PG&E Reports $1.6 Billion Loss as Fires, Blackouts Raise Costs

November 07 2019 - 11:50AM

Dow Jones News

By Katherine Blunt and Micah Maidenberg

PG&E Corp. reported a $1.6 billion third-quarter loss as the

costs of wildfires, bankruptcy and blackouts weighed on the

beleaguered California utility.

The San Francisco-based company on Thursday also recorded $2.5

billion in new pretax charges related to the claims it faces

following a series of deadly wildfires in 2017 and 2018 that

California investigators have linked to its equipment. That raises

the total charges the company has taken from the fires to $20.4

billion.

The charges reflect a tentative $11 billion settlement that

PG&E, the parent of Pacific Gas & Electric Co., reached in

September to compensate insurance companies that covered

fire-related losses. The company is still working to reach a

settlement with individual victims of those fires and has proposed

establishing an $8.4 billion trust fund to pay claims.

Shares in the company fell more than 10% in midmorning trading

on Thursday.

PG&E sought chapter 11 bankruptcy protection in January,

citing more than $30 billion in potential liability costs. Its

equipment was determined to have sparked 19 wildfires in 2017 and

2018 that collectively killed more than 100 people.

"We continue to make progress in our efforts to move

expeditiously through the chapter 11 process, and remain focused on

a fair and prompt resolution of wildfire victims' claims," said

Chief Executive Bill Johnson.

PG&E said it expects to incur as much as $6.3 billion in

after-tax costs related to wildfires, the bankruptcy proceeding and

a massive effort to shore up the safety of its electric grid, which

serves 16 million people in Central and Northern California.

The company has this year spent hundreds of millions of dollars

on legal services, as well as a monthslong blitz to trim trees and

accelerate equipment inspections.

It posted a third-quarter loss of $1.6 billion, or $3.06 a

share, compared with earnings of $564 million, or $1.09 a share,

during the same quarter last year.

The disclosures come as PG&E struggles to ensure the safety

of its electric system during wildfire season. In recent weeks, the

company has pre-emptively shut off power to millions of

Californians for days at a time in an effort to prevent its

equipment from sparking more destructive wildfires.

The shut-offs created havoc and angered customers, businesses

and state officials. The company anticipates $90 million in pretax

costs to provide a one-time bill credit to customers affected by

its first sweeping shut-off last month.

PG&E recently disclosed that one of its transmission lines

may have sparked the Kincade Fire in Sonoma County, despite having

turned off a large section of the power grid there, as well as a

series of smaller fires in the Bay Area.

The company said Thursday that it is "reasonably possible" that

it will incur a loss related to the Kincade Fire, which destroyed

374 structures, including 174 homes, but noted that the

investigation is preliminary.

News that PG&E equipment may be linked to some of last

month's fires sunk the company's stock and bond prices, and

threatened to stall negotiations among investors in bankruptcy

court. The company's shareholders and bondholders have proposed

competing plans to restructure the utility, pay creditors and exit

bankruptcy.

Gov. Gavin Newsom last week threatened a state takeover of the

company if its investors can't quickly agree on a restructuring

plan. He met with company executives and other stakeholders this

week in an effort to speed the process.

PG&E hasn't provided earnings guidance for the remainder of

2019, citing uncertainty related to the bankruptcy case and other

matters.

Write to Katherine Blunt at Katherine.Blunt@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

November 07, 2019 11:35 ET (16:35 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

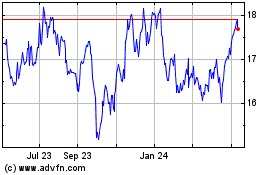

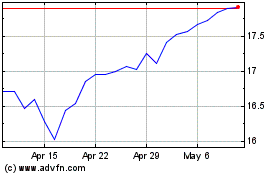

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024