Novartis Posts Sales Growth as It Slims Down -- Update

January 29 2020 - 4:43AM

Dow Jones News

By Denise Roland

Novartis AG reported strong sales of new drugs including gene

therapy Zolgensma, a sign the company's focus on cutting-edge

medicines is starting to pay off.

The Swiss pharmaceutical company on Wednesday said revenue from

continuing operations rose 8% to $12.4 billion in the fourth

quarter of last year, while core operating income, a measure

watched closely by analysts, increased 11% to $3.46 billion. Net

income fell 7% to $1.1 billion on a one-time tax charge.

Novartis is becoming a smaller but more focused company under

Chief Executive Vas Narasimhan, who took the helm nearly two years

ago. He has shed the company's consumer health-care and eye-care

units and trimmed its generics business, Sandoz.

Dr. Narasimhan has also bulked up the prescription-medicine

pipeline through deals. Among the drugs that powered Novartis's

growth last year were two that were added through acquisitions:

Zolgensma, a gene therapy for a muscle-wasting disease in infants;

and Lutathera, a cancer drug that delivers a radioactive dose to

tumor cells in the body.

Both drugs exemplify Novartis's focus on cutting-edge drugs.

Zolgensma provides a working version of the gene that is at fault

in spinal muscular atrophy, a disease whose sufferers cannot

control their muscles. It was last year one of the first gene

therapies to be approved for sale in the U.S. Lutathera is a

radiopharmaceutical, a kind of drug that carries radioactive

particles to tumors for close-range radiotherapy.

Novartis's strategy to take a leading position in new kinds of

medicine, especially gene therapy, has also created challenges.

Zolgensma has attracted attention for its eye-catching price

tag: at $2.1 million, it is the world's most expensive drug.

Novartis has defended the price by saying it is a one-time

treatment and that it is saves money in the long run over an

alternative therapy that is given regularly.

The high price sparked initial resistance from insurers, but

Novartis has since secured wide coverage. Novartis said that almost

all patients with commercial insurance and more than half of those

with Medicaid have plans that cover Zolgensma.

The gene therapy also attracted scrutiny over the summer when

Novartis told the U.S. Food and Drug Administration that scientists

at the unit that developed it had manipulated product-testing data

in mice. The agency criticized Novartis for failing to disclose the

issue earlier but said it didn't affect its view that the drug was

safe and effective.

Other drugs that helped drive Novartis's growth last year were

Cosentyx for psoriasis and certain rheumatoid conditions, and

Entresto for heart failure.

Dr. Narasimhan said he expected the company's growth to continue

next year. Novartis forecast net sales to grow by a

mid-to-high-single-digit percentage, and core operating profit to

increase by a mid-high or low-double-digit percentage in 2020.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

January 29, 2020 04:28 ET (09:28 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

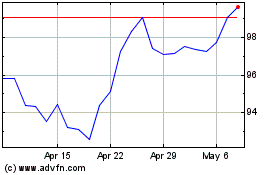

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

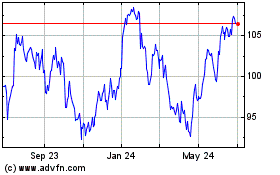

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024