SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For

the month of February, 2022

Commission

File Number 001-41129

Nu

Holdings Ltd.

(Exact

name of registrant as specified in its charter)

Nu

Holdings Ltd.

(Translation

of Registrant's name into English)

Campbells

Corporate Services Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1

345 949 2648

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F (X) Form 40-F

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No

(X)

| São Paulo –

February 22, 2022 – Nu Holdings Ltd. (“Nu”, “Nu Holdings” or “the Company”) (NYSE: NU | B3: NUBR33), Nu, one of the world’s largest digital banking platforms and one of the leading technology companies

globally, today reported its unaudited results for the fourth quarter and audited results for the year ended December 31, 2021. Financial

results are expressed in U.S. dollars and are presented in accordance with International Financial Reporting Standards (IFRS).

|

Strategic

Initiatives and Business Updates

|

Successful

Dual-Listing IPO. On December 10, 2021, Nu completed

an initial public offering, raising nearly $2.8 billion with its Class A ordinary shares beginning to trade on the NYSE, in

the U.S., and BDRs on the B3 in Brazil, after the partial exercise of the underwriters’ option to purchase additional shares

on January 6, 2022.

|

|

Growing

and Engaged Customer Base. Nu ended 2021 with a record 53.9 million

customers, both consumers and SMEs. In Brazil, Nu’s 52.4 million customers (up 58% YoY) already account for approximately

30% of the country’s adult population. Also, over 55% the monthly active customers who have been with Nu for

over a year have made it their primary banking account. In Mexico, the Company’s 1.4 million customers (up 1,243%

YoY) suggest it may have already become the largest issuer of new credit cards in the country, based on the number of cards issued

in Q4’21. In Colombia, Nu reached 114,000 customers only 15 months after launching in the country. Nu has NPS levels 90 or

above in the countries in which it operates.

|

|

Expanding

Product Breadth Through Proprietary and Third-Party Products. During

2021, Nu launched numerous new products and features across the five financial seasons of its customers. Notable launches include

Marketplace, Ultraviolet (premium) Credit Cards, Secured Cards, Apple/ Google/Whatsapp Pay, and Life Insurance and Proprietary Funds.

Nu also continued to leverage onselected acquisitions and partnerships to support the expansion of its product range. These included

Easynvest (investments, June 2021), Juntos (conversational platform, June 2021), Creditas (secured credit, September 2021), SpinPay

(checkout solutions, October 2021) and Olivia (AI-based PFM, transaction announced in November 2021 and closed in January 2022).

|

|

Growing and Engaged Employee Base. Nu ended 2021 with 6,075 employees, of which

60% self-identify as belonging to underrepresented groups. Nu believes it continues to attract and retain the best talent

regionally and globally. The favorable results of the employee engagement surveys validate its ability to continuously strengthen

the Company’s corporate culture and values, notwithstanding the complexities associated with remote work. |

| | | |

| Fourth Quarter 2021 Results | | 1 |

Summary of

Consolidated Financial and Operating Metrics is presented for the full years ended December 31, 2021, 2020 and 2019, and the three-months

periods ended December 31, 2021 and 2020. See definitions on page 11.

| Summary

of Consolidated Operating Metrics |

| |

Q4'21 |

Q4'20 |

FY'21 |

FY'20 |

FY'19 |

| CUSTOMERS

METRICS |

|

|

|

|

|

| Number of Customers (in

millions) |

53.9 |

33.3 |

53.9 |

33.3 |

20.1 |

| Number of Customers growth

(%) |

61.9% |

65.8% |

61.9% |

65.8% |

234.0% |

| Active Customers (in millions) |

41.1 |

21.8 |

41.1 |

21.8 |

12.1 |

| Activity Rate |

76.3% |

65.6% |

76.3% |

65.6% |

60.5% |

| CUSTOMER

ACTIVITY METRICS |

|

|

|

|

|

| Purchase Volume (in US$

billions) |

14.3 |

7.6 |

43.8 |

22.5 |

17.1 |

| Purchase Volume growth (%) |

88.2% |

33.7% |

94.7% |

31.6% |

78.1% |

| Monthly Average Revenue

per Active Customer (in $) |

5.6 |

3.3 |

4.5 |

3.6 |

5.9 |

| Monthly Average Cost to

Serve per Active Customer (in $) |

0.9 |

1.1 |

0.8 |

1.2 |

1.9 |

| FX NEUTRAL |

|

|

|

|

|

| Purchase Volume (FX Neutral)

(in US$ billions) |

14.3 |

7.3 |

43.8 |

21.7 |

12.5 |

| Purchase Volume growth (%) |

95.9% |

76.0% |

101.8% |

73.6% |

98.5% |

| Monthly Average Revenue

per Active Customer (in $) |

5.6 |

3.2 |

4.5 |

3.5 |

4.3 |

| Monthly Average Cost to

Serve per Active Customer (in $) |

0.9 |

1.1 |

0.8 |

1.2 |

1.4 |

| CUSTOMER

BALANCES |

|

|

|

|

|

| Deposits (in $ billions) |

9.7 |

5.6 |

9.7 |

5.6 |

2.7 |

| Deposits growth (%) |

73.2% |

107.4% |

73.2% |

107.4% |

350.0% |

| Interest-Earning Portfolio

(in $ billions) |

2.0 |

0.5 |

2.0 |

0.5 |

0.4 |

| Interest-Earning growth

(%) |

317.5% |

20.8% |

317.5% |

20.8% |

90.8% |

| FX NEUTRAL |

|

|

|

|

|

| Deposits (in $ billions) |

9.7 |

5.2 |

9.7 |

5.2 |

1.9 |

| Deposits growth (%) |

86.5% |

173.7% |

86.5% |

173.7% |

375.0% |

| Interest-Earning Portfolio

(in $ billions) |

2.0 |

0.5 |

2.0 |

0.5 |

0.3 |

| Interest-Earning growth

(%) |

343.5% |

58.6% |

343.5% |

58.6% |

190.0% |

| Summary

of Consolidated Financial Metrics |

| COMPANY

FINANCIAL METRICS |

Q4'21 |

Q4'20 |

FY'21 |

FY'20 |

FY'19 |

| Revenue

(in $ millions) |

635.9 |

202.6 |

1,698.0 |

737.1 |

612.1 |

| Revenue

growth (%) |

214.0% |

4.6% |

130.4% |

20.4% |

91.9% |

| Gross

Profit (in $ millions) |

226.9 |

76.3 |

732.9 |

326.9 |

247.9 |

| Gross

Profit Margin (%) |

35.7% |

37.7% |

43.2% |

44.3% |

40.5% |

| Credit

Loss Allowance Expenses / Credit Portfolio (%) |

3.0% |

1.7% |

7.3% |

5.1% |

5.7% |

| Loss

(in $ millions) |

(66.2) |

(107.1) |

(165.3) |

(171.5) |

(92.5) |

| Adjusted

Net Income (Loss) (in $ millions) |

3.2 |

15.8 |

6.6 |

(26.8) |

(74.2) |

| FX

NEUTRAL |

|

|

|

|

|

| Revenue

(in $ millions) |

635.9 |

196.1 |

1,698.0 |

713.3 |

446.7 |

| Revenue

growth (%) |

224.3% |

38.8% |

138.0% |

59.7% |

106.0% |

| Gross

Profit (in $ millions) |

226.9 |

73.9 |

732.9 |

316.4 |

180.9 |

| Gross

Profit Margin (%) |

35.7% |

37.7% |

43.2% |

44.3% |

40.5% |

| Loss

(in $ million) |

(66.2) |

(103.7) |

(165.3) |

(166.0) |

(67.5) |

| Adjusted

Net Income (Loss) (in $ millions) |

3.2 |

15.4 |

6.6 |

(26.0) |

(54.1) |

| | | |

| Fourth Quarter 2021 Results | | 2 |

Customers

reached 53.9 million at year-end 2021, up 61.9% from

year-end 2020. The base of SME customers almost tripled during 2021, growing from 0.5 million as of December 31, 2020 to 1.4

million as of December 31, 2021.

Activity

Rate increased 10.7 pp to 76.3% from 65.6% as

of December 31, 2020, mainly driven by the introduction of new products and features, and by the overall maturation of Nu’s customer

cohorts, with customers continuing to migrate more of their financial lives to the Company’s platform.

Purchase

Volume reached $14.3 billion in Q4'21, increasing 88.2% YoY,

or 95.9% YoY on an FX neutral basis. Volume expansion was driven by both growth in Nu’s customer base, as well as the maturation

of Nu’s existing customers cohorts, whose purchase volume per monthly active customer continued to expand. In 2021, purchase volume

rose to $43.8 billion, increasing 94.7%, or 101.8% YoY on an FX neutral basis, driven primarily by the same factors.

Deposits

stood at $9.7 billion at year-end 2021, increasing 73.2%

YoY, or 86.5% YoY on an FX neutral basis. Deposit expansion was mainly due to growth in Nu’s customer base.

| | | |

| Fourth Quarter 2021 Results | | 3 |

Interest-Earning

Portfolio reached $2.0 billion at year-end 2021, increasing 317.5%

YoY, or 343.5% YoY on an FX neutral basis. Growth was driven primarily by the ramp up of personal loans and, to a lesser extent, the

introduction of new consumer finance products, including purchase financing, boleto (bank slip) financing and bill refinancing.

Monthly

Average Revenue per Active Customer (ARPAC) reached $5.6 in

Q4'21, increasing 66.2% YoY or 71.8% YoY on an FX neutral basis, mostly driven by the maturation of Nu’s customer

cohorts and the rollout of new products. For the year 2021, ARPAC was $4.5, up 24.3% YoY, or 28.6% YoY on an FX

Neutral basis.

Growth

in the number of customers combined with higher levels of engagement drove ARPAC in both periods. As shown in the analysis below, Nu’s

customer cohorts keep expanding the ratios and velocity of primary banking accounts, number of products per active customer, and monthly

ARPAC.

Compounding

Effect of More Engagement and More Products

| | | |

| Fourth Quarter 2021 Results | | 4 |

Monthly

Average Cost to Serve Per Active Customer reached

$0.9 in Q4'21, declining 22.5% YoY or 20.4% YoY on an FX neutral basis, reflecting a reduction in transactional

expenses per customer through better pricing terms and a structural shift in the mix of transactions. The reduction in the Cost to Serve

per Active Customer was achieved despite higher transaction volumes and additional investments in customer support services to further

enhance and differentiate Nu's customer experience. In 2021, average Cost to Serve per Active Customer was $0.8, down 34.1%

YoY, or 31.9% YoY on an FX Neutral basis.

Non-Performing

Loans Delinquency rates have remained below both

Nu's historical averages and average industry levels.

Growth Has Not

Come At the Expense Of Asset Quality

Note:

‘Consumer Finance’ includes both credit card and personal loans balance. The information presented is for Brazil only. Source:

Brazil’s Central Bank, Company data.

| | | |

| Fourth Quarter 2021 Results | | 5 |

REVENUE,

FINANCIAL AND TRANSACTIONAL COSTS AND GROSS PROFIT

Revenue

totaled $635.9 million in Q4’21, increasing 214.0% YoY, or 224.3% YoY on an FX neutral basis. In 2021,

Revenue was $1.7 billion, setting a record for the Company and representing increases of 130.4% YoY, or 138.0% YoY

on an FX neutral basis.

| Revenue

($ million) |

Q4'21 |

Q4'20 |

FY'21 |

FY'20 |

| Interest Income and

Gains (Losses) on Financial Instruments |

439.5 |

89.6 |

1,046.7 |

382.9 |

| Fee and Commission

Income |

196.4 |

112.9 |

651.3 |

354.2 |

| Total |

635.9 |

202.6 |

1,698.0 |

737.1 |

| FX Neutral |

|

|

|

|

| Interest income and

Gains (Losses) on Financial Instruments |

439.5 |

86.8 |

1,046.7 |

370.6 |

| Fee and Commission

Income |

196.4 |

109.3 |

651.3 |

342.7 |

| Total |

635.9 |

196.1 |

1,698.0 |

713.3 |

In

Q4'21, Interest Income and Gains (Losses) on Financial Instruments was $439.5 million, an increase of 390.5% YoY, or 406.3%

YoY on an FX neutral basis. The increase resulted mainly from higher net interest income from the consumer finance portfolio, composed

of personal loans and credit cards. Also contributing to this increase was the rise in Brazil’s interest rates during 4Q'21 (the

interbank deposit rate in Brazil (CDI) averaged 7.6% p.a. in 4Q’21 compared to 1.9% p.a. in 4Q’20) coupled with an increase

in financial assets, mainly arising from Nu’s growing retail deposit base in Brazil. In 2021, Interest Income and Gains (Losses)

on Financial Instruments was $1.0 billion, up 173.4% YoY, or 182.4% YoY on an FX neutral basis.

In

Q4´21, Fee and Commission Income was $196.4 million, up 74.0% YoY, or 79.7% YoY on an FX neutral basis.

This was mainly due to the increase in interchange fees, reflecting higher credit and debit card purchase volumes driven by growth in

the number of customers and their activity rates. These increases were partially offset by a non-recurring $11.2 million reduction

in revenues resulting from the Customer Program (NuSócios), which represents the fair value of BDRs allocated to the 7.5 million

customers who enrolled in the program as part of the Company's IPO. In

2021, Fee and Commission Income was $651.3 million, up 83.9% YoY, or 90.0% YoY on a FX neutral basis.

| | | |

| Fourth Quarter 2021 Results | | 6 |

Cost

of Financial and Transactional Services Provided

In

Q4'21, Cost of Financial and Transactional Services Provided was $409.0 million, up 224.1% YoY, or 234.7% YoY on

an FX neutral basis. This cost represented 64.3% of revenue in the Q4’21, compared to 62.3% in Q4`20. In 2021, the Cost

of Financial and Transactional Services amounted to $965.1 million, up 135.3% YoY, or 143.1% YoY on an FX neutral

basis, accounting for 56.8% of revenue in the year, compared to 55.7% in 2020.

| Cost

of Financial and Transactional Services Provided ($ Million) |

Q4'21 |

Q4'20 |

FY'21 |

FY'20 |

| Interest and other

financial expenses |

(177.0) |

(31.4) |

(367.4) |

(113.9) |

| Transactional expenses |

(32.4) |

(39.1) |

(117.1) |

(126.8) |

| Credit loss allowance

expenses |

(199.6) |

(55.7) |

(480.6) |

(169.5) |

| Total |

(409.0) |

(126.2) |

(965.1) |

(410.2) |

| % of Revenue |

64.3% |

62.3% |

56.8% |

55.7% |

| FX Neutral |

|

|

|

|

| Interest and other

financial expenses |

(177.0) |

(30.4) |

(367.4) |

(110.2) |

| Transactional expenses |

(32.4) |

(37.9) |

(117.1) |

(122.7) |

| Credit loss allowance

expenses |

(199.6) |

(53.9) |

(480.6) |

(164.0) |

| Total |

(409.0) |

(122.2) |

(965.1) |

(397.0) |

| % of Revenue |

64.3% |

62.3% |

56.8% |

55.7% |

The

increase in Interest and Other Financial Expenses was principally driven by growth in interest expenses on retail deposits that resulted

from the aforementioned increase in Brazil’s interest rates coupled with the expansion of Nu’s retail deposit balance. The

increase in credit loss allowance expenses resulted from the rapid growth of Nu's interest-earning portfolio and related ECL credit provisioning.

During

2921, the evolution of Nu’s transactional expenses continued to benefit from cost reductions related to the growing adoption of

PIX in Brazil, which is an instant payment platform that replaces more expensive bank slip payment processing methods, as well as from

lower unit costs that stemmed from renegotiations with the Company’s key suppliers.

| | | |

| Fourth Quarter 2021 Results | | 7 |

Gross

Profit

In

Q4'21, Gross Profit totaled $226.9 million, increasing 197.4% YoY, or 207.0% YoY on an FX neutral basis. The gross

profit margin was 35.7% compared to 37.7% in Q4’20, reflecting the impact of Expected Credit Losses (ECL) under IFRS,

where loan loss provisions are recognized upfront at the time a loan is granted and before it has generated any revenue. In 2021, gross

profit was $732.9 million, up 124.2% YoY, or 131.6% on an FX neutral basis compared to $326.9 million

in 2020, while the gross profit margin was 43.2% compared to 44.3% in 2020.

OPERATING

EXPENSE

In

Q4´21, Operating Expenses totaled $315.4 million, up 208.9% YoY, or 218.9% YoY on an FX neutral basis,

but declined to 49.6% of total revenues from 50.4% in 4Q20. The main driver behind the absolute increase in operating expenses

was general and administrative expenses, which grew 174.8% YoY, or 183.8% YoY on an FX neutral basis, mainly reflecting

an increase in share-based compensation stemming from the effect of taxes arising from the share price appreciation in 2021 as a result

of Nu’s IPO, as well as the increase in headcount during the period. In addition, customer support and operations expenses increased

130.9% YoY, or 138.4% YoY on an FX neutral basis, to serve a significantly higher increase in the number of customers

while investing in services to further enhance the overall user experience.

In

2021, operating expenses reached $903.1 million, up 115.6% YoY, or 122.8% YoY on an FX neutral basis, while

declining to 53.2% of total revenue from 56.8% in 2020. In addition to the aforementioned factors, one-time marketing expenses

associated with Nu´s IPO contributed to the increase in operating expenses.

| Operating

Expenses ($ million) |

Q4'21 |

Q4'20 |

FY'21 |

FY'20 |

| Customer support and

operations |

(65.8) |

(28.5) |

(190.5) |

(124.0) |

| General and administrative

expenses |

(224.2) |

(81.6) |

(628.9) |

(266.0) |

| Marketing expenses |

(34.5) |

(7.9) |

(79.6) |

(19.4) |

| Other income (expenses) |

9.1 |

15.9 |

(4.1) |

(9.5) |

| Total |

(315.4) |

(102.1) |

(903.1) |

(418.9) |

| % of Revenue |

49.6% |

50.4% |

53.2% |

56.8% |

| FX Neutral |

|

|

|

|

| Customer support and

operations |

(65.8) |

(27.6) |

(190.5) |

(120.0) |

| General and administrative

expenses |

(224.2) |

(79.0) |

(628.9) |

(257.4) |

| Marketing expenses |

(34.5) |

(7.6) |

(79.6) |

(18.8) |

| Other income (expenses) |

9.1 |

15.4 |

(4.1) |

(9.2) |

| Total |

(315.4) |

(98.9) |

(903.1) |

(405.4) |

| % of Revenue |

49.6% |

50.4% |

53.2% |

56.8% |

| | | |

| Fourth Quarter 2021 Results | | 8 |

EARNINGS

Net

Income (Loss)

In

Q4'21, Nu reported a Net Loss of $66.2 million, improving 38.2% YoY, or 36.2% YoY on an FX neutral basis,

from the $107.1 million Net Loss in Q4'20.

In

2021, Nu reported a $165.3 million Net Loss, improving 3.6% YoY, or 0.4% YoY on an FX neutral basis, compared

to the $171.5 million net loss in 2020.

Adjusted

Net Income (Loss)

In

Q4'21, Nu reported an Adjusted Net Income of $3.2 million, compared with an Adjusted Net Income of $15.8 million in Q4'20.

In 2021, Nu reported an Adjusted Net Income of $6.6 million, compared with an Adjusted Net Loss of $26.8 million in 2020.

Adjusted

Net Income (Loss) is a non-IFRS measure calculated using Net Income and adding: (i) expenses related to share-based compensation, (ii)

amortization of intangibles, (iii) expenses (revenue deduction) related to the IPO-related Customer Program (NuSócios), and (iv)

the allocated tax effects on those items. For more information, please see “Non-IFRS Financial Measures - Reconciliation of Adjusted

Net Income section".

| | | |

| Fourth Quarter 2021 Results | | 9 |

Activity

rate -

is defined as monthly active customers divided by the total number of customers as of a specific date.

BDR

- means

Brazilian Depositary Receipt.

CAC

-

means customer acquisition costs and consists of the following expenses: printing and shipping of a card, credit data costs (primarily

consisting of credit bureau costs) and paid marketing.

CDI

(Certificado de Depósito Interbancário) -

Brazilian interbank deposit rate.

Credit

Loss Allowance Expenses/Credit Portfolio - is

defined as credit loss allowance expenses, divided by the sum of receivables from credit card operations (current, installments and revolving)

and loans to customers, in each case gross of ECL allowance, as of the period end date.

Customer

- is

defined as an individual or SME that has opened an account with Nu and does not include any such individuals or SMEs that have been charged-off

or blocked or have voluntarily closed their account. The number of customers as of December 31, 2021, does not include the number of

customers resulting from the acquisition of Easynvest, which as of such date amounted to 6.3 million customers, of which 0.6 million

were unique to Easynvest.

ECL

or ECL Allowance -

means the expected credit losses in Nu´s credit operations, including loans and credit cards.

Foreign

Exchange ("FX”) Neutral Measures -

refer to certain measures prepared and presented in this earnings release to eliminate the effect of FX volatility between the comparison

periods, allowing management and investors to evaluate Nu´s financial performance despite variations in foreign currency exchange

rates, which may not be indicative of the Company's core operating results and business outlook. For additional information, see “Non-IFRS

Financial Measures and Reconciliations”.

Interest-Earning

Portfolio - consists

of receivables from credit card operations on which Nu is accruing interest and loans to customers, in each case prior to ECL allowance,

as of the period end date.

IPO

-

means Initial Public Offering.

Monthly

Active Customers -

is defined as all customers that have generated revenue in the last 30 calendar days, for a given measurement period.

Monthly

Average Cost to Serve per Active Customer - is

defined as the monthly average of the sum of transactional expenses and customer support and operations expenses (sum of these expenses

in the period divided by the number of months in the period) divided by the average number of individual monthly active customers during

the period (average number of individual monthly active customers is defined as the average of the number of monthly active customers

at the beginning of the period measured, and the number of monthly active customers at the end of the period).

Monthly

Average Revenue per Active Customer or Monthly ARPAC - is

defined as the average monthly revenue (total revenue divided by the number of months in the period) divided by the average number of

individual monthly active customers during the period (average number of individual monthly active customers is defined as the average

of the number of monthly active customers at the beginning of the period measured, and the number of monthly active customers at the

end of the period).

| | | |

| Fourth Quarter 2021 Results | | 11 |

PFM

-

Personal Finance Management.

Purchase

Volume, or PV - is

defined as the total value of transactions that are authorized through Nu´s credit and debit cards only; it does not include other

payment methods that we offer such as PIX, WhatsApp payments or traditional wire transfers.

SME

- means

small and medium-sized enterprises.

| | | |

| Fourth Quarter 2021 Results | | 12 |

This release

speaks at the date hereof and the Company is under no obligation to update or keep current the information contained in this release.

Any information expressed herein is subject to change without notice. Any market or other third-party data included in this release has

been obtained by the Company from third party sources. While the Company has compiled and extracted the market data, it can provide no

assurances of the accuracy and completeness of such information and takes no responsibility for such data.

This release

contains forward-looking statements. All statements other than statements of historical fact contained in this release may be forward-looking

statements and include, but are not limited to, statements regarding the Company’s intent, belief or current expectations. These

forward-looking statements are subject to risks and uncertainties, and may include, among others, financial forecasts and estimates based

on assumptions or statements regarding plans, objectives and expectations. Although the Company believes that these estimates and forward-looking

statements are based upon reasonable assumptions, they are subject to several risks and uncertainties and are made in light of information

currently available, and actual results may differ materially from those expressed or implied in the forward-looking statements due to

various factors, including those risks and uncertainties included under the captions “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in our prospectus dated December 8, 2021 filed with the

Securities and Exchange Commission pursuant to Rule 424(b) under the Securities Act of 1933, as amended, and in our Annual Report on

Form 20-F for the year ended December 31, 2021, which will be filed with the Securities and Exchange Commission. The Company, its advisers

and each of their respective directors, officers and employees disclaim any obligation to update the Company’s view of such risks

and uncertainties or to publicly announce the result of any revision to the forward-looking statements made herein, except where it would

be required to do so under applicable law. The forward-looking statements can be identified, in certain cases, through the use of words

such as “believe,” “may,” “might,” “can,” “could,” “is designed to,”

“will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “forecast”, “plan”, “predict”, “potential”, “aspiration,”

“should,” “purpose,” “belief,” and similar, or variations of, or the negative of such words and expressions.

The financial

information in this document includes forecasts, projections and other predictive statements that represent the Company’s assumptions

and expectations in light of currently available information. These forecasts, projections and other predictive statements are based

on the Company’s expectations and are subject to variables and uncertainties. The Company’s actual performance results may

differ. Consequently, no guarantee is presented or implied as to the accuracy of specific forecasts, projections or predictive statements

contained herein, and undue reliance should not be placed on the forward-looking statements in this press release, which are inherently

uncertain.

In addition

to IFRS financials, this presentation includes certain summarized, non-audited or non-IFRS financial information. These summarized, non-audited

or non-IFRS financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared

in accordance with IFRS. References in this presentation to “R$” refer to the Brazilian real, the official currency of Brazil.

| | | |

| Fourth Quarter 2021 Results | | 13 |

This release

includes financial measures defined as “non-IFRS financial measures” by the SEC, including: Adjusted Net Income (Loss) and

certain FX Neutral measures and provides reconciliations to the most directly comparable IFRS financial measure. A non-IFRS financial

measure is generally defined as a numerical measure of historical or future financial performance or financial position that purports

to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. These

non-IFRS financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in

accordance with IFRS.

Adjusted

Net Income (Loss) is defined as profit (loss) attributable to shareholders

of the parent company for the year/period, adjusted for expenses and allocated tax effects on share-based compensation in such year/period,

finance costs related to results with convertible instruments in such year/period, as well as expenses (revenue deduction) and allocated

tax effects related to the IPO-related customer program (NuSócios) in such year/period.

Adjusted

Net Income (Loss) is presented because our management believes that this non-IFRS financial measure can provide useful information to

investors, securities analysts and the public in their review of our operating and financial performance, although it is not calculated

in accordance with IFRS or any other generally accepted accounting principles and should not be considered as a measure of performance

in isolation. We also use Adjusted Net Income (Loss) as a key profitability measure to assess the performance of our business. We believe

Adjusted Net Income (Loss) is useful to evaluate our operating and financial performance for the following reasons:

| ● | Adjusted

Net Income (Loss) is widely used by investors and securities analysts to measure a company’s

operating performance without regard to items that can vary substantially from company to

company and from period to period, depending on their accounting and tax methods, the book

value and the market value of their assets and liabilities, and the method by which their

assets were acquired; |

| ● | Non-cash

equity grants made to executives, employees or consultants at a certain price and point in

time, and their income tax effects, do not necessarily reflect how our business is performing

at any particular time and the related expenses (and their subject impacts in the market

value of our assets and liabilities) are not key measures of our core operating performance; |

| ● | Expenses

related to the Customer Program (NuSócios), and their income tax effects, do not necessarily

reflect how our business is performing at any particular time and it represents a specific

marketing effort event from our IPO and are not key measures of our core operating performance;

and |

| ● | Finance

costs with convertible instruments include fair value adjustments relating to the embedded

derivative conversion feature, which are based upon subjective assumptions and do not reflect

the cash cost of our convertible debt, and do not directly reflect how our business is performing

at any particular time and the related expense adjustment amounts are not key measures of

our core operating performance. |

Adjusted

Net Income (Loss) is not a substitute for Net Income, which is the IFRS measure of earnings. Additionally, our calculation of Adjusted

Net Income (Loss) may be different from the calculation used by other companies, including our competitors in the technology and financial

services industries, because other companies may not

calculate these measures in the same manner as we do, and therefore, our measure may not be comparable to those of other companies.

| | | |

| Fourth Quarter 2021 Results | | 14 |

Adjusted

Net Income reconciliation

For the years and the three-month period ended December 31, 2021 and

2020

(In thousands of U.S. Dollars)

| |

Q4'21 |

Q4'20 |

2021 |

2020 |

| Profit

(loss) attributable to shareholders of the parent company |

(66.1) |

(107.1) |

(165.0) |

(171.5) |

| Share-based

compensation |

90.1 |

26.6 |

225.4 |

56.3 |

| Allocated

tax effects on share-based compensation |

(27.0) |

(4.9) |

(60.0) |

(12.8) |

| Customer

Program (NuSócios) |

11.2 |

- |

11.2 |

- |

| Allocated

tax effects on Customer Program |

(5.0) |

- |

(5.0) |

- |

| Finance

costs - results with convertible instruments |

- |

101.2 |

- |

101.2 |

| Adjusted

Net Income (Loss) for the period |

3.2 |

15.8 |

6.6 |

(26.8) |

FX

Neutral measures are prepared and presented to eliminate

the effect of foreign exchange, or “FX,” volatility between the comparison periods, allowing management and investors to

evaluate our financial performance despite variations in foreign currency exchange rates, which may not be indicative of our core operating

results and business outlook.

FX Neutral

measures are presented because our management believes that these non-IFRS financial measures can provide useful information to investors,

securities analysts and the public in their review of our operating and financial performance, although they are not calculated in accordance

with IFRS or any other generally accepted accounting principles and should not be considered as a measure of performance in isolation.

The FX

Neutral measures were calculated to present what such measures in preceding periods/years would have been had exchange rates remained

stable from these preceding periods/years until the date of the Company's most recent financial information.

The FX

Neutral measures for the three months ended December 31, 2020 were calculated by multiplying the as reported amounts of Adjusted Net

Income (Loss) and the key business metrics for such period by the average Brazilian reais /U.S. dollars exchange rate for the three months

ended December 31, 2020 (R$5.434 to US$1.00) and using such results to re-translate the corresponding amounts back to U.S. dollars by

dividing them by the average Brazilian reais/U.S. dollars exchange rate for the three months ended December 31, 2021 (R$5.612 to US$1.00),

so as to present what certain of our statement of profit and loss amounts and key business metrics would have been had exchange rates

remained stable from this past period until the three months ended December 31, 2021.

The FX

Neutral measures for the year ended December 31, 2020 were calculated by multiplying the as reported amounts of Adjusted Net Income (Loss)

and the key business metrics for such periods/years by the average Brazilian reais/U.S. dollars exchange rates for the year ended December

31, 2020 (R$5.240 to US$1.00), and using such results to re-translate the corresponding amounts back to U.S. dollars by dividing them

by the average Brazilian reais/U.S. dollars exchange rate for the year ended December 31, 2021 (R$5.415 to US$1.00), so as to present

what certain of our statement of profit and loss amounts and key business metrics would have been had exchange rates remained stable

from these past periods/years until the year ended December 31, 2021.

The average

Brazilian reais/U.S. dollars exchange rates were calculated as the average of the month-end rates for each month in the three months

ended December 31, 2021 and 2020 and the average of the month-end rates for each month in the years 2021 and 2020 as reported by Bloomberg.

FX Neutral

measures for deposits and interest-earning portfolio were calculated by multiplying the as reported amounts as of December 31, 2020,

by the spot Brazilian reais/U.S. dollars exchange rates as of this date (R$5.199 to US$1.00), and using such results to re-translate

the corresponding amounts back to U.S. dollars by dividing them by using the spot rate as of December 31, 2021 (R$5.576 to US$1.00) so

as to present what these amounts would have been had exchange

rates been the same as those on December 31, 2021. The Brazilian reais/U.S. dollars exchange rates were calculated using rates as of

such dates as reported by Bloomberg.

| | | |

| Fourth Quarter 2021 Results | | 15 |

Profit

or Loss

For the years ended December 31, 2021 and 2020

(In thousands of U.S. Dollars, except loss per share)

| |

2021 |

|

2020 |

| |

|

|

|

| Interest income and gains (losses)

on financial instruments |

1,046,746 |

|

382,922 |

| Fee and commission income |

651,277 |

|

354,211 |

| Total revenue |

1,698,023 |

|

737,133 |

| Interest and other financial expenses

|

(367,344) |

|

(113,924) |

| Transactional expenses |

(117,119) |

|

(126,815) |

| Credit loss allowance expenses |

(480,643) |

|

(169,485) |

| Total cost of financial

and transactional services provided |

(965,106) |

|

(410,224) |

| Gross profit |

732,917 |

|

326,909 |

| Operating expenses

|

|

|

|

| Customer support and operations |

(190,509) |

|

(123,950) |

| General and administrative expenses

|

(628,901) |

|

(266,024) |

| Marketing expenses |

(79,574) |

|

(19,426) |

| Other income (expenses) |

(4,097) |

|

(9,535) |

| Total operating

expenses |

(903,081) |

|

(418,935) |

| Results with convertible instruments

|

- |

|

(101,152) |

| Loss before income

taxes |

(170,164) |

|

(193,178) |

| Income taxes |

|

|

|

| Current taxes |

(219,824) |

|

(22,338) |

| Deferred taxes |

224,654 |

|

44,025 |

| Total income taxes

|

4,830 |

|

21,687 |

| Loss for the year

|

(165,334) |

|

(171,491) |

| Loss attributable to shareholders of the

parent company |

(164,993) |

|

(171,491) |

| Loss attributable to non-controlling interests |

(341) |

|

0 |

| Loss per share –

Basic and Diluted |

(0.1030) |

|

(0.1304) |

| Weighted average

number of outstanding shares – Basic and Diluted (in thousands of shares) |

1,602,126 |

|

1,315,578 |

| | | |

| Fourth Quarter 2021 Results | | 16 |

Financial

Position

As of December 31, 2021 and 2020

(In thousands of U.S. Dollars)

| |

2021 |

|

2020 |

| Assets |

|

|

|

| Cash

and cash equivalents |

2,705,675

|

|

2,343,780

|

| Financial

assets at fair value through profit or loss |

918,332

|

|

4,378,118

|

| Securities |

815,962

|

|

4,287,277

|

| Derivative financial

instruments |

101,318

|

|

80

|

| Collateral for credit

card operations |

1,052

|

|

90,761

|

| Financial assets at

fair value through other comprehensive income |

8,163,428

|

|

- |

| Securities |

8,163,428

|

|

- |

| Financial

assets at amortized cost |

6,932,486

|

|

3,150,013

|

| Compulsory and other

deposits at central banks |

938,659

|

|

43,542

|

| Credit card receivables |

4,780,520

|

|

2,908,907

|

| Loans to customers |

1,194,814

|

|

174,694

|

| Other financial assets

at amortized cost |

18,493

|

|

22,870

|

| Other

assets |

283,264

|

|

123,495

|

| Deferred

tax assets |

360,752

|

|

125,131

|

| Right-of-use

assets |

6,426

|

|

10,660

|

| Property,

plant and equipment |

14,109

|

|

9,850

|

| Intangible

assets |

72,337

|

|

12,372

|

| Goodwill |

401,872

|

|

831

|

| Total

assets |

19,858,681

|

|

10,154,250

|

| | | |

| Fourth Quarter 2021 Results | | 17 |

| |

2021 |

|

2020 |

| Liabilities |

|

|

|

| Financial

liabilities at fair value through profit or loss |

102,380

|

|

90,796

|

| Derivative financial

instruments |

87,278

|

|

75,304

|

| Instruments eligible

as capital |

12,056

|

|

15,492

|

| Repurchase agreements |

3,046

|

|

- |

| Financial

liabilities at amortized cost |

14,706,713

|

|

9,421,710

|

| Deposits |

9,667,300

|

|

5,584,862

|

| Payables to credit

card network |

4,882,159

|

|

3,331,258

|

| Borrowings and financing |

147,243

|

|

97,454

|

| Securitized borrowings |

10,011

|

|

79,742

|

| Senior preferred shares |

- |

|

328,394

|

| Salaries,

allowances and social security contributions |

97,909

|

|

25,848

|

| Tax

liabilities |

241,197

|

|

30,782

|

| Lease

liabilities |

7,621

|

|

12,014

|

| Provision

for lawsuits and administrative proceedings |

18,082

|

|

16,469

|

| Deferred

income |

30,657

|

|

25,965

|

| Deferred

tax liabilities |

29,334

|

|

8,741

|

| Other

liabilities |

182,247

|

|

83,814

|

| Total

liabilities |

15,416,140

|

|

9,716,139

|

| |

|

|

|

| Equity |

|

|

|

| Share

capital |

83

|

|

45

|

| Share

premium reserve |

4,678,585

|

|

638,007

|

| Accumulated

gain (losses) |

(128,409) |

|

(102,441) |

| Other

comprehensive income (loss) |

(109,227) |

|

(97,500) |

| Equity attributable

to shareholders of the parent company |

4,441,032

|

|

438,111

|

| Equity

attributable to non-controlling interests |

1,509

|

|

- |

| Total

equity |

4,442,541

|

|

438,111

|

| Total

liabilities and equity |

19,858,681

|

|

10,154,250

|

| | | |

| Fourth Quarter 2021 Results | | 18 |

Cash

Flows

For the years ended December 31, 2021 and 2020

(In thousands of U.S. Dollars)

| |

2021 |

|

2020 |

| Cash

flows from operating activities |

|

|

|

| Reconciliation

of profit (loss) to net cash flows from operating activities: |

| Loss

for the year |

(165,334) |

|

(171,491) |

| Adjustments: |

|

|

|

| Depreciation

and amortization |

17,339

|

|

7,428

|

| Credit loss allowance

expenses |

503,679

|

|

187,790

|

| Deferred

income taxes |

(224,654) |

|

(44,025) |

| Customer Program |

11,180

|

|

- |

| Provision for lawsuits

and administrative proceedings |

2,818

|

|

227

|

| Losses

(gains) on others investments |

(39,280) |

|

- |

| Losses

(gains) on financial instruments |

19,338

|

|

48,433

|

| Interest

accrued |

11,077

|

|

39,521

|

| Share-based

payments granted |

157,324

|

|

35,569

|

| |

293,487

|

|

103,452

|

| |

|

|

|

| Changes

in operating assets and liabilities: |

|

|

|

| Securities |

(4,666,792) |

|

(2,008,861) |

| Compulsory

deposits and others at central banks |

(924,889) |

|

(43,841) |

| Credit

card receivables |

(2,568,423) |

|

(470,227) |

| Loans

to customers |

(1,522,217) |

|

(178,686) |

| Interbank

transactions |

- |

|

93

|

| Other

assets |

(64,072) |

|

78,319

|

| Deposits |

4,001,856

|

|

2,871,246

|

| Payables

to credit card network |

1,602,485

|

|

312,607

|

| Deferred

income |

4,848

|

|

3,621

|

| Other

liabilities |

417,225

|

|

57,841

|

| |

|

|

|

| Interest

paid |

(9,062) |

|

(6,199) |

| Income

tax paid |

(52,314) |

|

(7,880) |

| Interest received |

563,550

|

|

263,035

|

| Cash flows (used

in) generated from operating activities |

(2,924,318) |

|

974,520

|

| | | |

| Fourth Quarter 2021 Results | | 19 |

| |

2021 |

|

2020 |

| Cash

flows from investing activities |

|

|

|

| Acquisition

of fixed assets |

(6,025) |

|

(3,084) |

| Acquisition

of intangible assets |

(22,473) |

|

(4,902) |

| Acquisition

of subsidiary, net of cash acquired |

(114,486) |

|

(8,284) |

| Equity instrument |

(11,211) |

|

- |

| Cash flow (used

in) generated from investing activities |

(154,195) |

|

(16,270) |

| |

|

|

|

| Cash

flows from financing activities |

|

|

|

| Proceeds

from senior preferred shares |

- |

|

300,000

|

| Issuance

of preferred shares |

800,000

|

|

- |

| Issuance

of shares under IPO |

2,590,846

|

|

- |

| Transactions

costs from IPO |

(47,545) |

|

- |

| Payments

of securitized borrowings |

(66,403) |

|

(52,172) |

| Proceeds

from borrowings and financing |

116,349

|

|

17,974

|

| Payments

of borrowings and financing |

(60,523) |

|

(27,893) |

| Lease

payments |

(4,387) |

|

(4,568) |

| Exercise

of stock options |

12,252

|

|

6,776

|

| Shares

repurchased |

(4,607) |

|

(15) |

| Cash flows (used

in) generated from financing activities |

3,335,982

|

|

240,102

|

| Increase

(decrease) in cash and cash equivalents |

257,469

|

|

1,198,352

|

| |

|

|

|

| Cash

and cash equivalents |

|

|

|

| Cash

and cash equivalents - beginning of the year |

2,343,780

|

|

1,246,566

|

| Foreign exchange rate

changes on cash and cash equivalents |

104,426

|

|

(101,138) |

| Cash

and cash equivalents - end of the year |

2,705,675

|

|

2,343,780

|

| Increase

(decrease) in cash and cash equivalents |

257,469

|

|

1,198,352

|

| | | |

| Fourth Quarter 2021 Results | | 20 |

About

Nu Holdings Ltd.

Nu

is one of the world’s largest digital banking platforms, serving around 54 million customers across Brazil, Mexico and Colombia.

As one of the leading technology companies in the world, Nu leverages proprietary technologies and innovative business practices to create

new financial solutions and experiences for individuals and SMEs that are simple, intuitive, convenient, low-cost, empowering and human.

Guided by a mission to fight complexity and empower people, Nu is fostering the access to financial services across Latin America, connecting

profit and purpose to create value for all stakeholders and have a positive impact on the communities it serves. For more information,

please visit www.nubank.com.br

| | | |

| Fourth Quarter 2021 Results | | 21 |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Nu Holdings Ltd. |

| |

|

| |

By: |

/s/ Guilherme Lago |

| |

|

Guilherme

Lago

Chief Financial Officer |

Date: February

22, 2022

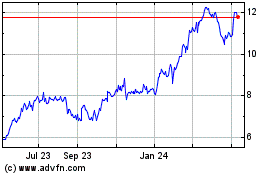

Nu (NYSE:NU)

Historical Stock Chart

From Mar 2024 to Apr 2024

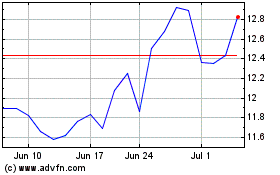

Nu (NYSE:NU)

Historical Stock Chart

From Apr 2023 to Apr 2024