:

|

|

Phillips 66 (the “Company”)

|

|

|

|

|

Guarantor:

|

|

Phillips 66 Company

|

|

|

|

|

Ratings*:

|

|

A3 (Moody’s); BBB+ (S&P)

|

|

|

|

|

Issue of Securities:

|

|

2.150% Senior Notes due 2030 (the “2030 Notes”)

|

|

|

|

|

Principal Amount:

|

|

$850,000,000

|

|

|

|

|

Coupon:

|

|

2.150%

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually on June 15 and December 15, commencing on December 15, 2020

|

|

|

|

|

Maturity Date:

|

|

December 15, 2030

|

|

|

|

|

Treasury Benchmark:

|

|

0.625% due May 15, 2030

|

|

|

|

|

U.S. Treasury Yield:

|

|

0.882%

|

|

|

|

|

Spread to Treasury:

|

|

130 bps

|

|

|

|

|

Re-offer Yield:

|

|

2.182%

|

|

|

|

|

Initial Price to Public:

|

|

99.701% of principal amount, plus accrued interest, if any, from June 10, 2020

|

|

|

|

|

Optional Redemption:

|

|

Prior to September 15, 2030 (the date that is three months prior to the maturity date of the 2030 Notes), the Company may elect to redeem any or all of the 2030 Notes, at any time in principal amounts of $2,000 or any integral

multiple of $1,000 above that amount. The Company will pay an amount equal to the principal amount of 2030 Notes redeemed plus a make-whole premium. The Company will also pay accrued but unpaid interest to, but not including, the redemption date.

Beginning on September 15, 2030, the Company may redeem the 2030 Notes at a redemption price equal to 100% of the principal amount of the 2030 Notes, plus accrued but unpaid interest thereon to, but not including, the redemption date.

|

|

|

|

|

Make-Whole Spread:

|

|

T + 20 bps

|

|

|

|

|

Settlement Date:

|

|

June 10, 2020

|

|

|

|

|

Settlement Cycle:

|

|

T+2

|

|

|

|

|

Day Count Convention:

|

|

30 / 360

|

|

|

|

|

CUSIP / ISIN:

|

|

718546 AW4 / US718546AW42

|

|

|

|

|

Denomination:

|

|

$2,000 and increments of $1,000 in excess thereof

|

|

|

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

BNP Paribas Securities Corp.

Goldman Sachs & Co. LLC

MUFG Securities Americas Inc.

Scotia Capital (USA) Inc.

Commerz Markets LLC

RBC Capital Markets, LLC

Barclays Capital Inc.

BofA Securities,

Inc.

Citigroup Global Markets Inc.

Mizuho Securities USA LLC

TD Securities (USA) LLC

Credit Suisse Securities (USA) LLC

J.P. Morgan Securities LLC

SMBC Nikko Securities America, Inc.

Wells Fargo Securities, LLC

|

|

|

|

|

Co-Managers:

|

|

SunTrust Robinson Humphrey, Inc.

BMO Capital Markets Corp.

CIBC World Markets Corp.

Credit Agricole Securities (USA) Inc.

HSBC Securities (USA) Inc.

PNC Capital Markets LLC

Siebert Williams Shank &

Co., LLC

U.S. Bancorp Investments, Inc.

UniCredit Capital Markets LLC

|

* Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling BNP Paribas

Securities Corp. toll free at 1-800-854-5674, Goldman Sachs & Co. LLC toll free at 1-866-471-2526, MUFG Securities Americas Inc. toll free at

1-877-649-6848 or Scotia Capital (USA) Inc. toll free at 1-800-372-3930.

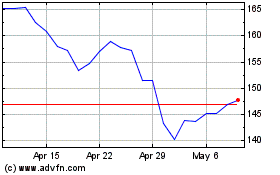

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

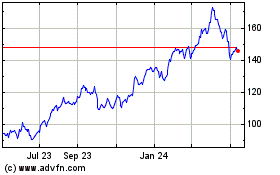

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Apr 2023 to Apr 2024