Net Revenues Increased by 26.3% Year-Over-Year BEIJING, Oct. 20

/PRNewswire-Asia/ -- New Oriental Education and Technology Group

Inc. (the "Company" or "New Oriental") (NYSE:EDU), the largest

provider of private educational services in China, today announced

its unaudited financial results for the first quarter ended August

31, 2009, which is the first quarter of New Oriental's fiscal year

2010. Highlights for the First Fiscal Quarter Ended August 31, 2009

-- Total net revenues increased by 26.3% year-over-year to US$149.4

million from US$118.3 million in the same period of the prior

fiscal year. -- GAAP net income increased by 27.1% year-over-year

to US$57.1 million from US$44.9 million in the same period of the

prior fiscal year. Non-GAAP net income, which excludes share-based

compensation expenses, increased by 24.6% year-over-year to US$60.8

million from US$48.8 million in the same period of the prior fiscal

year. -- GAAP income from operations increased by 24.7%

year-over-year to US$60.9 million from US$48.9 million in the same

period of the prior fiscal year. Non-GAAP income from operations

increased by 22.5% year-over-year to US$64.6 million from US$52.7

million in the same period of the prior fiscal year. -- GAAP basic

and diluted net income per ADS were US$1.52 and US$1.47,

respectively. Non-GAAP basic and diluted net income per ADS were

US$1.61 and US$1.57, respectively. Each ADS represents four common

shares of the Company. -- Total student enrollments in language

training and test preparation courses increased by 18.7%

year-over-year to approximately 647,500 from approximately 545,400

in the same period of the prior fiscal year. -- The total number of

schools and learning centers increased to 287 as of August 31,

2009, up from 270 as of May 31, 2008. The total number of schools

remained at 48, located in 40 cities, as of August 31, 2009. The

number of learning centers increased by 17 in the quarter to 239 as

of August 31, 2009, up from 222 as of May 31, 2009. Financial and

Student Enrollments Summary - First Quarter 2010 (US$ 000, except

per ADS data and student enrollments) Q1 of FY2010 Q1 of FY2009

Pct. Change Net revenues 149,364 118,262 26.3 % Non-GAAP net income

(1) 60,767 48,787 24.6 % GAAP Net income 57,066 44,903 27.1 %

Non-GAAP operating income (1) 64,632 52,749 22.5 % GAAP Operating

income 60,931 48,865 24.7 % Non-GAAP net income per ADS basic

(1)(2) 1.61 1.31 23.0 % Non-GAAP net income per ADS diluted (1)(2)

1.57 1.27 23.9 % GAAP Net income per ADS basic (2) 1.52 1.21 25.5 %

GAAP Net income per ADS diluted (2) 1.47 1.17 26.4 % Total student

enrollments in language training and test preparation courses

647,500 545,400 18.7 % (1) New Oriental provides net income,

operating income, and net income per ADS on a Non-GAAP basis that

excludes share-based compensation expenses to reflect meaningful

supplemental information regarding its performance and liquidity.

For more information on these Non-GAAP financial measures, please

see the table captioned "Reconciliation of Non-GAAP measures to the

most comparable GAAP measures" set forth at the end of this

release. (2) Each ADS represents four common shares. "We are

pleased to finish the first quarter of fiscal year 2010 with

revenue growth of 26.3% to approximately US$149.4 million and even

higher net income growth of 27.1% to over US$57 million," said Mr.

Michael Yu, New Oriental's chairman and chief executive officer.

"Strong first fiscal quarter student enrollments, with enrollment

growth in language training and test preparation courses increasing

18.7% year-over-year to over 647,500, drove solid results despite

the global economic slowdown and challenges resulting from the H1N1

flu pandemic. We estimate that the H1N1 flu pandemic negatively

impacted our top line growth by 2-4% with a more significant

negative percentage impact on our bottom line for the quarter. In

particular, fear of the H1N1 flu adversely impacted enrollments as

we received tens of thousands of inquiries from concerned parents

and students, and a large percentage of the students decided not to

enroll in New Oriental classes during the summer as an extra

precaution. Further, we experienced record cancellations and

deferments in enrollments from registered students, and we closed

or cancelled classes and summer camps across China whenever an

enrolled student was diagnosed with the H1N1 flu, as required by

applicable local health regulations. We are hopeful that the

adverse effects on our business from the fear of H1N1 will

gradually subside as the H1N1 flu vaccine has been made available

in China this month and will become widely available across the

country with over 60 million doses planned in the months ahead. Our

strong financial results in the face of these challenging external

factors underline the strength of the New Oriental brand and the

important role we play in the lives of Chinese students." Mr. Yu

continued, "We are delighted and excited to announce that during

the quarter we officially launched our customized learning program

for 6- to 18-year-olds, offering one-to-one tutoring and small

class size tutoring (up to five students per class), in all

subjects classes required for the gaokao (Chinese National College

Entrance Examination) and zhongkao (Chinese National High School

Entrance Examination). This will complement our very successful

U-Can program, launched last year targeting class sizes of 20 to 50

students, which recorded over 55,000 enrollments in non-English

subjects in its first year. This two-pronged strategy of offering

affordable larger classes of 20 or more students and higher priced

individualized small and one-to-one classes for school aged

students will enable New Oriental to expand our leading position in

the multi-billion dollar after school training market in China,

targeting the approximately 190 million students aged 6 to 18 years

old. We are targeting over US$25 million in revenue in fiscal year

2010 from non-English U-Can and our new individualized small class

offerings, more than triple the revenue generated from U-Can last

fiscal year." Louis T. Hsieh, New Oriental's president and chief

financial officer, stated, "During the first fiscal quarter

notwithstanding the challenges to our business posed by the fear of

the H1N1 flu, we saw continued strong growth in our three key

growth segments; (i) POP Kids English with enrollments up over 34%

to approximately 131,200 and over 40% revenue growth, (ii) English

for Middle and High School Students enrollments, including U-Can,

up over 18% to approximately 157,800 and over 40% revenue growth,

and U-Can non-English all subjects enrollments up over 100% to

approximately 32,400, and (iii) Overseas Test Preparation with

enrollments up over 14% to approximately 74,800 and over 27%

revenue growth. We recorded blended average selling price growth of

approximately 9.5% for the quarter, mostly driven by students

electing higher priced smaller size class offerings." Financial

Results for the Fiscal Quarter Ended August 31, 2009 For the first

fiscal quarter of 2010, New Oriental reported net revenues of

US$149.4 million, representing a 26.3% increase year-over-year. Net

revenues from educational programs and services for the first

fiscal quarter were US$142.4 million, representing a 28.1% increase

year-over-year. The growth was mainly driven by the increase in the

number of student enrollments in language training and test

preparation courses. Total student enrollments in language training

and test preparation courses in the first quarter of fiscal year

2010 increased by 18.7% year-over-year to approximately 647,500

from approximately 545,400 in the same period of the prior fiscal

year. GAAP operating costs and expenses for the quarter were

US$88.4 million, a 27.4% increase year-over-year. Non-GAAP

operating costs and expenses for the quarter were US$84.7 million,

a 29.3% increase year-over-year. Cost of revenues increased by

23.8% year-over-year to US$47.7 million, primarily due to the

increased number of courses and the greater number of schools and

learning centers in operation. Selling and marketing expenses

increased by 57.3% year-over-year to US$15.5 million, primarily due

to new program and brand promotion expenses related to POP Kids

English, U-Can and the launch of New Oriental's customized learning

program. GAAP general and administrative expenses were US$25.3

million, a 20.0% increase year-over-year. Non-GAAP general and

administrative expenses for the quarter increased by 25.0%

year-over-year to US$21.8 million, primarily due to increased

headcount as the Company expanded its network of schools and

learning centers. Total share-based compensation expenses, which

were allocated to related operating costs and expenses, decreased

slightly to US$3.7 million in the first quarter of fiscal year 2010

from US$3.9 million in the same period of the prior fiscal year.

GAAP income from operations for the quarter was US$60.9 million, a

24.7% increase from US$48.9 million in the same period of the prior

fiscal year, and Non-GAAP income from operations for the quarter

was US$64.6 million, compared to US$52.7 million in the same period

of the prior fiscal year. GAAP operating margin for the quarter was

40.8%, compared to 41.3% in the same period of the prior fiscal

year. Non-GAAP operating margin for the quarter was 43.3%, compared

to 44.6% in the same period of the prior fiscal year. This decline

in operating margin was primarily due to increased marketing

expenses related to POP Kids English, U-Can and the launch of New

Oriental's customized learning program. GAAP net income for the

quarter was US$57.1 million, representing a 27.1% increase from the

same period of the prior fiscal year. Basic and diluted net income

per ADS were US$1.52 and US$1.47, respectively. Non-GAAP net income

was US$60.8 million, representing a 24.6% increase from the same

period of the prior fiscal year. Non-GAAP basic and diluted net

income per ADS were US$1.61 and US$1.57, respectively. Capital

expenditures for the quarter were US$5.2 million, which was

primarily used to add a net of 17 new learning centers and remodel

older learning centers during the quarter. As of August 31, 2009,

New Oriental had cash and cash equivalents of US$238.7 million, as

compared to US$254.8 million as of May 31, 2009. In addition, the

Company had US$129.0 million in term deposits at the end of the

quarter. Net operating cash flow for the first quarter of fiscal

year 2010 was US$61.2 million. The deferred revenue balance (cash

collected from registered students for courses and recognized

proportionally as revenue as the instructions are delivered) at the

end of the first quarter of fiscal year 2010 was US$57.9 million,

an increase of 36.2% from US$42.6 million at the end of the first

quarter of fiscal year 2009. Outlook for Second Quarter of Fiscal

Year 2010 New Oriental expects its total net revenues in the second

quarter of fiscal year 2010 (September 1, 2009 to November 30,

2009) to be in the range of US$60.8 million to US$62.8 million,

representing year-over-year growth in the range of 23.0% to 27.0%,

respectively. We expect our student enrollments to continue to be

negatively impacted by fear of the H1N1 flu during our second

fiscal quarter. This forecast reflects New Oriental's current and

preliminary view, which is subject to change. Conference Call

Information New Oriental's management will host an earnings

conference call at 8 AM on October 20, 2009 U.S. Eastern Time (8 PM

on October 20, 2009 Beijing/Hong Kong time). Dial-in details for

the earnings conference call are as follows: US: +1-617-213-8837

Hong Kong: +852-3002-1672 UK: +44-207-365-8426 Please dial-in 10

minutes before the call is scheduled to begin and provide the

passcode to join the call. The passcode is "New Oriental earnings

call." A replay of the conference call may be accessed by phone at

the following number until October 27, 2009: International:

+1-617-801-6888 Passcode: 80512116 Additionally, a live and

archived webcast of the conference call will be available at

http://investor.neworiental.org/ . About New Oriental New Oriental

is the largest provider of private educational services in China

based on the number of program offerings, total student enrollments

and geographic presence. New Oriental offers a wide range of

educational programs, services and products consisting primarily of

English and other foreign language training, test preparation

courses for major admissions and assessment tests in the United

States, the PRC and Commonwealth countries, primary and secondary

school education, development and distribution of educational

content, software and other technology, and online education. New

Oriental's ADSs, each of which represents four common shares,

currently trade on the New York Stock Exchange under the symbol

"EDU." For more information about New Oriental, please visit

http://english.neworiental.org/ . Safe Harbor Statement This

announcement contains forward-looking statements. These statements

are made under the "safe harbor" provisions of the U.S. Private

Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by terminology such as "will,"

"expects," "anticipates," "future," "intends," "plans," "believes,"

"estimates" and similar statements. Among other things, the outlook

for the second quarter of fiscal year 2010 and quotations from

management in this announcement, as well as New Oriental's

strategic and operational plans, contain forward-looking

statements. New Oriental may also make written or oral

forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission in its annual report to

shareholders, in press releases and other written materials and in

oral statements made by its officers, directors or employees to

third parties. Statements that are not historical facts, including

statements about New Oriental's beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to the

following: our ability to attract students without a significant

decrease in course fees; our ability to continue to hire, train and

retain qualified teachers; our ability to maintain and enhance our

"New Oriental" brand; health epidemics and other outbreaks in

China; our ability to effectively and efficiently manage the

expansion of our school network and successfully execute our growth

strategy; the outcome of ongoing, or any future, litigation or

arbitration, including those relating to copyright and other

intellectual property rights; competition in the private education

sector in China; changes in our revenues and certain cost or

expense items as a percentage of our revenues; the expected growth

of the Chinese private education market; Chinese governmental

policies relating to private educational services and providers of

such services; and general economic conditions in China. Further

information regarding these and other risks is included in our

annual report on Form 20-F and other documents filed with the

Securities and Exchange Commission. New Oriental does not undertake

any obligation to update any forward-looking statement, except as

required under applicable law. All information provided in this

press release and in the attachments is as of the date of this

press release, and New Oriental undertakes no duty to update such

information, except as required under applicable law. About

Non-GAAP Financial Measures To supplement New Oriental's

consolidated financial results presented in accordance with GAAP,

New Oriental uses the following measures defined as non-GAAP

financial measures by the SEC: net income excluding share-based

compensation expenses, operating income excluding share-based

compensation expenses, operating costs and expenses excluding

share-based compensation expenses, general and administrative

expenses excluding share-based compensation expenses, operating

margin excluding share-based compensation expenses, and basic and

diluted net income per ADS excluding share-based compensation

expenses. The presentation of these non-GAAP financial measures is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

GAAP. For more information on these non-GAAP financial measures,

please see the table captioned "Reconciliation of non-GAAP measures

to the most comparable GAAP measures" set forth at the end of this

release. New Oriental believes that these non-GAAP financial

measures provide meaningful supplemental information regarding its

performance and liquidity by excluding share-based compensation

expenses that may not be indicative of its operating performance

from a cash perspective. New Oriental believes that both management

and investors benefit from referring to these non-GAAP financial

measures in assessing its performance and when planning and

forecasting future periods. These non-GAAP financial measures also

facilitate management's internal comparisons to New Oriental's

historical performance and liquidity. New Oriental computes its

non-GAAP financial measures using the same consistent method from

quarter to quarter. New Oriental believes these non-GAAP financial

measures are useful to investors in allowing for greater

transparency with respect to supplemental information used by

management in its financial and operational decision making. A

limitation of using these non-GAAP financial measures is that these

non-GAAP measures exclude the share-based compensation charge that

has been and will continue to be for the foreseeable future a

significant recurring expense in our business. Management

compensates for these limitations by providing specific information

regarding the GAAP amounts excluded from each non-GAAP measure. The

accompanying tables have more details on the reconciliations

between GAAP financial measures that are most directly comparable

to non-GAAP financial measures. For investor and media inquiries,

please contact: In China: Ms. Maria Xin New Oriental Education and

Technology Group Inc. Tel: +86-10-6260-5566 x8931 Email: Ms.

Courtney Shike Brunswick Group LLC Tel: +86-10-6566-2256 Email: In

the U.S.: Ms. Kate Tellier Brunswick Group LLC Tel: +1-212-333-3810

Email: NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (In thousands) As of August 31, As of

May 31, 2009 2009 (Unaudited) (Unaudited) USD USD ASSETS: Current

assets: Cash and cash equivalents 238,709 254,772 Restricted cash

541 540 Term deposits 129,027 59,845 Accounts receivable, net 1,985

1,539 Inventory 13,672 15,188 Deferred tax assets-Current 1,855

1,621 Prepaid expenses and other current assets 16,963 14,222 Total

current assets 402,752 347,727 Property, plant and equipment, net

112,721 109,785 Land use right, net 3,464 3,485 Amounts due from

related parties 396 396 Deferred tax assets 664 1,077 Long term

deposit 2,861 2,021 Long term prepaid rent 1,223 1,331 Intangible

assets 837 866 Goodwill 2,711 2,712 Long term investment 2 2 Total

assets 527,631 469,402 LIABILITIES, MINORITY INTEREST AND

SHAREHOLDERS' EQUITY Current liabilities: Accounts payable-trade

8,300 9,295 Accrued expenses and other current liabilities 45,398

29,854 Income tax payable 7,801 3,728 Amount due to related parties

51 102 Deferred revenue 57,941 74,782 Total current liabilities

119,491 117,761 Deferred tax liabilities 149 157 Total long-term

liabilities 149 157 Total liabilities 119,640 117,918 Total New

Oriental Education & Technology Group Inc. shareholders' equity

407,991 351,246 Noncontrolling interests (note 1) 0 238 Total

equity 407,991 351,484 Total liabilities and equity 527,631 469,402

NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands except for per

share and per ADS amounts) For the Three Months Ended August 31,

2009 2008 (Unaudited) (Unaudited) USD USD Net Revenues: Educational

Programs and services 142,421 111,221 Books and others 6,943 7,041

Total net revenues 149,364 118,262 Operating costs and expenses

(note 2): Cost of revenues 47,652 38,486 Selling and marketing

15,510 9,859 General and administrative 25,271 21,052 Total

operating costs and expenses 88,433 69,397 Operating income 60,931

48,865 Other income, net 1,463 1,863 Provision for income taxes

(5,566) (6,226) Less: Net income attributable to the noncontrolling

interests (note 3) 238 401 Net income attributable to New Oriental

Education & Technology Group Inc. 57,066 44,903 Net income per

share-basic 0.38 0.30 Net income per share-diluted 0.37 0.29 Net

income per ADS-basic (note 4) 1.52 1.21 Net income per ADS-diluted

(note 4) 1.47 1.17 Notes: Note 1: Amount in relation to

noncontrolling interest, formerly named minority interest, as of

May 31, 2009 is reclassified in accordance with FASB Statement No.

160, Noncontrolling Interest, which was adopted by the Company on

June 1, 2009 Note 2: Share-based compensation expenses (in

thousands) are included in the operating costs and expenses as

follows: For the Three Months Ended August 31, 2009 2008

(Unaudited) (Unaudited) USD USD Cost of revenues 193 230 Selling

and marketing 54 62 General and administrative 3,454 3,592 Total

3,701 3,884 Note 3: Amount in relation to noncontrolling interest,

formerly named minority interest, for the three-month period ended

August 31, 2008 is reclassified in accordance with FASB Statement

No. 160, Noncontrolling Interest, which was adopted by the Company

on June 1, 2009. Note 4: Each ADS represents four common shares.

NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC. RECONCILIATION

OF NON-GAAP MEASURES TO THE MOST COMPARABLE GAAP MEASURES (In

thousands except share and per ADS amounts) For the Three Months

Ended August 31, 2009 2008 (Unaudited) (Unaudited) USD USD General

and administrative expenses 25,271 21,052 Share-based compensation

expense in general and administrative expenses 3,454 3,592 Non-GAAP

general and administrative expenses 21,817 17,460 Total operating

costs and expenses 88,433 69,397 Share-based compensation expenses

3,701 3,884 Non-GAAP operating costs and expenses 84,732 65,513

Operating income 60,931 48,865 Share-based compensation expenses

3,701 3,884 Non-GAAP operating income 64,632 52,749 Operating

margin 40.8% 41.3% Non-GAAP operating margin 43.3% 44.6% Net income

57,066 44,903 Share-based compensation expense 3,701 3,884 Non-GAAP

net income 60,767 48,787 Net income per ADS - basic (note 1) 1.52

1.21 Net income per ADS - diluted (note 1) 1.47 1.17 Non-GAAP net

income per ADS - basic (note 1) 1.61 1.31 Non-GAAP net income per

ADS - diluted (note 1) 1.57 1.27 Weighted average shares used in

calculating basic net income per ADS (note 1) 150,592,959

148,688,611 Weighted average shares used in calculating diluted net

income per ADS (note 1) 154,875,557 154,000,783 Note 1: Each ADS

represents four common shares. DATASOURCE: New Oriental Education

and Technology Group Inc. CONTACT: In China: Ms. Maria Xin, New

Oriental Education and Technology Group Inc., +86-10-6260-5566

x8931, ,Ms. Courtney Shike, Brunswick Group LLC, +86-10-6566-2256,

; In the U.S.: Ms. Kate Tellier, Brunswick Group LLC,

+1-212-333-3810, Web site: http://investor.neworiental.org/

http://english.neworiental.org/

Copyright

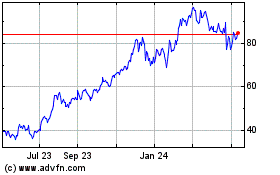

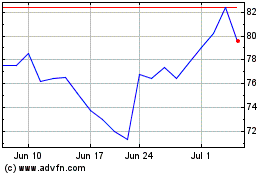

New Oriental Education a... (NYSE:EDU)

Historical Stock Chart

From Aug 2024 to Sep 2024

New Oriental Education a... (NYSE:EDU)

Historical Stock Chart

From Sep 2023 to Sep 2024