PG&E Bonds Hit Three-Month High on Settlement Talks

January 16 2020 - 12:40PM

Dow Jones News

By Matt Wirz

Prices of PG&E Corp.'s high-interest bonds are approaching

three-month records, lifted by expectations that bondholders and

the bankrupt utility will reach a settlement in their dispute over

recoveries on the debt.

PG&E's $3 billion 6.05% bond due in 2034 changed hands at

114.25 cents on the dollar Thursday morning, up from 113.81

Wednesday and around 110 on Monday. The company disclosed in a

bankruptcy-court hearing Tuesday that it was in "constructive

negotiations" with bondholders.

The 6.05% bond last traded at these levels in October, before

the Kincade Fire in California sparked a steep selloff in

PG&E's shares and bonds, according to trade data from

MarketAxess.

A committee of PG&E bond investors, which includes Elliott

Management Corp. and Pacific Investment Management Co., has argued

in court filings that the company's restructuring must pay

bondholders what they would have been entitled to absent a

bankruptcy. In that scenario, bonds that bear a higher rate of

interest would recover more than debt issued at a lower rate.

PG&E's $600 million 2.95% bond due 2026 fell slightly

Thursday to 100.50 cents on the dollar from 100.75 Wednesday,

according to data from MarketAxess. The utility's stock edged down

to $12.69 Thursday from $12.75 Wednesday but is up significantly

from its $11.07 close on Monday.

If PG&E reaches a compromise with the group, it would likely

keep its higher-cost bonds outstanding rather than issuing new debt

to retire the bonds, according to research by CreditSights. Such a

deal would raise the company's debt expense from what it proposed

in its plan of reorganization but would cut down the amount of new

bonds PG&E will have to sell, CreditSights said

Meanwhile, Treasury-bond yields rose Thursday amid a flurry of

positive economic data, including steady growth in December retail

sales and lower jobless claims in the week ended Jan. 11. The yield

of the 10-year note was trading around 1.806% Thursday, up from a

close of 1.788% Wednesday, according to Tradeweb.

The WSJ Dollar Index, which measures the U.S. currency against a

basket of 16 others, climbed Thursday to 90.28 from 90.20 on

Wednesday, paralleling a rise in U.S. stocks.

Write to Matt Wirz at matthieu.wirz@wsj.com

(END) Dow Jones Newswires

January 16, 2020 12:25 ET (17:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

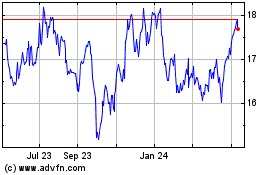

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

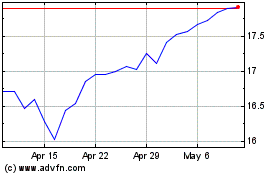

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024