SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February, 2022

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified in its charter)

Nu Holdings Ltd.

(Translation of Registrant's name into English)

Campbells Corporate Services Limited, Floor 4,

Willow House, Cricket Square, KY1-9010

Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

Yes _______ No (X)

Nu Holdings Ltd.

(the “Company”)

Written Resolutions of the Directors of the Company dated February

17, 2022

passed in accordance with the Articles of Association of the

Company (the “Articles”)

The undersigned, being the all of the Directors of the Company

for the time being (the “Directors”), hereby take the following actions and adopt the following resolutions:

DISCLOSURE OF INTERESTS

IT IS NOTED THAT to the extent any Director has any personal

interest, direct or indirect, in the matters contemplated by these resolutions which he or she is required to disclose in accordance with

the Articles or in accordance with applicable law or otherwise or which might disqualify such person from approving these resolutions,

such disclosure has been made and such Director may vote and act on the matters referred to herein.

APPROVAL OF UPDATED VERSION OF INSIDER TRADING POLICY

IT IS NOTED THAT:

| 1. | On November 09, 2021 the Board of Directors

approved the reviewed version of Insider Trading Policy (the “Policy”). |

| 2. | It is proposed that the Policy be adjusted

in order to include as an Addendum A a definition in general terms of Material Nonpublic Information and to provide some examples of such

type of information (the "Updated Policy"). |

| 3. | The Updated Policy has been reviewed and

considered in detail by the Board. |

IT IS RESOLVED THAT:

The Updated Policy is hereby approved and adopted, as per Exhibit A.

GENERAL AUTHORISATION

IT IS RESOLVED THAT any Director or Officer of the Company

be and is hereby authorised to do all such acts and things and agree and execute any other documents on behalf of the Company as may be

required in order to carry out the actions contemplated by the foregoing resolutions (including as deeds if appropriate) and generally

to sign all documents as may be required in connection with the actions contemplated by the foregoing resolutions and execution and delivery

by any such Director or Officer of any such documents being conclusive

| 1 |

|

evidence of their and the Company’s agreement to the

final terms and conditions thereof.

IT IS RESOLVED THAT, to the extent that any Director or

Officer has taken any actions or signed any documents or undertakings prior to the date hereof which would have been approved if taken

or signed after the date hereof, the same be and are hereby ratified, approved and confirmed.

[Remainder of page intentionally left blank]

| 2 |

|

IN WITNESS WHEREOF, each of the undersigned, being all of the

Directors of the Company for the time being, has executed these resolutions in writing on the date indicated above. These resolutions

may be executed in counterpart and each counterpart shall be deemed to be an original and which counterparts when taken together shall

constitute one and the same instrument.

|

_______________________________

David Vélez Osorno

|

_______________________________

Douglas Mauro Leone

|

|

_______________________________

Anita Sands

|

_______________________________

Jacqueline Dawn Reses

|

|

_______________________________

Daniel Krepel Goldberg

|

_______________________________

Luis Alberto Moreno Mejia

|

|

________________________________

Larissa de Macedo Machado |

_______________________________

Rogério Paulo Calderón Peres

|

|

____________________________

Muhtar Ahmet Kent

|

|

| 3 |

|

Nu Holdings Ltd.

INSIDER TRADING POLICY

Adopted in February 2022

Summary of Rules

| ➢ | First principles:

The Company will continue to have an environment of transparency of access to data and will treat Nubankers (as defined below) as

owners, not renters. Given this, the Company expects full compliance with this Policy, and will apply disciplinary measures for any violation

of this Policy; |

| ➢ | Nubankers shall

not trade in any securities of the Company when in possession of material non-public information and shall not provide such information

to third parties, unless previously authorized by the Company; |

| ➢ | Trading in the

Company’s securities is only allowed during the Trading Window specified in this Policy; |

| ➢ | As a general rule,

the Trading Window starts on the 2nd business day following a quarterly earnings release and ends on the 20th day after such release (inclusive).

For the annual release, the Trading Window ends on the 5th day of March (inclusive); |

| ➢ | Ad hoc trading

windows and ad hoc black-out periods may be determined by Compliance team, from time to time; and |

| ➢ | Nubankers shall

not engage in any transactions involving any hedging or derivatives of Company securities. |

In order to take an active role in the prevention of insider

trading violations by officers, directors, employees and interns ("Nubankers1") and other potential insiders of

Nu Holdings Ltd. and its controlled affiliates (collectively, the "Company"), the Company has adopted this Insider Trading Policy

(the “Policy”).

Statement of Intent

The Company opposes the misuse of material non-public

information (“MNPI”) in the trading of any securities, included but not limited to the Company's securities, and it is the

intent of this Policy to implement procedures designed to prevent trading based on MNPI regarding the Company or any other issuer. The

Company also wishes to discourage Nubankers from acting contrary to the interests of its shareholders.

1

For the purposes of this Policy, the Nubanker definition also includes any account or vehicle over

which the Nubanker has or shares the power, directly or indirectly, to make investment decisions (whether or not such persons have a financial

interest in the account, such as funds of one or more private investment companies).

| 4 |

|

Definition of Material Non-Public Information

It is not possible to define all categories of material

information. However, information should be regarded as material if (a) it may materially impact the prices of any security; (b) it may

materially impact investors’ decisions to exercise any right inherent to their condition as holders of any securities; or (c) there

is a substantial likelihood that a reasonable investor would consider it important in making an investment decision regarding the purchase,

sale, holding or hedging of any security. Either positive or negative information may be material information. Information is considered

non-public if it has not been publicly disclosed in a manner making it available to investors generally on a broad-based non-exclusionary

basis (e.g., a public filing). Questions concerning whether information is material and non-public can be directed to the Compliance team.

Covered Parties (Insiders)

This Policy applies to (i) all Nubankers irrespective

of where they are based, and extends to their spouses, domestic partners and any other close immediate family member, (ii) other people

who gain access to MNPI, (iii) any account or vehicle over which the Nubanker has or shares the power, directly or indirectly, to make

investment decisions (whether or not such persons have a financial interest in the account, such as funds of one or more private investment

companies), (iv) any account established or maintained by Nubankers or their close immediate family members with their consent or knowledge

and in which Nubankers or their close immediate family members have a direct or indirect financial interest, (v) other third parties that

may be identified as potential insiders by the Company from time to time (each, an "Insider").

For the purposes of this Policy, close immediate family

member means a member of a person's family who may be expected to influence, or be influenced by, such person in their dealings with the

Company, including but not limited to a child, step-child, spouse, domestic partner, and any person that is economically dependent on

such person and/or his or her spouse or domestic partner.

Nubankers are responsible to communicate the terms of

this Policy to their close immediate family members and to ensure compliance by them to the best of their ability.

Separation from Service

Any Nubankers who served as a director or officer of the

Company must continue to fully comply with this Policy for a period of 3 (three) months following the end of his or her service with the

Company.

Covered Transactions

This Policy applies to all transactions in the Company’s

securities, including ordinary shares, certificates of deposits (e.g. BDR's), options for ordinary shares and any other securities the

Company may issue from time to time, such as preferred shares, warrants and convertible debt, and derivative securities relating to the

Company’s shares, whether or not issued by

| 5 |

|

the Company, such as publicly traded options.

Because employee share options or similar rights cannot

be traded, the exercise of employee options or similar rights is not subject to this Policy. However, Company securities that are acquired

upon exercise of an option will be treated like any other Company security under this Policy.

This Policy also applies to transactions involving any

publicly traded securities issued by other companies where Nubankers learn MNPI about suppliers, customers, or competitors through their

work at the Company.

The Company’s Trading Window

The Company has determined that all Insiders shall be

prohibited from buying, selling or otherwise effecting transactions in the Company’s securities or derivatives based on the Company’s

securities EXCEPT during the trading window.

The trading window for a quarterly earnings period starts

on the 2nd business day following a quarterly earnings release and lasts until the 20th day after such release, inclusive; the trading

window for an annual earnings period starts on the 2nd business day following an annual earnings release and lasts until March 5th of

the applicable year, inclusive (as applicable, the "Trading Window").

In addition, the Company, through Compliance, may authorize

longer or additional trading windows in which buying, selling or otherwise effecting transactions in the Company’s securities shall

be permitted pursuant to this Policy as if in a standard “Trading Window.”

Ad Hoc Black-Out Periods

Similarly, the Company, through Compliance, may impose

special black-out periods during which certain Insiders will be prohibited from buying, selling or otherwise effecting transactions in

any securities of the Company or derivative securities thereof, even though the Trading Window would otherwise be open (an “ad hoc

black-out period”).

If an ad hoc black-out period is imposed, Compliance will

notify certain Insiders, who should thereafter not engage in any covered transaction involving the Company’s securities and should

not disclose the existence of the ad hoc black-out period to others.

Designated Brokers

Nubankers must use a pre-approved designated broker while

trading in Company securities. The list of pre-approved designated brokers is available on the Honey portal. The Compliance team may,

on a case by case basis, make an exception to the designated brokers list. Trading in Company securities outside of the designated brokers

is a violation of this Policy.

| 6 |

|

Prohibited Transactions and Conduct

Trading in securities in possession of MNPI

No Insider shall engage in any transaction involving the

Company’s securities, including any offer to purchase or offer to sell, during any period commencing with the date that the Insider

comes into possession of MNPI concerning the Company and ending at the beginning of the trading day following the date of public disclosure

of that information, or at such time as such MNPI is no longer material.

Even during a Trading Window and whether or not under

an ad hoc black-out period, any person possessing MNPI should not engage in any covered transactions in the Company’s securities

until the beginning of the trading day following the date of public disclosure of such MNPI.

No Insider shall engage in any transaction involving another

company’s publicly traded securities while in possession of MNPI about such company when that information is obtained in the course

of employment with, or the performance of services on behalf of, the Company and for which there is a relationship of trust and confidence

concerning the MNPI.

"Tipping" to third parties

No Insider shall disclose (“tip”) MNPI about

the Company to any other person where such information may be used by such person to his or her profit by trading in the Company’s

securities, nor shall such Insider make recommendations or express opinions on the basis of MNPI as to trading in the Company’s

securities. This restriction is also applicable to other issuers' securities.

Hedging, derivatives and short selling

Except for participation in the Company’s share

option program, Nubankers shall not engage in any transactions involving any hedging, short selling or derivatives of Company securities,

including trading in futures and derivative securities and engaging in hedging activities relating to Company securities, including exchange

traded options, puts, calls, collars, forward sale contracts, equity swaps, exchange funds or other arrangements or instruments designed

to hedge or offset decreases in the market value of the Company’s securities.

Nubankers are required to comply with the Code of Conduct

at all times.

Problematic Transactions

Pledging or margin accounts for Nubankers

While pledging Company securities is allowed, Nubankers

should be aware of the associated risks. Specifically, pledged securities may be sold by the pledgee without the pledgor’s consent

under certain conditions. For example, securities held in a margin account may be

| 7 |

|

sold by a broker without the customer’s consent

if the customer fails to meet a margin call. Because such a sale may occur at a time when a Nubanker has MNPI or is otherwise not permitted

to trade in Company securities, Nubankers should be conscious of the risks associated with pledging Company securities, including by purchasing

Company securities on margin or holding Company securities in a margin account.

Speculation

Investing in the Company’s securities provides an

opportunity to share in the future growth of the Company. But investment in the Company and sharing in the growth of the Company does

not mean short range speculation based on fluctuations in the market. Such activities put the personal gain of the Nubanker in conflict

with the best interests of the Company and its shareholders. Although this policy does not mean that Nubankers may never sell shares,

frequent trading in Company securities should be avoided. Speculating in Company securities is not part of the Company culture.

Limit orders

Limit orders with brokers should not extend beyond any

Trading Window and should be cancellable upon an imposition of an ad hoc black-out period.

Options

Exercising options issued pursuant to the Company’s

share option plan, as otherwise permitted under this Policy, is not considered problematic. The exercise of options under the Company’s

share option plan with a cash payment of the exercise (also known as cash exercise or exercise and hold) price is exempt from this Policy,

since the other party to these transactions is the Company itself and the price does not vary with the market, but is fixed by the terms

of the option agreement. This exemption does not apply to the sale of any shares issued upon such exercise and it does not apply to a

cashless exercise of options (also known as same-day-sale), which is accomplished by a sale of a portion of the shares issued upon exercise

of an option.

Adoption and Effect of 10b5-1 and Other Relevant Trading

Plans

The Company may approve and allow all directors, officers

and other employees to adopt trading plans in accordance with U.S. Securities and Exchange Commission Rule 10b5-1(c) (17 C.F.R. §

240.10b5-1(c)) and CVM Resolution 44 and other relevant local regulations and otherwise pursuant to the Company’s procedure for

adopting such a trading plan (a “share trading plan”).

The restrictions on trading set forth in this Policy shall

not apply to trades made pursuant to a share trading plan.

| 8 |

|

Individual Responsibility

Every Nubanker has the individual responsibility to comply

with this Policy and the applicable laws of their jurisdiction. An Insider may, from time to time, have to renounce a proposed transaction

in the Company’s securities even if he or she planned to make the transaction before learning of the MNPI and even though the Insider

believes he or she may suffer an economic loss or renounce anticipated profit by doing so. Trading in the Company’s securities

during the Trading Window should not be considered a “safe harbor,” and all Nubankers should use good judgment at all times.

Insider Monitoring and Privacy

Every Nubanker must acknowledge and authorize that the

compliance with the requirements of this Policy by Insiders may be subject to monitoring by the Company (or third-parties on behalf of

the Company) and by official authorities.

In this sense, Nubankers must be aware that trading information

will be monitored in order to prevent any breach of this Policy.

The Company takes privacy seriously and will treat any

information obtained through such monitoring as highly confidential. The Company will limit monitoring to what is necessary for the purpose

of this Policy, and will conduct all monitoring in a secure, lawful and proportionate way.

Consequences for Violation

Insiders may be subject to criminal and civil fines and

penalties as well as imprisonment for engaging in transactions in securities at a time when they have knowledge of MNPI regarding the

issuer or its controlled affiliates. In addition, Insiders may be liable for improper transactions by any person (commonly referred to

as a “tippee”) to whom they have disclosed MNPI or to whom they have made recommendations or expressed opinions on the basis

of such information as to trading in related securities.

Nubankers who violate this Policy shall also be subject

to disciplinary action by the Company, which may include ineligibility for future participation in the Company’s share option plan

and other incentive plans or termination of employment.

Any questions about this Policy should be directed to

Compliance at #ethics-help.

| 9 |

|

| Version |

Description of change |

Date of

change |

Squad

responsible |

Date of

approval |

Approver |

| 1.0 |

Initial Version |

- |

Compliance |

10/2021 |

Board of Directors |

| 2.0 |

Reviewed Version |

11/2021 |

Compliance |

11/2021 |

Board of Directors |

| 3.0 |

Reviewed Version | Inclusion of Addendum A |

02/2022 |

Compliance |

02/2022 |

Board of Directors |

| 10 |

|

Addendum A

Material Nonpublic Information

This addendum aims to define in general terms

material nonpublic information (MNPI) and to provide some examples of such type of information.

As described in the Insider Trading Policy, it

is not possible to define beforehand all categories of material information, but there are some situations that have a higher probability

to be considered as MNPI, in light of the regulation and jurisprudence. The likely characterization as MNPI results from the probability

of influencing investors when making an investment decision related to a company securities (i.e. purchase, sale, holding or hedging of

any security), once it becomes public.

While the regulators apply a backward-looking test in assessing materiality, the key here is that there is no bright-line rule, and materiality

depends upon the totality of the circumstances and the materiality.

So, besides determining if an information is

material to influence investment decisions, it is important to determine when such information becomes public, so investors as a whole

are able to trade based on the same level of information. Trading windows are usually placed right after earnings release. This means

that this period is when the asymmetry of information is expected to be mitigated. In other words, the market would have the same level

of information as internal insiders, mitigating MNPI risks. Information that was considered MNPI prior to the release should no longer

be considered MNPI during the period of the Trading Windows, since they have been disclosed to the public.

There might be situations where MNPI is not disclosed

during earnings release, due to its strategic component and according to a legitimate interest of the issuer may be kept confidential.

If you have access to any of such MNPI during a trading window, you are prevented from trading any company's securities.

Non exhaustive list of examples of potential

MNPI. If a particular situation is not described below it does not mean that it does not constitute MNPI. If in doubt, you must apply

your best judgment focusing on whether such information may influence the market price of Nu stock if known by the public.

(i) Financial results or related information

Material information may include information

regarding profit or loss, dividend payment practice and estimates, earnings estimates and projections, short and medium term financial

goals, changes in previously released earnings estimates. Underlying information may also be considered material, such as customer growth

and accounting provisions, provided that in all cases such information individually or in aggregate is able to change the course of the

pricing of the securities of the issuer. Pieces of financial and operational information alone have very low probability to be considered

MNPI, unless it has the potential to influence the market.

| 11 |

|

(ii) Change of control

Negotiations and agreements to transfer the company

shareholding control, shareholders agreement, initiating, amending or terminating a shareholders' agreement to which the company is a

party or intervening party, or that has been registered in the company's proper books and records.

(iii) M&A and corporate restructurings

Transactions involving investment in other companies,

such as mergers, acquisitions, changes in the company's corporate structure, including total or partial spin-off, or any form of corporate

reorganization and joint-ventures or substantial sales of assets.

(iv) Contracts and projects

Execution, change or termination of relevant

contractual agreements, launch of new projects and business units that may represent material revenues or expenses Discussion and decisions

to enter a new market or geography.

(v) Products and technologies

Discovery, change or development of technology,

exit/entry of relevant company's partner (that has operational, financial, technological, administrative collaboration), starting, resumption

or stoppage of the offering or sale of a product or service, all representing either present or future material revenues or expenses.

(vi) Registration and other corporate events

Registration for public offerings (including

follow-ons and tender offers), authorization to negotiate company securities in new countries (or delisting), change of environment or

segment of trading of its shares, changes in the rights and benefits of the securities issued by the company (inplit/split, equities bonus,

etc), transformation or dissolution of the company.

(vii) Accounting changes or equity changes

Changes in equity composition, change in accounting

policies, renegotiation of liabilities, purchase of shares to be held in treasury, their cancellation and/or disposal, approval of the

stock option plan.

(viii) Material litigation and other incidents

Request for judicial or extrajudicial recovery,

petition for bankruptcy or filing of lawsuit, administrative procedure or arbitration that may affect the company's economic-financial

situation (including those placed by regulators) Cyber-attacks and other information security incidents before made public.

(ix) Changes in management

Major changes in the Company and most relevant

subsidiaries, including the arrival or departure of directors and officers and heads of business units and geographies.

Further information

In order to assist Nubankers in determining whether

they are in possession of MNPI,

| 12 |

|

Compliance will manage blocklists, with direct input from

the BUs, covering people that are working in or have had exposure to relevant projects that have a high chance to constitute MNPI. If

you receive a notification that you are in a blocklist, you will not be allowed to trade during an open Trading Window and until you receive

a notification that the blocklist has been terminated.

If you were not included in a blocklist, but still believe you are in possession of MNPI during an open Trading Window, you should fill

the forms [link]. Compliance will assess the content and seek support from IR and Legal. Based on your report, Compliance will

return with the information that you should refrain from trading company securities during the period that the information is not public.

Finally, if you have access to information that

could be considered MNPI, you must align with the General Manager of your BU as to how you, as a team, will communicate it to the Investors

Relations team, which will define the appropriateness of an eventual communication to the market.

More information about the MNPI and the disclosing

process may be found in the Information Disclosure Policy.

| 13 |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 17, 2022

| |

|

|

| |

Nu Holdings Ltd. |

| |

|

|

| |

By: |

/s/ Guilherme Lago |

| |

Guilherme Lago

Chief Financial Officer |

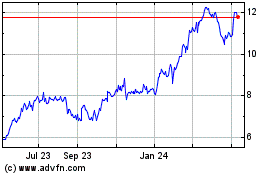

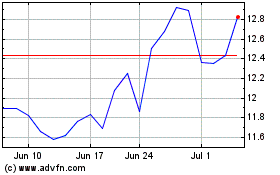

Nu (NYSE:NU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nu (NYSE:NU)

Historical Stock Chart

From Apr 2023 to Apr 2024