UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2021

Commission File Number: 001-35563

PEMBINA PIPELINE CORPORATION

(Name of registrant)

(Room #39-095) 4000, 585 8th Avenue S.W.

Calgary, Alberta T2P 1G1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PEMBINA PIPELINE CORPORATION |

|

| |

|

|

| |

|

|

|

|

|

|

| Date: December 8, 2021 |

By: |

/s/ Scott Burrows |

|

|

|

Name: Scott Burrows |

|

|

|

Title: Interim Chief Executive Officer |

|

|

|

|

Form

6-K Exhibit Index

Exhibit

99.1

Pembina Pipeline Corporation Announces 2022 Guidance,

Business Update and Additional ESG Targets

All financial figures are approximate and in Canadian

dollars unless otherwise noted. This news release refers to adjusted earnings before interest, taxes, depreciation and amortization ("adjusted

EBITDA"), which is a financial measure that is not defined by Generally Accepted Accounting Principles ("GAAP"), being

international Financial Reporting Standards, as issued by the International Accounting Standards Board. For more information see "Non-GAAP

Financial Measures" herein.

CALGARY, AB, Dec. 8, 2021 /CNW/ - Pembina Pipeline

Corporation ("Pembina" or the "Company") (TSX: PPL) (NYSE: PBA) is pleased to provide its 2022 financial guidance

and deliver an end-of-year business update.

Highlights

- 2022 adjusted EBITDA of $3.35 to $3.55 billion and a 2022 capital

investment program of $655 million.

- Cash flow from operating activities is expected to exceed dividends

and the capital investment program in 2022. As such, Pembina expects to allocate up to the first $200 million of the excess towards common

share repurchases, with the balance available for incremental capital investment if sanctioned, debt repayment, or additional distribution

to shareholders.

- The estimated capital cost of Peace Pipeline Expansion Phase VII

("Phase VII") has been revised lower by $110 million, to $665 million, and the expected in-service date has been advanced to

mid-2022.

- Executed an agreement with a second Montney producer for liquids

transportation service for volumes from development of the producer's northeast British Columbia ("NEBC") Montney acreage.

- Successfully contracted 76 percent of the capacity on Alliance

Pipeline ("Alliance"), which was set to expire on October 31, 2022, with an average contract length of nearly four years.

- Set additional environmental, social and governance ("ESG")

targets related to employee equity, diversity and inclusion, with a focus on advancing representation of women and other underrepresented

groups at all levels of the organization.

- Continue to progress pre-final investment decision development

activities for the Cedar LNG project ("Cedar LNG").

Business Update

As we close out 2021 and look ahead to 2022, it is

with a continued sense of optimism at what is possible for Pembina and its stakeholders. Our energy producing customers continue to generate

significant discretionary cash flow, consolidate smaller companies, thereby improving their execution capabilities and overall credit

profiles, and strengthen their balance sheets. Pembina is poised to benefit from a promising outlook for the NEBC Montney and Alberta

Duvernay areas, as well as through feedstock demand growth from a resurgent Alberta petrochemical industry, as evidenced by recent third-party

project announcements with support from the Government of Alberta's petrochemical diversification program.

As we strive towards our vision to be the leader in

delivering integrated infrastructure solutions and connecting customers to global markets, Pembina is also taking steps to reduce its

environmental footprint, enhance employee equity, diversity and inclusion, and partner with Indigenous communities in the development

of Canadian energy projects. We are excited about these initiatives and our strong commitment to ESG is being demonstrated by the ambitious

new projects, partnerships and targets we have announced this year.

Alliance Pipeline

Recent open seasons on Alliance have enhanced its

contractual profile. An open season completed at the end of September, for capacity in the 2021/2022 gas year, was nearly three times

oversubscribed, resulting in Alliance being essentially fully contracted for the 2021/2022 gas year, beginning November 1, 2021. An

additional open season was recently completed for longer-term capacity, including the 2022/2023 gas year, which begins November 1, 2022.

As a result of the open season and contract renewal efforts, 76 percent of the full path capacity set to expire October 31, 2022 was successfully

contracted on terms with an average contract length of nearly four years, beginning November 1, 2022. The desire of shippers to secure

longer-term capacity over exercising their annual renewal rights highlights the value of Alliance's reliable and highly competitive access

to mid-western U.S. gas markets, and as a conduit to the Gulf Coast and its robust liquefied natural gas market. The results of both recent

open seasons, along with improved market fundamentals, support the prospects for additional contracting over the coming months.

Peace Pipeline Expansions

In response to customer demand for services, including

to accommodate volume growth in the NEBC Montney, Pembina continues to pursue a measured, capital efficient, economic, and orderly expansion

of its Peace Pipeline System.

- Phase VII continues to trend under budget and ahead of schedule.

As such, the capital cost estimate for the project has been revised lower, by $110 million, to $665 million, reflecting highly effective

project management, favorable weather conditions and well performing contractors. Phase VII is now anticipated to be in service in mid-2022.

- The Phase VIII Peace Pipeline Expansion ("Phase VIII")

remains deferred. Initial contracts supporting the project remain intact and customers continue to signal plans that will necessitate

the incremental capacity. Value engineering work is ongoing, and Pembina continues to evaluate this project in discussions with its producing

customers. Due to ongoing uncertainty around development timing in NEBC stemming from ongoing discussion between the British Columbia

government and First Nations communities, a reactivation decision previously expected in the fourth quarter of 2021 is now expected in

the first half of 2022.

- The Phase IX Peace Pipeline Expansion ("Phase IX") will

add capacity in the northwest Alberta-to-Gordondale, Alberta corridor to accommodate increased activity in the NEBC Montney play. Construction

on a pump station has commenced and clearing activity for the pipeline is expected to begin in January 2022. Phase IX remains on-time

and on-budget with an estimated cost of approximately $120 million and an expected in-service date in the second half of 2022.

NEBC Producer Commitments

As previously announced earlier in 2021, Pembina has

entered into an exclusivity agreement with, and concurrently provided an irrevocable offer for, midstream services to a premiere NEBC

Montney producer. The exclusivity agreement provides a bridge to negotiation of definitive agreements for transportation and fractionation

("T&F") of a material volume of liquids and NGL mix from certain NEBC Montney lands. Negotiations have progressed well,

and Pembina and the producer expect to execute definitive agreements in early 2022. All new firm T&F services provided under the proposed

arrangement would be supported by long-term, take-or-pay agreements.

In addition, Pembina recently executed a new agreement

with a second Montney producer, which commits to Pembina volumes from a multiphase development of the producer's NEBC Montney

acreage, on a take-or-pay basis, upon the acreage being developed. The agreement provides the producer with certainty of transportation

egress from this key area for their future development and access to the remainder of Pembina's integrated value chain.

Cedar LNG Project

In partnership with the Haisla Nation, development

of Cedar LNG continues to progress. Cedar LNG will have a liquefaction capacity of approximately three million tonnes per annum of LNG

and will source natural gas from the Montney resource play in NEBC. Cedar LNG will be the largest First Nation-owned infrastructure project

in Canada and by utilizing renewable power as its primary energy source, will have one of the cleanest environmental profiles of any LNG

facility in the world. Front end engineering and design ("FEED") activities are currently underway and will continue through

2022. Early FEED work has already identified opportunities to optimize the site layout, thereby considerably reducing the project footprint

and local area disturbance.

Hythe Deep Cut

Veresen Midstream is evaluating the opportunity to

construct a 200 million cubic feet per day ("mmcf/d") deep cut NGL extraction facility ("Hythe Deep Cut") at the Hythe

Gas Plant. As previously announced, Veresen Midstream has secured an option from two key customers for NGL extraction rights on up to

750 mmcf/d of natural gas. The design would leverage Pembina's existing Saturn I/II design and enable recovery of approximately 6,000

barrels per day ("bpd") of propane-plus, as well as the ability to recover approximately 8,500 bpd of ethane for minimal incremental

capital. With existing connectivity between the Hythe Gas Plant and Peace Pipeline, the extracted NGL would be transported, fractionated

and marketed by Pembina. A final investment decision on the Hythe Deep Cut is expected in the first half of 2022.

2022 Guidance

Based on the Company's expectations and outlook for

2022, Pembina is anticipating adjusted EBITDA of $3.35 to $3.55 billion. Relative to 2021, adjusted EBITDA next year is expected to be

impacted largely by the following factors:

- Continued strength in NGL pricing and lower realized losses on

commodity-related derivatives; the Company has hedged approximately 50 percent of its 2022 frac spread exposure, excluding Aux Sable,

offset by higher average cost of inventory.

- Higher volumes on existing assets within the conventional pipelines

and gas processing businesses.

- Contributions from assets to be placed into service in 2022 including

Phase VII, Phase IX and Empress Cogeneration.

- Higher volumes at Veresen Midstream's Dawson Assets and a full-year

contribution from assets placed into service in the Facilities Division in 2021, including Hythe Developments and Prince Rupert Terminal.

- Higher integrity costs and other operating expenses, a portion

of which are not recoverable from customers.

- Lower contribution from select assets due to contract expirations.

- Increased spending on continuous improvement initiatives to support

long-term cost reduction efforts.

Current income tax expense in 2022 is anticipated

to be $325 to $375 million, as Pembina will continue to benefit from the availability of tax pools from assets recently placed into service.

After adjusting for the 2021 current tax expense on the termination fee payment related to the proposed acquisition of Inter Pipeline

Ltd., the year-over-year increase reflects primarily higher current tax expense on increased earnings.

Pembina's 2022 adjusted EBITDA may be directly impacted

by certain commodity prices and foreign exchange rates, amongst other items, including the impact of Pembina's hedging program as follows:

| Key Variable |

Impact on Adjusted EBITDA

($ millions) |

| |

|

| AECO ± $0.50 CAD/GJ |

± 39 |

| Propane ± $0.10 USD/usg |

± 38 |

| Foreign Exchange Rate ± $0.05 USD/CAD |

± 37 |

| Share Price ± $5.00 CAD/share |

± 11 |

2022 Capital Investment

Pembina's 2022 capital program is expected to be allocated

as follows:

| ($ millions) |

2022 Budget (1) |

| Pipelines Division |

$350 |

| Facilities Division |

$140 |

| Marketing & New Ventures Division |

$40 |

| Corporate |

$35 |

| Capital Expenditures |

$565 |

| Contributions to Equity Accounted Investees & Advances to Related Parties |

$90 |

| Capital Expenditures and Contributions to Equity Accounted Investees & Advances to Related Parties |

$655 |

| (1) Capital budget shown in Canadian dollars based on a forecasted average USD/CAD exchange rate of 1.27. |

Pembina's Pipelines Division capital investments will

be primarily related to the construction of Phase VII and Phase IX, in addition to remaining capital to be spent on projects previously

placed into service and smaller growth projects, including various new laterals and terminals.

Capital investments in the Facilities Division will

be focused on completion of Empress Co-generation Facility.

Marketing and New Ventures Division capital investments

include the cost of line fill for Phase VII and Phase IX and advancing Pembina's portfolio of unsecured development opportunities, including

Alberta Carbon Grid.

Spending within the Corporate segment is primarily

targeted at information technology enhancements to further the Company's continuous improvement initiatives to support long-term cost

reduction efforts.

Contributions to Equity Accounted Investees &

Advances to Related Parties primarily relate to development of Cedar LNG and contributions to Veresen Midstream.

The Company's 2022 capital program includes:

- $125 million of non-recoverable sustaining capital to support

safe and reliable operations.

- $60 million for administrative capital including technology and

commercial systems investments.

2022 Capital Allocation

Pembina has a proven track record of generating long-term

shareholder value through capital investment and over the long term will continue to prioritize allocating capital to growth projects

with attractive risk-adjusted returns. Cash flow from operating activities is expected to exceed dividends and the capital investment

program in 2022. Pembina expects to allocate up to the first $200 million of excess cash flow to common share repurchases during the first

half of the year, representing approximately one percent of the Company's common shares. Additional cash flow will be available for incremental

capital investment if sanctioned, debt repayment, or additional distribution to shareholders. Pembina will also continue to evaluate

the merits of dividend growth relative to other opportunities for capital allocation as 2022 evolves, particularly in consideration of

the dividend yield on Pembina's common shares.

Pembina expects to remain firmly within its financial

guardrails with ample liquidity. Leverage metrics are expected to remain within the ranges for a strong 'BBB' credit rating with a debt-to-adjusted

EBITDA ratio of 3.4 to 3.6 times.

Additional Environmental, Social and Governance

Targets

Committed to diversity, equal opportunity and ensuring

a safe and inclusive workplace, Pembina is pleased to announce the following employee equity, diversity and inclusion targets. These targets

support the work being done across the organization to advance ESG priorities, including to increase the representation of women and other

underrepresented groups at all levels of the organization. Pembina is committed to achieving the following targets over the next three

years:

- 35 percent women in the overall workforce by 2025.

- 30 percent women in executive leadership by 2022.

- 45 percent overall diversity in the workforce by 2025.

- 40 percent overall diversity in executive leadership by 2025.

The targets announced today are in addition to previously

announced Board diversity targets including:

- To maintain gender diversity of Board representation of at least

30 percent.

- That at least 40 percent of the independent directors be individuals

who belong to one of the four designated groups in the Employment Equity Act: Indigenous persons, people with disabilities, people who

are visible minorities, and women.

Building on a strong foundation, these targets are

an important next step in the Pembina's work to integrate sustainable business practices throughout the Company.

Conference Call & Webcast

Pembina will host a webcast and conference call

on Wednesday, December 8, 2021 at 9:00 a.m. MT (11:00 a.m. ET) where the Company's executive team will provide a general

business update, including progress on environmental, social and governance priorities, and outline the Company's 2022 outlook. Randy

Findlay, Chair of Pembina's Board of Directors will also be joining the call to provide a message from the Board. The conference call

dial-in numbers for Canada and the U.S. are 647-792-1240 or 800-437-2398. A recording of the conference call will be available

for replay until December 15, 2021 at 11:59 p.m. ET. To access the replay, please dial either 647-436-0148 or 888-203-1112

and enter the password 6464560.

A live webcast of the conference call can be accessed

on Pembina's website at www.pembina.com under Investor Centre/ Presentation & Events, or by entering:

https://produceredition.webcasts.com/starthere.jsp?ei=1499099&tp_key=9492e908e4

in your web browser. Shortly after the call, the presentation and an archive of the webcast will be posted on Pembina's website for a

minimum of 90 days at https://www.pembina.com/investors/presentations-events/.

About Pembina

Calgary-based Pembina Pipeline Corporation is a leading

transportation and midstream service provider that has been serving North America's energy industry for more than 65 years. Pembina owns

an integrated system of pipelines that transport various hydrocarbon liquids and natural gas products produced primarily in western Canada.

The Company also owns gas gathering and processing facilities; an oil and natural gas liquids infrastructure and logistics business; and

is growing an export terminals business. Pembina's integrated assets and commercial operations along the majority of the hydrocarbon value

chain allow it to offer a full spectrum of midstream and marketing services to the energy sector. Pembina is committed to identifying

additional opportunities to connect hydrocarbon production to new demand locations through the development of infrastructure that would

extend Pembina's service offering even further along the hydrocarbon value chain. These new developments will contribute to ensuring that

hydrocarbons produced in the Western Canadian Sedimentary Basin and the other basins where Pembina operates can reach the highest value

markets throughout the world.

Purpose of Pembina:

To be the leader in delivering integrated infrastructure

solutions connecting global markets:

- Customers choose us first for reliable and value-added

services.

- Investors receive sustainable industry-leading total returns.

- Employees say we are the 'employer of choice' and value

our safe, respectful, collaborative and inclusive work culture.

- Communities welcome us and recognize the net positive impact

of our social and environmental commitment.

Pembina is structured into three Divisions: Pipelines

Division, Facilities Division and Marketing & New Ventures Division.

Pembina's common shares trade on the Toronto and New

York stock exchanges under PPL and PBA, respectively. For more information, visit www.pembina.com.

Forward-Looking Information and Statements

This news release contains certain forward-looking

statements and forward-looking information (collectively, "forward-looking statements"), including forward-looking statements

within the meaning of the "safe harbor" provisions of applicable securities legislation, that are based on Pembina's current

expectations, estimates, projections and assumptions in light of its experience and its perception of historical trends. In some cases,

forward-looking statements can be identified by terminology such as "continue", "anticipate", "schedule",

"will", "expects", "estimate", "potential", "planned", "future", "outlook",

"strategy", "protect", "trend", "commit", "maintain", "focus", "ongoing",

"believe" and similar expressions suggesting future events or future performance.

In particular, this news release contains forward-looking

statements, including certain financial outlooks, pertaining to, without limitation, the following: Pembina's 2022 adjusted EBITDA expectations

and 2022 capital program; Pembina's capital allocation plans, including with respect to share repurchases; Pembina's corporate strategy

and the development and expected timing of new business initiatives and growth opportunities and the expected timing thereof; expectations

about industry activities and development opportunities; expectations about future growth opportunities and the demand for our services;

expectations regarding new corporate developments and their impact on access to markets; planning, construction, capital expenditure and

cost estimates, schedules, locations, regulatory and environmental applications and approvals, expected capacity, incremental volumes,

power output, completion and in-service dates, rights, activities and operations with respect to planned construction of, or expansions

on, existing pipelines systems, gas services facilities, processing and fractionation facilities, terminalling, storage and hub facilities

and other facilities or infrastructure; the impact of current market conditions on Pembina; Pembina's hedging strategy and expected results

therefrom; expected cost savings and efficiencies; Pembina's options for allocating capital, including any common share repurchases; Pembina's

credit ratings; Pembina's ability to maintain its financial guardrails; and Pembina's commitment to and the future level and sustainability

and potential growth of cash dividends that Pembina intends to pay its shareholders, including the expected future cash flows, the sufficiency

and expected uses thereof.

The forward-looking statements are based on certain

assumptions that Pembina has made in respect thereof as at the date of this news release regarding, among other things: oil and gas industry

exploration and development activity levels and the geographic region of such activity; that favourable market conditions exist, and that

Pembina has available capital, for share repurchases; the success of Pembina's operations; prevailing commodity prices, interest rates,

carbon prices, tax rates and exchange rates; the ability of Pembina to maintain current credit ratings; the availability of capital to

fund future capital requirements relating to existing assets and projects; future operating costs; geotechnical and integrity costs; that

all required regulatory and environmental approvals can be obtained on the necessary terms in a timely manner; prevailing regulatory,

tax and environmental laws and regulations; maintenance of operating margins; and certain other assumptions in respect of Pembina's forward-looking

statements detailed in Pembina's Restated Annual Information Form for the year ended December 31, 2020 (the "AIF") and Restated

Management's Discussion and Analysis for the year ended December 31, 2020 (the "Annual MD&A"), which were each filed on

SEDAR on November 18, 2021, in Pembina's Management's Discussion and Analysis for the three and nine months ended September 30, 2021 (the

"Interim MD&A") and from time to time in Pembina's public disclosure documents available at www.sedar.com, www.sec.gov and

through Pembina's website at www.pembina.com.

Although Pembina believes the expectations and

material factors and assumptions reflected in these forward-looking statements are reasonable as of the date hereof, there can be no assurance

that these expectations, factors and assumptions will prove to be correct. These forward-looking statements are not guarantees of future

performance and are subject to a number of known and unknown risks and uncertainties that could cause actual events or results to differ

materially, including, but not limited to: the regulatory environment and decisions and Indigenous and landowner consultation requirements;

the impact of competitive entities and pricing; reliance on third parties to successfully operate and maintain certain assets; the strength

and operations of the oil and natural gas production industry and related commodity prices; nonperformance or default by counterparties

to agreements which Pembina or one or more of its affiliates has entered into in respect of its business; actions by governmental or regulatory

authorities; the ability of Pembina to acquire or develop the necessary infrastructure in respect of future development projects; fluctuations

in operating results; adverse general economic and market conditions in Canada, North America and worldwide; risks relating to the current

and potential adverse impacts of the COVID-19 pandemic; the ability to access various sources of debt and equity capital; changes in credit

ratings; counterparty credit risk; and certain other risks and uncertainties detailed in the AIF, Annual MD&A, Interim MD&A and

from time to time in Pembina's public disclosure documents available at www.sedar.com, www.sec.gov and through Pembina's website at www.pembina.com.

This list of risk factors should not be construed

as exhaustive. Readers are cautioned that events or circumstances could cause actual results to differ materially from those predicted,

forecasted or projected. The forward-looking statements contained in this news release speak only as of the date hereof. Pembina does

not undertake any obligation to publicly update or revise any forward-looking statements or information contained herein, except as required

by applicable laws. Management approved the 2022 adjusted EBITDA guidance contained herein as of the date of this news release. The purpose

of our 2022 adjusted EBITDA guidance is to assist readers in understanding our expected and targeted financial results, and this information

may not be appropriate for other purposes. The forward-looking statements contained in this news release are expressly qualified by this

cautionary statement.

Non-GAAP Financial Measures

Throughout this news release, Pembina has disclosed

certain financial measures that are not specified, defined or determined in accordance with GAAP and which are not disclosed in Pembina's

financial statements. Non-GAAP financial measures either exclude an amount that is included in, or include an amount that is excluded

from, the composition of the most directly comparable financial measure specified, defined or determined in accordance with GAAP. These

non-GAAP financial measures are used by management to evaluate the performance and cash flows of Pembina and its businesses and to provide

additional useful information respecting Pembina's financial performance, financial condition and cash flows to investors and analysts.

In this news release, Pembina has disclosed the

non-GAAP financial measure adjusted EBITDA, which does not have any standardized meaning under GAAP and may not be comparable to similar

financial measures disclosed by other issuers. The measure should not, therefore, be considered in isolation or as a substitute for, or

superior to, measures of Pembina's financial performance, financial position or cash flows specified, defined or determined in accordance

with IFRS, including earnings before income tax.

Except as otherwise described herein, non-GAAP

financial measures are calculated on a consistent basis from period to period. Specific reconciling items may only be relevant in certain

periods.

Adjusted Earnings Before Interest, Taxes, Depreciation

and Amortization

Adjusted EBITDA is a non-GAAP measure and is calculated

as earnings before net finance costs, income taxes, depreciation and amortization (included in operations and general and administrative

expense) and unrealized gains or losses on commodity-related derivative financial instruments. Adjusted EBITDA also includes adjustments

to earnings for losses (gains) on disposal of assets, transaction costs incurred in respect of acquisitions, dispositions and restructuring,

impairment charges or reversals in respect of goodwill, intangible assets, investments in equity accounted investees and property, plant

and equipment, certain non-cash provisions and other amounts not reflective of ongoing operations. The most directly comparable financial

measure to adjusted EBITDA that is determined in accordance with GAAP and disclosed in Pembina's financial statements is earnings before

income tax.

| ($ millions, except per share amounts) |

9 Months Ended

September 30, 2021 |

12 Months Ended

December 31, 2020 |

| Earnings (loss) before income tax |

781 |

(416) |

| Adjustments to share of profit from equity accounted investees and other |

103 |

418 |

| Net finance costs |

144 |

420 |

| Depreciation and amortization |

180 |

700 |

| Unrealized (gain) loss on commodity-related derivative financial instruments |

(47) |

84 |

| Canadian Emergency Wage Subsidy |

8 |

(39) |

| Transformation and restructuring costs |

11 |

10 |

| Transaction costs incurred in respect of acquisitions |

8 |

18 |

| Arrangement Termination Payment |

(350) |

- |

| Impairment charges and non-cash provisions |

12 |

2,086 |

| Adjusted EBITDA |

850 |

3,281 |

Additional information relating to adjusted EBITDA,

including disclosure of the composition of adjusted EBITDA, an explanation of how adjusted EBITDA provides useful information to investors

and the additional purposes, if any, for which management uses adjusted EBITDA and an explanation of the reason for any change in the

label or composition of adjusted EBITDA from what was previously disclosed, is contained in the "Non-GAAP Measures" section

of the Annual MD&A and Interim MD&A, which sections are incorporated by reference in this news release. The Annual MD&A and

Interim MD&A are each available on SEDAR at www.sedar.com, EDGAR at www.sec.gov and Pembina's website at www.pembina.com.

For more information on Pembina's significant assets,

including as such relate to definitions for capitalized terms used herein and not otherwise defined, refer to Pembina's Annual Information

Form (the "AIF") filed at www.sedar.com (filed with the U.S. Securities and Exchange Commission at www.sec.gov under

Form 40-F) and at www.pembina.com.

View original content to download multimedia:https://www.prnewswire.com/news-releases/pembina-pipeline-corporation-announces-2022-guidance-business-update-and-additional-esg-targets-301439890.html

SOURCE Pembina Pipeline Corporation

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2021/08/c1561.html

%CIK: 0001546066

For further information: Investor Relations: Scott Arnold, (403)

231-3156, 1-855-880-7404, e-mail: investor-relations@pembina.com, www.pembina.com

CO: Pembina Pipeline Corporation

CNW 07:00e 08-DEC-21

This regulatory filing also includes additional resources:

ex991.pdf

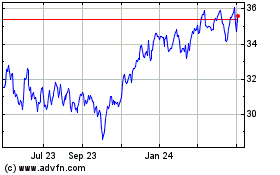

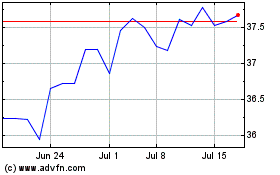

Pembina Pipeline (NYSE:PBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pembina Pipeline (NYSE:PBA)

Historical Stock Chart

From Apr 2023 to Apr 2024