Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

October 14 2020 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO

RULE 13A-16 OR 15D-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month

of October 2020

Commission File

Number 001-15106

PETRÓLEO

BRASILEIRO S.A. - PETROBRAS

(Exact name of

registrant as specified in its charter)

Brazilian Petroleum

Corporation - PETROBRAS

(Translation of

Registrant's name into English)

Avenida República

do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

PETROBRAS ANNOUNCES THE PRICING OF

U.S. DOLLAR-DENOMINATED GLOBAL NOTES

RIO DE JANEIRO, BRAZIL – OCTOBER 13, 2020 –

Petróleo Brasileiro S.A. – Petrobras (“Petrobras”) (NYSE: PBR) announces the pricing of an

offering (the “Reopening”) of additional notes of its 5.600% Global Notes due 2031 (CUSIP No. 71647NBH1/

ISIN No. US71647NBH17) (the “Notes”) to be issued by its wholly-owned subsidiary Petrobras Global Finance

B.V. (“PGF”). The Notes will be unsecured obligations of PGF and will be fully and unconditionally guaranteed

by Petrobras. The additional Notes will be consolidated, form a single series, and be fully fungible with, PGF’s outstanding

U.S.$1,500,000,000 aggregate principal amount of 5.600% Global Notes due 2031 issued on June 3, 2020. Settlement is expected

to occur on October 21, 2020.

The terms of the 5.600% Global Notes due 2031 are as follows:

|

|

•

|

Issue: 5.600% Global Notes due 2031

|

|

|

•

|

Reopening Principal Amount: US$ 1,000,000,000, for an aggregate principal amount for the series of US$ 2,500,000,000

|

|

|

•

|

Reopening Price: 109.579 % of principal amount, plus accrued and unpaid interest from, and including, June 3, 2020 to,

but excluding, the settlement date of the Notes

|

|

|

•

|

Yield to Worst: 4.400 % (calculated as yield to October 3, 2030, the Notes’ first par call date)

|

|

|

•

|

Interest Payment Dates: January 3 and July 3 of each year, commencing on January 3, 2021

|

|

|

•

|

Maturity: January 3, 2031

|

PGF intends to use the net proceeds from the sale of the Notes

to repurchase its 4.375% Global Notes due 2023, 4.250% Global Notes due 2023, 6.250% Global Notes due 2024, 4.750% Global Notes

due 2025, 5.299% Global Notes due 2025, 8.750% Global Notes due 2026, 7.375% Global Notes due 2027, 5.999% Global Notes due 2028,

5.750% Global Notes due 2029 and 5.093% Global Notes due 2030, in each case that PGF accepts for purchase in the tender offers

announced concurrently with the offering of the Notes, and to use any remaining net proceeds for general corporate purposes.

This announcement is for informational purposes only, and does

not constitute an offer to purchase or sell or a solicitation of an offer to sell or purchase any securities. There shall be no

offer or sale of the Notes in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction.

In any Member State of the European Economic Area (“EEA”)

or in the United Kingdom (the “UK”) (each, a “Relevant State”), this announcement is addressed

to and directed at qualified investors in that Relevant State within the meaning of the Prospectus Regulation (EU) 2017/1129. Consequently,

no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for

offering or selling the Notes or otherwise making them available to retail investors in the EEA or in the UK has been prepared

and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA or in the UK may

be unlawful under the PRIIPs Regulation.

The communication of this announcement and any other documents

or materials relating to the Notes is not being made and such documents and/or materials have not been approved by an authorized

person for the purposes of Section 21 of the Financial Services and Markets Act 2000. This announcement and any other documents

related to the Notes are for distribution only to persons who (i) have professional experience in matters relating to investments

falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”),

(ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations

etc.”) of the Order, (iii) are outside the United Kingdom, or (iv) are persons to whom an invitation or inducement

to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000) in connection

with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons

together being referred to as “relevant persons”). This announcement and any other documents related to the

Notes are directed only at Relevant Persons and must not be acted on or relied on by persons who are not relevant persons. Any

investment or investment activity to which this announcement and any other documents related to the Notes are available only to

relevant persons and will be engaged in only with relevant persons.

Forward-Looking Statements

This announcement contains forward-looking statements. Forward-looking

statements are information of a non-historical nature or which relate to future events and are subject to risks and uncertainties.

No assurance can be given that the transactions described herein will be consummated or as to the ultimate terms of any such transactions.

Petrobras undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information

or future events or for any other reason.

This report on Form 6-K shall be deemed to be incorporated

by reference into the Offer to Purchase dated October 13, 2020, relating to the previously announced tender offers by Petrobras

Global Finance B.V., a wholly-owned subsidiary of Petróleo Brasileiro S.A. – Petrobras.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

PETRÓLEO

BRASILEIRO S.A.—PETROBRAS

|

|

|

|

|

|

By:

|

/s/ Guilherme Rajime T. Saraiva

|

|

|

Name:

|

Guilherme Rajime T. Saraiva

|

|

|

Title:

|

Attorney in Fact

|

Date: October 14, 2020

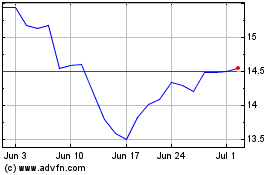

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

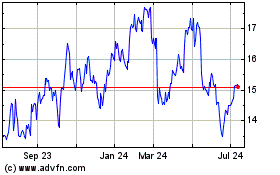

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024