Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 30 2020 - 6:14AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-236366

FINAL TERM SHEET

Philip

Morris International Inc.

Dated April 29, 2020

1.125% Notes due 2023

1.500%

Notes due 2025

2.100% Notes due 2030

|

|

|

|

|

Issuer:

|

|

Philip Morris International Inc.

|

|

|

|

|

Offering Format:

|

|

SEC Registered

|

|

|

|

|

Security:

|

|

1.125% Notes due 2023 (the “2023 Notes”)

1.500% Notes due 2025 (the “2025 Notes”)

2.100% Notes due 2030 (the “2030 Notes”)

|

|

|

|

|

Aggregate Principal Amount:

|

|

2023 Notes: $750,000,000

2025 Notes: $750,000,000

2030 Notes: $750,000,000

|

|

|

|

|

Maturity Date:

|

|

2023 Notes: May 1, 2023

2025 Notes: May 1, 2025

2030 Notes: May 1, 2030

|

|

|

|

|

Coupon:

|

|

2023 Notes: 1.125%

2025 Notes: 1.500%

2030 Notes: 2.100%

|

|

|

|

|

Interest Payment Dates:

|

|

2023 Notes: Semi-annually on each May 1 and November 1, commencing November 1, 2020

2025 Notes: Semi-annually on each May 1 and November 1, commencing November 1, 2020

2030 Notes: Semi-annually on each May 1 and November 1, commencing November 1, 2020

|

|

|

|

|

Record Dates:

|

|

2023 Notes: April 15 and October 15

2025 Notes: April 15 and October 15

2030 Notes: April 15 and October 15

|

|

|

|

|

Price to Public:

|

|

2023 Notes: 99.665% of principal amount

2025 Notes: 99.512% of principal amount

2030 Notes: 99.383% of principal amount

|

|

|

|

|

|

Underwriting Discount:

|

|

2023 Notes: 0.200% of principal amount

2025 Notes: 0.300% of principal amount

2030 Notes: 0.450% of principal amount

|

|

|

|

|

Net Proceeds:

|

|

2023 Notes: $745,987,500 (before expenses)

2025 Notes: $744,090,000 (before expenses)

2030 Notes: $741,997,500 (before expenses)

|

|

|

|

|

Benchmark Treasury:

|

|

2023 Notes: 0.250% due April 15, 2023

2025 Notes: 0.500% due March 31, 2025

2030 Notes: 1.500% due February 15, 2030

|

|

|

|

|

Benchmark Treasury Price/Yield:

|

|

2023 Notes: 100-01 / 0.239%

2025 Notes: 100-23 / 0.352%

2030 Notes: 108-11+ / 0.619%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

2023 Notes: +100 basis points

2025 Notes: +125 basis points

2030 Notes: +155 basis points

|

|

|

|

|

Yield to Maturity:

|

|

2023 Notes: 1.239%

2025 Notes: 1.602%

2030 Notes: 2.169%

|

|

|

|

|

Optional Redemption:

|

|

2023 Notes: Make-whole redemption at Treasury plus 15 bps at any time

2025 Notes:

Prior to April 1, 2025: Make-whole redemption at Treasury plus 20 bps

On or after April 1, 2025: Redemption at par

2030 Notes:

Prior to February 1, 2030: Make-whole redemption at Treasury plus 25 bps

On or after February 1, 2030: Redemption at par

|

|

|

|

|

Settlement Date (T+2):

|

|

May 1, 2020

|

|

|

|

|

CUSIP/ISIN:

|

|

2023 Notes: CUSIP Number: 718172 CQ0

ISIN Number: US718172CQ07

2025

Notes: CUSIP Number: 718172 CN7

ISIN Number: US718172CN75

2030

Notes: CUSIP Number: 718172 CP2

ISIN Number: US718172CP24

|

|

|

|

|

Listing:

|

|

None

|

|

|

|

|

Joint Book-Running Managers:

|

|

Banca IMI S.p.A.

BBVA Securities Inc.

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc.

Goldman Sachs & Co. LLC

Mizuho Securities USA LLC

SMBC Nikko Securities America, Inc.

|

|

|

|

|

|

Co-Managers:

|

|

BofA Securities, Inc.

Commerz Markets LLC

UBS Securities LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allocations:

|

|

2023 Notes

|

|

|

2025 Notes

|

|

|

2030 Notes

|

|

|

Banca IMI S.p.A.

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

BBVA Securities Inc.

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

Citigroup Global Markets Inc.

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

Deutsche Bank Securities Inc.

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

Goldman Sachs & Co. LLC

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

Mizuho Securities USA LLC

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

SMBC Nikko Securities America, Inc.

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

$

|

97,500,000

|

|

|

BofA Securities, Inc.

|

|

$

|

22,500,000

|

|

|

$

|

22,500,000

|

|

|

$

|

22,500,000

|

|

|

Commerz Markets LLC

|

|

$

|

22,500,000

|

|

|

$

|

22,500,000

|

|

|

$

|

22,500,000

|

|

|

UBS Securities LLC

|

|

$

|

22,500,000

|

|

|

$

|

22,500,000

|

|

|

$

|

22,500,000

|

|

|

Total

|

|

$

|

750,000,000

|

|

|

$

|

750,000,000

|

|

|

$

|

750,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Banca IMI S.p.A. toll

free at 1-800-477-9296, BBVA Securities Inc. toll free at 1-800-266-7277, Citigroup Global Markets Inc. toll free at 1-800-831-9146,

Deutsche Bank Securities Inc. toll free at 1-800-503-4611, Goldman Sachs & Co. LLC toll free at 1-866-471-2526, Mizuho Securities USA LLC toll free at 1-866-271-7403, and SMBC Nikko Securities America, Inc. toll free at

1-888-868-6856.

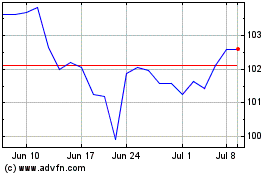

Philip Morris (NYSE:PM)

Historical Stock Chart

From Mar 2024 to Apr 2024

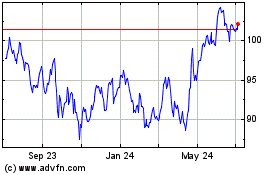

Philip Morris (NYSE:PM)

Historical Stock Chart

From Apr 2023 to Apr 2024