Altria Sees Smoker Shift From Vaping To Cheap Cigarettes -- WSJ

May 01 2020 - 3:02AM

Dow Jones News

By Jennifer Maloney

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 1, 2020).

Older smokers who had switched to e-cigarettes are turning back

to traditional cigarettes because of negative news coverage and

regulatory crackdowns on vaping, Marlboro maker Altria Group Inc.

said Thursday.

But those people are mostly buying discount cigarettes, a trend

that is cutting into Marlboro's market share and is likely to

continue as the economic downturn takes hold and cigarette smokers

trade down to cheaper brands, Altria Chief Executive Billy Gifford

said.

Smokers age 50 and over, who have driven the shift, are more

likely to buy discount cigarettes than younger consumers are, Mr.

Gifford said. Marlboro's U.S. cigarette market share fell half a

percentage point to 42.8% in the first quarter of the year.

Last year, U.S. health officials investigating a vaping-related

lung illness warned against the use of e-cigarettes before they

said that the ailment was linked not to e-cigarettes, but to vaping

products containing marijuana and Vitamin E oil. The Food and Drug

Administration also early this year barred the sale of sweet and

fruity flavored e-cigarette cartridges in an effort to curb a rise

in underage vaping.

The FDA, noting that cigarette smoking is the most dangerous way

to consume nicotine, has encouraged adult smokers to switch to less

harmful products such as e-cigarettes.

U.S. retail-store sales of e-cigarettes have fallen over seven

of the past nine four-week periods, according to a Cowen analysis

of Nielsen data.

Altria said the coronavirus hasn't yet had a material impact on

its sales, as convenience stores and other retail outlets where

cigarettes are sold have largely remained open. The tobacco giant

withdrew its earnings guidance, but said its generous dividend

remained a top priority and that it was maintaining a dividend

payout ratio target of 80% of adjusted diluted earnings per

share.

"The degree of down-trading will depend on several factors

including the depth and duration of higher unemployment and the

severity of Covid-19 impacts," Mr. Gifford said Thursday on a call

with analysts and reporters. The company noted that it could be

offset by lower gasoline prices, increased unemployment benefits

and government stimulus payments.

Altria recently refreshed its Chesterfield brand, a discount

offering the company is marketing to smokers age 40 and older, Mr.

Gifford said.

The tobacco giant has a 35% stake in Juul Labs Inc., the

e-cigarette market leader. Juul recorded a $1 billion loss in 2019

as it expanded its workforce and its international footprint, and

is now planning to cut about a third of its staff, The Wall Street

Journal reported Wednesday.

"We feel like the overhead got a bit ahead of itself," Mr.

Gifford said Thursday, referring to Juul. "We certainly believe the

reduction in overhead and that kind of spending is a smart move to

make."

Altria reopened its cigarette factory this month after a

two-week closure because two employees had tested positive for the

virus. The tobacco giant also has paused the rollout of a new

heated tobacco device because of the pandemic.

Altria launched the product in the U.S. last year through a

partnership with Philip Morris International Inc. The rollout of

its IQOS device, which heats but doesn't burn tobacco, began in

Atlanta and Richmond, Va. In March, the company closed its

standalone IQOS stores in those cities, where the sales staff had

been coaching consumers, one-on-one, on how to use it. On Thursday,

Altria said it would delay its planned release in Charlotte,

N.C.

Altria's cigarette shipment volume fell in the quarter by 3.5%

when adjusted for trade inventories, calendar differences and other

factors. When also adjusted for pantry-loading, it fell by 5%

compared with 3.5% for the overall U.S. cigarette industry, Mr.

Gifford said.

Revenue increased 13% to $6.36 billion, topping the FactSet

consensus forecast of $5.79 billion. Net income rose to $1.55

billion, or 83 cents a share, compared with $1.12 billion, or 60

cents a share, a year ago. Adjusted earnings per share were $1.09,

above the FactSet consensus forecast of 98 cents.

Shares of the company rose about 2% to $41.30 in early trading

Thursday.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

May 01, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

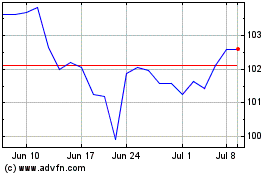

Philip Morris (NYSE:PM)

Historical Stock Chart

From Mar 2024 to Apr 2024

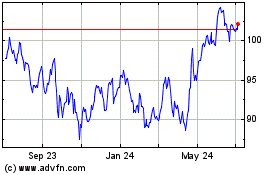

Philip Morris (NYSE:PM)

Historical Stock Chart

From Apr 2023 to Apr 2024