Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 02 2022 - 6:37AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of May,

2022

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified

in its charter)

Nu Holdings Ltd.

(Translation of Registrant's

name into English)

Campbells Corporate Services

Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes No (X)

CLARIFICATION NOTE

NU HOLDINGS LTD.

Listed Company

Grand Cayman,

Cayman Islands, May 2, 2022 – With the objective of correcting and clarifying inaccurate and out of context information regarding

the compensation of our Executive Officers remuneration released in the news and social media in the last few days, Nu Holdings Ltd. (“Nu”

or the “Company”) clarifies to its shareholders and the market the following:

| 1 | | The 2022 Reference Form ("Formulário de Referência")

of the Company discloses an estimated compensation for its Executive Officers of R$ 804.4 million during the 2022 calendar year (Chart

13.2). However, from this amount (i) R$ 678.9 million, or 84%, refers to the annual accounting recognition of the Contingent Share Award

(“CSA”), and (ii) R$ 125.5 million, or 16%, refers to the remaining compensation of the Executive Officers in 2022.

|

| 2 | | The CSA is a stock compensation program granted to our founder and CEO,

David Vélez, conditioned to the achievement of ambitious targets, which will represent almost 100% of the total compensation of

Mr. Vélez throughout the next 5 years, this is the minimum period that Mr. Vélez must remain in the Company to be entitled

to the benefits of the CSA.

|

| 3 | | The CSA was approved by the Company Board of Directors in October 2021

and ratified by our shareholders, as set forth in our articles. It determines that Company stock will be issued to Mr. Vélez as

a long-term incentive award, subject to specific performance of Nu Holdings stock, as disclosed in our Final Prospectus of December 8,

2021 ("Prospectus") and the 2022 Reference Form:

(i) Mr. Vélez will be compensated with Class A common shares

equivalent to 1% of the social capital of the Company, if our stock price reaches the threshold of US$18.69, around 3 times our last stock

closing price; and

(ii) Mr. Vélez will be compensated with Class A common shares equivalent to 1% of the social capital of the Company, if our

stock price reaches the threshold of US$35.30, around 6 times our last stock closing price.

|

| 4 | | If the market prices of our stock do not reach these thresholds, the variable

compensation of Mr. Vélez will be zero during this period of 5 years, thus, Mr. Vélez will not be entitled to any form of

variable compensation, be it of long or short term, in cash, stock, or pegged to stock.

|

| 5 | | The CSA sets forth ambitious targets that reflect levels of market capitalization

attractive to our shareholders. Therefore, the CSA creates a long-term interest alignment, strong and transparent, between Mr. Vélez

and our shareholders. This plan was approved by our Board of Directors and prepared with the support of an internationally renowed consulting

firm, which analyzed the best global practices.

|

| 6 | | Mr. Vélez adhered to the Giving Pledge initiative and committed

to donate all the stock resulting from the CSA to the philanthropic platform that his family has established to help foster opportunities

for vulnerable and underprivileged children and young adults from Latin America, as previously mentioned in the Prospectus. |

Contacts:

Investor Contact:

Guilherme Lago

investors@nubank.com.br

Media Contact:

Leila Suwwan

press@nubank.com.br

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nu Holdings Ltd. |

| |

|

| |

By: |

/s/ Guilherme Lago |

| |

|

Guilherme Lago

Chief Financial Officer |

Date: May

2, 2022

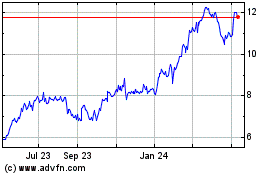

Nu (NYSE:NU)

Historical Stock Chart

From Mar 2024 to Apr 2024

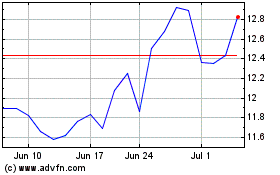

Nu (NYSE:NU)

Historical Stock Chart

From Apr 2023 to Apr 2024