SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of May,

2022

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified

in its charter)

Nu Holdings Ltd.

(Translation of Registrant's

name into English)

Campbells Corporate Services

Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes No (X)

Nu Holdings Ltd.

(the “Company”)

Written Resolutions of the Directors of the

Company dated May 27, 2022 passed in accordance with the Articles of Association of the Company (the “Articles”)

_________________________________________________________________

The undersigned, being the all of the Directors

of the Company for the time being (the “Directors”), hereby take the following actions and adopt the following resolutions:

DISCLOSURE OF INTERESTS

IT IS NOTED THAT to the extent any Director

has any personal interest, direct or indirect, in the matters contemplated by these resolutions which he or she is required to disclose

in accordance with the Articles or in accordance with applicable law or otherwise or which might disqualify such person from approving

these resolutions, such disclosure has been made and such Director may vote and act on the matters referred to herein.

ADOPTION

OF AMENDED COMMITTEE CHARTERS

IT IS NOTED THAT:

| 1. | pursuant to resolutions of

the Board dated October 25, 2021, the Company updated the Audit and Risk Committee Charter (the “Existing ARC Charter"); |

| 2. | pursuant to resolutions of

the Board dated December 30, 2021, the Company updated the Stakeholders Committee Charter (the “Existing Stakeholders Charter”); |

| 3. | the Board now wishes to adopt

a new Audit and Risk Committee Charter (the “Updated ARC Charter”) in the form set out in Exhibit A hereto in

substitution for the Existing ARC Charter; |

| 4. | the Board now wishes to adopt

a new Stakeholders Committee Charter (the “Updated Stakeholders Charter”) in the form set out in Exhibit B hereto

in substitution for the Existing Stakeholders Charter; and |

| 5. | the Updated ARC Charter and

the Updated Stakeholders Charter have been reviewed and considered in detail by the Board. |

IT IS RESOLVED THAT the

Updated ARC Charter and Updated Stakeholders Charter be hereby approved and adopted as of the date hereof in all respects in

substitution for the Existing ARC Charter and the Existing Stakeholders Charter, respectively, and the Audit and Risk Committee and

the Stakeholders Committee are hereby delegated all of the powers and authority set forth in the Updated ARC Charter and the Updated

Stakeholders Charter, and as per Exhibits A and B,

respectively.

| | 1 |  |

APPROVAL OF UPDATED VERSION OF CODE OF

CONDUCT

IT IS NOTED THAT:

| 1. | pursuant to resolutions of

the Board dated October 25, 2021, the Company adopted the Code of Conduct (the “Existing Code of Conduct"); |

| 2. | as part of the annual review

process, it is proposed that the Existing Code of Conduct be amended, in the form set out in Exhibit C hereto (the "Updated

Code of Conduct") in substitution for the Existing Code of Conduct; and |

| 3. | The Updated Code of Conduct

has been reviewed and considered in detail by the Board. |

IT IS RESOLVED THAT:

The

Updated Code of Conduct is hereby approved and adopted as of the date hereof, s per Exhibit C.

GENERAL

AUTHORISATION

IT IS RESOLVED THAT any Director or Officer

of the Company be and is hereby authorised to do all such acts and things and agree and execute any other documents on behalf of the Company

as may be required in order to carry out the actions contemplated by the foregoing resolutions (including as deeds if appropriate) and

generally to sign all documents as may be required in connection with the actions contemplated by the foregoing resolutions and execution

and delivery by any such Director or Officer of any such documents being conclusive evidence of their and the Company’s agreement

to the final terms and conditions thereof.

RATIFICATION

IT IS RESOLVED THAT, to the extent that

any Director or Officer has taken any actions or signed any documents or undertakings prior to the date hereof which would have been approved

if taken or signed after the date hereof, the same be and are hereby ratified, approved and confirmed.

[Remainder of page intentionally left blank]

| | 2 |  |

IN WITNESS WHEREOF, each of the undersigned,

being all of the Directors of the Company for the time being, has executed these resolutions in writing on the date indicated above. These

resolutions may be executed in counterpart and each counterpart shall be deemed to be an original and which counterparts when taken together

shall constitute one and the same instrument.

________________________ |

___________________________ |

David Vélez Osorno |

Anita Mary Sands |

| |

________________________ |

___________________________ |

Daniel Krepel Goldberg |

Douglas Mauro Leone |

| |

________________________ |

___________________________ |

Jacqueline Dawn Reses |

Larissa de Macedo Machado |

| |

________________________ |

___________________________ |

Luis Alberto Moreno Mejía |

Muhtar Ahmet

Kent |

| |

| ________________________ |

|

Rogério Paulo Calderón Peres |

|

| | 3 |  |

NU HOLDINGS LTD.

Audit and Risk Committee Charter

Adopted May 27, 2022

Purpose

The Audit and Risk Committee

(the “Committee”) shall assist the Board of Directors (the “Board”) of Nu Holdings Ltd., a Cayman

Islands exempted company with limited liability (the “Company”), in fulfilling its oversight responsibilities to the

Company’s shareholders with respect to (i) the Company’s corporate accounting and financial reporting practices and the audit

of the Company’s financial statements, (ii) the independent auditors’ qualifications and independence, (iii) the performance

of the Company’s internal audit function and independent auditors, (iv) the quality and integrity of the Company’s financial

statements and reports, (v) reviewing and approving all audit engagement fees and terms, as well as all non-audit engagements with the

independent auditors, (vi) overseeing the Company’s overall risk framework and risk appetite framework and (vii) overseeing the

Company’s compliance with legal and regulatory requirements, including reviewing relevant communications with regulators. In discharging

these obligations, the Committee shall maintain and foster an open avenue of communication between the Committee and the independent auditors,

the Company’s management and internal auditors.

Composition and Organization

The Committee shall consist of at least three

members, comprised of directors deemed by the Board to be independent and who meet independence and experience requirements of the New

York Stock Exchange (“NYSE”) and meet the criteria for independence set forth in Rule 10A-3(b)(1) of the Securities

Exchange Act of 1934, as amended. Each member shall have the ability to read and understand the Company’s basic financial statements.

At least one member of the Committee shall, in the judgment of the Board, be an “audit committee financial expert” in accordance

with the rules and regulations of the SEC.

| | 4 |  |

The members of the Committee

shall be appointed by the Board. The members of the Committee shall serve at the discretion of the Board. The Board shall designate one

member of the Committee as the Committee’s chairperson (the "Chairperson").

No member of the Committee may

serve on more than two other public company audit committees unless the Board determines that such simultaneous service will not impair

the ability of the member to serve effectively on the Committee. No Committee member shall have participated in the preparation of the

Company’s or any of its subsidiaries’ financial statements at any time during the previous three years.

Meetings

The Committee shall hold

such regular or special meetings as its members shall deem necessary or appropriate, it being understood that the Committee will ordinarily

meet quarterly in advance of the release of quarterly financial results. The Chair of the Committee shall preside at each meeting and,

in the absence of the Chair, one of the other members of the Committee shall be designated as the acting chair of the meeting by the Committee.

The Chair of the Committee, in consultation with the other committee members, shall determine the length of the committee meetings and

shall set meeting agendas consistent with this charter.

Call notices to the meetings shall

be made by the Board's Corporate Secretariat through any available physical or electronic means at least five (5) business days in advance

of every meeting. Except for matters that demand urgent review or to reflect changes or modifications from the initial materials distributed,

the agenda and material of the meetings will be available to the members at least four (4) business days in advance of every meeting.

Meetings shall be held at such times

and places as the Committee determines. The Committee can also meet by means of audio and/or video conference, or by any other electronic

communication tool which allows review and discussion of the matters proposed to the Committee, which will be conducted in real time

and be considered as one single act.

Meetings shall be considered duly

installed with the presence of at least two-thirds (2/3) of its members. Resolutions shall be adopted by majority votes of the attending

members. Ordinary and Extraordinary meetings, its resolutions, statements and opinions of the Committee shall be drawn up and signed by

the Chairperson (or such other Committee member who presided over

the applicable meeting as the chairperson). Written resolutions shall be draw up and signed by all the members.

| | 5 |  |

In order to ensure effective

communication, coordination and coverage of the matters under the Committee’s responsibilities, the Committee may periodically call

joint meetings with other committees of the Board.

In addition, the Committee

shall separately meet on a periodic basis with management, the officer of the internal audit department or another designated employee

and the independent auditors to discuss any matters that the Committee or any of these persons or firms believe should be discussed. The

Committee shall also meet periodically in separate executive sessions with the Chief Financial Officer, the Chief Legal Office/General

Counsel, the Chief Risk Officer, the Chief Compliance Officer and other members of management as it determines appropriate. The Committee

may request any officer or employee of the Company or the Company’s outside counsel or independent auditors to attend a meeting

of the Committee or to meet with any members of, or consultants to, the Committee.

In addition to this Charter,

the operation of the Committee will be subject to any applicable provisions of the Memorandum and Articles of Association of the Company,

the Cayman Islands Law, the rules and regulations of the SEC and the listing standards of NYSE, each as in effect from time to time.

Minutes and Reports

Minutes of each meeting,

and each written consent to take action without a meeting, will be kept by the Corporate Secretariat. The Chair shall periodically report

to the Board.

Duties and Responsibilities

To carry out its purposes,

the Committee shall have the following responsibilities, duties and powers:

| | 6 |  |

| ▪ | The Committee

shall be directly responsible for the appointment, compensation, retention, termination, and oversight of the work of any accounting firm

engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company.

Each such accounting firm shall report directly to the Committee; |

| ▪ | The Committee

shall pre-approve the audit services and non-audit services (including the fees and terms thereof) to be provided by the Company’s

independent auditor pursuant to its internal procedure and/or policies established by the Committee; |

| ▪ | The Committee

shall discuss with the independent auditor its responsibilities under generally accepted auditing standards, review and approve the planned

scope and timing of the independent auditor’s annual audit plan(s) and discuss significant findings from the audit and any problems

or difficulties encountered, including any restrictions on the scope of the auditor’s activities or on access to requested information,

and any significant disagreements with management; |

| ▪ | The Committee

shall evaluate the independent auditor’s qualifications, performance and independence, and shall present its conclusions with respect

to the independent auditor to the full Board on at least an annual basis. As part of such evaluation, at least annually, the Committee

shall: |

| ● | obtain

and review a report or reports from the Company’s independent auditor: |

| o | describing

the independent auditor’s internal quality-control procedures; |

| o | describing

any material issues raised by (i) the most recent internal quality-control review, peer review or Public Company Accounting Oversight

Board (“PCAOB”)

review, of the independent auditing firm, or (ii) any inquiry or investigation by governmental or professional authorities, within the

preceding five years, regarding one or more independent audits carried out by the auditing firm; and any steps taken to deal with any

such issues; and |

| o | describing

all relationships between the independent auditor and the Company consistent with applicable requirements of the PCAOB regarding the independent

auditor’s communications with the audit committee concerning independence. |

| | 7 |  |

| ● | review

and evaluate the lead audit partner of the independent auditor team(s); |

| ● | confirm

and evaluate the rotation of the audit partners on the audit engagement team as required by law; |

| ● | consider

whether the independent auditor should be rotated, so as to assure continuing auditor independence; and |

| ● | obtain

the opinion of management and the internal auditors of the independent auditor’s performance. |

| ▪ | The

Committee shall establish policies for the Company’s hiring of current or former employees of the independent auditor. |

Internal Auditors

| ▪ | At least

annually, the Committee shall evaluate the performance, responsibilities, budget and staffing of the Company’s internal audit function

and review and approve the internal audit plan; |

| ▪ | At least

annually, the Committee shall evaluate the performance of the senior officer or officers responsible for the internal audit function of

the Company and make recommendations to the Board and management regarding the responsibilities, retention or termination of such officer

or officers; and |

| ▪ | The Committee

shall be responsible for recommending to the Board and management the election, replacement or dismissal of a senior officer responsible

for the internal audit function of the Company. |

Financial Statements; Disclosure and Other

Audit and Financial Matters

| ▪ | The Committee

shall meet to review and discuss with management and the independent auditor the annual audited financial statements and unaudited quarterly

financial statements, including reviewing the Company’s specific disclosures under “Management’s Discussion and Analysis

of Financial Condition and Results of Operations,” prior

to the filing of the Company’s Annual Report on Form 20-F (or any annual report to shareholders if distributed prior to the filing

of the 20-F) or quarterly report filed on Form 6-K, as applicable, with the SEC; |

| | 8 |  |

| ▪ | The Committee

shall review with management, the internal auditors and the independent auditor, in separate meetings whenever the Committee deems appropriate: |

| ● | any

analyses or other written communications prepared by management and/or the independent auditor setting forth significant financial reporting

issues and judgments made in connection with the preparation of the financial statements, including analyses of the effects of alternative

International Financial Reporting Standards (“IFRS”)

methods on the financial statements; |

| ● | the

critical accounting policies and practices of the Company; |

| ● | the

effect of regulatory and accounting initiatives, as well as off-balance sheet transactions and structures, on the Company’s financial

statements; and |

| ● | any

major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s

selection or application of accounting principles. |

| ▪ | The Committee,

or the Chair of the Committee, shall review the type and presentation of information included in the Company’s earnings press releases,

as well as financial information and earnings guidance provided to analysts and rating agencies, paying particular attention to the use

of non-GAAP/non-IFRS financial information; |

| ▪ | The Committee

shall, in conjunction with the Chief Executive Officer and Chief Financial Officer of the Company, review the Company’s disclosure

controls and procedures and internal control over financial reporting. The review of internal control over financial reporting shall include

whether there are any significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting

which are reasonably likely to affect the Company’s ability to record, process, summarize and report financial information and any

fraud involving management or other employees with a significant role in internal control over financial reporting. The Committee

shall also review any special audit steps adopted in light of material control deficiencies; |

| | 9 |  |

| ▪ | The Committee

shall review and discuss with the independent auditor any audit problems or difficulties and management’s response thereto, including

those matters required to be discussed with the Committee by the auditor pursuant to established auditing standards, as amended, such

as: |

| ● | any

restrictions on the scope of the independent auditor’s activities or on access to requested information; |

| ● | any

accounting adjustments that were noted or proposed by the auditor but were not adopted or reflected; |

| ● | any

communications between the audit team and the audit firm’s national office regarding auditing or accounting issues presented by

the engagement; |

| ● | any

management or internal control letter issued, or proposed to be issued, by the auditor; and |

| ● | any

significant disagreements between management and the independent auditor. |

| ▪ | In connection

with its oversight responsibilities, the Committee shall be directly responsible for the resolution of disagreements between management

and the auditor regarding the Company’s financial reporting; |

| ▪ | The Committee

shall establish procedures for: |

| ● | the

receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing

matters; and |

| ● | the

confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

Risk Management and Compliance Matters

| ▪ | The Committee

shall review the Company’s compliance with laws and regulations, including major legal and regulatory initiatives. The Committee

shall meet and discuss these matters with management

and others as appropriate, including the General Counsel of the Company; |

| | 10 |  |

| ▪ | The Committee shall review

and monitor, at least every half year, the entries in the Whistleblowing Channel, its conclusions, as well as the monitoring of critical

issues and the applicability of the Company's Code of Conduct and Whistleblower Policy, and supervising the actions and updates involving

the theme; |

▪

The Committee shall advise the Board in reviewing the

development and assessment of risk policies, risk management framework and internal controls systems to mitigate those risks applicable

to the Company and its subsidiaries (including identifying the various types of financial and non-financial risks) and in determining

the Company's risk appetite and risk strategy;

▪

The Committee will discuss, at least annually, the Company’s

cybersecurity program and will receive periodic updates from the Company’s management on cybersecurity;

▪

The Committee shall advise the Board in the implementation

of the Company's risk strategy;

▪

The Committee shall advise the Board in the systematic

review of the Company's risk exposure to economic sectors, geographic areas and risk types, if applicable;

▪

The Committee shall advise the Board in the supervision

of the risk and compliance functions within the Company, ensuring their independence and that the risk and compliance functions have the

appropriate means to discharge their responsibilities;

▪

The Committee shall receive reports and period information

from the risk and compliance functions, which shall include the detection of potential deficiencies and breaches of pre-established limits;

▪

The Committee shall assess at least annually the Company's

risk and compliance functions performance, with particular attention to the performance of the Chief Risk Officer and the Chief Compliance

Officer, if applicable;

▪

The Committee shall advise the Board in the performance

of stress tests by the Company or its subsidiaries;

▪

The Committee will review with management the risks

related to the Company’s tax planning and regulatory compliance;

| | 11 |  |

▪

The Committee will review with management the Company’s

(i) investment philosophy, policies and procedures, (ii) allocation and performance of its investment portfolio, (iii) management of investment

risk, and (iv) foreign exchange risk management.

▪

The Committee shall assess the Compliance Program adopted

by the Company; and

▪

The Committee shall be informed of significant correspondence

with regulators and advise the Board in the adoption of actions and measures that result from the reports and inspections made by regulatory

authorities to which the Company and its subsidiaries might be subjected.

Annual Evaluation

The Committee shall produce

and provide to the Board on an annual basis an evaluation of the Committee’s performance of its duties under this charter. The evaluation

shall be conducted in such a manner as the Committee deems appropriate. The Chair of the Committee will present the evaluation to the

Board. The evaluation shall also include an assessment by the Committee of the adequacy of this charter and any recommendations to improve

this charter.

Resources and Authority of the Committee;

Retention of Advisors

The Committee shall have the

resources and authority appropriate to discharge its duties and responsibilities and shall be empowered to conduct its own investigation

into issues related to its duties and responsibilities, including the authority to select, retain, terminate, and approve the fees and

other retention terms of special counsel or independent counsel or other experts and advisors, as it deems necessary or appropriate. The

Committee shall receive appropriate funding from the Company, as determined by the Committee, for payment of compensation to the independent

auditors and any other advisors retained by the Committee and ordinary administrative expenses of the Committee that are necessary or

appropriate in carrying out its duties.

| | 12 |  |

_______________________________________________________________________

__

| Version |

Description of change |

Date of

change |

Squad

responsible |

Date of

approval |

Approver |

| 1 |

Initial Version |

- |

Coroporate Governance Secretariat |

06/18/21 |

Board of Directors |

| 2 |

Adjustments to increase best governance practices |

10/18/21 |

Coroporate Governance Secretariat |

10/25/21 |

Board of Directors |

| 3 |

Execute the minutes with only the Chairperson signature |

05/20/22 |

Corporate Governance Secretariat |

05/27/22 |

Board of Directors |

| | 13 |  |

NU HOLDINGS LTD.

Stakeholders’ Committee Charter

Adopted on May 27, 2022

Purpose

The Stakeholders’ Committee (the “Committee”)

shall assist the Board of Directors (the “Board”) of Nu Holdings Ltd. (the “Company,” and together

with its subsidiaries “Nubank”) in its consideration and monitoring of the interests of the key stakeholders of Nubank,

including its shareholders, customers, employees, regulators and other stakeholders as may be identified by the Board or the Committee

from time to time (the “Key Stakeholders”) by providing insights and recommendations intended to create long-term value

for shareholders and other Key Stakeholders.

Main Duties and Responsibilities

To carry out its purposes, the Committee

shall have the following duties and responsibilities:

| (i) | Overseeing Nubank’s relationship

and notable interactions with Key Stakeholders; |

| (ii) | Engaging with Nubank senior

management with regards to the Company’s strategies on environmental, social and governance policies and programs and other matters

of import to the Key Stakeholders, as may be determined by the Board or the Committee from time to time (the “Stakeholder Principles”); |

| (iii) | Reviewing the initiatives and

metrics used to measure Nubank’s progress towards the Stakeholder Principles; |

| (iv) | Evaluating Nubank’s progress

towards the Stakeholder Principles; |

| (v) | Advising the Board and Nubank’s

senior management on ways to address matters and initiatives that may affect Key Stakeholders’ interests, considering the Stakeholder

Principles; and |

| | 14 |  |

| (vi) | Reviewing the Key Stakeholders

and the Stakeholders Principles and recommending to the Board any change the Committee deems appropriate. |

Composition and Organization

The Committee shall consist of at least five

members, including:

| (i) | One representative of Nubank’s

senior management; |

| (ii) | Three members of the Board;

and |

| (iii) | The chairperson of the Board. |

The members of the Committee shall be appointed

by the Board and shall serve at the discretion of the Board. The Committee’s chairperson (the "Chairperson") will

be designated by the Board.

Meetings

The Committee shall hold such regular

or special meetings as its members shall deem necessary or appropriate, it being understood that the Committee will ordinarily meet at

least three times a year. The Chairperson shall preside at each meeting and, in the absence of the Chairperson, one of the other members

of the Committee shall be designated as the acting chair of the meeting by a majority of Committee members present at such meeting. The

Chairperson, in consultation with the other Committee members, shall determine the date and length of the Committee meetings and shall

set meeting agendas consistent with this charter.

The Chairperson will be supported

in his or her responsibilities by Nubank’s Global Head of ESG, who shall be invited to attend all Committee meetings as a recurrent

guest. Notice of each Committee meeting shall be made by the Company’s Corporate Secretariat through any available physical or electronic

means in advance of such meeting. The Committee may be called to meet at the request of the Chairperson if any urgent situation takes

place involving Key Stakeholders.

Meetings shall be held at such times

and places as the Committee determines. The Committee may also meet by means of audio and/or video conference, or by any other electronic communication tool which

allows review and discussion of the matters proposed to be addressed by the Committee, which will be conducted in real time and shall

be considered as one single act.

| | 15 |  |

Meetings shall be considered duly installed

with the presence of at least three-fifths (3/5) of its members. Recommendations to the Board shall be adopted by a majority vote of the

attending members. Ordinary and extraordinary meetings, its resolutions, statements and opinions of the Committee shall be drawn up and

signed by the Chairperson (or such other Committee member who presided over the applicable meeting as the chairperson). Written resolutions

shall be drawn up and signed by all the members.

In order to facilitate effective

communication, coordination and oversight of the matters under the Committee’s purview, members of the Committee may periodically

call joint meetings with other committees of the Board.

The Committee and the Chairperson

may invite any Nubank employee or other person, including external Key Stakeholders (or their representatives), as it deems appropriate

in order to carry out its responsibilities, to attend and participate (in a non-voting capacity) in all or a portion of any Committee

meeting.

Minutes and Reports

Minutes of each meeting, and each

written consent adopted without a meeting, will be kept by the Corporate Secretariat. The Chairperson shall periodically report to the

Board.

Annual Evaluation

The Committee shall prepare and

provide to the Board on an annual basis an evaluation of the Committee’s performance of its duties under this charter. The evaluation

shall be conducted in such a manner as the Committee deems appropriate. The Chairperson will present the evaluation to the Board, which

shall include an assessment by the Committee of the adequacy of this charter and any recommendations to improve this charter.

| | 16 |  |

Resources and Authority of the Committee; Retention

of Advisors

The Committee shall have the resources

and authority appropriate to discharge its duties and responsibilities and shall be equipped with resources to fulfill its duties and

responsibilities. The Committee shall receive appropriate funding from the Company, as determined by the Board, for payment of compensation

to consultants and any other advisors retained by the Committee and ordinary administrative expenses of the Committee that are necessary

or appropriate in carrying out its duties.

Control

Version

| Version |

Description of change |

Date of

change |

Squad

responsible |

Date of

approval |

Approver |

| 1 |

Initial Version |

- |

ESG |

07/26/2021 |

Board of Directors |

| 2 |

Adjustment of the minimum number of annual meetings from 4 to 3 |

12/15/2021 |

ESG |

12/30/2021 |

Board of Directors |

| 3 |

Execute the minutes with only the Chairperson signature |

05/20/22 |

ESG and Corporate Governance Secretariat |

05/27/2022 |

Board of Directors |

| | 17 |  |

Code of Conduct review 2022

|

Important

For this review, the Compliance team suggests transforming the Code of

Conduct into an expectations document with less text and more visual elements.

Today, Nubankers need to read the Code of Conduct, read the Corporate Policies

in addition to carrying out Compliance training. Therefore, the object is to make these activities complementary, not a repetition of

content, making better use of Nubankers' time. We pursue smart efficiency.

In addition, you will see that we have included some curiosities during

the Code so that readers are more interested in the subjects presented.

If you would like more information about the proposed changes to the Code

of Conduct, access this presentation. And to check the last version of the Code of Conduct, click

here. |

Nu Holdings Ltd.

Code of Conduct

May 2022

Table of Contents

1. Founders Letter

2. The Nu Way

A. Nu Values

B. Nu Code

3. Nu way for People

A. Human Rights

B. Fostering Diversity & Inclusion

C. Discriminations & Harassment

D. Alcohol and Drugs

E. Political and Religious Activities

4. Nu way to treat our Communities

A. Environmental, Social and Governance (ESG)

B. Donations & Sponsorships

| | 18 |  |

5. Nu way to treat Information

A. Data Protection

B. Information Security, Business and Trade Secrets

C. Brand: public appearances, social media and trademarks

D. Insider Trading

6. Nu way to conduct our business

A. Sustainable Operations

B. Conflict of Interest

C. Corruption

D. Preventing fraud and safeguarding the Company's resources

E. Financial Records

F. Anti Money Laundering and Terrorism Financing

7. Nu way to reporting violations

A. Parker, Whistleblowing Channel

B. Ethics Forum

C. Reporting Violations to a Governmental Agency.

1. Founders Letter

The Company was born to fight against the complexity of the financial system and help

people to have a truly healthy relationship with their finances. This mission guides everything we do, from the birth of a new product

to humanized service, always placing the customer at the center of our actions.

Knowing the influence that the Company has in society, we want to be recognized not only

for the positive impact we make on the lives of millions of people, but also for how we got there – promoting and respecting the

highest ethical standards, reflected here in this Code of Conduct.

We operate in a high-trust and safe environment, where each Nubanker can challenge the

status quo and pursue increasingly audacious goals to develop the best work of their lives, creating a revolution together.

For that reason, if you believe a Nubanker is not meeting our expectations of conduct,

remember to report the situation through Parker, our Whistleblowing Channel. We want and need to hear from you.

We have come a long way, Nubanker, but remember, this is the first minute of the first

day. It’s still Day 1.

Best wishes,

David, Cris and Ed

| | 19 |  |

2. The Nu Way

A. Our Values

Our mission is to fight complexity to empower people. Our motivation is the impact that

we create on the lives of our customers.

We want our customers to love us fanatically. We believe that delighting customers

is fundamental to building a solid relationship of loyalty and trust in the long term.

We are hungry and challenge the status quo. We encourage all of our teams not to

conform to the way things have already been done.

We build strong and diverse teams. We work actively so that our teams are formed

by the best talents, regardless of their characteristics, training or experience, and with that we have increasingly plural voices.

We act like owners, not renters. We treat employees as partners and our relationships

are based on humility, respect, transparency and responsibility. We foster a culture that is absolutely focused on serving our customers,

where there is no room for ego or status symbols and where making mistakes and learning from them is encouraged.

We pursue smart efficiency. We use technology to build scalable systems and optimize

the use of all resources: our teams, time and capital. As we gain efficiency, we pass these gains on to our customers at lower and lower

rates and fees.

B. Nu Code

This Code applies to all Nubankers (employees, directors, independent advisors, apprentices,

interns, officers of Nu Holdings Ltd. and its controlled affiliates), regardless of position, job or tenure at the Company.

This is a document of expectations and, therefore, doesn't aim to cover all the details

of Nubankers' daily actions.

No one is entitled to violate or ask anyone to violate any provision contained in this

Code.

In describing our ethical values, this Code is intended to deter wrongdoing and to promote:

| ● | honest and ethical conduct, including the ethical handling of actual or apparent conflicts

of interest; |

| ● | transparent and fair experiences and results for our customers and the markets in which

we operate; |

| ● | full, fair, accurate, timely, and understandable disclosure in reports to any and all of

our stakeholders, including documents that we file with, or submit to, governmental authorities and regulators (including, but not limited

to, the relevant central bank and securities and exchange commission) and in other public communications we make; |

| | 20 |  |

| ● | compliance with applicable laws, rules and regulations; |

| ● | the prompt internal reporting of violations of this Code through Parker; and |

| ● | accountability for noncompliance with this Code. |

If you know of a situation that is contrary to the principles contained in this Code,

please use Parker to speak up.

We want – and need – to hear you.

3. Nu way for People

The Company believes that strong and diverse teams are the foundation of a healthy work

environment and key to sustaining our long term success.

Nubankers can only fulfill their true potential and thrive in a workplace free of discrimination,

retaliation, harassment and bullying.

We expect Nubankers to uphold the highest ethical standards and treat one another with

dignity and respect always. Nubankers are also expected to act in a professional manner in everyday interactions, including in-person

and virtual meetings, written and audio communication in messaging applications and internal communication platforms. The same principles

apply to Nubankers’ relationships with our customers, service providers and stakeholders.

A. Human Rights

The Company supports the principles set forth in the United Nations Universal Declaration

of Human Rights and the Declaration on Fundamental Principles and Rights at Work of the International Labor Organization.

The respect, protection and promotion of human rights is simply the right thing to do.

Nubankers must commit to:

| ● | Having zero-tolerance towards forced and child labour or any type of modern slavery. |

| ● | Promoting diversity and offering equal and fair opportunities to all. |

| ● | Promoting a workplace free from harassment, bullying, prejudice and discrimination. |

| ● | Enabling freedom of association; |

| ● | Ensuring decent and safe working conditions. |

| ● | Guaranteeing the privacy and data protection rights of all individuals. |

B. Fostering Diversity and Inclusion

D&I is not a goal but a perspective on everything we do and every decision we make.

We strengthen our business and enrich our own culture through the diverse skills, experiences and backgrounds that each Nubanker has.

Employment opportunities are organized on equity for all applicants and employees.

We reject discrimination based on age, sex, ancestry, color, gender identity or

expression, genetic information, marital status, medical condition or any kind of leave,

national origin, disability, parentage, race, religion, believes, sexual orientation, type of family or any other characteristic protected

by laws, rules and ordinances by law.

| | 21 |  |

Today we have 5 institutionalized groups that support the construction of a more inclusive

environment. The groups are exclusive to black people, people who self-identify as women, LGBTQUIAP+ community, people with disabilities

and parents.

Our goal is to be among the most diverse and inclusive companies, reflecting the same

representation of the countries we serve and making all Nubankers feel welcomed, valued and belonging.

Curiosity: We expect to have until 2025:

50% of our population being women and 50% in leadership positions and

30% of our population being B&B and 23% in leadership positions.

Did you know?

The Company encourages Nubankers to participate in affinity groups that are part of its

social aspects, in addition to encouraging everyone to participate in groups formed by allies.

C. Discrimination and Harassment

We work hard to create a healthy, psychologically safe work environment where Nubankers

are respected in their individuality and can thrive.

Thus, we reject harassment of any kind, retaliation, bullying or discrimination.

We are committed to proactively implement solutions against harassment, retaliation, bullying

and discrimination in the workplace and act if a case is identified.

The following behaviors may cause disciplinary actions or even termination, according

to their severity and potential aggravating or extenuating factors:

| ● | Engage in verbal or physical abuse, |

| ● | Unprofessional communication, |

| ● | Excessive aggressiveness, |

| ● | Disrespectful/demeaning comments, |

| ● | Publicly exposing colleagues, |

| ● | Negatively influencing work environment, |

| ● | Sexual advances (verbal or physical), |

| ● | Jokes with sexual connotation, |

| ● | Other unprofessional behaviors. |

Nubankers are expected to report potential misconduct they may witness through Parker,

the Company’s Whistleblowing Channel.

D. Alcohol and Drugs

To keep a healthy and respectful workplace, a few rules concerning the consumption of

alcohol and drugs must be observed.

| | 22 |  |

Whenever you consume alcohol during working hours, in our premises or in external activities

associated with the Company, do it in moderation and only when appropriate. Nubankers must not perform their professional activities in

our premises or outside while drunk.

Also, Nubankers are strictly prohibited to use or be under the influence of illicit drugs

while performing their professional activities.

In every act as a Nubanker we must be owners, not renters!

Curiosity: If you understand that you are experiencing any problems related to

alcohol or drug use, please remember that we have NuCare. The Company is here to help.

E. Political and Religious Activities

We respect freedom of speech, as well as our employees' political and religious associations.

We believe in building strong and diverse teams.

The Company does not adopt religious or party-political positions nor contribute directly

or indirectly to political parties, movements, committees or unions, nor to their candidates or representatives.

Nubankers should not use the Company’s tools and platforms to engage in religious

or political activities.

The Company strongly recommends avoiding the use of items related to political campaigns

during work hours.

Nubankers that intend to run for public office should request a non-paid leave.

We are also aware of our active role in supporting the development of public policies

alongside government agencies. In case you are contacted by any public authority while performing your activities at the Company, contact

our Compliance or Public Policy team immediately.

4. Nu way to treat our communities

A. Environmental, Social and Governance (ESG)

The Company considers environmental, social and governance (ESG) factors in our business

activities as a result of a high degree of ESG integration on all decision-making processes, and works to deliver long-term value for

our clients, shareholders and other stakeholders.

Our Nu Impact strategy is based on 4 pillars:

| ● | ESG Integration: Commitment with the integration of ESG criteria in our decision-making

and processes at Nubank. |

| ● | Creating Shared Value: Commitment with the convergence of our stakeholders' expectations and Nubank's business strategy and priorities. |

| | 23 |  |

| ● | Governance: Commitment with ethical, transparent and efficient corporate management as a

top priority. |

| ● | Social Impact: Our commitment is to impact people's lives in a positive, meaningful and

lasting way. |

Image for support:

Would you like to know more?

See our Nu Impact Manifesto here.

B. Donations & Sponsorships

A donation is a voluntary support that is given without the expectation of receiving anything

in return. Receiving any compensation breaks the principle of donation, which may have serious tax, administrative and, depending on the

case, criminal implications for the Company and its directors.

Sponsorships refer to promoting the name and image of the company, its products or services

through its association with events, activities, sports or cultural organizations.

Every sponsorship and donation on behalf of the Company is subject to a due diligence

screening process. Additional review and approval from Compliance is required if any inconsistency is identified in the screening process.

The Company does not donate or contribute, directly or indirectly, to political parties

or candidates. Nubankers’ donations or contributions to political parties or campaigns must follow the applicable legislation and should not be linked to the Company.

| | 24 |  |

5. Nu way to treat Information

A. Data Protection

Protecting the personal data of our customers, employees and all persons that the Company

interacts with is fundamental to preserving trust in Nubank’s relationships.

A strong privacy and data protection approach aims to make people feel safe knowing we

use their data ethically and safeguard their privacy and data protection rights (as provided by privacy and data protection laws and regulations,

such as the right to access personal data).

All access, processing and usage of personal data must be done according to the principles

of our Privacy Governance Policy, which includes:

| ● | We use personal data in a way that is lawful, fair and transparent |

| ● | We only collect personal data for specified, clear and legitimate purposes |

| ● | We take steps to guarantee the quality and accuracy of the data we hold |

| ● | We keep personal data for as long as necessary for the purposes for which we are using it |

| ● | We use appropriate measures to ensure data security |

Would you like to know more, Nubanker?

Access The Company’s Privacy Governance Policy in our Intranet.

B. Information Security, Business and Trade Secrets

Nubankers must protect all data, even the ones that will be publicly disclosed. All information

and documents must be stored in appropriate virtual environments that are previously approved by the Information Security team.

In an attempt to avoid the improper use and disclosure of information, the Company is

always intensifying and investing in security and awareness mechanisms for all Nubankers. Also, Nubankers' credentials are personal information

and must not be shared with anyone, not even with another Nubanker.

Every Nubanker is responsible for protecting our information and should not share anything

that is not previously authorized, except for public information.

In order to protect information, the Company classifies the information using levels of

confidentiality. This method is applied to all types of information during storage, transition and use. This rule is documented in the

Company's Cyber Security Policy.

Important!

The Company can monitor all Nubankers' logs of internet access, emails and instant

messages, as well as information and files that are received or stored in the Company's electronic devices and communication systems, and can access them at any time. Nubankers cannot

expect to have privacy regarding any activities, even if of personal nature, that are performed on devices or virtual environments that

belong to the Company or third party apps or services connected to a device from the Company. Please check our Cybersecurity Policy for

further details on such matters.

| | 25 |  |

Curiosity: In order to protect your data, the Company has a security recommendation

to all customers that can be found on our public Cyber Security Policy.

Would you like to know more, Nubanker?

Access The Company’s Internal Cyber Security Policy in our Intranet.

C. Brand: public appearances, social media and trademarks

Our company's brand is one of our most valuable assets, and Nubankers are expected to

protect our trademark rights and corporate and brand identities. The Company does not authorize the use of its brand or brand assets for

commercial purposes without its prior written consent.

As a general rule:

| ● | Nubankers, partners, suppliers, and third parties must ask for permission to use, outside

our environment, the Company's logos and Brand Assets (photos, typography, trademarks). Any use must be aligned with the Branding team,

ensuring correct execution of our brand guideline. |

| ● | Nubankers are not allowed to negotiate the logo’s use to obtain advantages for their

own purposes. |

| ● | Nubankers are not allowed to make public statements to the press without support and consent

of the Corporate Communications team. |

| ● | Nubankers should reach out to Corporate Communications team before participating in any

public events (live broadcasts, talks, seminars, and others). The Company does not allow employees to get paid for public speaking events.

Nubankers should always review the Conflict of Interest Policy before engaging in any professional external activity. |

| ● | Unless previously authorized, do not state personal opinions on social media or other public

forums implying they are the Company's official standpoints. |

| ● | Disclosing classified information (e.g., texts, images, screenshots of systems, platforms

and presentations) through any other media outside of work is strictly forbidden. |

| ● | Discrimination, harassment, and abuse on social media or instant message applications, even

when not related to the Company is against this Code. |

D. Insider Trading

Insider Trading is a crime in the United States, Brazil and many other locations.

We are a transparent company and treat Nubankers as owners, therefore, full compliance

with the established guidelines on Insider Trading crime prevention is expected.

| | 26 |  |

Nubankers must not trade any Company securities when in possession of Material Non-Public

Information (MNPI), directly or through third parties. Also, you shall not disclose such information to third parties.

You are required to ensure that yourself, your close family members or other people who

gain access to MNPI are familiarized with and comply with the Company's Insider Trading Policy.

Would you like to know more, Nubanker?

Access The Company’s Insider Trading Policy in our Intranet.

6. Nu way to conduct our business

A. Sustainable Operations

The Company acts with responsibility towards people and the planet to mitigate risks and

maximize the creation of shared-value. All Nubankers must comply with our Global ESG Policy. Additionally, all Nubankers in Brazil must

also comply with our local Social and Environmental Responsibility Policy

Our supplier qualification and selection process includes ESG criteria, and we launched

an engagement platform, the Nu Academy for Suppliers, to support them in the process of implementing ESG best practices in their own operations.

To ensure we have the best partners, Nubankers are expected not only to operate ethically

and follow the Contracts, Suppliers and Payments Policy when interacting with a supplier or business partner but also to report any situation

of potential violation of these policies as well as labor laws and regulations.

Curiosity: 1. The Company is committed to being carbon neutral forever. Nubankers

must make every effort to reduce emissions in their Company’s activities.

2. In 2020, we estimated all our emissions since our foundation and offset them, and we

continue to do this annually.

Did you know that the actions of our suppliers and business partners have a direct

influence on the perceived image of Nubank? That's why we pursue suppliers that fit our values and with whom we can maintain a sustainable

relationship with.

Would you like to know more, Nubanker?

Access The Company’s ESG Global Policy, the

Social and Environmental Responsibility Policy (Brazil) the Procurement Policy and Social and Environmental

Risk Management Policy (Portuguese only) in our Intranet.

B. Conflict of Interest

Conflicts of interest occur when Nubankers are in a situation that may lead them to

make decisions that are motivated by interests other than the Company's.

| | 27 |  |

If you believe you may have a potential conflict of interest of any type, such as professional

external activities, suppliers and business partners, gifts and entertainment, Kinship or close personal relationship or personal investments

in competitors, please read the Conflict of Interest Policy and report it to Compliance through the Conflict of Interest Form, available

in our Intranet.

We do what's best for the Company, not for specific individuals or teams, that’s

why while performing their professional activities, all Nubankers must always act like owners, not renters.

Having a conflict of interest does not necessarily represent a violation of this Code

of Conduct and the Global Conflict of Interest Policy; but not reporting it does!

Would you like to know more, Nubanker?

Access The Company’s Conflict of Interest Policy in our Intranet.

C. Corruption

We do the right thing. We act with integrity, honesty and transparency, following the

Company's policies and procedures.

We don't pay bribes. We do not offer, give money or any other thing of value to public

officials or any third parties to obtain inappropriate advantages.

The Company has also several restrictions on the offering of gifts, meals, travel and

entertainment to Public Officials and Third Parties.

We have zero tolerance for corruption. If you witness or suspect any inappropriate activity

performed by the Company, a Nubanker or any vendor, report the case through Parker immediately with as much detail as you can.

Further details are provided in the Company's Global Anti-Bribery and Anti-Corruption

Policy.

Would you like to know more, Nubanker?

Access The Company’s Global Anti-Bribery and Anti-Corruption Policy in our Intranet.

Curiosity: Did you know that many countries have their own Anti-Bribery and Anti-Corruption

Law? In Brazil, Law 12.846 addresses the prevention of these crimes.

D. Preventing fraud and safeguarding the Company's resources

We do not tolerate fraud or breaches of confidence.

It is every Nubanker’s duty to protect the Company's integrity and assets, and all

Nubankers must follow internal guidelines.

Examples of fraud are document forgery (medical statements, invoices, etc.), system manipulation (undue back office changes, tampering with metrics, etc.)

or improper accounting.

| | 28 |  |

Also, we expect Nubankers to act like owners when submitting an expense, making sure it

is reasonable and has a legitimate business purpose for the Company. To learn more about this topic, consult the Expenses Policy available

in our Intranet.

E. Financial Records

The Company’s financial reporting statement, financial records or audit reports

must obey all internal controls, all applicable laws, regulations and accounting rules and principles. The information registered and

provided should be transparent, complete and precise, based on proper documentation and with as many details as necessary to demonstrate

the Company’s full and fair reporting of its financial condition.

Any fraud, intentional error, misrepresentation or false statement regarding the financial

statements of the Company, and attempts to mislead or improperly influence the independent auditor must be immediately reported through

Parker.

The Company’s Audit & Risk Committee will manage treatment of fraud reports

on a global level.

F. Anti Money Laundering and Terrorism Financing

Money laundering and Terrorism Financing are crimes that can occur through the financial

institutions. Therefore, it is Nubank's social function and regulatory obligation to fight these crimes by creating policies and procedures

that enable the identification, analysis and reporting of these suspicious behaviors to the authorities.

Every Nubanker has a duty to report to the AML Team whenever they identify a suspicious

situation of Money Laundering or Terrorism Financing involving customers, suppliers, third parties or partners according to the guidelines

described in the internal Policies.

Curiosity: Did you know that the Authorities have already launched operations to

dismantle criminal organizations based on the suspicions identified and reported by the Company?

All Nubankers can contribute to combating of money laundering and terrorism financing,

creating a positive impact in our society.

Would you like to know more, Nubanker?

Access The Company’s AML Policy in our Intranet.

7. Nu way to reporting violations

A. Parker, Whistleblowing Channel

Parker is the Company's Whistleblowing Channel, hosted by a reliable external provider,

available to any person, Nubanker or not, who wants to report any violation of this Code of Conduct or any law or regulation applicable

to the Company.

The Company encourages reporting any suspected violations promptly and intends to thoroughly investigate any good faith reports of violations.

| | 29 |  |

A specially assigned team will investigate all reports received through Parker that represent

a violation. This team may be formed by Nubankers who work in Ethics, People, Information Security and other teams, as required, or by

external parties, if needed.

If you reported an issue in good faith, rest assured that your identity is strictly confidential

and that you are protected from any kind of retaliation. If you experience retaliation, or have any concern regarding any kind of retaliation,

let us know, and please make another complaint through Parker or directly contact any member of the Ethics team, as no form of retaliation

or threat will be tolerated.

Parker can be easily accessed at www.nubankparker.com.br

Every Nubanker should follow the guidelines of this Code and the Company’s internal

policies and procedures, and cooperate with internal investigations when required. Failure to follow this Code can be subject to legal

measures, administrative sanctions and/or internal disciplinary measures, according to applicable law.

Would you like to know more, Nubanker?

The Company has a full dedicated Policy for Parker, please check the Whistleblower Policy

in our Intranet.

Curiosity

Investigation flow:

- Complaint received by the partner company.

- Analysis to detect conflict of interest in the process.

- Screening.

- Definition of those responsible for the investigation.

- Investigation.

- The Committee meets to align the case recommendation.

- Measures applied.

- Case closed.

B. Ethics Forum

The Company has an Ethics Forum formed by senior members of the Company's management.

The Forum is responsible for advising the Ethics team on general matters and certain cases

of possible violations of the rules contained in this Code, and deliberating on the most significant complaints received through Parker.

C. Reporting Violations to a Governmental Agency

All Nubankers have the right to certain protections for cooperating with or reporting

legal violations to governmental agencies or entities and self-regulatory organizations. As such, nothing in this Code is intended to

prohibit you from disclosing or reporting violations to, or from cooperating with, a governmental agency or entity or self-regulatory

organization, and you may do so without notifying the Company. Details are provided in the Company’s Global Whistleblower Policy.

| | 30 |  |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nu Holdings Ltd. |

| |

|

| |

By: |

/s/ Guilherme Lago |

| |

|

Guilherme Lago

Chief Financial Officer |

Date: May

27, 2022

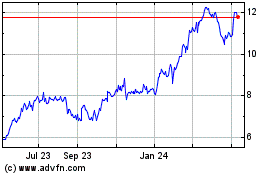

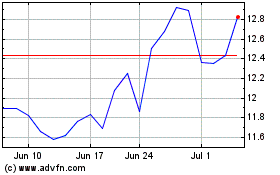

Nu (NYSE:NU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nu (NYSE:NU)

Historical Stock Chart

From Apr 2023 to Apr 2024