NGL Energy Partners LP (NYSE:NGL) (“NGL,” “our,” “we,” or the

“Partnership”) today reported income from continuing operations for

the quarter ended December 31, 2019 of $49.1 million, compared to

income from continuing operations of $97.2 million for the quarter

ended December 31, 2018. For the nine months ended December 31,

2019, the Partnership reported income from continuing operations of

$42.5 million, compared to a loss from continuing operations of

$137.3 million for the nine months ended December 31, 2018.

“Our transformation to a simpler business model with improved

predictability of cash flows and reduced volatility in earnings is

substantially complete,” stated Mike Krimbill, the Partnership’s

CEO. “During this quarter, our Water Solutions segment closed the

Hillstone acquisition, which added important long-term acreage

dedications and minimum volume commitments with some of the highest

quality producers in the Delaware Basin. Additionally, we exited

another portion of our Refined Products and Renewables segment,

further streamlining our business and reducing working capital

debt. Overall, this was a tremendous quarter from an operating

standpoint as we transported almost 1.6 million barrels per day of

produced water on our systems and 134,000 barrels per day of crude

oil on Grand Mesa Pipeline. Our Liquids segment had a particularly

strong quarter as we optimized our expanded asset position, which

includes 27 terminals and approximately 5,000 rail cars. Our

results for the quarter illustrate the benefit of asset

diversification across our three primary business units and we look

forward to continuing to build each of these businesses in the

coming quarters.”

Highlights for the quarter include:

- Acquisition of Hillstone Environmental Partners, LLC

(“Hillstone”) completed on October 31, 2019 for a total purchase

price of $642.5 million; acquired assets include the following:

- Minimum volume commitments and long-term dedications covering

over 110,000 contracted acres, including a 20-year Poker Lake

acreage dedication with XTO Energy, a 10-year acreage dedication,

including first call rights, with a leading independent exploration

and production company, and multiple contracts with one of the

largest crude oil and natural gas exploration and production

companies in the United States;

- 19 saltwater disposal wells, representing approximately 580,000

barrels per day of permitted disposal capacity;

- A network of produced water pipelines with approximately

680,000 barrels per day of transportation capacity; and

- 22 permits to develop another 660,000 barrels per day of

disposal capacity

- Income from continuing operations for the third quarter of

Fiscal 2020 of $49.1 million, compared to $97.2 million for the

third quarter of Fiscal 2019

- Adjusted EBITDA from continuing operations for the third

quarter of Fiscal 2020 of $200.5 million, compared to $131.3

million for the third quarter of Fiscal 2019

- Issued 9.00% Class D Preferred Units for gross proceeds of

$200.0 million to fund a portion of the Hillstone acquisition

Quarterly Results of Operations

The following table summarizes operating income (loss) and

Adjusted EBITDA from continuing operations by operating segment for

the periods indicated:

Quarter Ended

December 31, 2019

December 31, 2018

Operating Income

(Loss)

Adjusted EBITDA

Operating Income

(Loss)

Adjusted EBITDA

(in thousands)

Crude Oil Logistics

$

28,696

$

55,575

$

32,022

$

50,693

Liquids

64,084

69,129

21,532

26,992

Water Solutions

(583

)

62,214

86,737

48,250

Refined Products and Renewables

24,954

24,082

20,552

9,118

Corporate and Other

(20,756

)

(10,489

)

(16,394

)

(3,728

)

Total

$

96,395

$

200,511

$

144,449

$

131,325

The tables included in this release reconcile operating income

(loss) to Adjusted EBITDA from continuing operations, a non-GAAP

financial measure, for each of our operating segments.

Crude Oil Logistics

Results for the third quarter of Fiscal 2020 improved compared

to the same quarter in Fiscal 2019 primarily due to increased

volumes on our Grand Mesa Pipeline as a result of additional

volumes purchased from third parties and increased production in

the DJ Basin. During the three months ended December 31, 2019,

financial volumes on the Grand Mesa Pipeline averaged approximately

134,000 barrels per day.

Liquids

Total product margin per gallon was $0.098 for the quarter ended

December 31, 2019, compared to $0.049 for the quarter ended

December 31, 2018. This increase was primarily the result of higher

propane, butane, and other product margins, driven primarily by

strong butane sales and increased propane product margins as our

inventory values aligned with reduced commodity prices.

Propane volumes increased by approximately 39.4 million gallons,

or 9.2%, during the quarter ended December 31, 2019 compared to the

quarter ended December 31, 2018. Butane volumes increased by

approximately 74.2 million gallons, or 36.7%, during the quarter

ended December 31, 2019 compared to the quarter ended December 31,

2018. Butane volumes were augmented by steady volumes at our

Chesapeake, Virginia export terminal. Other Liquids volumes

increased by approximately 3.0 million gallons, or 2.3%, during the

quarter ended December 31, 2019 compared to the same period in the

prior year.

Water Solutions

The Partnership processed approximately 1,585,000 barrels of

produced water per day during the quarter ended December 31, 2019,

a 58.8% increase when compared to approximately 999,000 barrels of

produced water per day during the quarter ended December 31, 2018.

Water Solutions revenue increased to $121.6 million for the quarter

ended December 31, 2019, a 61.3% increase over the comparable prior

year quarter as a result of the increase in volume, which was

primarily driven by our acquisition of Mesquite Disposals

Unlimited, LLC (“Mesquite”) and Hillstone. These increases were

partially offset by the sale of our Bakken and South Pecos water

disposal businesses during the fiscal year ended March 31,

2019.

Revenues from recovered hydrocarbons, including the impact from

realized skim oil hedges, totaled $17.8 million for the quarter

ended December 31, 2019, a decrease of $5.5 million from the prior

year period. The decrease was primarily due to realized gains on

our derivatives of $1.3 million for the quarter ended December 31,

2019 compared to realized gains of $6.1 million for the quarter

ended December 31, 2018, and lower skim oil volumes resulting from

the sale of our Bakken and South Pecos water disposal businesses.

Additionally, the percentage of recovered hydrocarbons per barrel

of produced water processed decreased during the quarter ended

December 31, 2019, when compared to the quarter ended December 31,

2018, due to an increase in produced water transported through

pipelines (which contains less oil per barrel of produced water)

and contract structures that allow producers to keep the skim oil

recovered from produced water.

Refined Products and Renewables

The Partnership has announced its intention to divest its

refined products marketing business in the mid-continent region of

the United States (“Mid-Con”) and its gas blending business in the

southeastern and eastern regions of the United States (“Gas

Blending”). The Partnership completed the sale of certain Mid-Con

assets on January 3, 2020. The Partnership determined that these

businesses were no longer core to the Partnership’s strategy. The

operations of these businesses have been classified as discontinued

operations as the exiting of these businesses, along with the sale

of TransMontaigne Product Services, LLC (“TPSL”) on September 30,

2019, represent a strategic shift in the Partnership’s operations

and will have a significant effect on its operations and financial

results going forward. Certain assets and liabilities have also

been classified as held for sale.

The results from the Refined Products and Renewables businesses

being retained are included in continuing operations for the

quarter ended December 31, 2019. These results were positively

impacted by the biodiesel tax credit being reinstated in December

2019 for calendar years 2018 and 2019. The tax credit is now

effective through December 31, 2022. The total amount of income

recognized in earnings from continuing operations totaled $13.8

million during the quarter ended December 31, 2019. An additional

amount of $17.3 million was recognized in discontinued

operations.

Refined product barrels sold during the quarter ended December

31, 2019 totaled approximately 7.8 million barrels, which was

slightly lower than the same period in the prior year. Renewables

barrels sold during the quarter ended December 31, 2019 totaled

approximately 0.9 million, which was slightly higher than the same

period in the prior year.

Corporate and Other

Corporate and Other expenses primarily increased from the

comparable prior year period due to costs related to compensation,

consulting services and insurance costs as the Partnership has

restructured its operations and completed certain acquisitions

during this fiscal year.

Capitalization and Liquidity

On October 30, 2019, the Partnership amended its Credit

Agreement to adjust the allocation of the commitments of the

lenders to make revolving loans thereunder and amend the covenant

package. During the quarter, the Partnership also utilized a

portion of the accordion feature under its Credit Agreement,

whereby two new lenders and one existing lender committed to

provide an additional $150.0 million of commitments in total. The

Credit Agreement now provides for up to $1.915 billion in aggregate

commitments, consisting of (i) a $641.5 million Working Capital

Facility for working capital requirements and other general

corporate purposes and (ii) a $1.273 billion Expansion Capital

Facility for acquisitions, internal growth projects, other capital

expenditures and general corporate purposes. Working capital

borrowings totaled $447.0 million at December 31, 2019 compared to

$896.0 million at March 31, 2019, a decrease of $449.0 million.

Expansion capital borrowings totaled $945.0 million, resulting in

approximately $1.392 billion outstanding under the revolving credit

facility at December 31, 2019.

Total debt outstanding was $3.073 billion at December 31, 2019

compared to $2.161 billion at March 31, 2019, an increase of $912

million due primarily to the redemption of the Partnership’s Class

A Preferred Units, the Mesquite and Hillstone acquisitions and the

funding of certain capital expenditures, which was partially offset

by a reduction in working capital borrowings using proceeds from

the sale of TPSL and decreased activity in the Gas Blending and

Mid-Con businesses.

The Partnership’s Total Leverage Indebtedness Ratio (as defined

in our Credit Agreement) was approximately 5.0x at December 31,

2019. Total liquidity (cash plus available capacity on our

revolving credit facility) was approximately $417.9 million as of

December 31, 2019.

Fiscal 2020 Guidance Update

For Fiscal 2020, the Partnership expects to generate Adjusted

EBITDA from continuing operations in a range for each of its

operating segments as follows:

FY 2020 Adjusted EBITDA

Ranges

Low

High

(in thousands)

Crude Oil Logistics

$

215,000

$

220,000

Water Solutions

240,000

250,000

Liquids

115,000

120,000

Refined Products and Renewables

35,000

40,000

Corporate and Other

(40,000

)

(35,000

)

Total Guidance Range

$

565,000

$

595,000

Third Quarter Conference Call Information

A conference call to discuss NGL’s results of operations is

scheduled for 10:00 am Central Time on Thursday, February 6, 2020.

Analysts, investors, and other interested parties may access the

conference call by dialing (800) 291-4083 and providing access code

2980107. An archived audio replay of the conference call will be

available for 7 days beginning at 1:00 pm Central Time on February

6, 2020, which can be accessed by dialing (855) 859-2056 and

providing access code 4747666.

Non-GAAP Financial Measures

NGL defines EBITDA as net income (loss) attributable to NGL

Energy Partners LP, plus interest expense, income tax expense

(benefit), and depreciation and amortization expense. NGL defines

Adjusted EBITDA as EBITDA excluding net unrealized gains and losses

on derivatives, lower of cost or market adjustments, gains and

losses on disposal or impairment of assets, gains and losses on

early extinguishment of liabilities, equity-based compensation

expense, acquisition expense, revaluation of liabilities, certain

legal settlements and other. NGL also includes in Adjusted EBITDA

certain inventory valuation adjustments related to its Refined

Products and Renewables segment, as discussed below. EBITDA and

Adjusted EBITDA should not be considered as alternatives to net

income (loss), income (loss) from continuing operations before

income taxes, cash flows from operating activities, or any other

measure of financial performance calculated in accordance with

GAAP, as those items are used to measure operating performance,

liquidity or the ability to service debt obligations. NGL believes

that EBITDA provides additional information to investors for

evaluating NGL’s ability to make quarterly distributions to NGL’s

unitholders and is presented solely as a supplemental measure. NGL

believes that Adjusted EBITDA provides additional information to

investors for evaluating NGL’s financial performance without regard

to NGL’s financing methods, capital structure and historical cost

basis. Further, EBITDA and Adjusted EBITDA, as NGL defines them,

may not be comparable to EBITDA, Adjusted EBITDA, or similarly

titled measures used by other entities.

Other than for NGL’s Refined Products and Renewables segment,

for purposes of the Adjusted EBITDA calculation, NGL makes a

distinction between realized and unrealized gains and losses on

derivatives. During the period when a derivative contract is open,

NGL records changes in the fair value of the derivative as an

unrealized gain or loss. When a derivative contract matures or is

settled, NGL reverses the previously recorded unrealized gain or

loss and records a realized gain or loss. NGL does not draw such a

distinction between realized and unrealized gains and losses on

derivatives of NGL’s Refined Products and Renewables segment. The

primary hedging strategy of NGL’s Refined Products and Renewables

segment is to hedge against the risk of declines in the value of

inventory over the course of the contract cycle, and many of the

hedges are six months to one year in duration at inception. The

“inventory valuation adjustment” row in the reconciliation table

reflects the difference between the market value of the inventory

of NGL’s Refined Products and Renewables segment at the balance

sheet date and its cost, adjusted for the impact of seasonal market

movements related to our base inventory and the related hedge. NGL

includes this in Adjusted EBITDA because the unrealized gains and

losses associated with derivative contracts associated with the

inventory of this segment, which are intended primarily to hedge

inventory holding risk and are included in net income, also affect

Adjusted EBITDA.

Distributable Cash Flow is defined as Adjusted EBITDA minus

maintenance capital expenditures, income tax expense, cash interest

expense, preferred unit distributions and other. Maintenance

capital expenditures represent capital expenditures necessary to

maintain the Partnership’s operating capacity. Distributable Cash

Flow is a performance metric used by senior management to compare

cash flows generated by the Partnership (excluding growth capital

expenditures and prior to the establishment of any retained cash

reserves by the Board of Directors) to the cash distributions

expected to be paid to unitholders. Using this metric, management

can quickly compute the coverage ratio of estimated cash flows to

planned cash distributions. This financial measure also is

important to investors as an indicator of whether the Partnership

is generating cash flow at a level that can sustain, or support an

increase in, quarterly distribution rates. Actual distribution

amounts are set by the Board of Directors.

Forward-Looking Statements

This press release includes “forward-looking statements.” All

statements other than statements of historical facts included or

incorporated herein may constitute forward-looking statements.

Actual results could vary significantly from those expressed or

implied in such statements and are subject to a number of risks and

uncertainties. While NGL believes such forward-looking statements

are reasonable, NGL cannot assure they will prove to be correct.

The forward-looking statements involve risks and uncertainties that

affect operations, financial performance, and other factors as

discussed in filings with the Securities and Exchange Commission.

Other factors that could impact any forward-looking statements are

those risks described in NGL’s Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and other public filings. You are

urged to carefully review and consider the cautionary statements

and other disclosures made in those filings, specifically those

under the heading “Risk Factors.” NGL undertakes no obligation to

publicly update or revise any forward-looking statements except as

required by law.

NGL provides Adjusted EBITDA guidance that does not include

certain charges and costs, which in future periods are generally

expected to be similar to the kinds of charges and costs excluded

from Adjusted EBITDA in prior periods, such as income taxes,

interest and other non-operating items, depreciation and

amortization, net unrealized gains and losses on derivatives, lower

of cost or market adjustments, gains and losses on disposal or

impairment of assets, gains and losses on early extinguishment of

liabilities, equity-based compensation expense, acquisition

expense, revaluation of liabilities and items that are unusual in

nature or infrequently occurring. The exclusion of these charges

and costs in future periods will have a significant impact on the

Partnership’s Adjusted EBITDA, and the Partnership is not able to

provide a reconciliation of its Adjusted EBITDA guidance to net

income (loss) without unreasonable efforts due to the uncertainty

and variability of the nature and amount of these future charges

and costs and the Partnership believes that such reconciliation, if

possible, would imply a degree of precision that would be

potentially confusing or misleading to investors.

About NGL Energy Partners LP

NGL Energy Partners LP is a Delaware limited partnership. NGL

owns and operates a vertically integrated energy business with four

primary businesses: Crude Oil Logistics, Water Solutions, Liquids,

and Refined Products and Renewables. NGL completed its initial

public offering in May 2011. For further information, visit the

Partnership’s website at www.nglenergypartners.com.

NGL ENERGY PARTNERS LP AND

SUBSIDIARIES

Unaudited Condensed

Consolidated Balance Sheets

(in Thousands, except unit

amounts)

December 31, 2019

March 31, 2019

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

12,008

$

18,572

Accounts receivable-trade, net of

allowance for doubtful accounts of $4,055 and $4,016,

respectively

947,534

998,203

Accounts receivable-affiliates

12,445

12,867

Inventories

183,738

136,128

Prepaid expenses and other current

assets

90,694

65,918

Assets held for sale

95,093

580,985

Total current assets

1,341,512

1,812,673

PROPERTY, PLANT AND EQUIPMENT, net of

accumulated depreciation of $504,731 and $417,457, respectively

2,704,112

1,828,940

GOODWILL

1,307,055

1,110,456

INTANGIBLE ASSETS, net of accumulated

amortization of $603,573 and $503,117, respectively

1,600,555

800,889

INVESTMENTS IN UNCONSOLIDATED ENTITIES

22,236

1,127

OPERATING LEASE RIGHT-OF-USE ASSETS

183,141

—

OTHER NONCURRENT ASSETS

83,944

113,857

ASSETS HELD FOR SALE

—

234,551

Total assets

$

7,242,555

$

5,902,493

LIABILITIES AND EQUITY

CURRENT LIABILITIES:

Accounts payable-trade

$

846,767

$

879,063

Accounts payable-affiliates

29,374

28,469

Accrued expenses and other payables

352,848

107,759

Advance payments received from

customers

29,993

8,461

Current maturities of long-term debt

4,835

648

Operating lease obligations

57,091

—

Liabilities held for sale

40,899

226,753

Total current liabilities

1,361,807

1,251,153

LONG-TERM DEBT, net of debt issuance costs

of $20,263 and $12,008, respectively, and current maturities

3,068,205

2,160,133

OPERATING LEASE OBLIGATIONS

122,798

—

OTHER NONCURRENT LIABILITIES

104,060

63,542

NONCURRENT LIABILITIES HELD FOR SALE

—

33

CLASS A 10.75% CONVERTIBLE PREFERRED

UNITS, 0 and 19,942,169 preferred units issued and outstanding,

respectively

—

149,814

CLASS D 9.00% PREFERRED UNITS, 600,000 and

0 preferred units issued and outstanding, respectively

531,768

—

EQUITY:

General partner, representing a 0.1%

interest, 128,477 and 124,633 notional units, respectively

(51,038

)

(50,603

)

Limited partners, representing a 99.9%

interest, 128,348,906 and 124,508,497 common units issued and

outstanding, respectively

1,682,071

2,067,197

Class B preferred limited partners,

12,585,642 and 8,400,000 preferred units issued and outstanding,

respectively

305,488

202,731

Class C preferred limited partners,

1,800,000 and 0 preferred units issued and outstanding,

respectively

42,905

—

Accumulated other comprehensive loss

(248

)

(255

)

Noncontrolling interests

74,739

58,748

Total equity

2,053,917

2,277,818

Total liabilities and equity

$

7,242,555

$

5,902,493

NGL ENERGY PARTNERS LP AND

SUBSIDIARIES

Unaudited Condensed

Consolidated Statements of Operations

(in Thousands, except unit and

per unit amounts)

Three Months Ended December

31,

Nine Months Ended December

31,

2019

2018

2019

2018

REVENUES:

Crude Oil Logistics

$

690,989

$

751,180

$

2,048,301

$

2,395,064

Water Solutions

121,607

75,458

294,639

231,367

Liquids

685,625

749,433

1,361,781

1,759,772

Refined Products and Renewables

728,028

718,979

2,197,236

2,178,734

Other

280

319

799

1,066

Total Revenues

2,226,529

2,295,369

5,902,756

6,566,003

COST OF SALES:

Crude Oil Logistics

628,443

685,417

1,847,382

2,226,397

Water Solutions

14,004

(39,470

)

4,701

(17,309

)

Liquids

592,340

707,187

1,205,938

1,668,646

Refined Products and Renewables

700,248

695,033

2,155,247

2,167,458

Other

437

494

1,337

1,481

Total Cost of Sales

1,935,472

2,048,661

5,214,605

6,046,673

OPERATING COSTS AND EXPENSES:

Operating

94,412

60,465

230,610

172,219

General and administrative

29,150

24,759

93,400

86,428

Depreciation and amortization

73,726

53,281

190,593

157,771

(Gain) loss on disposal or impairment of

assets, net

(12,626

)

(36,246

)

(10,482

)

71,077

Revaluation of liabilities

10,000

—

10,000

800

Operating Income

96,395

144,449

174,030

31,035

OTHER INCOME (EXPENSE):

Equity in earnings of unconsolidated

entities

534

1,777

277

2,375

Interest expense

(46,920

)

(39,151

)

(131,814

)

(126,776

)

Loss on early extinguishment of

liabilities, net

—

(10,083

)

—

(10,220

)

Other (expense) income, net

(226

)

1,187

967

(31,415

)

Income (Loss) From Continuing Operations

Before Income Taxes

49,783

98,179

43,460

(135,001

)

INCOME TAX EXPENSE

(677

)

(980

)

(996

)

(2,322

)

Income (Loss) From Continuing

Operations

49,106

97,199

42,464

(137,323

)

(Loss) Income From Discontinued

Operations, net of Tax

(6,115

)

13,329

(192,800

)

433,501

Net Income (Loss)

42,991

110,528

(150,336

)

296,178

LESS: NET LOSS ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

166

307

563

1,170

LESS: NET LOSS ATTRIBUTABLE TO REDEEMABLE

NONCONTROLLING INTERESTS

—

—

—

446

NET INCOME (LOSS) ATTRIBUTABLE TO NGL

ENERGY PARTNERS LP

$

43,157

$

110,835

$

(149,773

)

$

297,794

NET INCOME (LOSS) FROM CONTINUING

OPERATIONS ALLOCATED TO COMMON UNITHOLDERS

$

28,895

$

67,656

$

(123,792

)

$

(209,928

)

NET (LOSS) INCOME FROM DISCONTINUED

OPERATIONS ALLOCATED TO COMMON UNITHOLDERS

$

(6,109

)

$

13,316

$

(192,607

)

$

433,513

NET INCOME (LOSS) ALLOCATED TO COMMON

UNITHOLDERS

$

22,786

$

80,972

$

(316,399

)

$

223,585

BASIC INCOME (LOSS) PER COMMON UNIT

Income (Loss) From Continuing

Operations

$

0.23

$

0.54

$

(0.97

)

$

(1.71

)

(Loss) Income From Discontinued

Operations, net of Tax

$

(0.05

)

$

0.11

$

(1.52

)

$

3.53

Net Income (Loss)

$

0.18

$

0.65

$

(2.49

)

$

1.82

DILUTED INCOME (LOSS) PER COMMON UNIT

Income (Loss) From Continuing

Operations

$

0.22

$

0.53

$

(0.97

)

$

(1.71

)

(Loss) Income From Discontinued

Operations, net of Tax

$

(0.05

)

$

0.11

$

(1.52

)

$

3.53

Net Income (Loss)

$

0.18

$

0.64

$

(2.49

)

$

1.82

BASIC WEIGHTED AVERAGE COMMON UNITS

OUTSTANDING

128,201,369

123,892,680

127,026,510

122,609,625

DILUTED WEIGHTED AVERAGE COMMON UNITS

OUTSTANDING

129,358,590

125,959,751

127,026,510

122,609,625

EBITDA, ADJUSTED EBITDA AND

DISTRIBUTABLE CASH FLOW RECONCILIATION

(Unaudited)

The following table reconciles NGL’s net

income (loss) to NGL’s EBITDA, Adjusted EBITDA and Distributable

Cash Flow:

Three Months Ended December

31,

Nine Months Ended December

31,

2019

2018

2019

2018

(in thousands)

Net income (loss)

$

42,991

$

110,528

$

(150,336

)

$

296,178

Less: Net loss attributable to

noncontrolling interests

166

307

563

1,170

Less: Net loss attributable to redeemable

noncontrolling interests

—

—

—

446

Net income (loss) attributable to NGL

Energy Partners LP

43,157

110,835

(149,773

)

297,794

Interest expense

46,946

39,151

131,969

126,930

Income tax expense

676

988

1,015

2,454

Depreciation and amortization

72,939

54,153

191,049

169,235

EBITDA

163,718

205,127

174,260

596,413

Net unrealized losses (gains) on

derivatives

16,787

(47,909

)

7,851

(30,849

)

Inventory valuation adjustment (1)

(370

)

(61,665

)

(25,555

)

(60,497

)

Lower of cost or market adjustments

(646

)

48,198

(2,465

)

47,785

(Gain) loss on disposal or impairment of

assets, net

(4,837

)

(36,507

)

171,757

(337,925

)

Loss on early extinguishment of

liabilities, net

—

10,083

—

10,220

Equity-based compensation expense (2)

2,213

7,845

27,209

32,575

Acquisition expense (3)

11,419

5,155

18,595

9,270

Revaluation of liabilities (4)

10,000

—

10,000

800

Gavilon legal matter settlement (5)

—

(212

)

—

34,788

Other (6)

4,026

2,475

10,681

5,694

Adjusted EBITDA

$

202,310

$

132,590

$

392,333

$

308,274

Adjusted EBITDA - Discontinued

Operations

$

1,799

$

1,265

$

(35,362

)

$

3,839

Adjusted EBITDA - Continuing

Operations

$

200,511

$

131,325

$

427,695

$

304,435

Less: Cash interest expense (7)

43,919

36,922

124,406

119,644

Less: Income tax expense

676

982

995

2,322

Less: Maintenance capital expenditures

16,964

9,521

50,354

33,457

Less: Preferred unit distributions

12,612

11,174

31,484

33,522

Less: Other (8)

515

237

642

546

Distributable Cash Flow - Continuing

Operations

$

125,825

$

72,489

$

219,814

$

114,944

(1)

Amount reflects the difference between the

market value of the inventory of NGL’s Refined Products and

Renewables segment at the balance sheet date and its cost, adjusted

for the impact of seasonal market movements related to our base

inventory and the related hedge. See “Non-GAAP Financial Measures”

above for a further discussion.

(2)

Equity-based compensation expense in the

table above may differ from equity-based compensation expense

reported in the footnotes to our unaudited condensed consolidated

financial statements included in the Partnership’s Quarterly Report

on Form 10-Q for the quarter ended December 31, 2019.

Amounts reported in the table above include expense accruals for

bonuses expected to be paid in common units, whereas the amounts

reported in the footnotes to our unaudited condensed consolidated

financial statements only include expenses associated with

equity-based awards that have been formally granted.

(3)

Amounts represent expenses we incurred

related to legal and advisory costs associated with acquisitions,

including Mesquite and Hillstone, along with amounts accrued

related to the LCT Capital, LLC legal matter (as discussed in the

footnotes to our unaudited condensed consolidated financial

statements included in the Partnership’s Quarterly Report on

Form 10-Q for the quarter ended December 31, 2019),

partially offset by reimbursement for certain legal costs incurred

in prior periods.

(4)

Amounts for the three months and nine

months ended December 31, 2019 represent the non-cash

valuation adjustment of our contingent consideration liability

issued by us as part of our acquisition of Mesquite (as discussed

in the footnotes to our unaudited condensed consolidated financial

statements included in the Partnership’s Quarterly Report on

Form 10-Q for the quarter ended December 31, 2019).

Amount for the nine months ended December 31, 2018 represents

the non-cash valuation adjustment of contingent consideration

liabilities, offset by the cash payments, related to royalty

agreements acquired as part of acquisitions in our Water Solutions

segment.

(5)

Represents the accrual for the estimated

cost of the settlement of the Gavilon legal matter (as discussed in

the footnotes to our unaudited condensed consolidated financial

statements included in the Partnership’s Quarterly Report on

Form 10-Q for the quarter ended December 31, 2019). We

have excluded this amount from Adjusted EBITDA as it relates to

transactions that occurred prior to our acquisition of Gavilon LLC

in December 2013.

(6)

Amounts for the three months and nine

months ended December 31, 2019 and 2018 represent non-cash

operating expenses related to our Grand Mesa Pipeline, unrealized

losses on marketable securities and accretion expense for asset

retirement obligations.

(7)

Amounts represent interest expense payable

in cash for the period presented, excluding changes in the accrued

interest balance.

(8)

Amounts represents cash paid to settle

asset retirement obligations.

ADJUSTED EBITDA RECONCILIATION BY

SEGMENT

Three Months Ended December

31, 2019

Crude Oil Logistics

Water Solutions

Liquids

Refined Products and

Renewables

Corporate and Other

Continuing Operations

Discontinued Operations (TPSL,

Mid-Con, Gas Blending)

Consolidated

(in thousands)

Operating income (loss)

$

28,696

$

(583

)

$

64,084

$

24,954

$

(20,756

)

$

96,395

$

—

$

96,395

Depreciation and amortization

17,950

48,074

6,811

132

759

73,726

—

73,726

Amortization recorded to cost of sales

—

—

21

65

—

86

—

86

Net unrealized losses (gains) on

derivatives

6,060

11,924

(1,197

)

—

—

16,787

—

16,787

Inventory valuation adjustment

—

—

—

(2,099

)

—

(2,099

)

—

(2,099

)

Lower of cost or market adjustments

—

—

—

(18

)

—

(18

)

—

(18

)

Gain on disposal or impairment of assets,

net

(182

)

(12,176

)

(26

)

—

(242

)

(12,626

)

—

(12,626

)

Equity-based compensation expense

—

—

—

—

2,213

2,213

—

2,213

Acquisition expense

—

3,967

—

—

7,452

11,419

—

11,419

Other income (expense), net

64

(450

)

17

24

119

(226

)

—

(226

)

Adjusted EBITDA attributable to

unconsolidated entities

—

685

17

—

(34

)

668

—

668

Adjusted EBITDA attributable to

noncontrolling interest

—

(203

)

(616

)

—

—

(819

)

—

(819

)

Revaluation of liabilities

—

10,000

—

—

—

10,000

—

10,000

Intersegment transactions (1)

—

—

—

979

—

979

—

979

Other

2,987

976

18

45

—

4,026

—

4,026

Discontinued operations

—

—

—

—

—

—

1,799

1,799

Adjusted EBITDA

$

55,575

$

62,214

$

69,129

$

24,082

$

(10,489

)

$

200,511

$

1,799

$

202,310

Three Months Ended December

31, 2018

Discontinued

Operations

Crude Oil Logistics

Water Solutions

Liquids

Refined Products and

Renewables

Corporate and Other

Continuing Operations

TPSL, Mid-Con, Gas

Blending

Retail Propane

Consolidated

(in thousands)

Operating income (loss)

$

32,022

$

86,737

$

21,532

$

20,552

$

(16,394

)

$

144,449

$

—

$

—

$

144,449

Depreciation and amortization

18,387

27,561

6,412

168

753

53,281

—

—

53,281

Amortization recorded to cost of sales

—

—

37

64

—

101

—

—

101

Net unrealized gains on derivatives

(13,165

)

(34,114

)

(630

)

—

—

(47,909

)

—

—

(47,909

)

Inventory valuation adjustment

—

—

—

(2,881

)

—

(2,881

)

—

—

(2,881

)

Lower of cost or market adjustments

11,446

—

—

1,572

—

13,018

—

—

13,018

Gain on disposal or impairment of assets,

net

(75

)

(36,171

)

—

—

—

(36,246

)

—

—

(36,246

)

Equity-based compensation expense

—

—

—

—

7,845

7,845

—

—

7,845

Acquisition expense

—

3,459

—

—

1,696

5,155

—

—

5,155

Other income (expense), net

3

(1,134

)

19

(285

)

2,584

1,187

—

—

1,187

Adjusted EBITDA attributable to

unconsolidated entities

—

1,845

—

—

—

1,845

—

—

1,845

Adjusted EBITDA attributable to

noncontrolling interest

—

(33

)

(394

)

—

—

(427

)

—

—

(427

)

Gavilon legal matter settlement

—

—

—

—

(212

)

(212

)

—

—

(212

)

Intersegment transactions (1)

—

—

—

(10,359

)

—

(10,359

)

—

—

(10,359

)

Other

2,075

100

16

287

—

2,478

—

—

2,478

Discontinued operations

—

—

—

—

—

—

1,423

(158

)

1,265

Adjusted EBITDA

$

50,693

$

48,250

$

26,992

$

9,118

$

(3,728

)

$

131,325

$

1,423

$

(158

)

$

132,590

Nine Months Ended

December 31, 2019

Crude Oil Logistics

Water Solutions

Liquids

Refined Products and

Renewables

Corporate and Other

Continuing Operations

Discontinued Operations (TPSL,

Mid-Con, Gas Blending)

Consolidated

(in thousands)

Operating income (loss)

$

101,018

$

34,380

$

80,965

$

32,242

$

(74,575

)

$

174,030

$

—

$

174,030

Depreciation and amortization

53,228

114,066

20,651

383

2,265

190,593

—

190,593

Amortization recorded to cost of sales

—

—

67

195

—

262

—

262

Net unrealized losses on derivatives

76

5,887

1,888

—

—

7,851

—

7,851

Inventory valuation adjustment

—

—

—

(264

)

—

(264

)

—

(264

)

Lower of cost or market adjustments

—

—

(1,508

)

19

—

(1,489

)

—

(1,489

)

Gain on disposal or impairment of assets,

net

(1,428

)

(9,021

)

(33

)

—

—

(10,482

)

—

(10,482

)

Equity-based compensation expense

—

—

—

—

27,209

27,209

—

27,209

Acquisition expense

—

3,987

—

—

14,608

18,595

—

18,595

Other income (expense), net

103

(452

)

61

(20

)

1,275

967

—

967

Adjusted EBITDA attributable to

unconsolidated entities

—

685

(5

)

—

(170

)

510

—

510

Adjusted EBITDA attributable to

noncontrolling interest

—

(597

)

(1,296

)

—

—

(1,893

)

—

(1,893

)

Revaluation of liabilities

—

10,000

—

—

—

10,000

—

10,000

Intersegment transactions (1)

—

—

—

1,125

—

1,125

—

1,125

Other

9,284

1,247

53

97

—

10,681

—

10,681

Discontinued operations

—

—

—

—

—

—

(35,362

)

(35,362

)

Adjusted EBITDA

$

162,281

$

160,182

$

100,843

$

33,777

$

(29,388

)

$

427,695

$

(35,362

)

$

392,333

Nine Months Ended December 31,

2018

Discontinued

Operations

Crude Oil Logistics

Water Solutions

Liquids

Refined Products and

Renewables

Corporate and Other

Continuing Operations

TPSL, Mid-Con, Gas

Blending

Retail Propane

Consolidated

(in thousands)

Operating (loss) income

$

(36,694

)

$

97,476

$

34,913

$

4,516

$

(69,176

)

$

31,035

$

—

$

—

$

31,035

Depreciation and amortization

56,486

79,212

19,339

504

2,230

157,771

—

—

157,771

Amortization recorded to cost of sales

80

—

110

195

—

385

—

—

385

Net unrealized (gains) losses on

derivatives

(11,895

)

(23,216

)

4,183

—

—

(30,928

)

—

—

(30,928

)

Inventory valuation adjustment

—

—

—

(2,592

)

—

(2,592

)

—

—

(2,592

)

Lower of cost or market adjustments

11,446

—

(504

)

1,583

—

12,525

—

—

12,525

Loss (gain) on disposal or impairment of

assets, net

105,186

(32,966

)

994

(3,026

)

889

71,077

—

—

71,077

Equity-based compensation expense

—

—

—

—

32,575

32,575

—

—

32,575

Acquisition expense

—

3,459

161

—

5,696

9,316

—

—

9,316

Other income (expense), net

26

(1,504

)

63

(343

)

(29,657

)

(31,415

)

—

—

(31,415

)

Adjusted EBITDA attributable to

unconsolidated entities

—

2,214

—

476

—

2,690

—

—

2,690

Adjusted EBITDA attributable to

noncontrolling interest

—

(119

)

(945

)

—

—

(1,064

)

—

—

(1,064

)

Revaluation of liabilities

—

800

—

—

—

800

—

—

800

Gavilon legal matter settlement

—

—

—

—

34,788

34,788

—

—

34,788

Intersegment transactions (1)

—

—

—

11,778

—

11,778

—

—

11,778

Other

4,976

304

49

365

—

5,694

—

—

5,694

Discontinued operations

—

—

—

—

—

—

(1,028

)

4,867

3,839

Adjusted EBITDA

$

129,611

$

125,660

$

58,363

$

13,456

$

(22,655

)

$

304,435

$

(1,028

)

$

4,867

$

308,274

(1)

Amount reflects the intersegment

transactions between the continuing businesses within the Refined

Products and Renewables segment and TPSL, Mid-Con and Gas Blending

that are eliminated in consolidation.

OPERATIONAL DATA

(Unaudited)

Three Months Ended

Nine Months Ended

December 31,

December 31,

2019

2018

2019

2018

(in thousands, except per day

amounts)

Crude Oil Logistics:

Crude oil sold (barrels)

11,217

12,333

32,929

35,449

Crude oil transported on owned pipelines

(barrels)

12,202

11,820

34,913

31,385

Crude oil storage capacity - owned and

leased (barrels) (1)

5,362

5,362

Crude oil inventory (barrels) (1)

866

1,204

Water Solutions:

Produced water processed (barrels per

day)

Northern Delaware Basin (2)

845,817

36,147

788,630

14,719

Permian Basin

325,061

461,722

323,217

455,211

Eagle Ford Basin

242,238

282,070

263,064

277,431

DJ Basin

162,456

177,412

167,178

159,980

Other Basins

9,813

41,173

10,976

68,209

Total

1,585,385

998,524

1,553,065

975,550

Solids processed (barrels per day)

6,132

7,284

5,779

6,728

Skim oil sold (barrels per day)

3,429

3,609

3,124

3,516

Liquids:

Propane sold (gallons)

468,332

428,961

975,782

929,401

Butane sold (gallons)

276,046

201,891

588,694

446,340

Other products sold (gallons)

133,392

130,362

377,264

372,282

Liquids storage capacity - owned and

leased (gallons) (1)

397,343

399,757

Propane inventory (gallons) (1)

123,265

120,239

Butane inventory (gallons) (1)

50,867

34,488

Other products inventory (gallons) (1)

15,858

8,367

Refined Products and Renewables

(continuing operations):

Gasoline sold (barrels)

2,994

3,031

8,978

8,129

Diesel sold (barrels)

4,790

4,818

14,365

14,045

Ethanol sold (barrels)

640

592

1,773

1,757

Biodiesel sold (barrels)

210

237

568

815

Refined Products and Renewables storage

capacity - leased (barrels) (1)

189

73

Diesel inventory (barrels) (1)

124

162

Ethanol inventory (barrels) (1)

40

592

Biodiesel inventory (barrels) (1)

134

100

(1)

Information is presented as of

December 31, 2019 and December 31, 2018,

respectively.

(2)

Barrels per day of wastewater processed by

the assets acquired in the Mesquite and Hillstone transaction are

calculated by the number of days in which we owned the assets for

the periods presented.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200206005306/en/

NGL Energy Partners LP Trey Karlovich, 918-481-1119 Chief

Financial Officer and Executive Vice President

Trey.Karlovich@nglep.com or Linda Bridges, 918-481-1119 Senior Vice

President - Finance and Treasurer Linda.Bridges@nglep.com

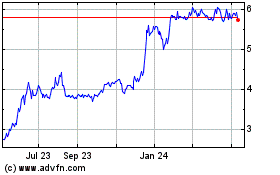

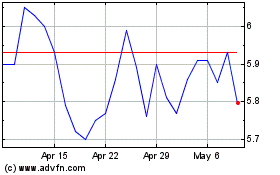

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Apr 2023 to Apr 2024