Securities Registration: Employee Benefit Plan (s-8)

May 27 2021 - 4:18PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on May 27, 2021

Registration

No. 333-______________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NORWEGIAN CRUISE LINE HOLDINGS LTD.

(Exact Name of Registrant as Specified in Its Charter)

|

Bermuda

|

98-0691007

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

Identification No.)

|

7665 Corporate Center Drive

Miami, Florida 33126

(Address, Including Zip Code, of Principal Executive Offices)

Norwegian Cruise Line Holdings Ltd.

Amended and Restated 2013 Performance Incentive

Plan

(Full Title of the Plan)

Daniel S. Farkas

Executive Vice President, General Counsel, and Assistant Secretary

Norwegian Cruise Line Holdings Ltd.

7665 Corporate Center Drive

Miami, Florida 33126

(305) 436-4000

(Name, Address and Telephone Number, Including

Area Code, of Agent for Service)

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and

"emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer þ

|

Accelerated filer o

|

|

|

|

|

Non-accelerated filer o

|

Smaller reporting company o

|

|

|

|

|

|

Emerging growth company o

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

Title of

Securities

To Be Registered

|

|

Amount

To Be

Registered

|

|

Proposed

Maximum

Offering

Price

Per Share

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount Of

Registration

Fee

|

|

|

Ordinary Shares, $0.001 par value per share

|

|

4,910,000(1)

Shares

|

|

$

|

28.83

|

(2)

|

|

$

|

141,555,300.00

|

(2)

|

|

$

|

15,443.69

|

(2)

|

|

|

(1)

|

This Registration Statement covers, in addition to the number

of Norwegian Cruise Line Holdings Ltd., a company organized under the laws of Bermuda (the “Company” or the “Registrant”),

ordinary shares, par value $0.001 per share (the “Ordinary Shares”), stated above, options and other rights to purchase or

acquire the Ordinary Shares covered by this Registration Statement and, pursuant to Rule 416 under the Securities Act of 1933, as amended

(the “Securities Act”), an additional indeterminate number of shares, options and rights that may be offered or issued pursuant

to the Norwegian Cruise Line Holdings Ltd. Amended and Restated 2013 Performance Incentive Plan (the “Plan”) as a result

of one or more adjustments under the Plan to prevent dilution resulting from one or more share splits, share dividends or similar transactions.

|

|

|

(2)

|

Pursuant to Securities Act Rule 457(h), the maximum offering

price, per share and in the aggregate, and the registration fee were calculated based upon the average of the high and low prices of

the Ordinary Shares on May 20, 2021, as quoted on the New York Stock Exchange.

|

|

|

|

The Exhibit Index for this Registration Statement is at page

7.

|

EXPLANATORY NOTE

This Registration Statement is filed by the Company

to register additional securities issuable pursuant to the Plan and consists of only those items required by General Instruction E to

Form S-8.

PART I

INFORMATION REQUIRED IN THE

SECTION 10(a) PROSPECTUS

The document(s) containing the information specified

in Part I of Form S-8 will be sent or given to participants as specified by Securities Act Rule 428(b)(1).

PART II

INFORMATION REQUIRED IN THE

REGISTRATION STATEMENT

|

|

Item 3.

|

Incorporation of Certain Documents by Reference

|

The following documents of the Company filed with

the Securities and Exchange Commission (the “Commission”) are incorporated herein by reference:

|

|

(a)

|

The Company’s Registration Statements on Form S-8, filed with the Commission on January 24, 2013 and June 30, 2016 (Commission

File Nos. 333-186184 and 333-212352, respectively);

|

|

|

(d)

|

The Company’s Current Reports on Form 8-K, filed with the Commission on February 4, 2021, February 23, 2021, March 3, 2021,

March 9, 2021, March 15, 2021 and May 21, 2021 (each, Commission File No. 001-35784); and

|

All documents subsequently filed by the Company

pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), prior

to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all

securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof

from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed

in accordance with Commission rules shall not be deemed incorporated by reference into this Registration Statement. Any statement contained

herein or in a document, all or a portion of which is incorporated or deemed to be incorporated by reference herein, shall be deemed to

be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other

subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any

such statement so modified or superseded shall not be deemed, except as so modified or amended, to constitute a part of this Registration

Statement.

|

|

Item 5.

|

Interests of Named Experts and Counsel

|

Not applicable.

|

|

Item 6.

|

Indemnification of Directors and Officers

|

The Companies Act 1981 of Bermuda (the “Companies

Act”) requires every officer, including directors, of a company in exercising powers and discharging duties, to act honestly in

good faith with a view to the best interests of the company, and to exercise the care, diligence and skill that a reasonably prudent person

would exercise in comparable circumstances. The Companies Act provides that a Bermuda company may indemnify its directors in respect of

any loss arising or liability attaching to them as a result of any negligence, default, breach of duty or breach of trust of which they

may be guilty. However, the Companies Act further provides that any provision, whether in the bye-laws of a company or in any contract

between the company and any officer or any person employed by the company as auditor, exempting such officer or person from, or indemnifying

him against, any liability which by virtue of any rule of law would otherwise attach to him, in respect of any fraud or dishonesty of

which he may be guilty in relation to the company shall be void.

The Registrant has adopted provisions in its bye-laws

that, subject to certain exemptions and conditions, require the Registrant to indemnify to the full extent permitted by the Companies

Act in the event each person who is involved in legal proceedings by reason of the fact that person is or was a director, officer or resident

representative of the Registrant, or is or was serving at the request of the Registrant as a director, officer, resident representative,

employee or agent of another company or of a partnership, joint venture, trust or other enterprise, including service with respect to

an employee benefit plan against all expense, liability and loss (including attorneys’ fees, judgments, fines, amounts paid or to

be paid in settlement, and excise taxes or penalties arising under the Employee Retirement Income Security Act of 1974) incurred and suffered

by the person in connection therewith. The Registrant is also required under its bye-laws to advance to such persons expenses incurred

in defending a proceeding to which indemnification might apply, provided if the Companies Act requires, the recipient provides an undertaking

agreeing to repay all such advanced amounts if it is ultimately determined that he is not entitled to be indemnified. In addition, the

Registrant’s bye-laws specifically provide that the indemnification rights granted thereunder are non-exclusive.

In addition, the Registrant has entered into separate

contractual indemnification arrangements with its directors. These arrangements provide for indemnification and the advancement of expenses

to these directors in circumstances and subject to limitations substantially similar to those described above. Section 98A of the Companies

Act and the Registrant’s bye-laws permit the Registrant to purchase and maintain insurance for the benefit of any officer or director

in respect of any loss or liability attaching to him in respect of any negligence, default, breach of duty or breach of trust, whether

or not the Registrant may otherwise indemnify such officer or director. The Registrant expects to continue to maintain standard policies

of insurance that provide coverage (i) to its directors and officers against loss arising from claims made by reason of breach of duty

or other wrongful act and (ii) to the Registrant with respect to indemnification payments that it may make to such directors and officers.

See the attached Exhibit Index at page 7, which

is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities

Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this Form S-8 Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in

the City of Miami, State of Florida, on May 27, 2021.

|

|

NORWEGIAN CRUISE LINE HOLDINGS

LTD.

|

|

|

|

|

|

By:

|

/s/Frank J. Del Rio

|

|

|

|

Frank J. Del Rio

|

|

|

|

President and Chief Executive Officer

|

POWER OF ATTORNEY

Each person whose signature appears below constitutes

and appoints Frank J. Del Rio, Mark A. Kempa, Daniel S. Farkas and Angela Stark, and each of them, acting individually and without the

other, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her

and in his or her name, place, and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments,

exhibits thereto and other documents in connection therewith) to this Registration Statement, and to file the same, with all exhibits

thereto, and other documents in connection therewith, with the Commission, granting unto said attorneys-in-fact and agents, and each of

them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises,

as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact

and agents, or either of them individually, or their or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

Date

|

|

|

|

|

|

|

/s/Frank J. Del Rio

|

|

Director, President and Chief Executive Officer

|

May 27, 2021

|

|

Frank J. Del Rio

|

|

(Principal Executive Officer)

|

|

|

/s/Mark A. Kempa

|

|

Executive Vice President and

|

May 27, 2021

|

|

Mark A. Kempa

|

|

Chief Financial Officer

(Principal Financial Officer)

|

|

|

/s/Faye L. Ashby

|

|

Senior Vice President and

|

May 27, 2021

|

|

Faye L. Ashby

|

|

Chief Accounting Officer

(Principal Accounting Officer)

|

|

|

Signature

|

|

Title

|

Date

|

|

|

|

|

|

|

/s/Russell W. Galbut

|

|

Director, Chairperson of the

|

May 27, 2021

|

|

Russell W. Galbut

|

|

Board

|

|

|

|

|

|

|

|

/s/David M. Abrams

|

|

Director

|

May 27, 2021

|

|

David M. Abrams

|

|

|

|

|

|

|

|

|

|

/s/Adam M. Aron

|

|

Director

|

May 27, 2021

|

|

Adam M. Aron

|

|

|

|

|

|

|

|

|

|

/s/John W. Chidsey

|

|

Director

|

May 27, 2021

|

|

John W. Chidsey

|

|

|

|

|

|

|

|

|

|

/s/Stella David

|

|

Director

|

May 27, 2021

|

|

Stella David

|

|

|

|

|

|

|

|

|

|

/s/Mary E. Landry

|

|

Director

|

May 27, 2021

|

|

Mary E. Landry

|

|

|

|

|

|

|

|

|

|

/s/Chad A. Leat

|

|

Director

|

May 27, 2021

|

|

Chad A. Leat

|

|

|

|

|

|

|

|

|

|

/s/Pamela A. Thomas-Graham

|

|

Director

|

May 27, 2021

|

|

Pamela A. Thomas-Graham

|

|

|

|

|

|

|

|

|

|

/s/Daniel S. Farkas

|

|

Authorized Representative in the United States

|

May 27, 2021

|

|

Daniel S. Farkas

|

|

|

|

EXHIBIT INDEX

Exhibit

|

Number

|

Description of Exhibit

|

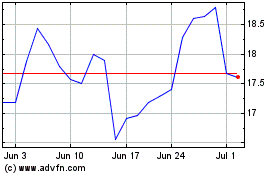

Norwegian Cruise Line (NYSE:NCLH)

Historical Stock Chart

From Mar 2024 to Apr 2024

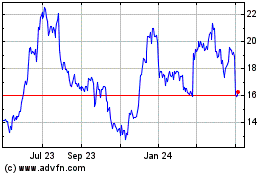

Norwegian Cruise Line (NYSE:NCLH)

Historical Stock Chart

From Apr 2023 to Apr 2024